Mild risk-off tone to equities pressures oil and lifts USDCAD in NY trade

Summary

-

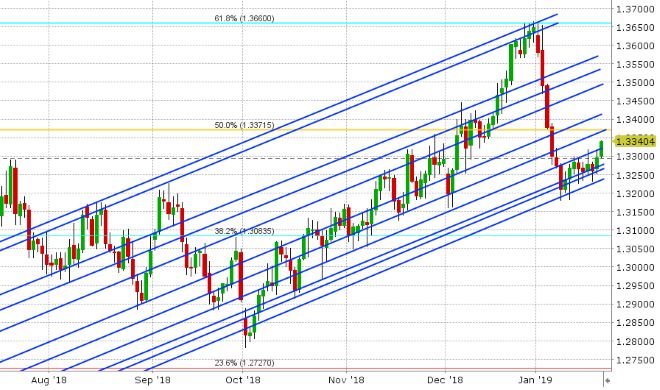

USDCAD: Dollar/CAD continues its drift higher today, and this is coming amidst some crude oil selling during European trade this morning. Oil prices seem to be following the global tone to equities today, which is a bit on the negative side following some poor German ZEW survey data, the IMF’s latest downgrade to global growth, and headlines that the US is planning to formally extradite Huaweo’s CFO from Canada. Yesterday’s trend-line resistance level in the 1.3310s gave way in early European trade today, but it’s becoming relevant once again as some broad USD selling ahead of NY trade pushes the market back below it. We think this level becomes the pivot for today’s USDCAD price action. Trade back above it and the market should have legs to resume higher into the high 1.33s, but trade below it and we could see traders retest the lower bounds of the recent range (1.3270s). Canada just reported weaker than expected Manufacturing Shipments and Wholesale Sales data for November (-1.4% MoM vs -0.9% for the former, and -1.0% MoM vs flat for the latter), which is USDCAD positive.

-

EURUSD: Euro/dollar is holding up relatively well this morning, despite the weak German ZEW survey and the moderate risk-off tone to global equities. The January read came in a 27.6 vs. expectations of 43.5, but EURUSD continues to hold trend-line support in the 1.1350-60s. While we view this as somewhat of a positive development (market can’t go down on bad news), we remain leery of the market’s willingness to add to long positions ahead of the ECB meeting on Thursday. EURJPY, a very liquid EUR cross rate than can influence EURUSD flows from time to time, appears to be coiling up for a breakout in one direction or another. We think the technical setup for EURUSD gets increasingly precarious the longer we stay at chart support and fail to bounce. The next major chart support level is 1.1300, which is a ways off.

-

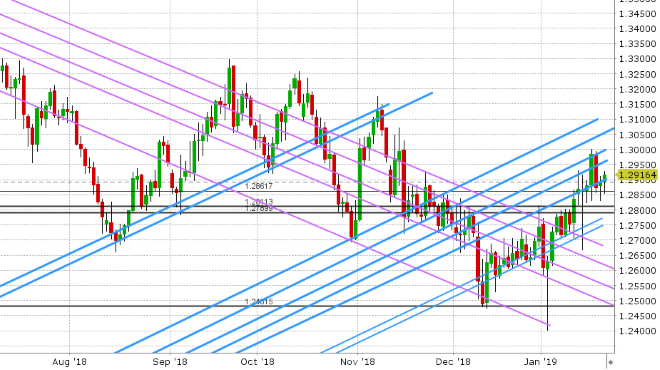

GBPUSD: Sterling is enjoying a bit of a bid this morning after the UK reported better than expected wage growth in its January employment report, but the market is merely clawing back losses from selling in Asia today. The selling in Asia came about after traders failed to close NY trade above the 1.2900 resistance level, and after the marketplace had a chance to digest Theresa May’s Plan B for Brexit, which the UK PM announced to Parliament yesterday. The plan lacked substance in our opinion; referred to the need to go back to Brussels and North Ireland to address the backstop, but more importantly did not rule out a “no-deal” Brexit scenario. Why we saw GBP go bid while Theresa May spoke is beyond us, and so we think traders corrected this false optimism in early overnight trade. The chart technicals are looking mixed to negative at this hour, with GBPUSD once again back below the 1.2900 level (after breaking above it when the UK employment figures came out). The lack of any further major UK economic headlines this week will leave the focus squarely on broad USD price action on the next significant Brexit headline.

-

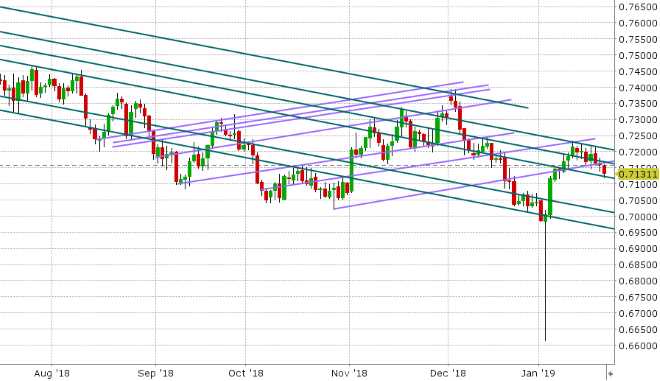

AUDUSD: The Aussie continues to look for buyers today (something we alluded to yesterday), and this was made possible by another weak NY close yesterday (below trend-line support in the 0.7160s). March copper prices are pulling back another 1.5% this morning, and the negative tone to global equities is not helping at this hour either. We’re seeing some buyers step up to the plate here in the 0.7120s (the next support level), but there’s not much momentum behind the bounce. We think AUDUSD follows the broader USD tone ahead of the Australian employment report out tomorrow night.

-

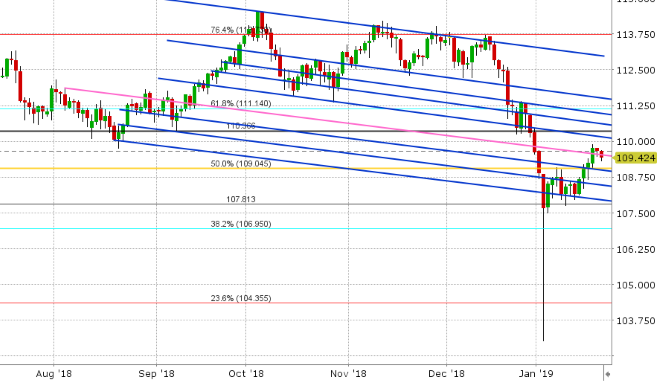

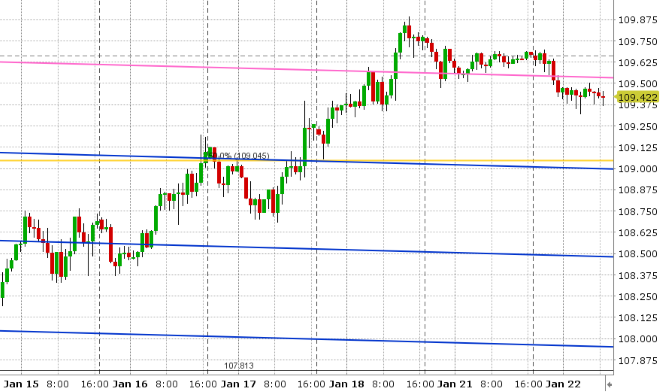

USDJPY: Dollar/yen is trading on the defensive this morning as the S&P futures continue to slip from Friday’s highs. The market has slipped back below the 109.60 level we talked about yesterday (a key level to maintain for upward momentum), but we would note the selling isn’t intense, and so we wouldn’t be surprised to see traders regain the level should the S&Ps bounce. Japan’s 40-yr JGB bond yield hit its lowest level since December 2016 today, which should almost guarantee the Bank of Japan stays the course when it announces its latest update on monetary policy tonight.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.