Bank of Canada in focus today. Broader USD trying to bottom on the charts. Australian jobs numbers on deck tonight.

Summary

-

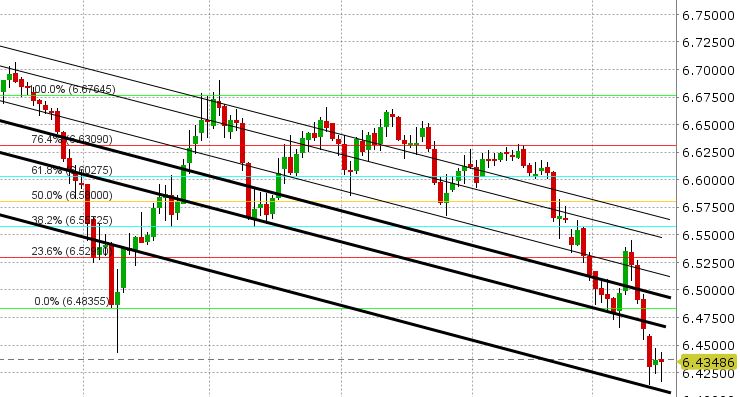

USDCAD: All eyes are on the Bank of Canada this morning, with their latest update to monetary policy set to be announced at 10am, followed by a press conference at 11:15amET. A slew of analyst previews made the rounds yesterday and there are three scenarios being tossed up: 1) Dovish hike, 2) Hawkish hike, and 3) Hawkish hold. We view a dovish 25bp hike as being the most likely scenario, as it acknowledges recent strength in the Canadian economy, gives the market what it wants, but would allow Governor Poloz to temper expectations (and provide more wiggle room) going forward in light of ongoing NAFTA negotiations, potential negative impacts of the new OFSI regulation on the housing market and slack when it comes to labor market wages. Should we get this outcome, we would not be surprised to see USDCAD spike lower initially, but then reverse higher towards 1.2500. It would also coincide nicely with the broader USD bottoming patterns we’re seeing overnight against EUR, GBP and JPY. A hawkish hike would be decidedly bearish USDCAD, and would put trend-line support at 1.2330 under serious threat (there’s not much support underneath there until the September lows (1.2060s). A hawkish hold is probably the least likely scenario, as it would show the Bank of Canada all of sudden being seriously concerned about NAFTA (they haven’t shown any indication of this and if anything want the markets to be more focused on the hard data). Needless to say, Poloz would have a lot of explaining to do under that scenario and that would likely see USDCAD surge into the 1.26s. For now, USDCAD treads water. Support at 1.2410-1.2420 continues to hold. The key today will be how the market reacts to chart resistance at 1.2500 and 1.2550 in our view, and chart support at 1.2350. Overnight at-the-money option straddle pricing suggests heightening volatility for this Bank of Canada meeting day, with breakevens indicating a 120pt range today. EURCAD is working on a daily reversal lower, following in the footsteps of EURUSD. GBPCAD, on the other hand, remains bid.

-

AUDUSD: The Aussie has had a bit of a volatile overnight session, following EURUSD and GBPUSD higher initially, and it’s now seeing some selling as EUR and GBP start to come off. The psychological 0.8000 level was tested earlier and failed, which is technically negative, but trend-line support at 0.7950 (mentioned yesterday) held again earlier this morning in Europe. Copper is consolidating yesterday’s losses and is managing to hold 3.20 for the time being. We feel AUDUSD will continue to trade off the broader USD theme again today, but we have a big data item tonight (tomorrow in Australia) with the Australian employment report out at 7:30pmET. Markets are expecting a gain of 15k jobs in December. Again, the 0.7940-0.7950 level will be key to watch. Another attempt at new highs would need to see this level hold. Failure at support would invite selling back into the low 0.79s, where Reuters is now reporting a large option expiry into month’s end.

-

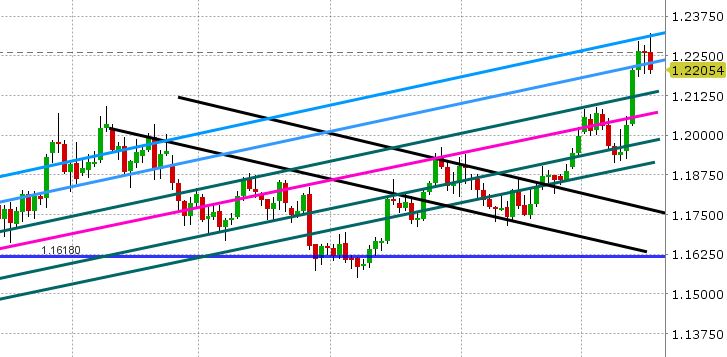

EURUSD: After staging a nice recovery higher off support at 1.2200-1.2220 yesterday, and hitting another new high overnight on what’s being described as a flow driven move (stop hunt/trigger of 1.2300 barrier options), the EURUSD is now working on a daily reversal lower that is picking up steam as North American traders walk in. Trend-line resistance at 1.2305 (highest blue line on our chart) has now effectively capped trade, and the next trend-line level (1.2225) has just broken to the downside. In our view, this puts the recent EURUSD rally on hold and invites some selling back into the 1.21s. USDCNH and EURJPY are flat, not offering any hints. EURGBP has broken chart support at 0.8870-0.8880, which is mildly EURUSD bearish. There’s been some central bank jawboning today from the ECB’s Constancio (concerned about sudden movements in the Euro that don’t reflect fundamentals), the ECB’s Nowotny (strengthening Euro is not helpful) and the Fed’s Kaplan (base case should be three rate hikes this year), and this talk is sort of EURUSD negative. The final read on Eurozone CPI for Dec was a non-event, coming in at +1.4% YoY (in-line with expectations).

-

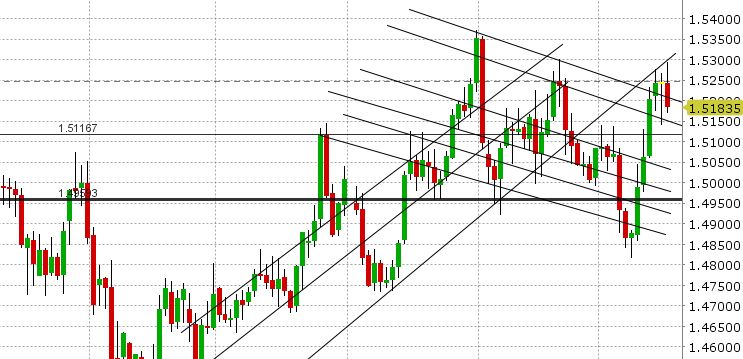

GBPUSD: Sterling is holding up relatively well compared to the EUR overnight, but it too failed technically at overhead trend-line resistance earlier in European trade. Trend-line support at 1.3750-1.3760 is stemming the selling however, as is a little breakdown in EURGBP over the last few hours. Support in GBPUSD is the key to watch again today as the EURUSD reversal could intensify. Should 1.3740-1.3750 give way, we would not be surprised to see a swift move back down to the mid 1.36s. Nothing to fret about yet however, as GBPUSD coasts between resistance at 1.3825 and support at 1.3750. A reminder that we get UK Retail Sales on Friday morning.

-

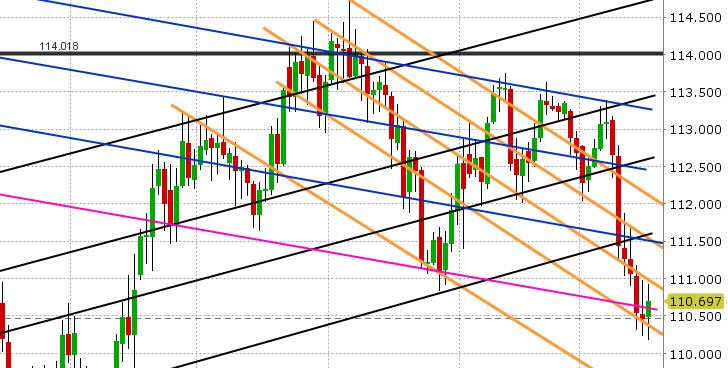

USDJPY: Dollar/yen continues to work on an important bullish reversal on the charts this morning, after a scary NY close yesterday. The swift reversal lower in US stocks yesterday put pressure on USDJPY, taking the market below trend-line support at 110.30, but Asia swooped in and bought USDJPY as EURUSD, GBPUSD and AUDUSD failed at overhead resistance. Reuters is still reporting sizable option expiries tomorrow between 110.80-111.00 for the NY cut, which may now act to keep this overnight bid intact. US yields and US stocks are higher this morning too, which is also supportive USDJPY. The key today will be how USDJPY responds to 110.50-110.60 (the support level is has regained overnight). The next resistance level comes in at 110.95-111.00.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

EUR/CAD Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.