CAD traders awaiting Canadian Retail Sales & CPI data

Summary

-

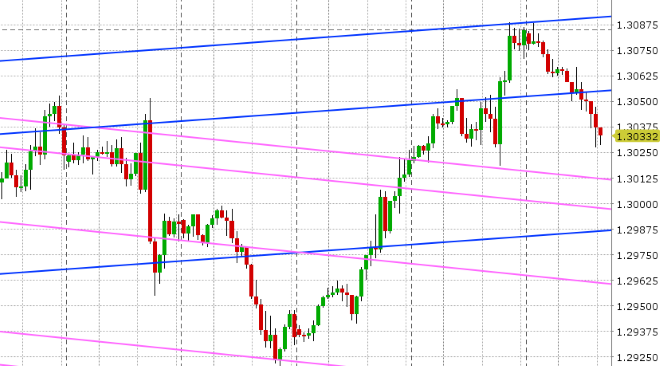

USDCAD: All eyes are on Italian debt markets this morning as the BTP/Bund yield blew out +338bp in early trading today. This caused some mild risk off flows (USD positive) at the start of European trade, but USDCAD had already pulled back to trend-line support in the 1.3050s after rejecting trend-line resistance at the 1.3080s earlier. Italian bond spreads have since come back in, which has allowed equities to perk back up and USD sellers back in. USDCAD has now lost the 1.3050s and appears en-route to the 1.3000-1.3010 support region ahead of the Canadian Retail Sales and CPI figures out shortly at 8:30amET. Traders are expecting +0.3% MoM for August Retail Sales and +0.2% ex. Autos. The consensus is +2.7% YoY for September CPI, 0.0% MoM, and +2.0% YoY on core CPI. Expect pressure into 1.2960-80 on good numbers, a bounce up to yesterday’s highs on weak numbers, and chop around 1.3050 if we get mixed results.

-

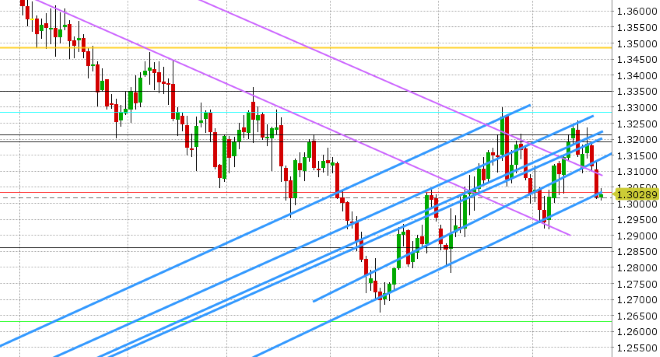

EURUSD: Euro/dollar is trying to bounce with Italian bonds at this hour, as the BTP/Bund spread trades back down to +329bp, but the Italian budget drama with the EU is far from over. More here. USDCNH stalled at the psychological 6.95 level earlier today despite another slight rise in the USDCNY fix last night, which is helping somewhat. We think EURUSD could drift higher to more option expiries at the 1.1500 strike today, but the market needs to hold the 1.1460s. Resistance today is 1.1490s, then the 1.1530s.

-

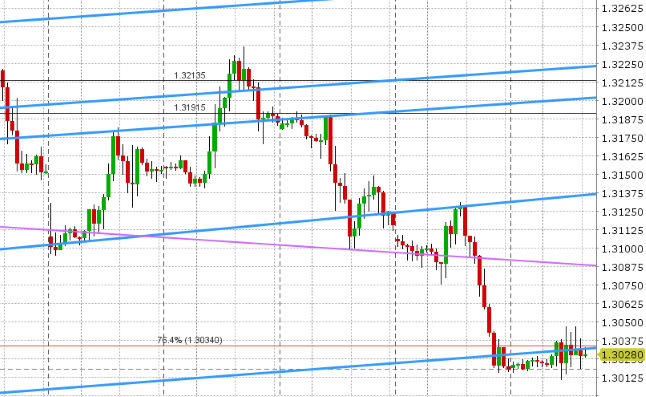

GBPUSD: Sterling is sitting directionless this morning after the market fell apart again yesterday. The EU summit has come and gone with no progress on Brexit, and if anything we have more uncertainty now. See here, from the BBC, for a nice summary. Open interest at the CME jumped over 5k contracts yesterday, suggesting new shorts piled in. While a close above the 1.3030s (support) would stem the selling temporarily and perhaps give us a bounce, we think the fund shorts remain in charge here sub 1.3100.

-

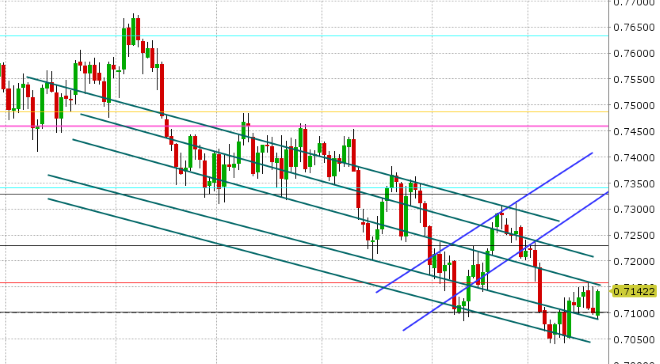

AUDUSD: Aussie/dollar is trading 0.5% higher again this morning as traders continue to play the 0.7100-0.7150 range. The fact that the market bounced off 0.7090 support just as USDCAD faded resistance in the 1.3080s, in our opinion, helped foment the move this morning. Seeing USDCNH back off 6.95, and now EURUSD and the S&Ps bounce with Italian bonds appeared to be the catalyst for the next wave higher around the 7am hour. We still think the fund short position looks vulnerable here. China reported Q3 GDP of +6.5% YoY last night, slightly less than the +6.6% consensus. Copper has just spiked 1% higher, regaining the 2.76 handle with authority. We continue to observe a bullish inverted head & shoulders pattern on the copper daily, which would gather more validity with a close above 2.80.

-

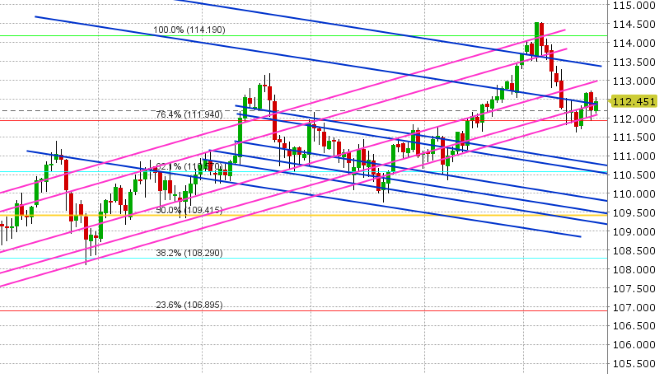

USDJPY: Dollar/yen has clawed back all of yesterday’s losses as we speak, toying with fund longs that appeared to liquidate yet again during yesterday’s equity driven selloff down to 111.90-112.00. The BOJ’s Kuroda spoke overnight, but didn’t offer much of substance for markets. With another 1blnUSD+ of options expiring at 112.50 today and EURJPY now breaking down technically (sub 129), we think USDJPY might wander here a little bit.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

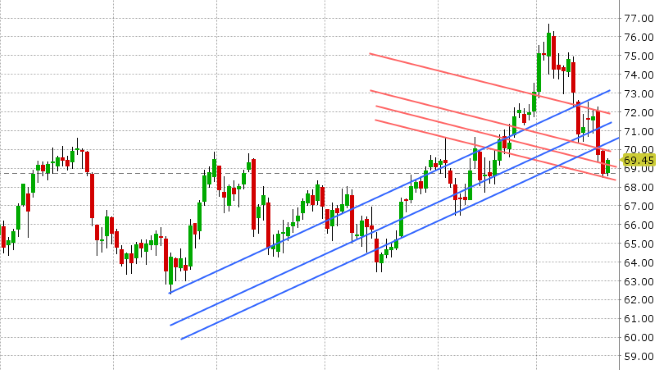

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

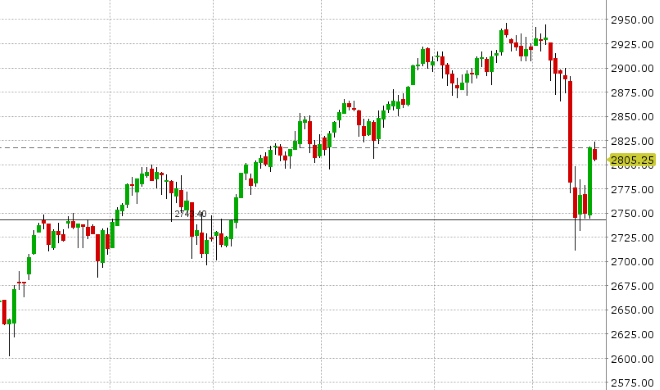

DEC S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.