USD extends gains after positive NY closes across the major currencies. GBP weighed down by soft UK jobs report. FOMC minutes in focus for 2pmET today

Summary

-

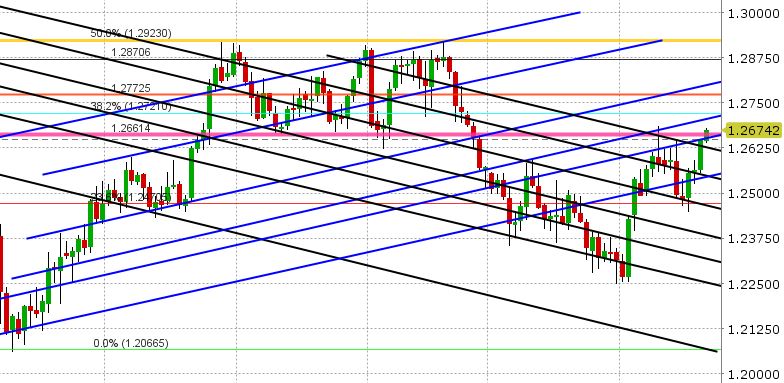

USDCAD: Dollar/CAD put in a great performance yesterday. The market extended Friday’s bullish outside day pattern and closed right above resistance of 1.2630-1.2645. Technically speaking, this opens the door to an upside test of 1.2660-1.2680 for today’s trade. Overnight activity has been muted, with the market hugging the 1.2660s for now, but there’s nothing evident on the charts to suggest buyer failure yet. The broader USD is trading higher at this hour as well, which is a supportive factor. While both EURCAD and GBPCAD scored bullish closing patterns yesterday as well (the former with an inverted hammer and the latter with a bullish outside day), both CAD crosses are looking a little tired this morning and we think this is part and parcel what’s keeping USDCAD stuck at this hour. Today’s focus will be the FOMC minutes, released at 2pmET. Any sort of hawkish tilt to the Fed’s rhetoric will likely see markets speculate about a fourth rate hike this year from the Fed and push the USD higher still, whereas a more cautious tone would invite some broad based USD profit taking in our opinion.

-

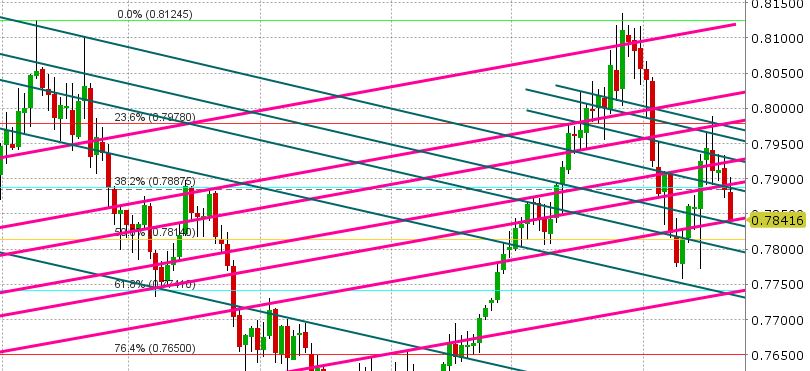

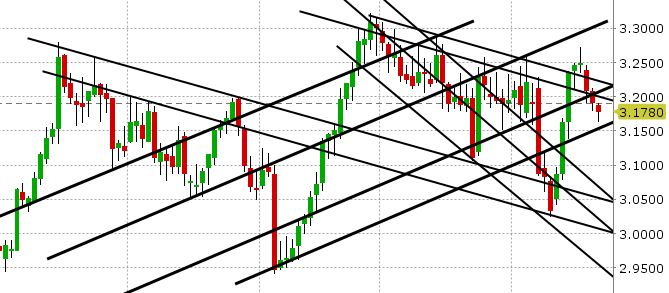

AUDUSD: The Aussie held the 0.7885-0.7900 level for most of NY trading yesterday, but then it moved right below the support level going into the close. This sort of dampened the mood going into Asian trade, and when the gains following the release of the positive Australian wage price data quickly fizzled, it proved sellers were in control and traders had their excuse to keep pushing AUD lower. AUDUSD has extended lower to the next chart support level, which is the 0.7830-0.7840s. Copper is weaker now for a third day in a row, and while its decent has slowed, there’s still not much support on its chart until the mid 3.15s (further weakness here would be AUD negative). We think AUDUSD coasts ahead of the FOMC minutes later this afternoon.

-

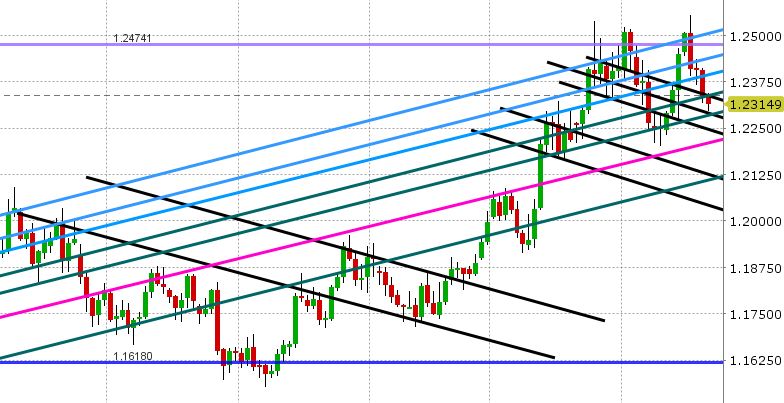

EURUSD: The Euro held its support level (1.2325-1.2350) for most of NY trading yesterday as we expected, and then it gave way in a choppy start to European trade overnight. The market has just tested the next support level at 1.2300 and so far it is holding, but the momentum is still down at this hour. EURJPY’s complete reversal of its overnight breakout higher is not helping the mood. Nor is USDCNH’s steady bid just shy of 6.34. Next support in EURUSD is the 1.2270s, then the 1.2250s. Resistance today is 1.2330-1.2340. A move back above resistance would invite a quick jump back to the 1.2380s. All eyes on now on the FOMC minutes.

-

GBPUSD: Sterling tested resistance at 1.4010-1.4025 yesterday as we thought (following the positive momentum from the positive Brexit headlines), but the market failed and pulled back into a tight range going into the NY close. That left the technicals directionless for most of the overnight session until the release of the UK employment report at 4:30am. The report than come out weaker than expected on net (better than expected wage growth, but higher unemployment rate and weaker than expected headline figure for actual jobs created). GBPUSD broke support in the 1.3970s just ahead of the numbers, and while the 4am hour was volatile, the 1.3970s could not be regained and that technical overhang allowed traders to push the market lower even further. We’re now trading in the low 1.39s looking for support. Next support checks in at the 1.3890s. EURGBP is benefiting from the broad GBP weakness, and has managed to regain most of yesterday’s Brexit losses. We anticipate further negative headwinds for GBP, should the EURGBP cross muster enough momentum to challenge the 0.8860 again.

-

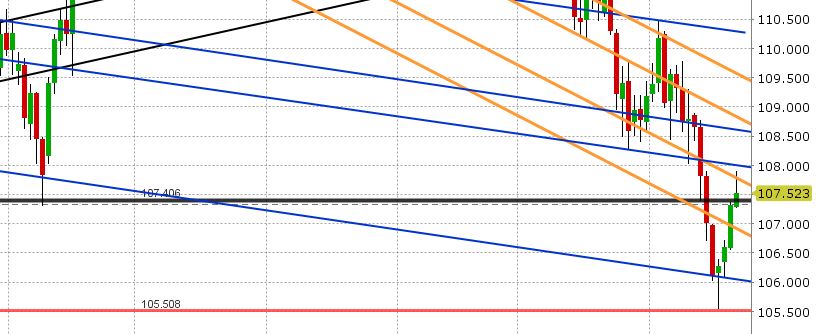

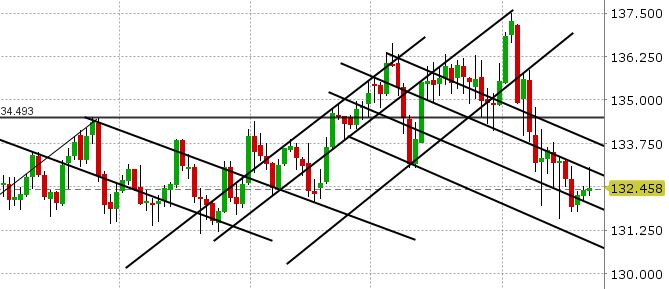

USDJPY: Dollar/yen put in an impressive performance yesterday; making quick work of resistance at 107.00-107.15 and closing near its NY high. The 107.40s broke to the upside in early Asian trade, EURJPY broke higher above 132.50 and this opened the door to the 107.90-108.00 level in USDJPY (which we saw play out by the start of European trading). Once the resistance levels were achieved in both USDJPY and EURJPY, however, everything reversed sharply and we’re now looking at broad based JPY strength going into NY trading today. Given USDJPY’s strong influence lately on the broader USD, we think this might allow EURUSD to find a bid ahead of the FOMC minutes later this afternoon. The technicals for USDJPY have improved considerably following Friday’s bounce off weekly support. While we’re off our highs in USDJPY today, the positive momentum is still intact so long as the market stays above the 107.40s. Should we lose it, we could see a drop back to 106.90-107.00.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

EUR/JPY Chart

March Copper

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.