Sterling sales leading USD strength into NY open

Summary

-

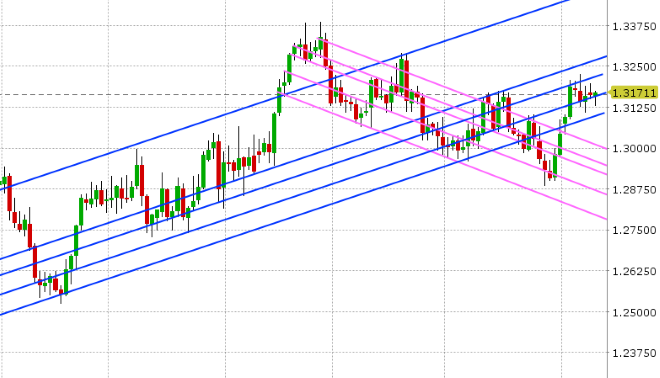

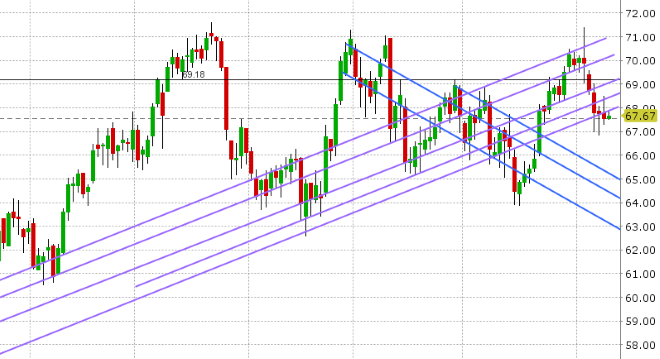

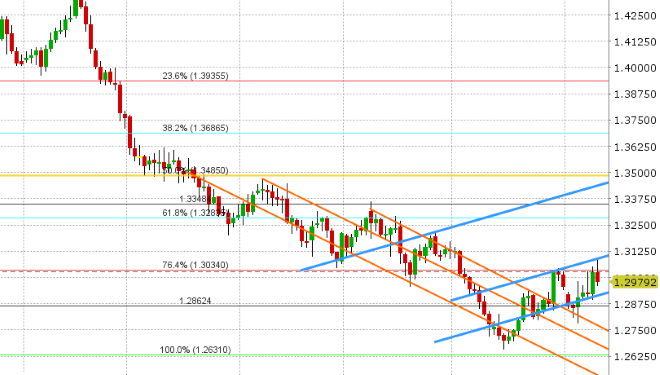

USDCAD: Dollar/CAD leaked lower during NY trade yesterday and into Asian trade overnight, following another wave of Brexit related USD selling against EUR and GBP. All this is reversing course now however and the market is trying to regain the 1.3150s support level it lost in Asia. Canadian Housing Starts for August were just reported +201k vs expectations of +210k. October crude oil is up marginally this morning, but well off yesterday’s highs and currently still below trend-line resistance in the 67.90s. Given the broad USD strength we continue to see against EUR and GBP this morning, and the resumption of NAFTA talks between Freeland and Lighthizer scheduled for later this morning, we think USDCAD takes another stab at the upside today. The market must confidently hold above 1.1360 however. The US/Canadian 2yr yield spread is trading back above +60bp (USDCAD supportive).

-

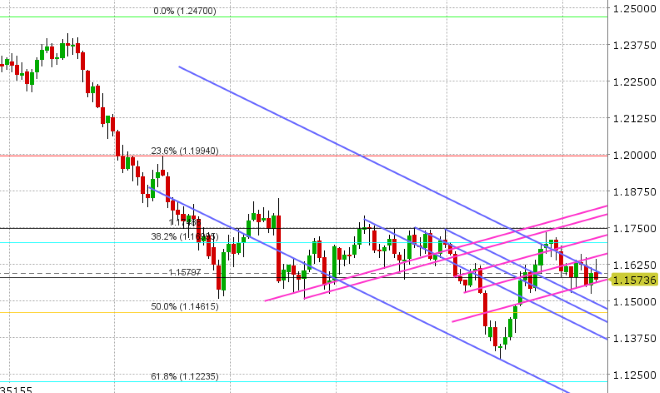

EURUSD: Euro/dollar has had a volatile session so far, rallying in early European trade alongside GBPUSD as that pair broke resistance in the lead up to the better than expected UK jobs report, and then falling afterwards as GBPUSD experienced a mini flash crash. Italian assets are doing well again today, with the BTP/Bund spread trading at +231bp, and the German ZEW survey for September beat expectations (both EURUSD supportive), but USDCNH is showing signs of breaking out to the upside from a triangular consolidation dating back to August (which is EURUSD negative). We think EURUSD follows GBPUSD lower here, and we think how the market responds to the 1.1550-60s trend-line support will define the momentum into tomorrow.

-

GBPUSD: Sterling was the big driver of price action in G10FX overnight, with traders building upon yesterday’s Brexit positive headlines from Barnier. Chart resistance in the 1.3030s gave way in early European trade, allowing the market to run higher heading into the UK employment report at 4:30am. The numbers then beat expectations, coming in at +8.7k increase in unemployed vs +10k expected and +2.6% 3M/Yr vs +2.4% on wages. This gave GBPUSD another slight pop, but then a massive wave of GBP selling came in, flushing the market down almost 100pts in minutes. We’re hearing trader talk that this could have been flow driven (sell stops, option defense of a 1.31 barrier, or a fat finger mistake) and we’re also hearing talk of an article being circulated about China asking the WTO for permission to put trade sanctions on the US (which if true, would be a “risk-off” type headline). The market quickly recovered half its losses from the plunge lower, but it hasn’t been able to regain the 1.3030s, and so we’re drifting lower now into NY trade today. With this negative technical development on the GBPUSD chart and EURGBP looking increasingly comfortable with support at 0.8900, we think GBPUSD goes on the defensive here ahead of the BoE meeting on Thursday. Some negative Brexit headlines have just crossed: EU warns Britain of too much optimism over “red lines”. More here.

-

AUDUSD: The Aussie continues to struggle, with today’s move being driven by GBP losses. Copper is going along for the ride too, giving back all its early European gains when GBPUSD broke lower. With the 0.7100 support level now broken, traders will likely eye the next level at 0.7050. Copper is now looking particularly vulnerable again sub 2.62 on the December contract. Tonight features the Australian Consumer Confidence data for September at 8:30pm ET.

-

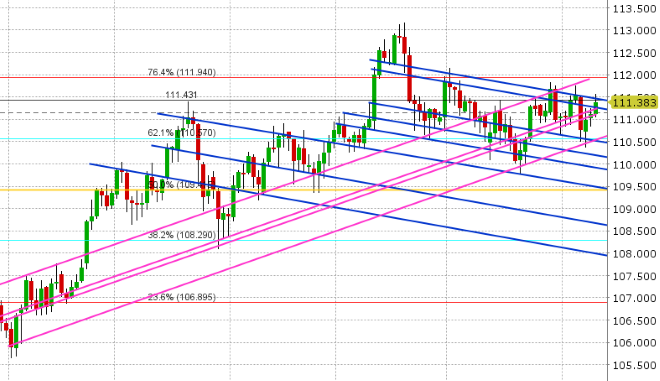

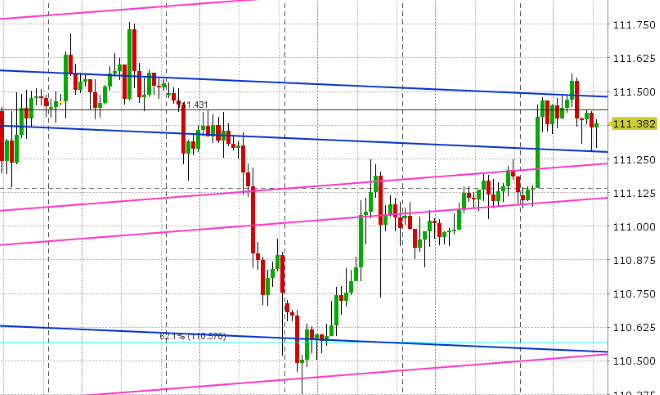

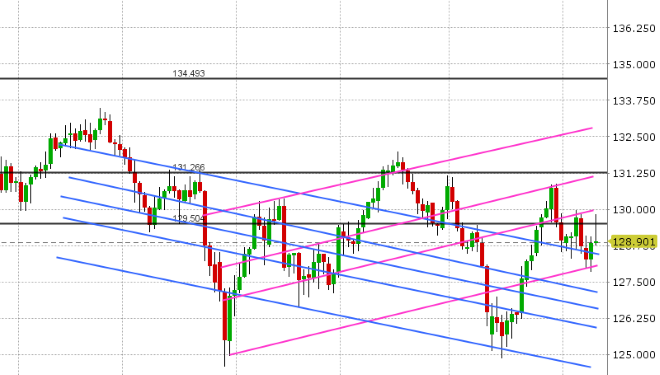

USDJPY: Dollar/yen’s drift higher yesterday turned into a pop higher in Asia trade overnight, with gains in the Nikkei leading the way. The market broke resistance in the 111.20s, and moved higher to the next level (111.50s) ahead of the UK employment report. A combination of chart resistance at the 111.50s and a massive wave of JPY cross buying following the GBPUSD plunge arrested the upward momentum in USDJPY, and we’re now drifting back lower to the 111.20s where a large option expiry lies for today’s NY session (1.7blnUSD at 111.25). We’ll be watching US treasury yields closely over the next three days as a raft of US paper gets auctioned (4 week bills+52 week bills+3yr notes today, 10yr notes tomorrow, 30yr bonds Thursday).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

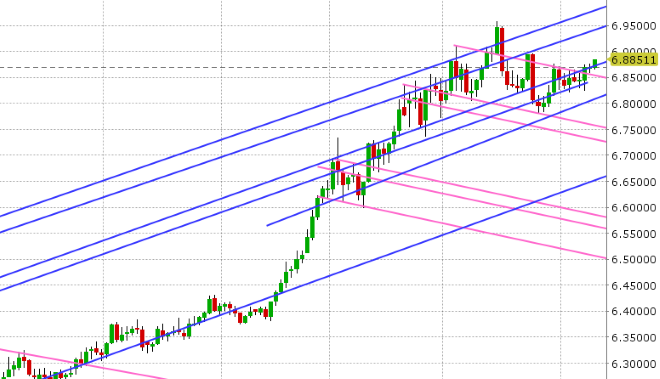

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

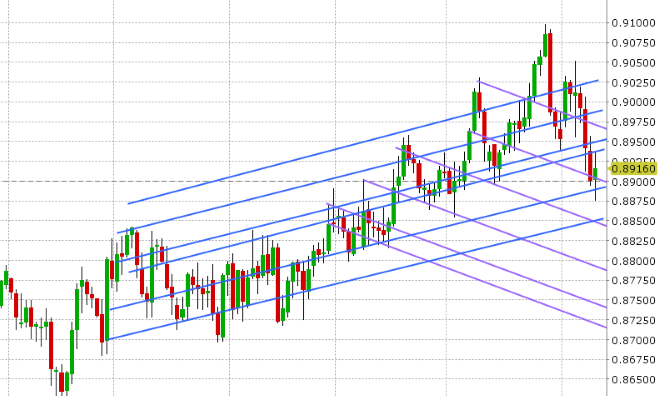

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.