Sterling surge leads broad USD selling into NY open

Summary

-

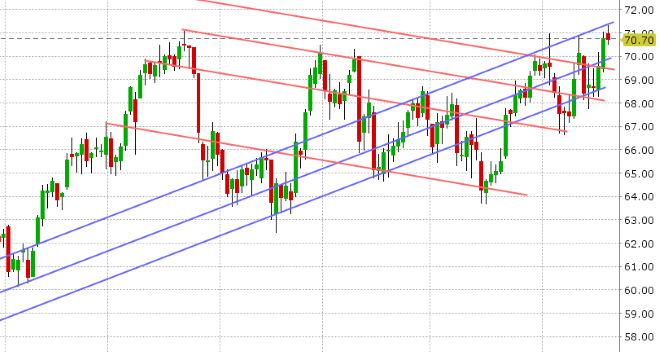

USDCAD: Dollar/CAD has had a volatile 24hrs. The market popped higher during the NY morning yesterday after another negative NAFTA headline crossed (U.S.-CANADA NAFTA DEAL SAID UNLIKELY TO BE REACHED THIS WEEK). We touched trend-line resistance at 1.3010 briefly and then the market came to its senses and plunged right back down. The move back below the 1.2960 level and a resumption in the crude oil rally post EIA inventories then set an offered tone for USDCAD for the rest of the day. We closed just above the next trend-line support level at 1.2900, bounced a tad in Asia overnight, but are retesting the level again now as NY trading gets underway today. We’re seeing some broad based USD selling today, which appears to be GBP driven (more on that below). November crude is backing off trend-line resistance in the 71.20s as Trump tweeted again about his displeasure with OPEC and high oil prices. The US Philly Fed was just announced +22.9 vs +17 expected. Over 1blnUSD of options expire at the 1.2900 strike this morning. Tomorrow features two big Canadian numbers (July Retail Sales & August CPI). We think USDCAD remains on the defensive here. Light support at 1.2880s. Better support at 1.2810-20.

-

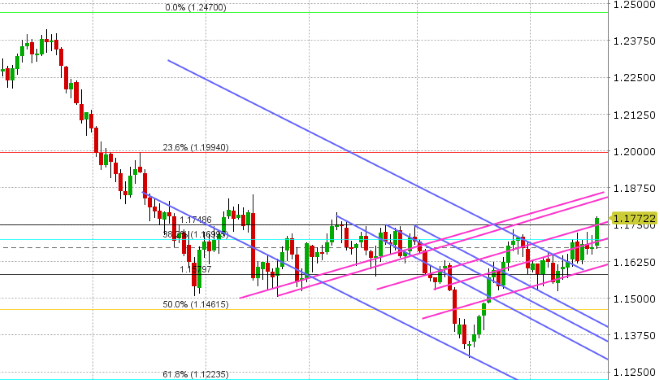

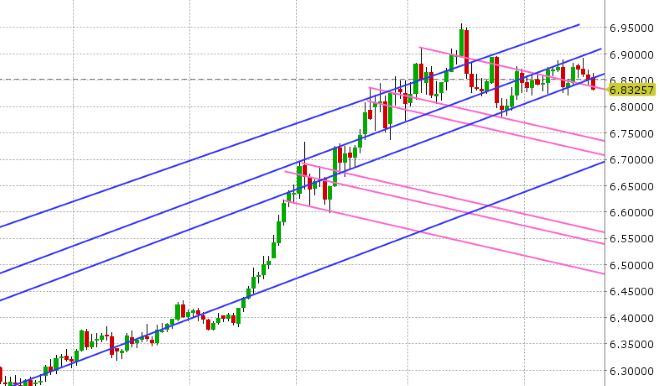

EURUSD: Euro/dollar is rallying strongly this morning after a surge higher in GBPUSD and a “risk-on” rally in global stocks combine to see the market finally shatter chart resistance in the low 1.17s. Traders are now testing the next resistance level, which is 1.1740-50, where 1blnEUR of options expire tomorrow. USDCNH has fallen back below 6.85, but we would argue the Yuan is following today rather than leading. Support at 6.84 has just given way, which is a big EURUSD positive. We think EURUSD now has legs to extend into the mid-1.18s provided the 1.1750s hold.

-

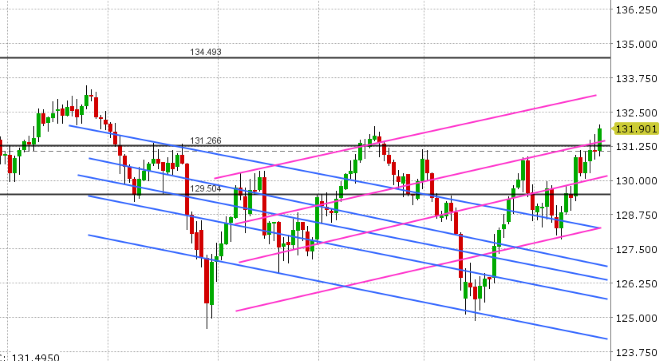

GBPUSD: Sterling is leading the pack this morning; up almost 1% at this hour on the day. European traders got the party started this morning by rallying the market back above the key 1.3150 level we pointed out yesterday. This allowed for technical buying back up to yesterday’s highs in the 1.3210s. A beat on UK Retail Sales for August (+0.3% MoM vs -0.2% expected) then validated this buying. After a brief pause, the market then broke higher, shattering the 1.3210s and it continues higher now on course to test the next resistance level in the 1.3280s. This post 5am action in GBPUSD this morning has all the hallmarks of a short squeeze, which we’ve been warning about given market positioning. The Salzburg summit is going on today, but we’re not getting much in the way of headlines. A special EU summit on Brexit has just been announced for Nov 17/18. Perhaps somebody knows something, and there could be more driving this move. There’s not much technical resistance on the GBPUSD chart after the 1.3280s until 1.3340-50. We think entrenched shorts may now use any pullback to get out.

-

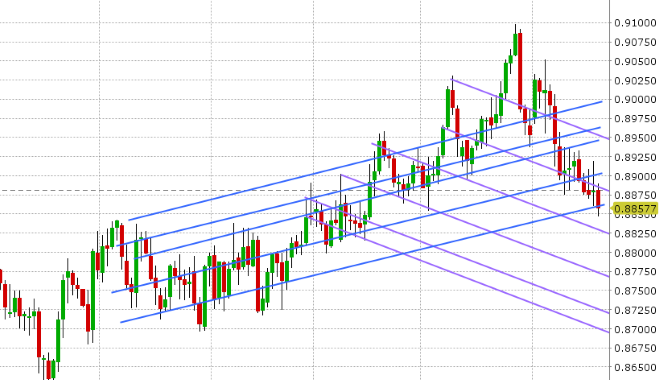

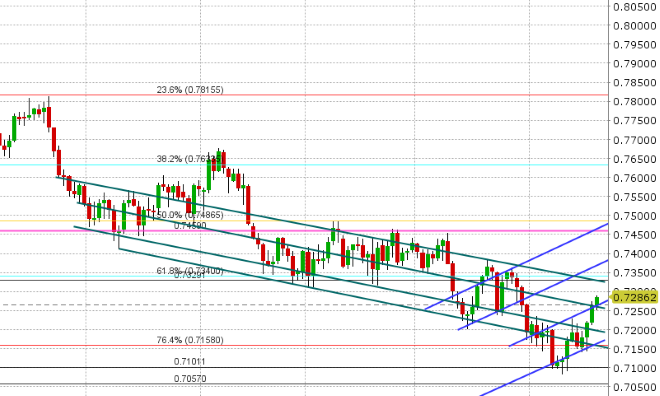

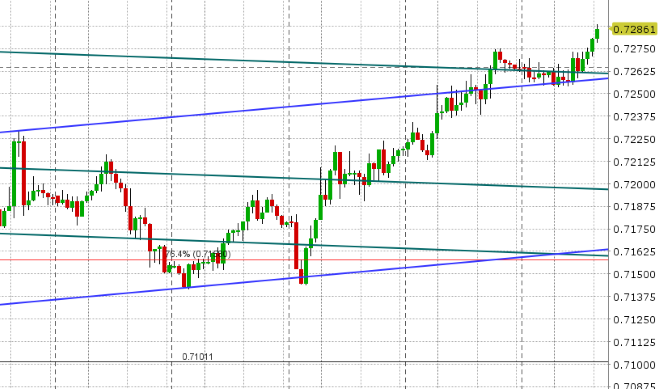

AUDUSD: The Aussie hasn’t cooled off yet; inching higher again today as traders watch EURUSD rally. Resistance in the 0.7260s has given way, which opens the door technically to a run up to the 0.7320s, but there hasn’t been much momentum to AUDUSD so far today, much like its commodity cousin USDCAD. USDCNH has just broken below support at 6.84, so it might be time to watch for further gains in copper and AUDUSD here.

-

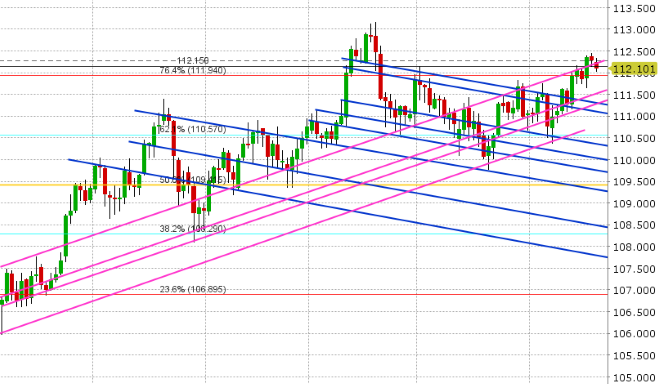

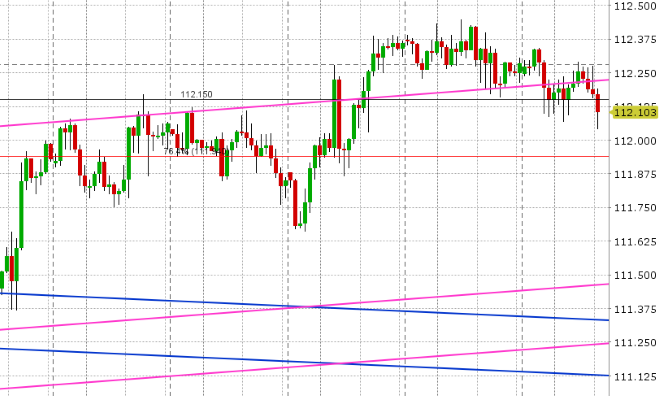

USDJPY: Dollar/yen is struggling today despite firming US yields and the breakout higher in global equities today. The JPY is being sold broadly in this “risk-on” move, but so too is the USD and so we can only postulate the negative USD flows are outweighing for the time being. Option expiries may also be weighing as well, considering another 800mlnUSD goes off the board between 112.00-112.15 today, and another 1.3blnUSD goes off at 112.00 tomorrow. With USDJPY now back below the 112.20s, we think the market wanders here for a bit.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

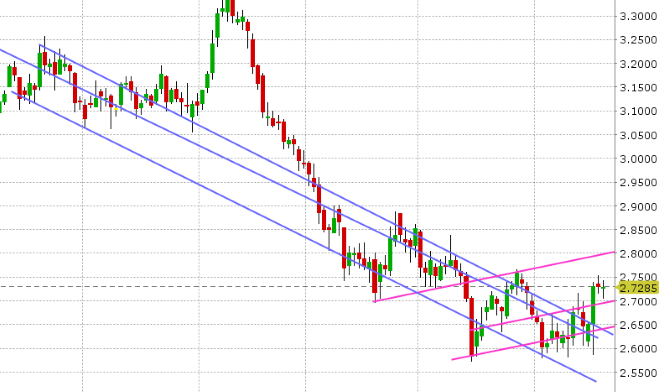

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.