US Durable Goods and Q3 GDP (2nd estimate) surprise to the upside

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

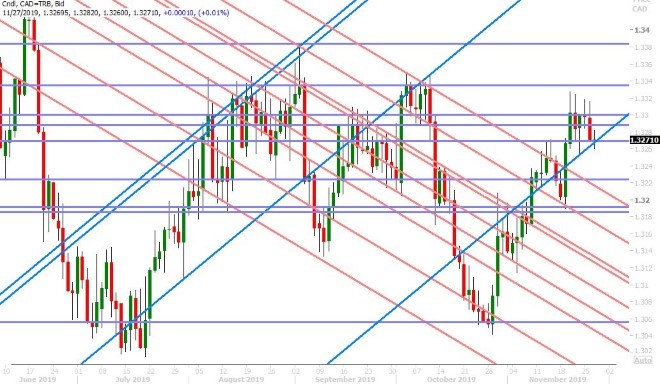

USDCAD

The dollar/CAD bulls held on for dear life during early European trade this morning after a broad USD selling wave swept over commodity currency pairs. There’s been some chatter overnight about the US/China trade deal being in its “final throes”, according to President Trump, but this is old news we feel. More than likely what we’re seeing here is some position adjustment ahead of some large G7 option expiries today, the US Thanksgiving holiday tomorrow and month end on Friday. The US has just released some economic data that is worthy of attention:

Durable Goods (Oct): +0.6% MoM vs -0.8% exp and -1.2% prior (beat)

GDP 2nd Estimate (Q3): +2.1% vs +1.9% exp and +1.9% prior (beat)

Core PCE Index (Oct): +2.1% YoY vs +2.2% exp and +2.2% prior (slight miss)

The USD is catching a broad bid off the better than expected Durable Goods and GDP numbers, but USDCAD has yet to materially benefit from this (which is quite concerning in our opinion). The day is young but we think the market needs to confidently close above the 1.3260s in order to keep the bull thesis alive. Otherwise, we risk completely unravelling last week’s, Wilkins-inspired, upside breakout.

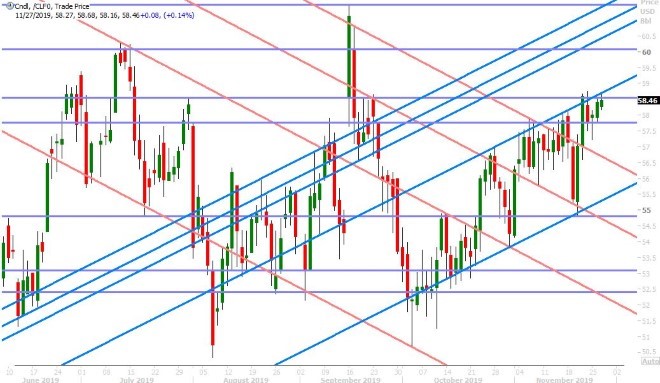

The EIA reports its weekly oil inventory report at 10:30amET, with traders expecting a draw of 418k barrels. This would be in contrast to the API report, which last night showed an unexpected build to inventories (+3.639M barrels vs -0.418M). January crude oil futures continue to struggle with the mid $58 level, which could help USDCAD ultimately if this technical failure leads to further selling.

USDCAD DAILY

USDCAD HOURLY

JAN CRUDE OIL DAILY

EURUSD

Euro/dollar continues to hug the familiar 1.1010s trend-line support level this morning after US yields bounced into the NY close yesterday. That bit of upside momentum to yields continues this morning (with US 10s punching back above 1.7550%) and when we combine this with some massive option expiries below here (2blnEUR between 1.0995 and 1.1000) and the better than expected US Durable Goods and GDP numbers just released, it’s not surprising to see EURUSD under pressure again here.

EURUSD DAILY

EURUSD HOURLY

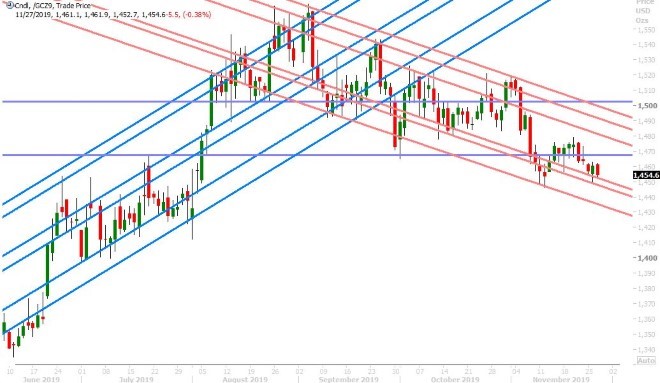

DEC GOLD DAILY

GBPUSD

Sterling is the relative outperformer this morning amid market chatter of month-end demand for GBP against EUR. We also think we could also be see hedging flows related to over 1.1blnGBP in options expiring between the 1.2845 and 1.2860 strikes at 10amET this morning. Everyone’s talking about the YouGov MRP poll, which will be released at 5pmET today, because it correctly predicted the outcome of the 2017 UK general election. More here from Bloomberg. We think the market’s downward momentum of late could stall with a NY close today above the 1.2870s, but today's close will be fraught with event risk.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie is holding up rather well today, despite the continued pressure on EURUSD, an aggressive RBA rate cut/QE call out of Westpac bank and despite some horrible industrial profit data out of China last night (-9.9% YoY in October…steepest fall in 8years). More here from the South China Morning Post. We think defensive hedging of this morning’s 1blnAUD option expiry between 0.6760 and 0.6775 is playing a part in influencing today’s price action. We’ve seen some selling come in after the better the expected US data, but we’d note that chart support in the 0.6770s continues to hold.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is riding high after US 10yr yields recovered into the NY close yesterday and continued their rally this morning off some better than expected US economic data. Over 1blnUSD in options at the 109.15 strike at 10amET could slow the market’s ascent here, but it feels like USDJPY wants to now go after the early November highs at 109.50.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.