Central bank bonanza leaves traders yawning. US CPI surprises to the downside

Summary

-

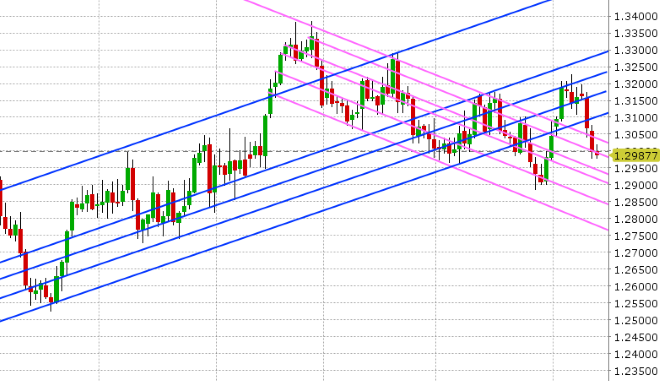

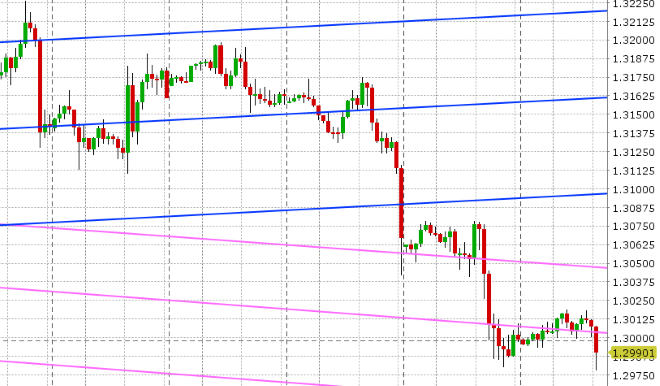

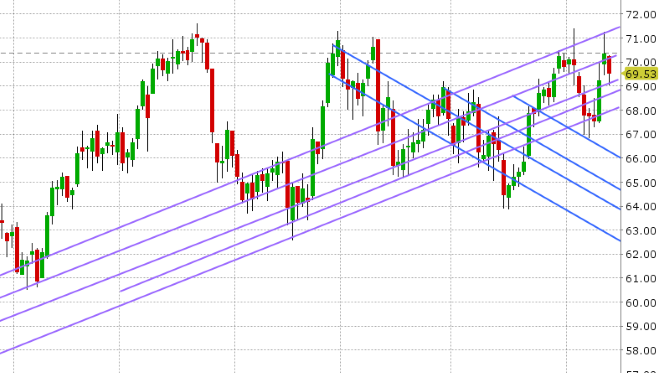

USDCAD: Dollar/CAD longs are licking their wounds this morning after yesterday’s combination of bullish oil inventory data, positive trade headlines, and a break of chart support in the 1.3050s saw the market continue its fall lower. We now sit 200pts below the week’s high, at trend-line support in the 1.3000 region. The Turkish central bank just raised interest rates 600bp to 24%, exceeding market expectations and defying President Erdogan’s comments from earlier today when he said “we must lower interest rates”. TRY has rallied from 3% lower against the USD to now 3% higher, but the move is not doing much for broader risk sentiment at this hour. October crude oil is trading down 1% morning, as the market follows through on a technically weak NY close. Next up at 8:30amET is US CPI, with traders are expecting +2.8% YoY and +0.3% for August. We think the 1.3000 level is the line in the sand today. Trade above and we could see buying into 1.3050 (yesterday’s support turned resistance). Break below and we could see further pressure into 1.2950-60. Canada’s Freeland said NAFTA talks would resume today, but she won’t be in Washington for them.

-

EURUSD: Euro/dollar is mildly bid this morning as traders successful test the 1.1610-20 level that they broke the market above yesterday after the positive US/China trade headlines from Mnuchin. The ECB just held interest rates at 0%, reiterated that their asset purchase program will end in December, and that it will keep interest rates unchanged “through the summer of 2019”. EURUSD has barely reacted, seeing as this is very much a rehash of the July ECB headlines. Traders will now focus on Mario Draghi’s press conference at 8:30amET. Support 1.1610-20, then 1.1570-80. Resistance 1.1650s, then 1.1700. Almost 3blnEUR in options expire between 1.1600-1.1625 this morning (10amET).

-

GBPUSD: Sterling is trading steady this morning after the Bank of England kept interest rates on hold at 0.75% with a 9-0 vote. The tone of their statement was relatively balanced in our opinion (raised their Q3 GDP estimate but cited some risks from trade tensions/Brexit) and so markets are not reacting much at all. We think the 1.3030s will be the line in the sand again today. Trade above and there’s scope for gains to the 1.31 level, but trade back below and we could see shorts re-enter. About 1.3blnGBP in options expire at the 1.3060 strike this morning (10amET).

-

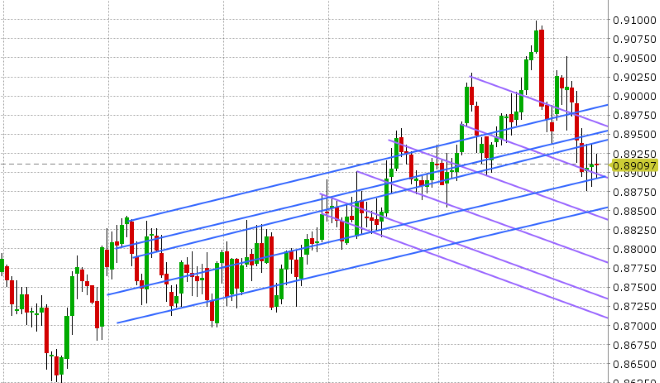

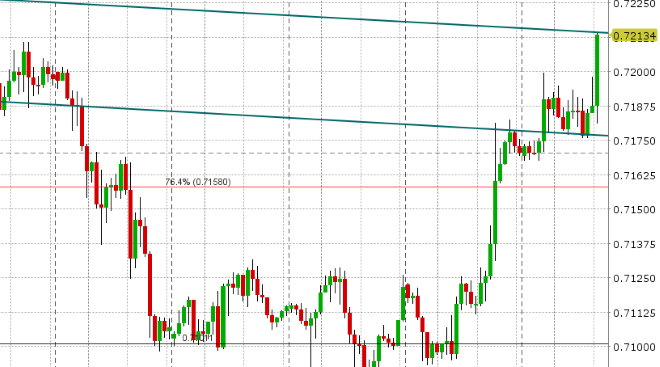

AUDUSD: The Aussie is building upon yesterday’s Mnuchin driven rally and the better than expected Australian jobs report from last night is helping to keep the upward momentum intact. December copper has broken above the 2.69 level in early European trade today, which helps AUDUSD here as well, but we think traders will take pause here ahead of the ECB’s press conference. Support 0.7160-75. Resistance 0.7215.

-

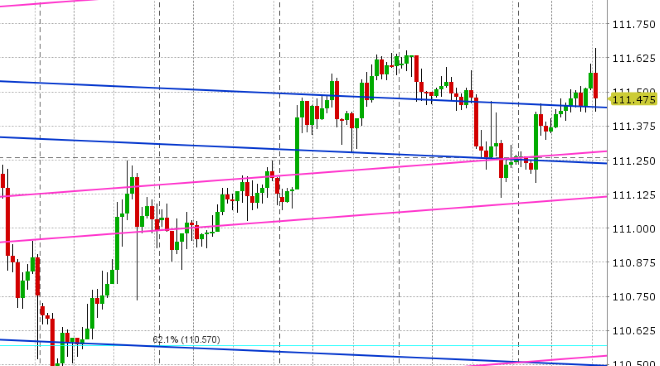

USDJPY: Dollar/yen leads the G10 FX space in gains this morning, after Japanese Machine Orders for July smashed expectations (+11% MoM vs +5.7%). This shot up the Nikkei up by over 1%, igniting a “risk-on” move in equities today that typically hurts the JPY. With USDJPY now regaining the 111.40s (a level it lost yesterday), we see the market possibly making a run here to the 112 level. Traders may need to wait for over 1blnUSD in options to roll off at the 111.50 strike today first (10amET).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

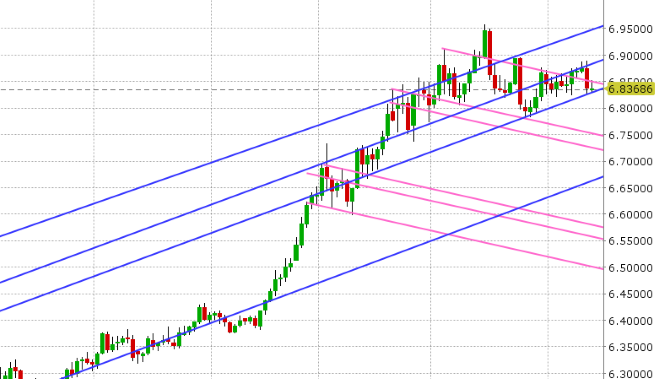

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

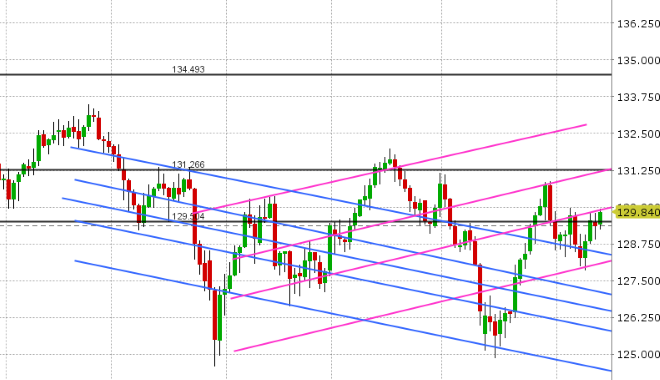

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.