Boris Johnson's Tories achieve landslide UK election victory

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- GBPUSD surges 350pts in early Asia to hit 1.35 handle. Broad USD sales ensue.

- Risk-on wave in Asia follows very positive US/China trade deal sentiment from NY session yesterday.

- President Trump reportedly signs off on deal to reduce existing China tariffs by 50% + delay planned Dec 15th tariffs.

- Chinese officials do not confirm anything in the overnight session. Expected to speak shortly after 10amET.

- USDCAD funds shorts can’t benefit from two waves of “risk-on”. AUDUSD longs looking nervous.

- GBPUSD now 150pts off session highs. “Buy the rumour/sell the fact” + 5pmET hour gap fill in play.

- USDJPY fund longs breath sigh of relief over the last 24hrs. US 10yr yields back below 1.90% now though.

- US Retail Sales disappoints for November, +0.2% MoM vs +0.5% expected.

ANALYSIS

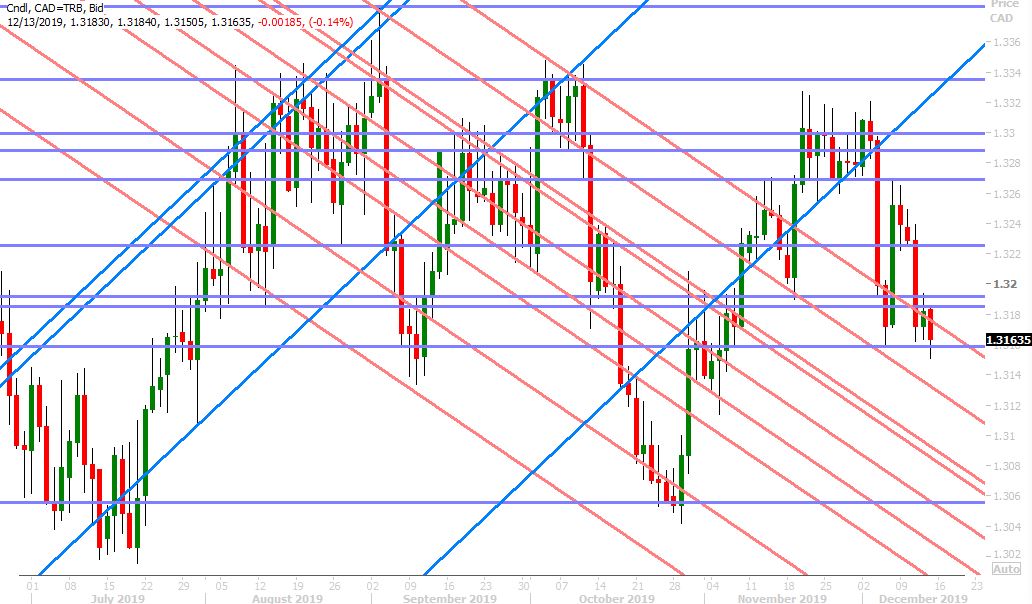

USDCAD

The dollar/CAD buyers failed at the pivotal 1.3180s yesterday, which in turn set up traders to respond negatively to the onslaught of “risk-on” headlines that came out towards the NY close, but the market put in one heck of a defense of the 1.3150-60 support level. First we got headlines about President Trump agreeing to a deal “in principle” with China which would include a 50% reduction to existing tariffs and a delay of the planned new tariffs effective December 15th. Then we got word from the New York Federal Reserve that they plan to pump an additional 365blnUSD of liquidity into term repo markets for year’s end. Finally, we got the 5pmET exit polls results from the UK election, which showed Boris Johnson’s Tories winning by a landslide 86-seat majority. All of these “risk-on” headlines should have seen USDCAD break lower amid a reactive wave of broad USD selling, but the market barely moved.

When we now combine this downside failure on the part of USDCAD sellers with some GBP profit taking and some unnerving silence on the part of Chinese state media following the Trump deal headlines, we have to think the fund short community is getting frustrated here this morning. They’ve had to withstand the Bank of Canada’s November flip-flop on the global growth narrative, and now the market can’t benefit from some obvious improvement in broader risk sentiment? The US just reported its Retail Sales data for the month of November and the numbers missed expectations (+0.2% MoM vs +0.5% on the headline, and +0.1% vs +0.4% ex Autos), which is more bearish news for USDCAD, yet it can’t sell off. FX dealer defense of over 1blnUSD in options expires between the 1.3140 and 1.3155 strikes at 10amET could also be in play this morning. We think the longer USDCAD keeps defending the bottom end of its post-payrolls 1.3160-1.3260 range, we think the likelihood increases that we see another bounce back to the 1.32s.

USDCAD DAILY

USDCAD HOURLY

JAN CRUDE OIL DAILY

EURUSD

Euro/dollar struggled during most of NY trade yesterday as the combination of a Trump “getting very close to a big deal” tweet and headlines about the 50% tariff reduction offer to China sparked a strong “risk-on” wave across markets. US bond yields surged and gold prices plummeted, which was the perfect recipe for EURUSD selling. However, then came Boris Johnson’s massive UK election win, predicted with confidence at yesterday’s 5pmET exit poll, combined with a monstrous 350pt move higher in GBPUSD. EURUSD traders joined the party, taking the market all the way higher to some mild chart resistance at the 1.1200 level and they definitely had positive chart technicals on their side, given Wednesday’s Fed-driven upside break of the 1.1100 level. All this has taken a bit of breather in the overnight session however as GBPUSD recedes 150pts from its session highs and US bond markets begin to cast doubt once again on whether or not we have actually have a US/China trade deal this morning. We see mild support in EURUSD at 1.1150-60 today, where it just so happens we’ll see 1.1blnEUR in options expiring at 10amET.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling shot to the moon at the start of Asian trade last night, following a 5pmET exit poll that showed Boris Johnson’s Tories winning the 2019 UK election with a massive majority of 68 seats. The exit poll forecast has largely come true as the actual votes now get counted, and this mammoth Tory victory now basically ensures that Boris Johnson can finally pass his Brexit Withdrawal Bill and the UK can begin leaving the EU at the end of January 2020. So why has the GBPUSD sold off since surging 2.5% to the 1.3500 mark last night? There are a few reasons in our opinion:

1. The market largely saw this UK election result coming. If you discount yesterday’s GBPUSD put option activity as natural hedging ahead of a big event, what we really saw last night was a lottery ticket for the fund longs that hung in there during the tumultuous summer period; and we think it was also a “cha-ching” sounding event for the new speculative length that came into the market following the bullish breakout from November’s triangular price consolidation. A classic “buy the rumour, sell the fact” type trade.

2. The market’s surge occurred at the worst time of day for FX market liquidity. Many trading platforms and price feeds shut down around the 5-5:30pmET hour for daily maintenance and so that swaps/position rollovers can be automatically processed. What this created in our view was a) an exacerbated move because liquidity was thin and b) a massive upside chart gap on many platforms…and we know all too well how much traders love to fill gaps on the charts.

3. A major Brexit road-block may have just passed, but people are already talking about the tough slog that lies ahead for Boris Johnson during the Brexit Transition Period of 2020. More here from Reuters.

We think the sterling will spend the better part of today and next week consolidating last night’s massive upside move, and we think stepping aside from a directional view may be the prudent thing to do until the GBPUSD charts (the technicals) settle down a bit.

GBPUSD WEEKLY

GBPUSD HOURLY

EURGBP WEEKLY

AUDUSD

Australian dollar traders are a nervous bunch this morning as Chinese officials are reportedly set to break their silence on yesterday’s US/China deal story, according to Reuters. All the UK-election driven gains from the overnight session have evaporated and the market is now falling back to familiar chart support levels in the 0.6870s. CNBC is reporting that Chinese officials will be holding a press briefing at 10amET this morning. Off-shore dollar/yuan is already surging back above the key 7.00 level. Grab your popcorn.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

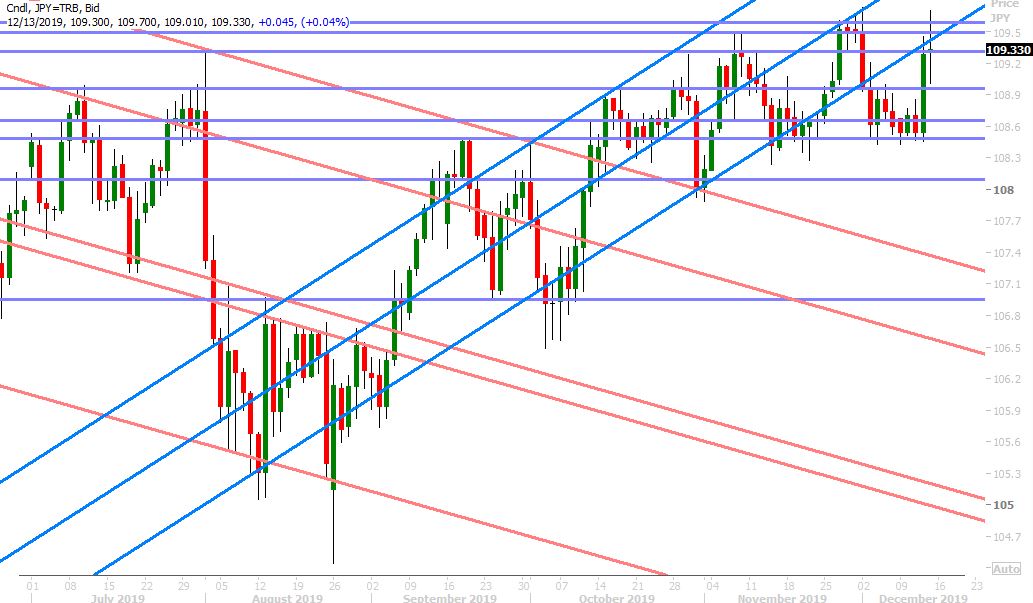

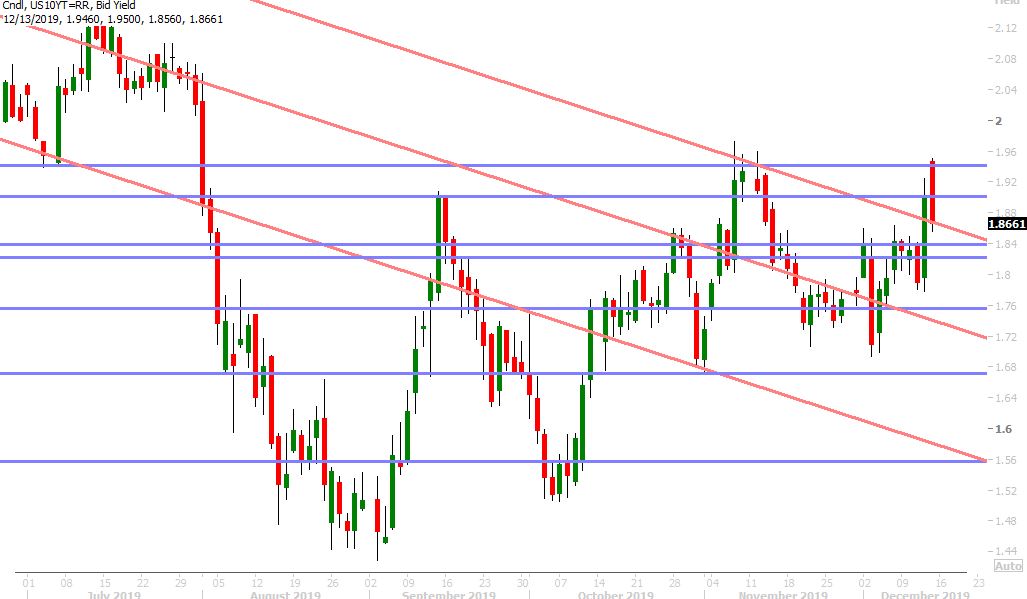

USDJPY

The dollar/yen fund longs were given a gift over the last 24hrs as two strong waves of “risk-on” sentiment vaulted the market off chart support in the 108.50s; first from the positive sounding US/China trade deal headlines, and then from the overwhelming positive UK election results. The sellers are back however now as traders get anxious about the upcoming China press conference. US 10yr yields have slipped back below the 1.90% support level, after having surged over 15bp yesterday (trough to peak).

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.