FX markets quiet ahead of Fed rate decision

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD continues to mark time this morning as traders await today’s Fed decision on interest rates. The US just reported slightly higher than expected CPI figures for the month of November (+0.3% MoM vs +0.2% and +2.1% YoY vs +2.0%) and while this number hasn’t moved markets all that much, we think this data point will give Jerome Powell and the FOMC further ammo when it comes to defending why the “current stance of monetary policy is likely to remain appropriate”. The bond and money markets aren’t forcing the Fed to do anything today and so it’s quite possible we get a whole lot of nothing in terms of market reaction. It’s also quite possible that markets have telegraphed today’s Fed meeting so well that we see a “buy the rumour, sell the fact” trade emerge post Fed, which could hurt the USD more broadly. As always, all eyes (and all the trading algorithms) will be glued on the FOMC’s press release at 2pmET and Jerome Powell’s press conference at 2:30pmET.

We hope some reporters will press Powell on the stealth “not-QE” that the NYFed is now conducting by way of 60blnUSD/month in T-Bill purchases and we’d be delighted if somebody asks the Fed chairman to comment on a bombshell report released from the Bank of International Settlements a couple days ago, which found that four mega US banks (cough…cough JP Morgan) and leveraged hedge funds were at the core of the crisis that hit repo markets back in September. More here from Reuters.

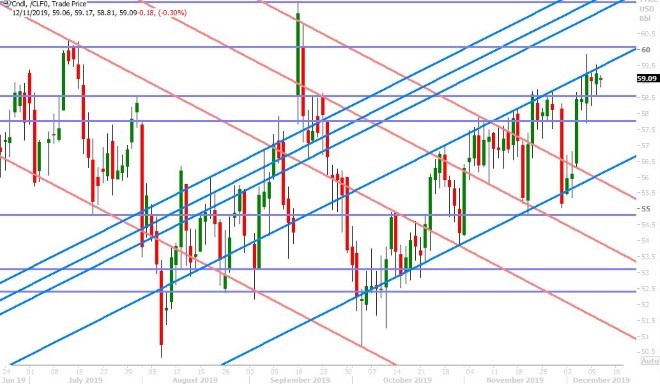

January crude oil futures are trading marginally lower this morning after last night’s weekly API report showed a surprise 1.41M barrel build in oil inventories versus expectations for a 2.8M barrel draw. The Reuters Poll expectation for this morning’s 10:30amET EIA release is -2.763M barrels. OPEC released its monthly Oil Market Report for November over the last hour but it left its 2020 global and OPEC oil demand growth forecasts unchanged at 1.08mln bpd and 29.58mln bpd respectively.

USDCAD DAILY

USDCAD HOURLY

JAN CRUDE OIL DAILY

EURUSD

Euro/dollar appeared to slump back lower with German bund yields earlier this morning, but we’re talking about a very small, low volatility, move; which is quite normal ahead of the event risk which is on deck today. The release of the US CPI report has brought in some broad USD selling (perhaps because the core CPI measure simply met expectations of +2.3% YoY), but again we’re talking about very small moves here for EURUSD. We think a strong NY close above the 1.1100 level, however it happens, would be a very bullish technical development for the market. Perhaps there is a dovish surprise in store for us from the Fed today? The ECB releases its latest monetary policy announcement tomorrow at 7:45amET.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling bulls got a little ahead of themselves yesterday by trying to break GBPUSD above the 1.3200 mark into the NY close. The final YouGov MPR election poll, released at 5pmET yesterday, showed the 68 seat Tory majority from two weeks ago being reduced to just 28. This was a perfect excuse to hit the sell key for sterling traders as it now reintroduces fears of a hung parliament result after tomorrow’s UK general election. Some GBP buyers have returned in European trade today after a successful re-test of the post YouGov lows in the 1.3110s and we also think the over 700mlnGBP in option expiries at the 1.3150-60 strikes this morning is having a part to play in this price action. The broad USD selling post US CPI this morning has now helped GBPUSD extend its gains from the European AM.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

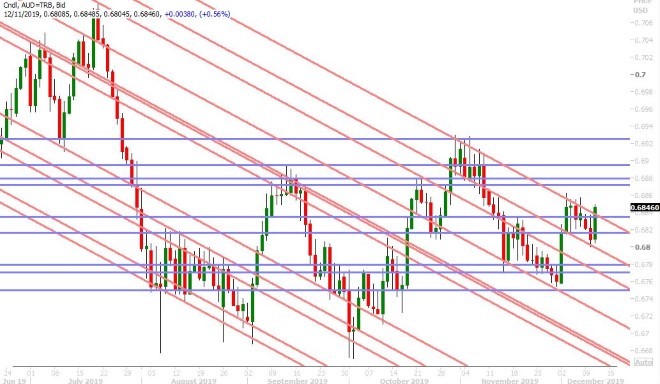

There’s an odd, buoyant, tone to the Australian dollar this morning. The overnight US/China news flow has not offered up any “positives” in our opinion; uncertainty about the Dec 15th tariff deadline still remains in light of Navarro’s comments on Fox News last night; plus we’ve seen broad USD strength since the start of Asian trade last night. Some traders are chalking up this AUD outperformance to strength in NZDUSD today, following some positive news on the New Zealand fiscal front, but whatever the reason we have to note AUDUSD’s quick rally back above the 0.6840 level. We said yesterday how a sustainable path higher for the market will depend upon the AUDUSD closing firmly above this level, and so today’s post-Fed price action could be pivotal.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

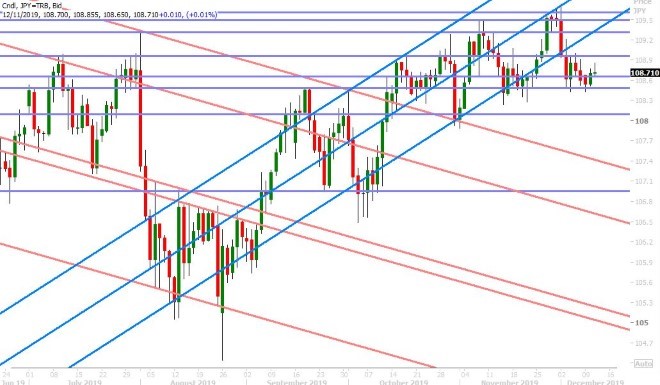

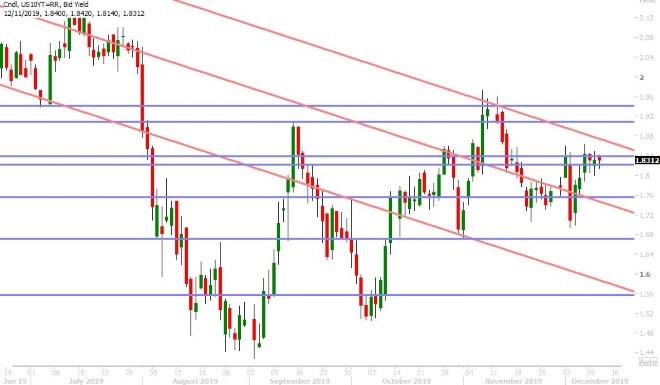

Dollar/yen traders seem a bit paralyzed morning. Yesterday’s WSJ-driven boost to risk sentiment helped drive US 10yr yields higher into the 1.83-1.84% zone we talked about, which hoisted USDJPY back above the 108.60 level; but all this is unravelling now as traders digest an in-line to slightly better than expected US CPI report, more conflicting US/China trade headlines from the overnight session and looming event risk (Fed decision today and UK election tomorrow). We still believe the funds are positioned poorly here in the event we see some sort of dovish surprise from the Fed or a shock hung parliament result out of the UK election tomorrow.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.