Markets bracing for one of the more important Fed meetings in recent times

Summary

-

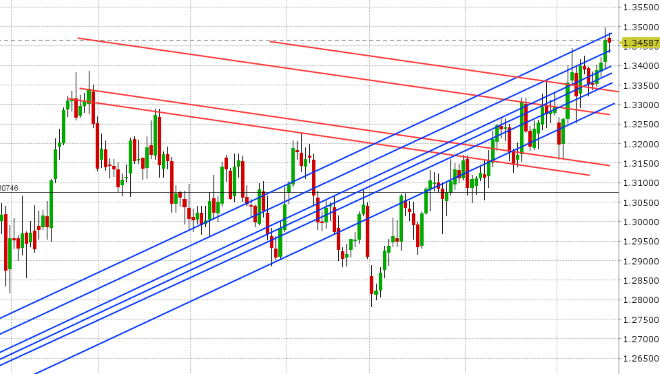

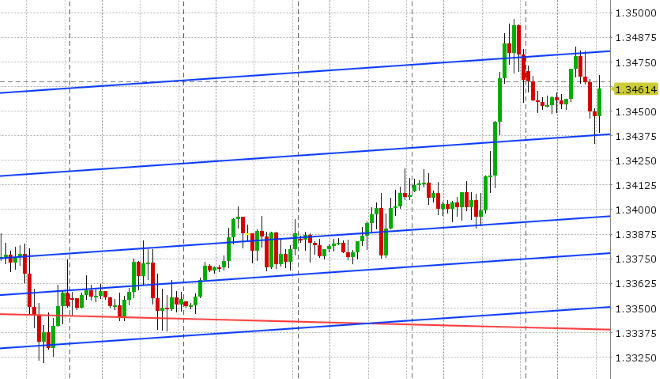

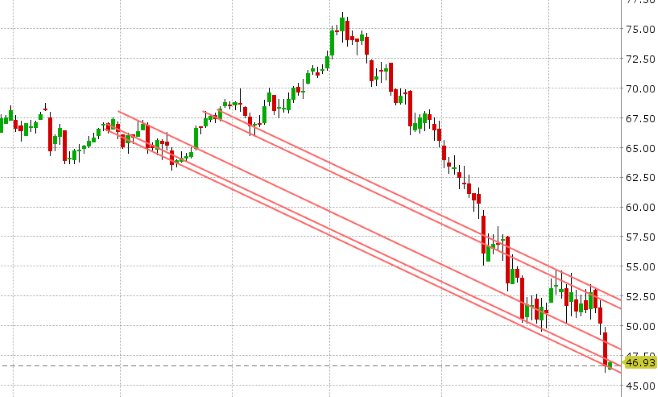

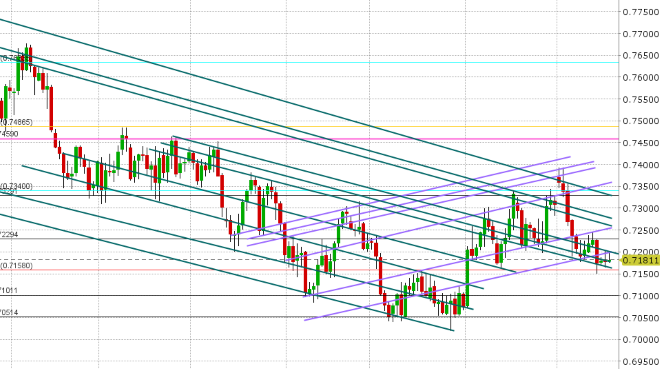

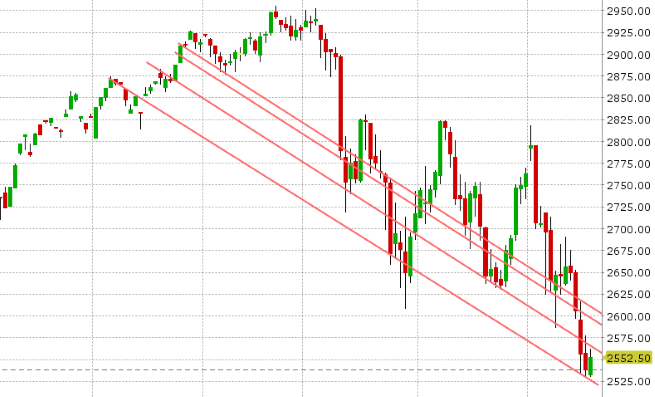

USDCAD: Dollar/CAD surged higher yesterday after another spectacular collapse in crude oil prices. Supply fears continue to mount, with Russia and Saudi Arabia reportedly pumping at record rates for the month of December. Perhaps OPEC is doing some window dressing now to dampen the impact of the agreed production cuts to come in Q1 2019? The $49.50 level in the February crude contract also gave way yesterday, which opened up an abyss of support on the charts and exacerbated the move we feel. USDCAD blew through the 1.3430s and attacked its next chart resistance level (1.3480s) in short order. After a brief attempt to gun for the 1.35s, this resistance level held price back into the NY close, and the level proved formidable for traders once again in overnight price action. Canada just reported November CPI at -0.4% MoM and +1.7% YoY, which slightly missed expectations but marks a considerable slowdown with regard to inflation expectations on a month over month basis. USDCAD is now bouncing off chart support in the 1.3430s as traders now prepare for the weekly EIA oil inventory report at 10:30amET and the oil price reaction. Expectations are for a draw of 2.43M barrels. Then of course we’ll have the Fed’s latest decision on monetary policy later today. A press release will come out at 2pmET, followed by a press conference from Jerome Powell at 2:30pmET. We can’t think of a Fed meeting in recent memory that is garnering more attention/angst than this one. By the end of today, we could be talking about a significant change in the policy path for the Fed, new lows for stock prices and potentially a swift selloff for the USD more broadly if the Fed sounds really dovish. Or we could see a violent move in the other direction if the Fed buries its head in the sand and continues with its rate hiking agenda (we feel the market isn’t positioned for this).

-

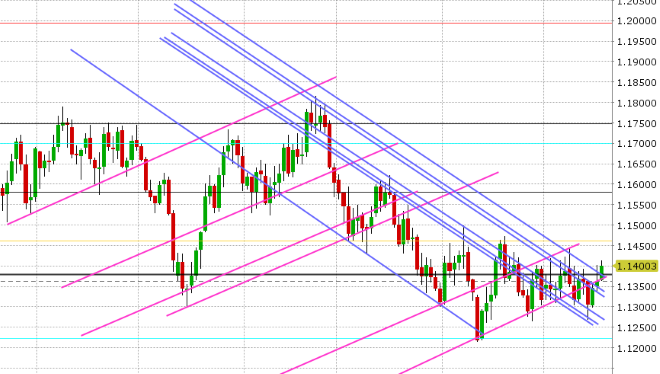

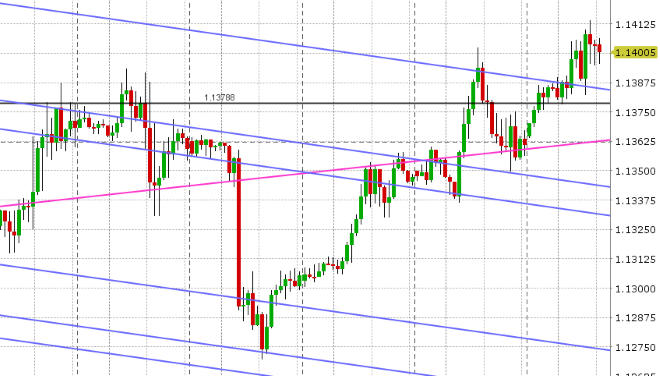

EURUSD: After stalling and pulling back a touch yesterday, Euro/dollar is once again bid this morning as the European Commission has formally accepted Italy’s budget deficit plan without any disciplinary excessive debt procedures. These headlines really shouldn’t have come as a surprise for markets given last week's headlines, but Italian bond traders are celebrating nonetheless by pushing the Italian 10-yr yield back below 2.80% and the BTP/Bund yield spread back down into the +250s. This has helped EURUSD surpass chart resistance in the 1.1380s, but the gains have been tepid as the Fed meeting looms at 2pmET today.

-

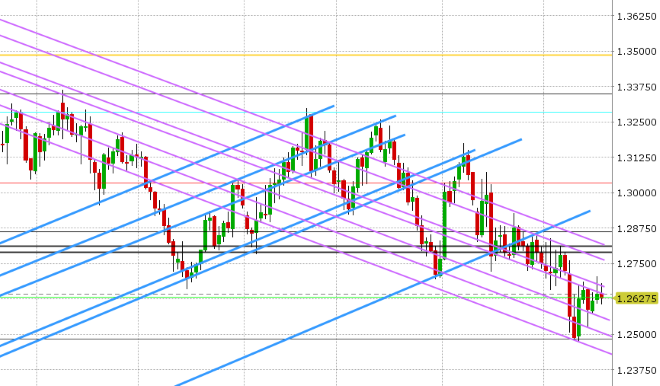

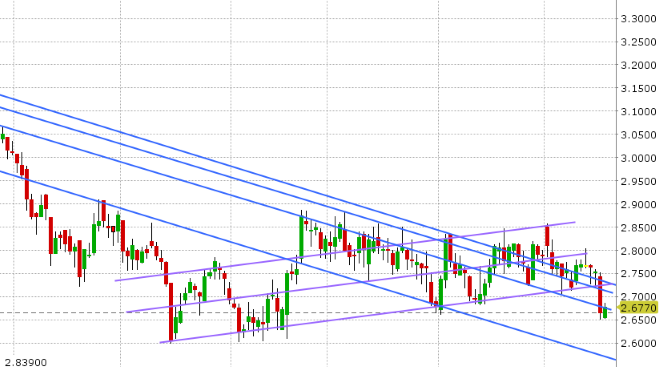

GBPUSD: Sterling has had a choppy overnight session after yesterday’s stall in the high 1.26s turned into an all-out pullback below the chart levels it broke to the upside earlier in the session. This negative technical development on the charts is carrying over into today’s trade and now sees GBPUSD on the defensive ahead of the Fed meeting. The lower bound of the 1.2640-70 trend-line channel has just given way, which now exposes the low 1.26s. EURGBP repaired its chart heading into the NY close yesterday, effectively cancelling the bearish outside day pattern we were observing, and this was allowed it to rally today (which also hurts GBPUSD here). The UK reported its November CPI at 0.2% MoM and +2.3% YoY, and while this met expectations, it marked a new 20-month low on a key inflation gauge and confirms the Bank of England will do nothing tomorrow and for the foreseeable future when it comes to UK interest rates.

-

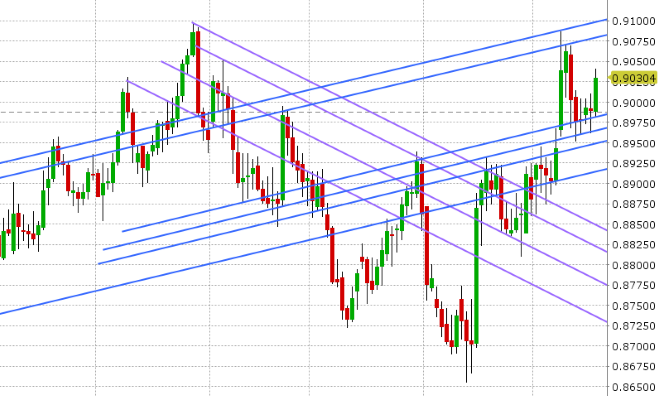

AUDUSD: The Aussie trades on the defensive this morning as well after yesterday’s plunge in oil prices hit equity and copper market sentiment. The market failed on multiple attempts to trade above the 0.7200 mark and while buyers bought the dips overnight, they continue to struggle at this key resistance level. The Fed decision at 2pmET will dominate the news flow today, but then we’ll get the November employment report from Australia tonight at 7:30pmET. Traders are expecting +20k jobs gained on the headline, and 5% on the unemployment rate.

-

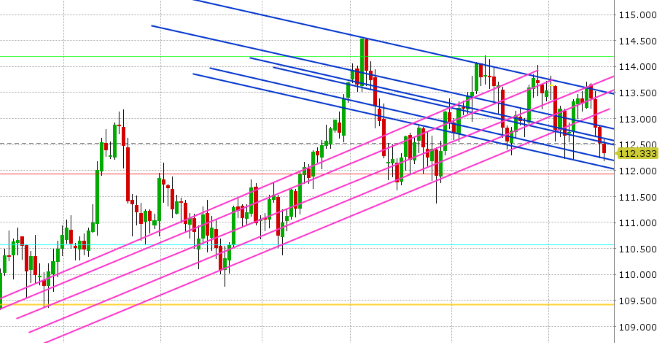

USDJPY: Dollar/yen continues to struggle here after yesterday’s bounce was faded by sellers in the 112.60s (the lower bound of the chart resistance zone we mentioned yesterday). Next up is the Fed and what’s expected to be a dovish hike to interest rates. Expect volatility here as we’ll have competing forces at play: the broad USD reaction and then the reaction from US stocks/US yields, which don’t always correlate. After the Fed, we’ll have the Bank of Japan’s latest update on monetary policy for the overnight session, where no changes are expected to the central bank’s dovish outlook.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.