Traders price-out some US/China risk since late Friday

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Trump’s much anticipated press conference deemed soft on China by market participants.

- Risk sentiment recovers late on Friday, spills over as upbeat mood in Asian trade overnight.

- Mild USD returns after Bloomberg report about China pausing some US agricultural purchases.

- China says US “will be exposed to a decisive counterattack” for interfering with internal affairs.

- US ISM Manufacturing report for May up next, 43.6 expected. Big week of economic data ahead.

- Reserve Bank of Australia meets tonight at 12:30amET. Bank of Canada meets Wednesday.

- ECB meeting on Thursday. Brexit talks resume. OPEC may move up policy meeting to this Thursday.

ANALYSIS

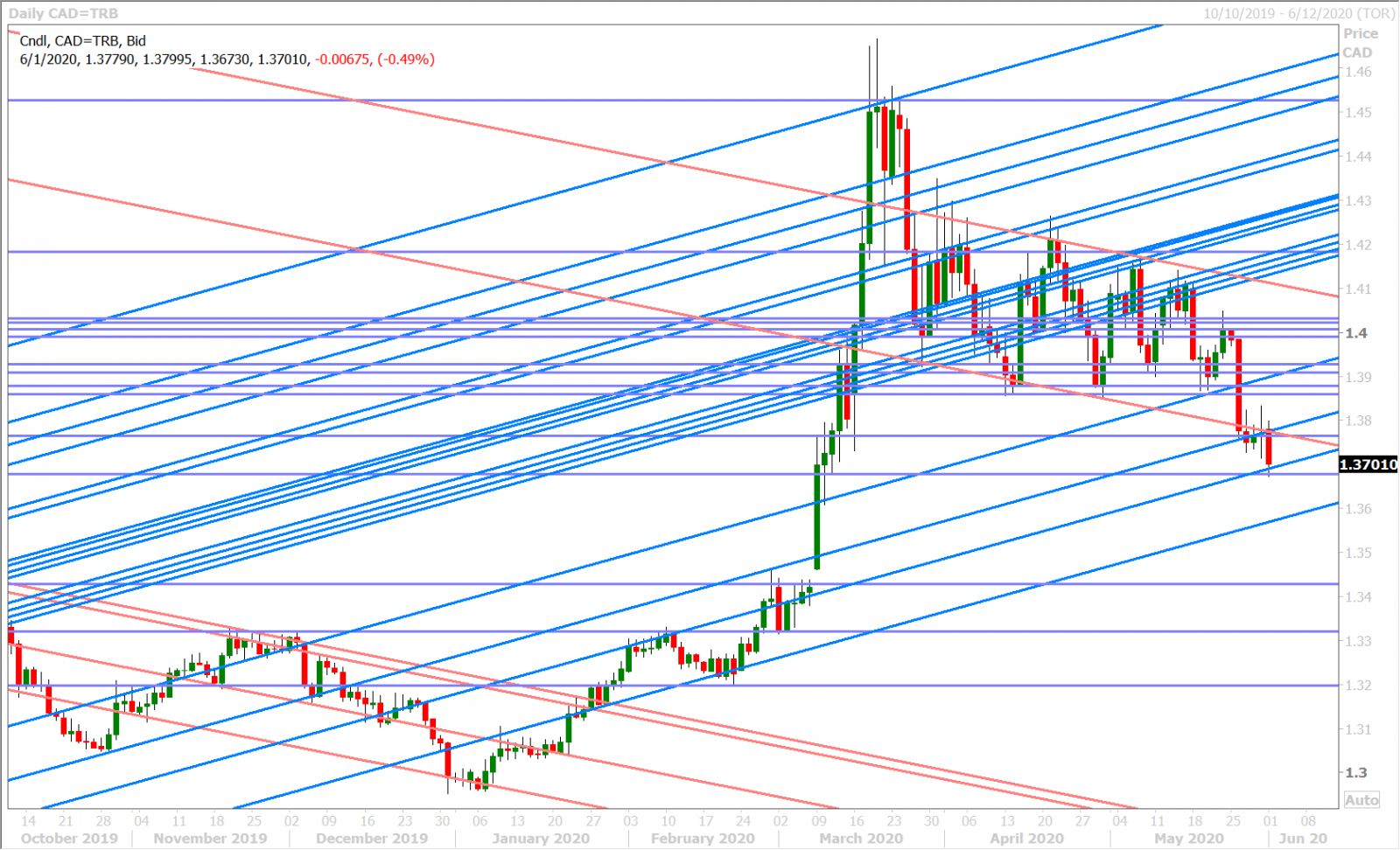

USDCAD

Global markets breathed a sigh of relief late Friday after it was deemed that President Trump “took it easy on China” during his much anticipated press conference. While risk sentiment dipped initially as Trump railed negative comments towards China, it reversed higher when the President simply confirmed the US’ intention to revoke Hong Kong’s special status and sanction Chinese officials, but nothing more. These actions had largely been anticipated by traders, but there were no other serious actions taken against the Chinese state specifically, and so the press conference simply didn’t live up to the hyped up retaliatory campaign that the US administration was waging for over a week up until that point.

The resulting bounce in risk sentiment was enough to see USDCNH fall below the important 7.1550 level going into Friday’s NY close and we think this was the key driver behind the broad, “risk-on, USD sales we saw last night as Asian markets played catchup. A Bloomberg report then made the rounds in Europe this morning about Chinese government officials telling state-run agricultural companies to pause purchases of some US farm goods including soybeans and, while these headlines have seen the USD go bid, we’d take this with a grain of salt as China has been buying most of its beans from Brazil this year anyways. Global markets haven’t been bothered whatsoever by the widespread rioting against police brutality across the US over the weekend.

Traders are now getting ready for this morning’s 10amET release of the US ISM Manufacturing report for May, where read of 43.6 is expected, versus 41.5 in April. We wonder if the number could come out even weaker though, given the plunge in Chicago’s May PMI number last week. This week’s North American economic calendar will be a busy one as it will feature the US ISM surveys, the Bank of Canada meeting, and the official May employment data out of the US and Canada. There is even talk now that this month’s OPEC meeting could get pushed forward to this Thursday, June 4th.

The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds liquidating only some of their long USDCAD positions during the week ending May 26; which is a bit disconcerting given the market’s breakdown to a new downtrend on that very same day. This tells us that the “pain trade” is still lower for dollar/CAD but traders are using this morning’s Bloomberg report, and some chart support in the 1.3680-90s, as justification though to curb the selling for now though.

USDCAD DAILY

USDCAD HOURLY

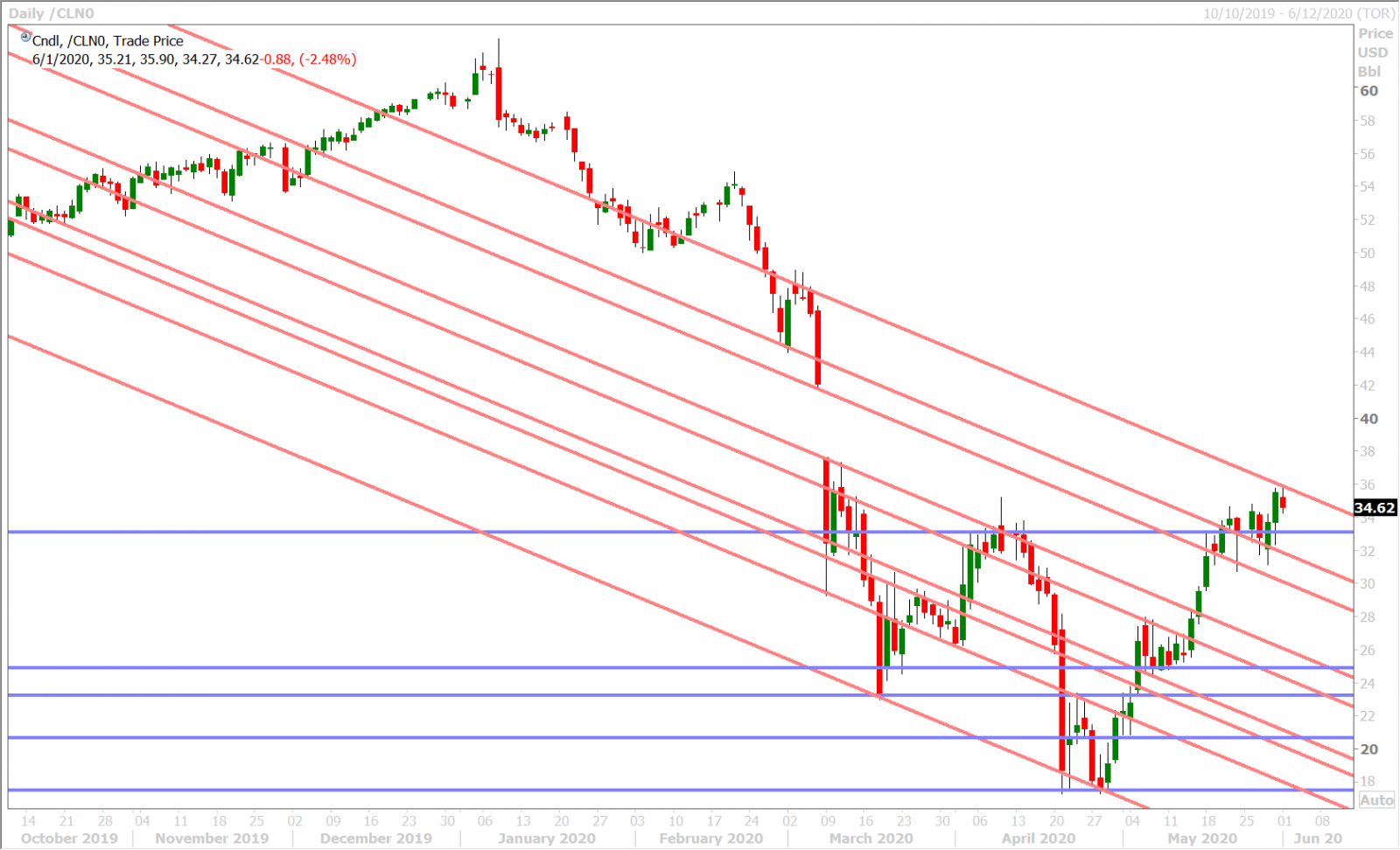

JULY CRUDE OIL DAILY

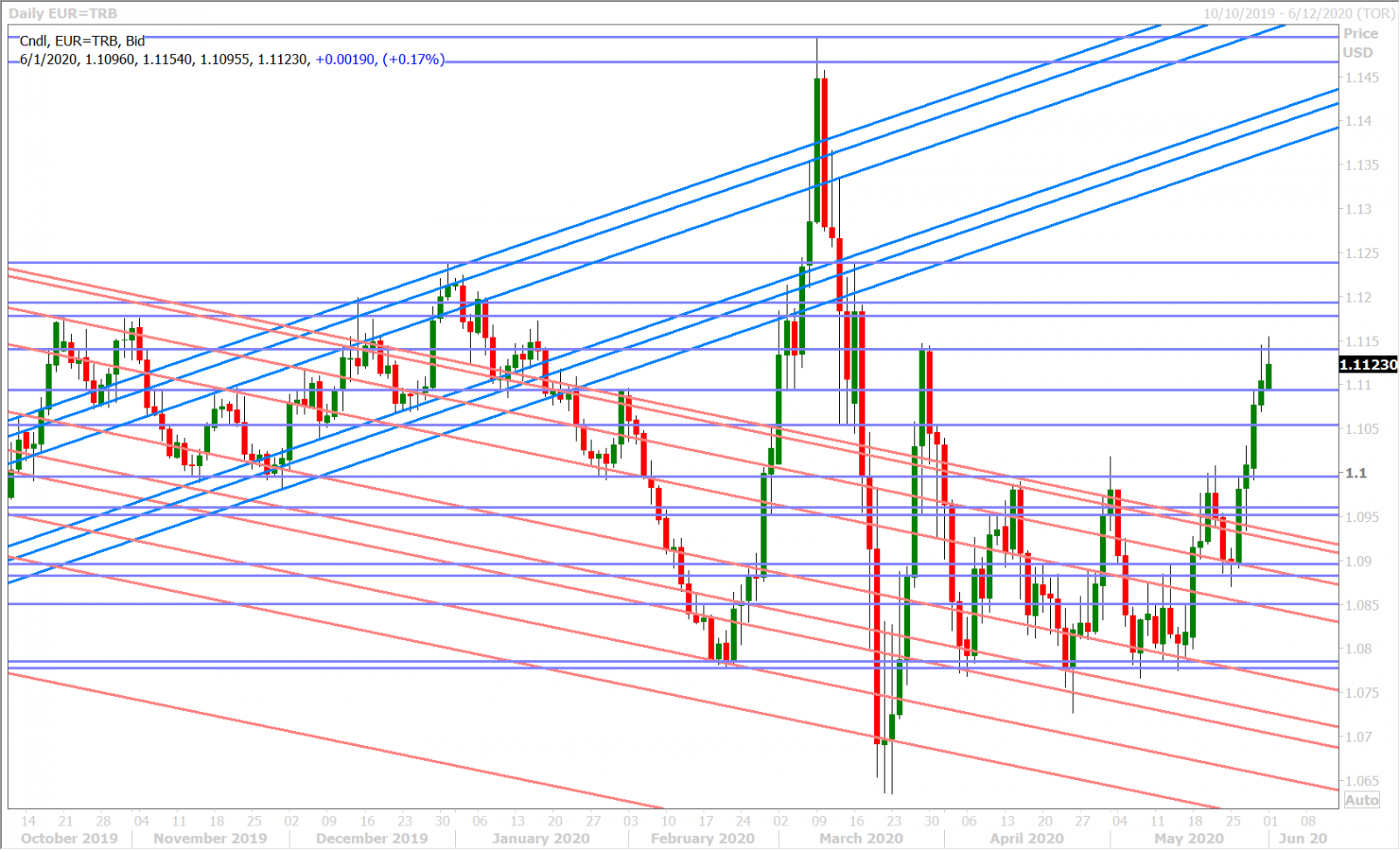

EURUSD

Euro/dollar is starting the month of June with a somewhat heavy tone after this morning’s Bloomberg report caused buyers to fail in the 1.1140s yet again. Over 2blnEUR in options are also just about to expire between 1.1100 and 1.1125 strikes, which could have been adding some weight to the market. The final May Manufacturing PMIs for Germany and the Eurozone were released slightly below their flash estimates this morning, but this was not truly surprising and was shrugged off by markets. This week’s key feature will be the ECB meeting on Thursday, where traders are expecting a 500blnEUR boost to the central bank’s Pandemic Emergency Purchase Program.

The leveraged funds at CME started re-building their net long EURUSD position during the week ending May 26th, after marginally trimming that position over the last month; which has turned out to be a great move given EURUSD’s breakout above the 1.0990s level last week.

EURUSD DAILY

EURUSD HOURLY

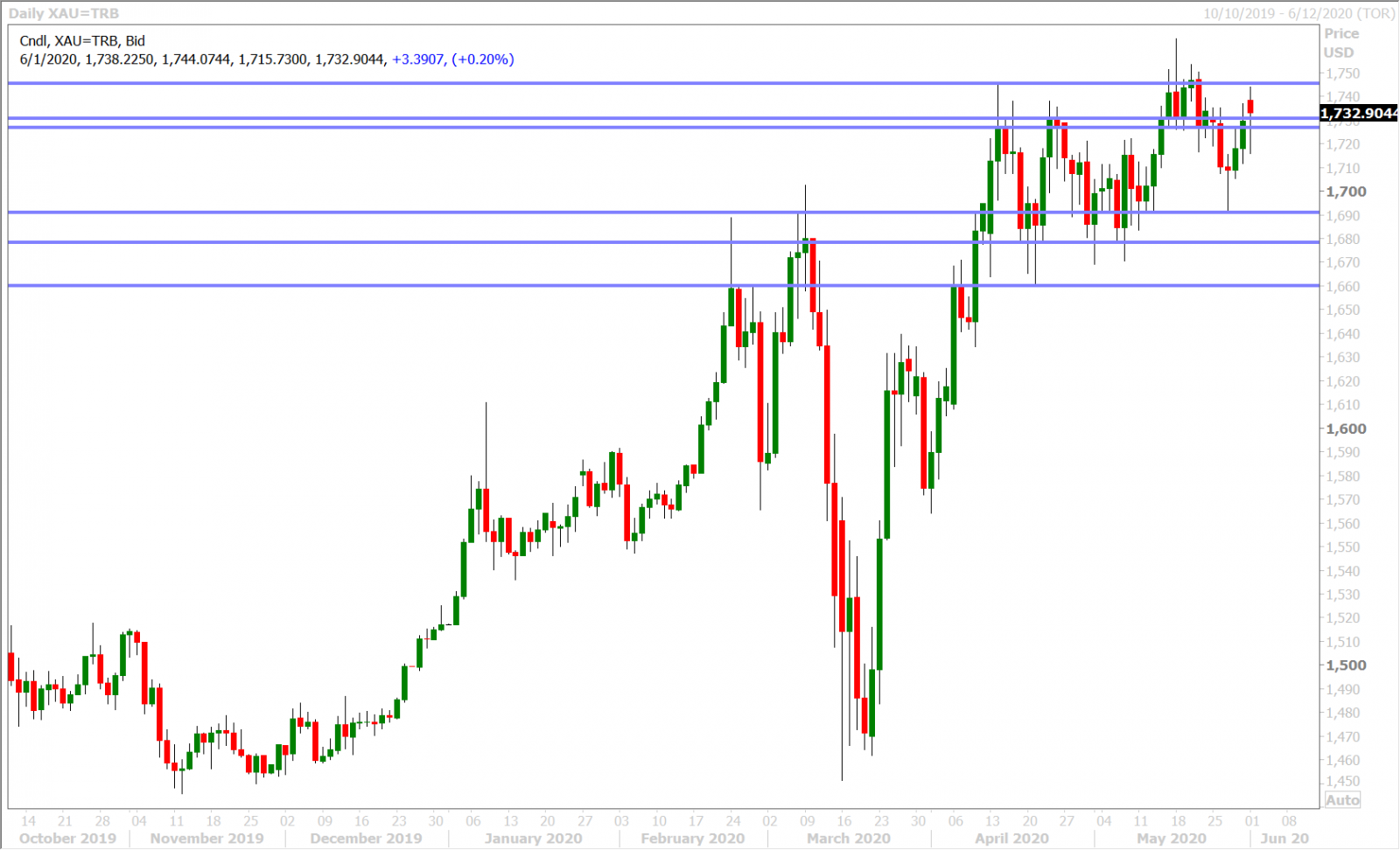

SPOT GOLD DAILY

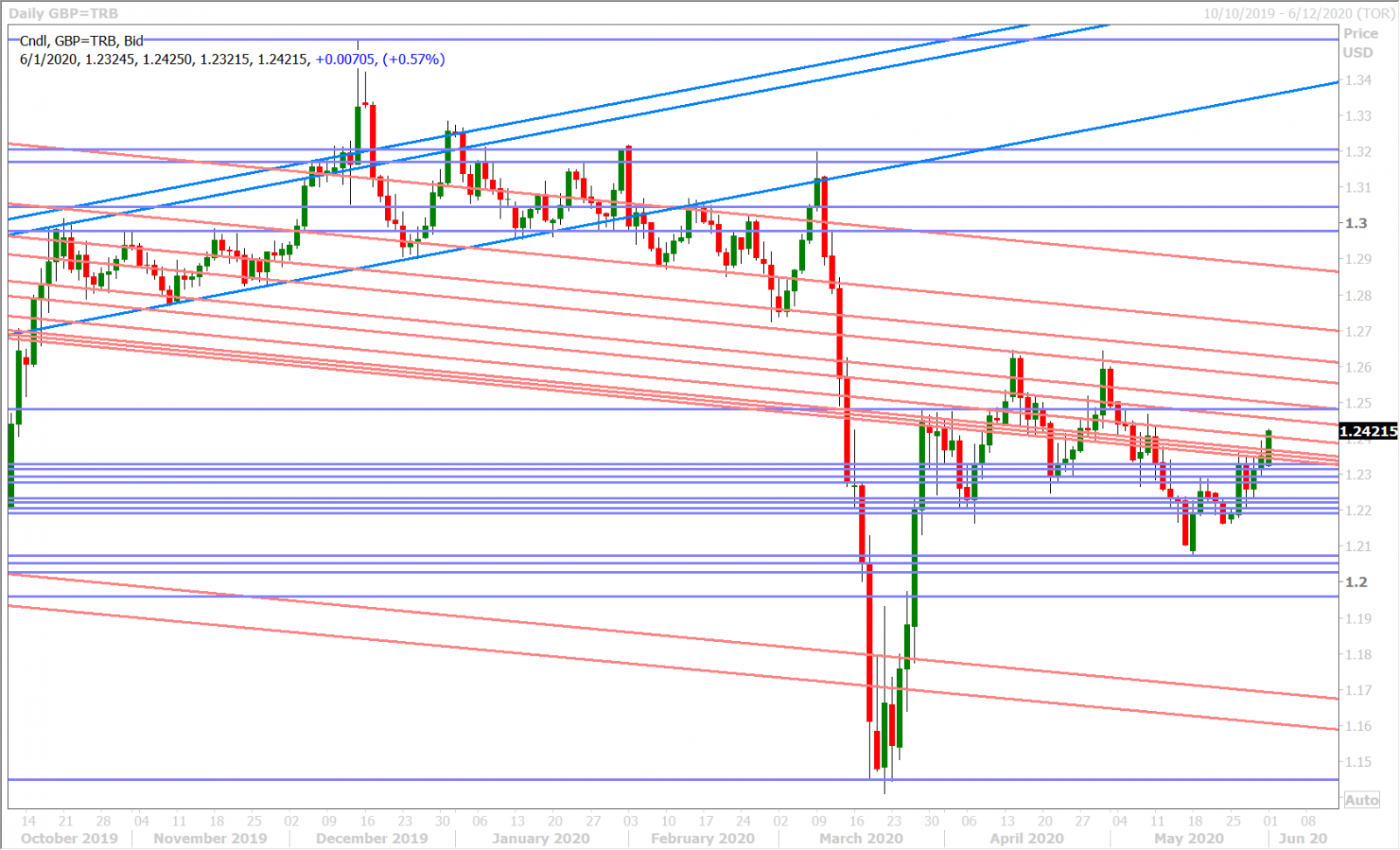

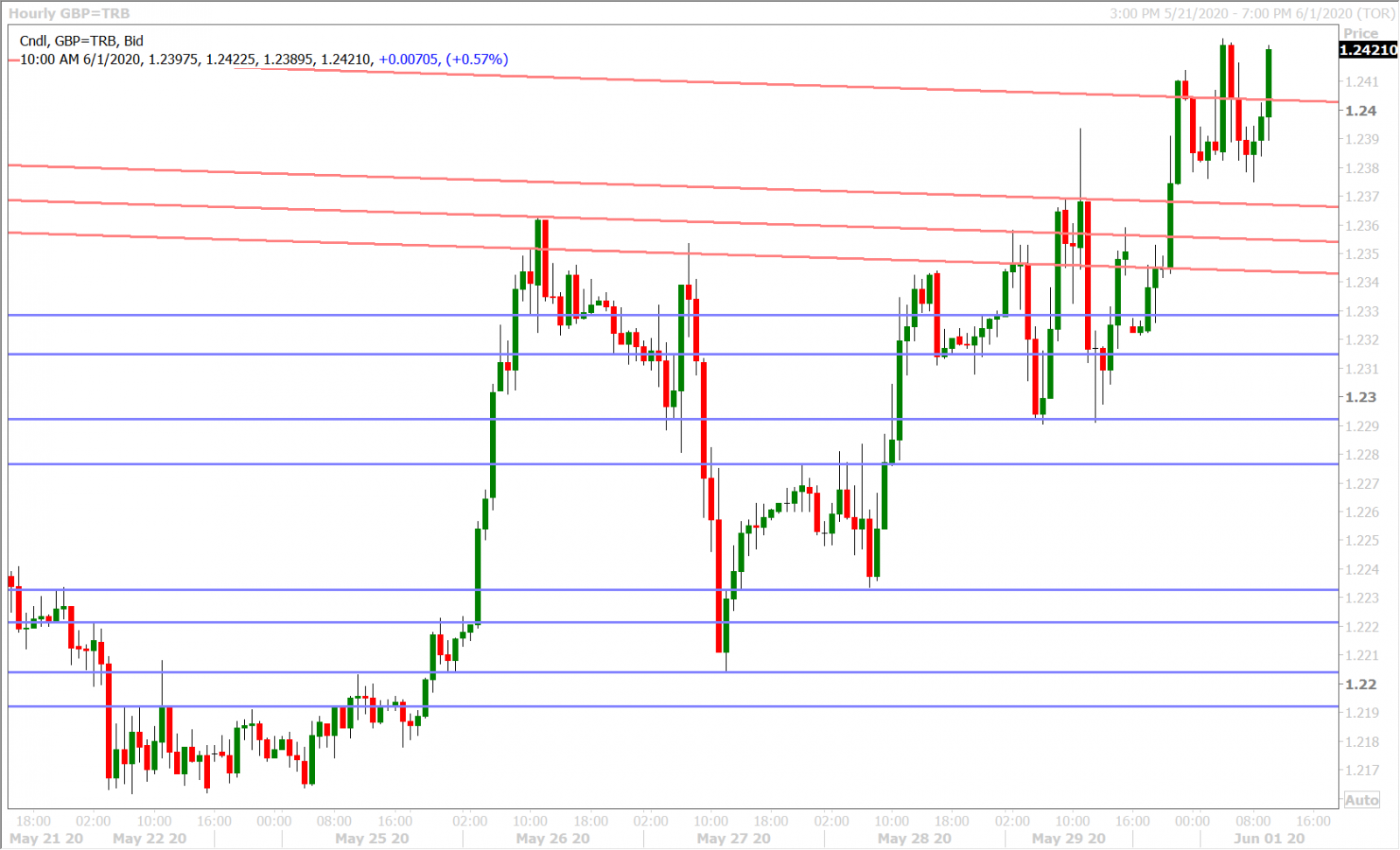

GBPUSD

Sterling/dollar enjoyed some follow-through, risk-on, buying in Asia last night after Trump’s press conference on Friday, but the buyers are now struggling at trend-line resistance in the 1.2400-1.2410 area. Recall that this was the region where GBPUSD broke down from after confirming a bearish head & shoulders pattern on May 6th, and we think this area now serves as the top end of sterling’s new trading range for the moment. We see the bottom end of this trading range as the 1.2190s, which got defended largely on non-UK factors since the third week on May (general risk-on from the Fed’s Powell, vaccine headlines, EU recovery fund news, and the unwinding of negative China bets), but we think there’s a risk of negative shocks returning on both the US/China and Brexit front over the next week.

The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds adding to their net short GBPUSD position for the 5th week in a row during the week ending May 26. This is the only overtly bullish signal we see right now, given the fact the market has moved against these traders and their short accumulation for the last two weeks. The UK reported its final May Manufacturing PMI at 40.7 this morning, which was in-line with the flash estimate from two weeks ago.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

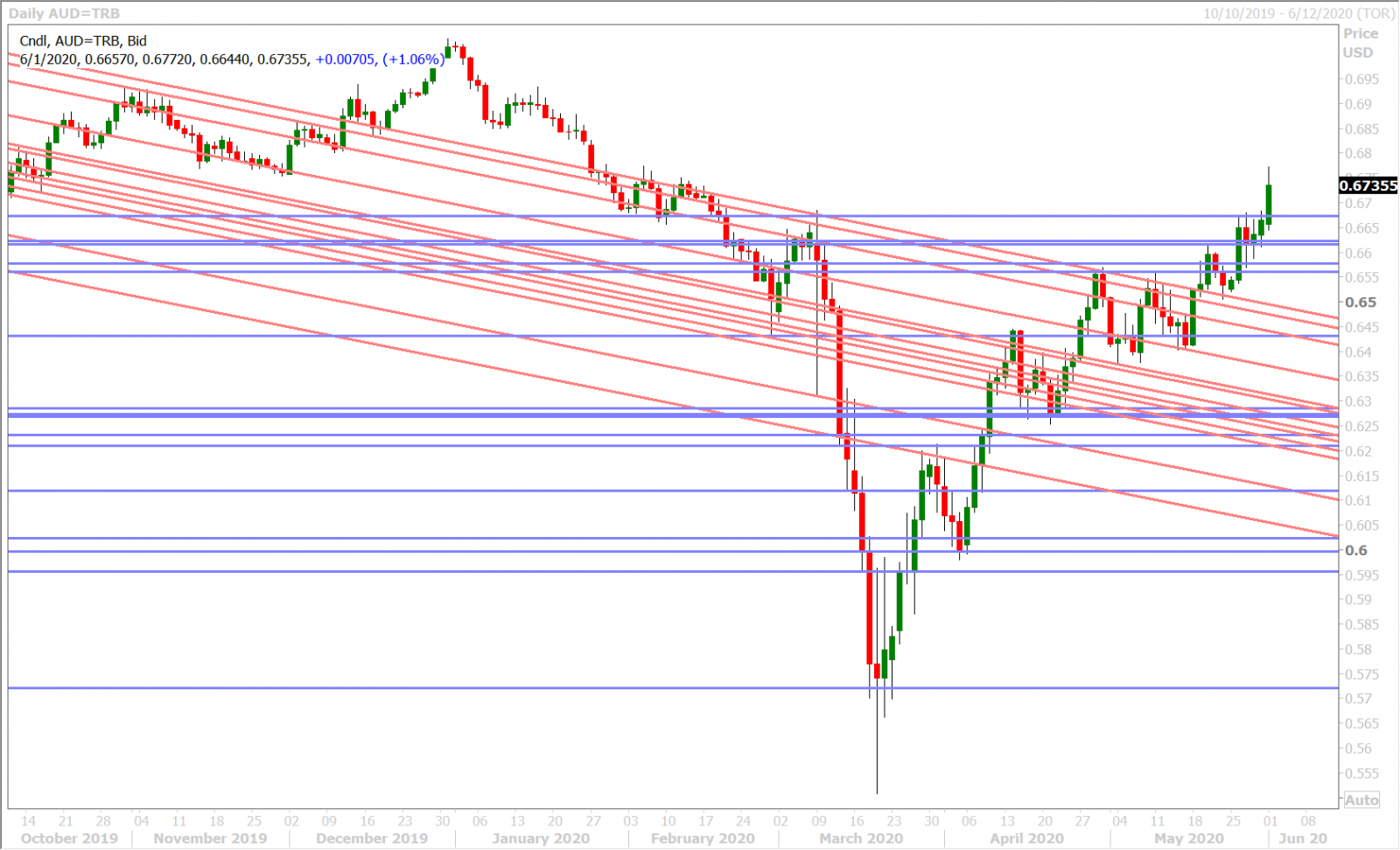

AUDUSD

The Australian dollar has broken out to the upside again this morning, with the market’s latest push coming from yet more unwinding of negative US/China bets from last Friday. We have to say though that every upside breakout we’ve witnessed appears shaky (May 20th, May 26th, and now even’s todays). It hasn’t taken much lately to see risk sentiment turn on a dime and, while we don’t think there’s much meat to this morning’s Bloomberg report about China pausing some US agricultural purchases, we were reminded by China’s foreign ministry this morning that the US “will be exposed to a decisive counterattack” for interfering with China’s internal affairs. We think this is why the leveraged fund AUDUSD shorts haven’t liquidated yet and are still adding to positions, but they continue to pay the price for this. The latest Commitment of Traders Report released by the CFTC on Friday showed the leveraged funds adding to their net short AUDUSD position for the third week in a row during the week ending May 26th.

The Reserve Bank of Australia will announce its latest decision on monetary policy tonight at 12:30amET. No changes to interest rates or the asset purchase program are expected, however the tone of the press release is expected to be upbeat given the tone of governor Lowe’s comments from last week. Australia will report its Q1 GDP figures tomorrow night ET and its April Retail Sales numbers on Wednesday night ET.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

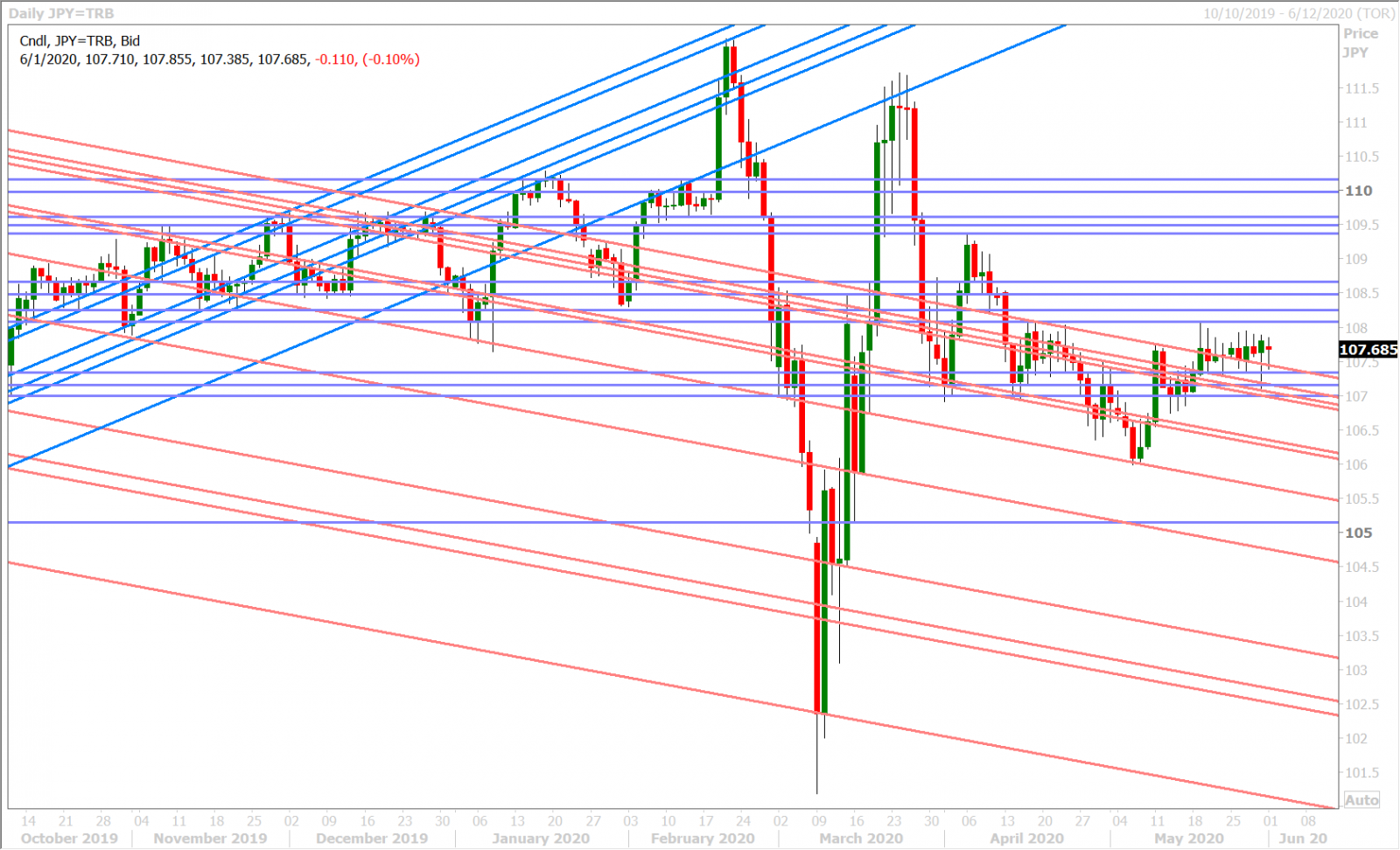

USDJPY

Dollar/yen traded lower with the broader USD late Friday and overnight in Asia as global markets priced-out a lot the China retaliatory hype from the US administration over the last week, but traders are quickly reverting back to their recent desire to anchor the market to large option expiries. Over 1.6blnUSD is about to roll off between the 107.80 and 108.05 strikes this morning, and another 1.1blnUSD is set to expire around the 107.50 strike this Wednesday.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.