USD quiet to start week. USDJPY plunge halted by BOJ intervention. EUR traders eyeing ECB meeting this week.

Summary

-

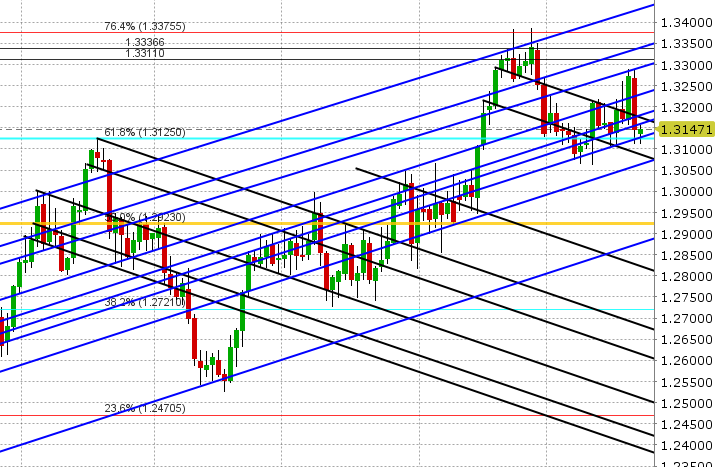

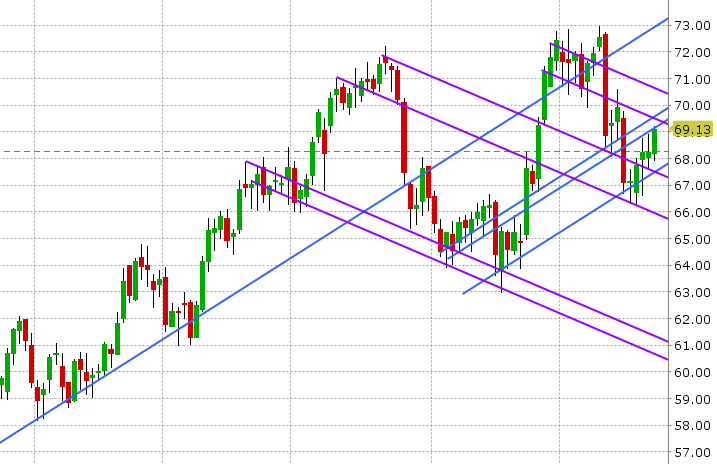

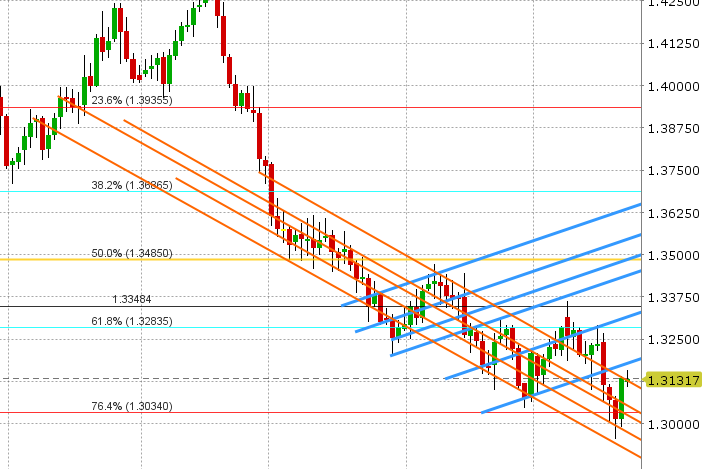

USDCAD: Dollar/CAD is starting the week steady after a plunge lower on Friday which was spurred on by strong Canadian data. While Canadian core CPI for June missed expectations by a bit, the headline beat estimates (+2.5% YoY vs. +2.3%) and the May Canadian Retail Sales figures (reported at the same time) blew away expectations, coming in +2% MoM vs. +1.1%. USDCAD fell though three support levels on the charts, and finally caught a bid at support in the 1.3120s, but the bounce was muted leaving sellers in control going into the NY close. Today’s action so far has lacked momentum, with USDCAD trading comfortably within the 1.3120s to 1.3160s. This week’s calendar is significantly lighter, with just US Durable Goods on Thursday and the first look at Q2 US GDP on Friday. The net USD long (CAD short) position at CME fell slightly in the week ending July 17 (as USDCAD reversed higher following the Bank of Canada meeting), but this position still remains elevated relative to how the market was positioned during the rally in June. We think USDCAD drifts higher here in search of sellers in the 1.3160-80 area. September crude oil is bid this morning as Trump and the Iranian leader Rouhani exchange tough words. More here: https://nationalpost.com/news/world/israel-middle-east/donald-trump-iran-war.

-

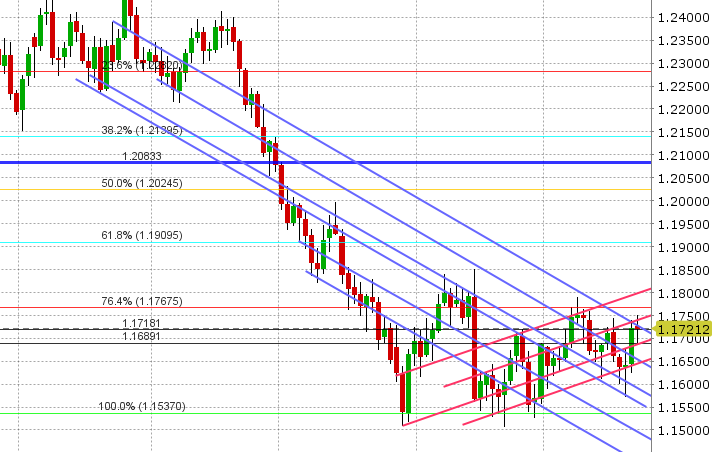

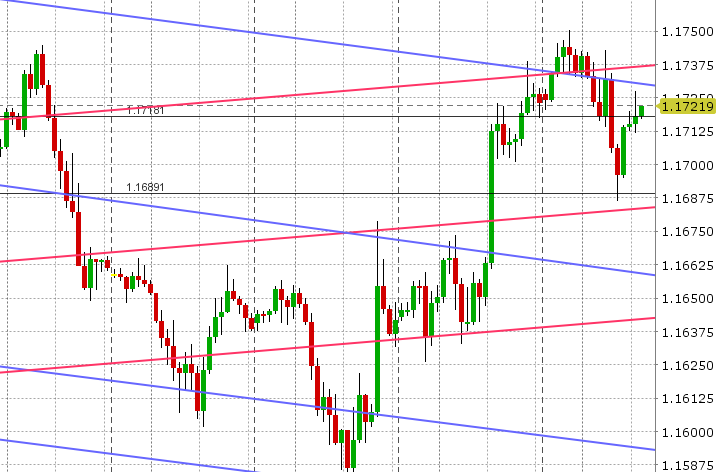

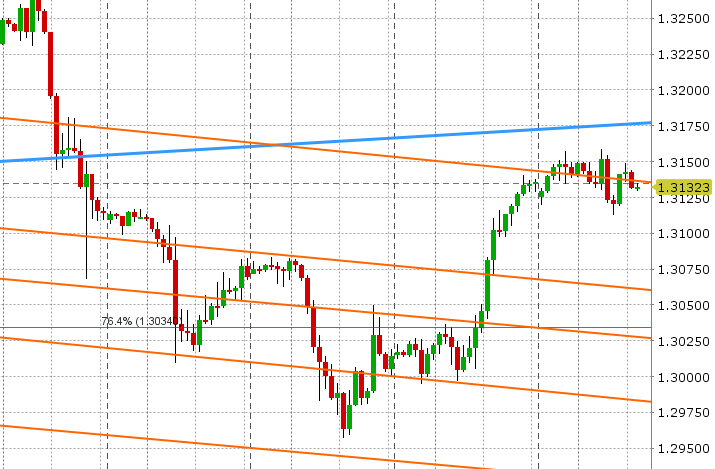

EURUSD: Euro/dollar is trading with a range-bound tone this morning after ratcheting higher in NY trade on Friday. The move was largely Trump driven after the President doubled down on his concern about another two rate hikes from the Fed this year. Chart resistance in the 1.1680s was taken out, and with that the market was able to extend to the next resistance level in the 1.1720-40 region. This level capped trade however in late NY trade Friday, and then again in Asia overnight, and so Europe has been selling EUR so far today. A bounce higher in USDCNH, despite a slightly weaker USDCNY fix, and EURJPY sales are also pressuring EURUSD a little bit this morning. Buyers stepped back in on the dip back to the 1.1680s however, and so traders are once again deciding what to do with the 1.1720-40 resistance level. This week features the ECB meeting on Thursday, where no change to interest rates is expected. However, traders will be paying close attention to developments regarding the timing of the first hike in mid to late 2019. This week’s European calendar also features the Markit Services PMIs on Tuesday and the German IFO survey on Wednesday. The net EUR long position fell to +21k contracts as some longs liquidated in the week ending July 17. We think EURUSD could very well range trade here as there’s not much on the docket until the big day on Thursday. A close above the 1.1760s would be bullish for price action.

-

GBPUSD:Sterling is trading with a neutral tone today as well, after Friday’s impressive performance higher. Trump was the driver here as well, with chart resistance in the 1.3040-50s falling early and then 1.3070s. The move through the 1.3070s then allowed for a surge up to the 1.3140s. Friday’s NY close was positive (closing on the daily high right at trend-line resistance) and it’s this level that the market is hugging so far today as the broader USD range trades. This week’s UK calendar is light, with the only key feature being BoE Broadbent’s speech at 1pmET today before the Society of Professional Economists in London. OIS swaps are currently pricing in over an 85% chance of a 25bp hike on August 2nd. The net GBP short position at CME fell marginally as longs added slightly more than shorts in the volatile week ending July 17. With EURGBP finding a bid once again after Friday’s sell off, we think GBPUSD might succumb to some pressure here. A close above the 1.3130s would invite a drift higher to trend-line resistance in the 1.3170-80s in our opinion.

-

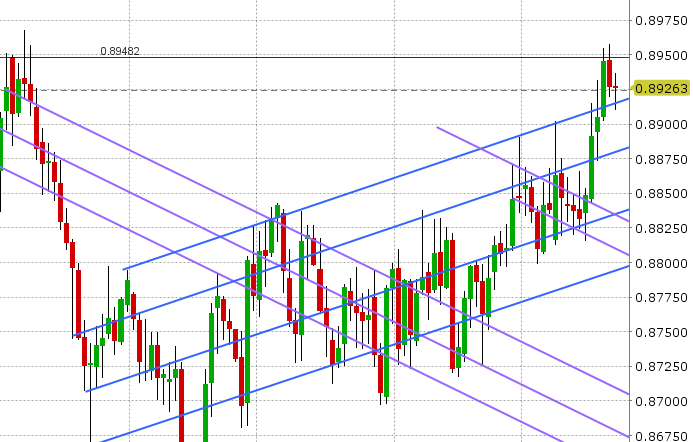

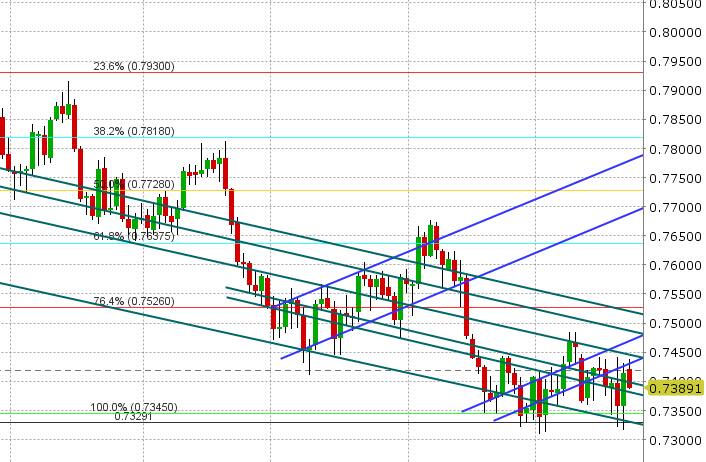

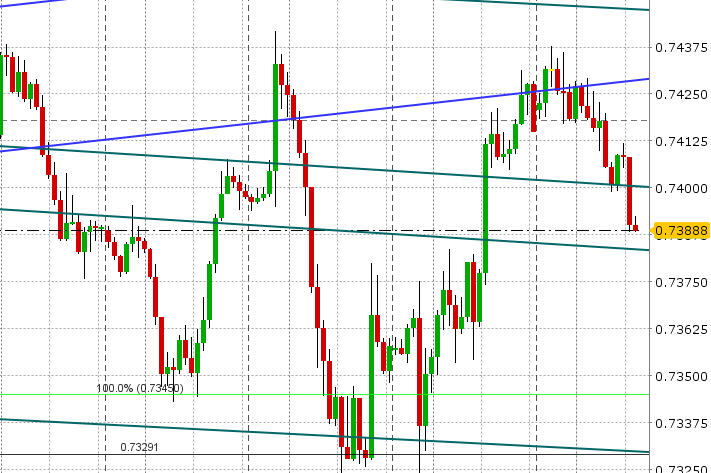

AUDUSD: The Aussie is trading with a weak tone this morning, after Friday’s Trump driven rally capped out at chart resistance in the 0.7420s. This level held price back in Asia today, and traders have been quick to push AUDUSD back to chart support in the 0.7385-0.7400 area. Copper prices inched higher earlier today but are now struggling with resistance in the 2.77s. This week’s calendar features Australian CPI on Wednesday (Tuesday night ET). The net short AUD position at CME remained largely unchanged during the week ending July 17 as both longs and shorts liquidated a bit. We think AUDUSD range trades here ahead of CPI tomorrow night.

-

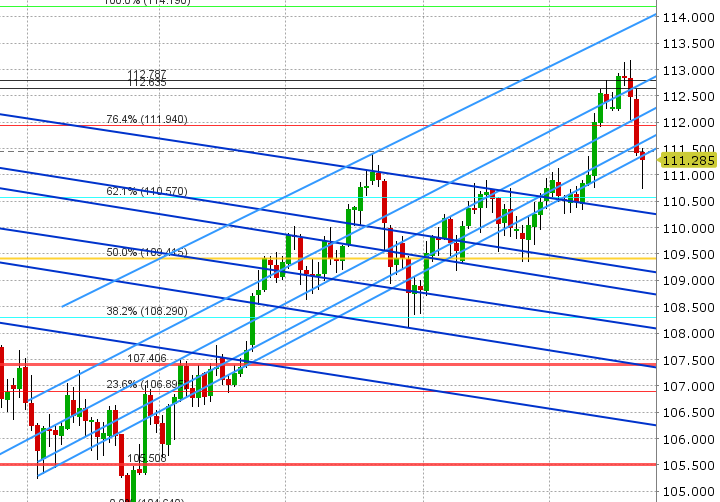

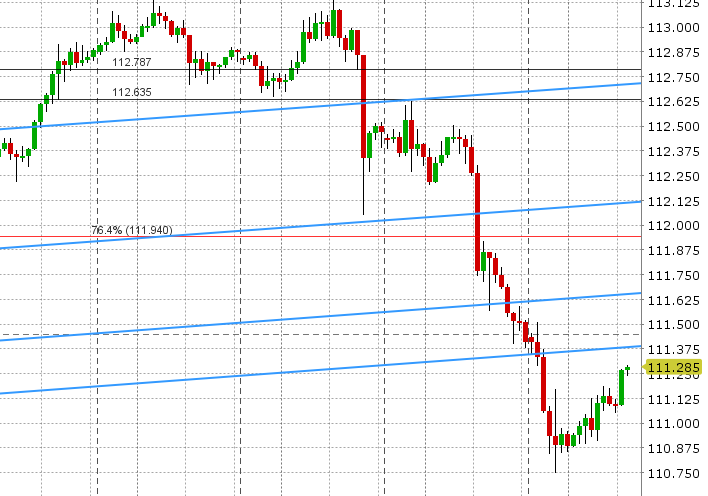

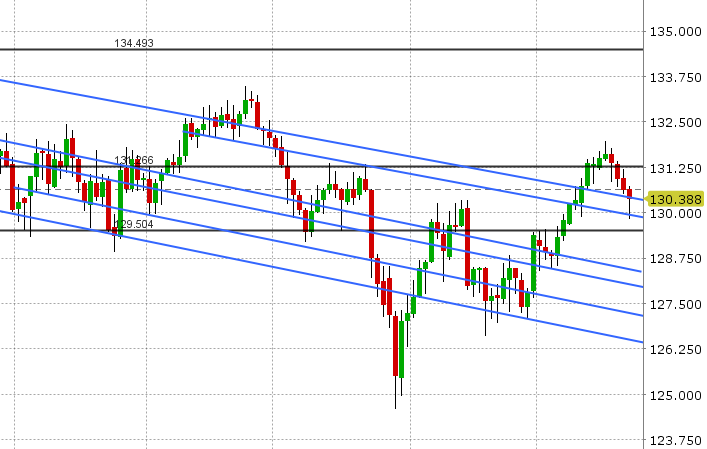

USDJPY:It’s been a tumultuous 72hrs of trading for USDJPY longs as a combination of Trump comments on rising interest rates/rising USD, overextended JPY short positioning, plus rumors of the BOJ tweaking its yield curve control program at its upcoming meeting (Aug 31st) have all but ruined the technical breakout higher in the market earlier this month. Trump’s comments on Friday saw the market shatter chart support in the low 112s and then 111.60 late in NY trade. Then we got the latest COT report from the CFTC showing new USD longs (JPY shorts) piling in during the week ending July 17. The Sunday open saw JGB yields spike higher and USDJPY lower again following reports that the BOJ is conducting a full review of the negative effects of its yield curve control program on JGB liquidity and bank sector profitability (the BOJ’s Kuroda denied this, when questioned by reporters at the G20 meeting over the weekend). It wasn’t until the BOJ formally intervened last night with its first fixed rate operation since February (announced it would buy unlimited amounts of JGBs at 0.11%) and with that JGBs and USDJPY have rebounded a bit. Some broad USD strength in early European trade, rising US yields and some broad JPY cross buying at this hour is helping USDJPY into the NY open. We think the long USDJPY thesis now hinges on the market regaining the 111.50s on closing basis.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Daily

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.