Canadian GDP misses expectations

Summary

-

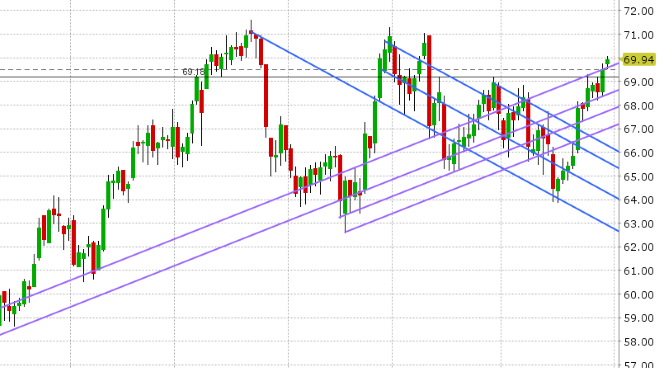

USDCAD: Higher crude oil prices and positive comments out of Freeland, Trudeau and Trump regarding US/Canada trade negotiations combined to keep pressure on USDCAD yesterday. Some of that pressure is abating today as traders watch EM FX fall apart again (TRY -4%, ZAR -2%). This is giving the USD majors a broad, albeit mild, bid. The market has shot up a bit here following the weak Canadian GDP numbers. We think the longs may now have a shot today, but the 1.2940s must hold. Trade back below however, and they’ll likely bail again. October crude oil is trading above chart resistance in the 69.80s today but upward momentum appears to be waning. Any move back below will likely invite some selling and help USDCAD here.

-

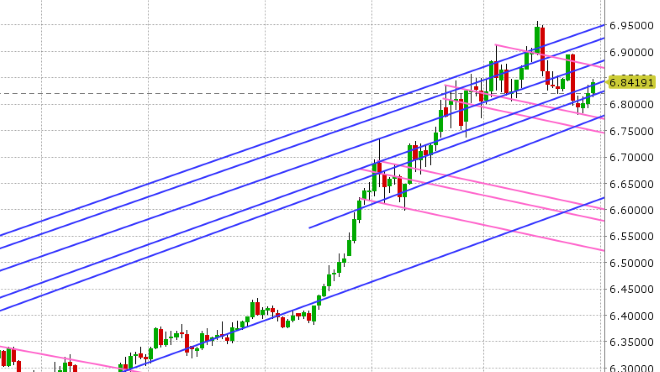

EURUSD: Euro/dollar has been hugging the 1.1700 level more or less since the close of trading yesterday. Continued selling in EM FX is weighing on the market here a bit, but large option expiries tomorrow (2.8blnEUR+ between 1.1700 and 1.1725) appear to be acting as a countervailing upward force, hence keeping the market steady here. A “risk” positive report is also circulating about the EU willing to scrap car tariffs altogether if the US does the same. Germany reported its employment report for August earlier today, and the results were in-line with expectations (8k decline in the number of unemployed and 5.2% on the unemployment rate). German CPI for August was just reported a tad light (+1.9% YoY vs. +2.0% expected). Decent bond auctions in Italy today in the 5 and 10yr sectors sees the BTP/Bund spread trading steady at +275bp. https://in.reuters.com/article/eurozone-bonds/update-2-italys-bond-market-survives-key-auction-test-idINL8N1VL235. USDCNH looks to be making headway today above the 6.8350 level that capped the market yesterday (which is a drag on EURUSD), but the day is young.

-

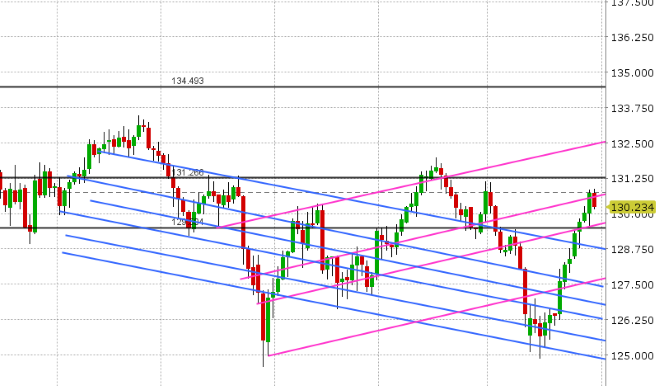

GBPUSD: Sterling was the star of yesterday’s trade, rallying 150pts higher after the EU chief Brexit negotiator, Michel Barnier, said “we are ready to propose a partnership with Britain such as has never been with any other third country”. More here: https://www.europeaninterest.eu/article/eu-ready-propose-ambitious-partnership-post-brexit-britain/. GBPUSD exploded higher following the headlines, and successfully broke out of the triangular consolidation we mentioned yesterday. Open interest at CME actually went up yesterday by 722 contracts, suggesting that new longs entered as shorts covered (we’ll know more on the Sep 7th COT report). Chart resistance in the 1.3030s has capped the trade overnight and we now sit a little directionless ahead of NY trade. EURGBP is trading with a negative tone this morning, as one might expect, but we see chart support into 0.8960-70. We think a move above the 1.3030s will invite further buying, whereas an 2nd attempt higher/failure of the level will prompt some selling.

-

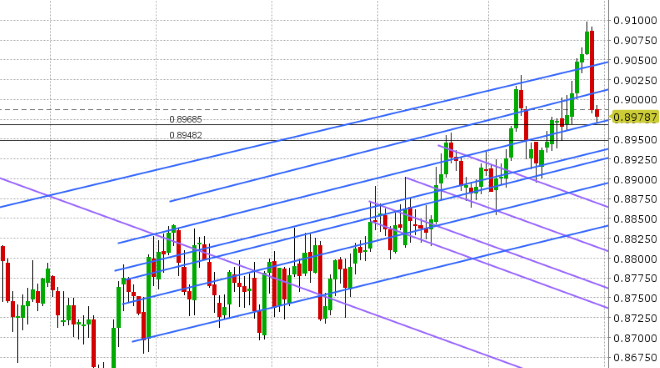

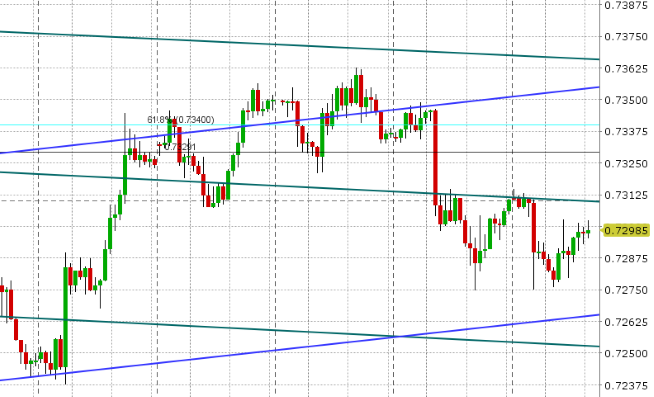

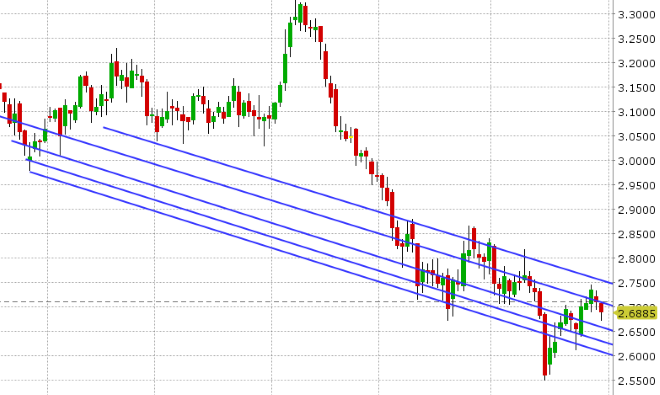

AUDUSD: The Aussie is trading lower again this morning, after Australian Building Permits for July and Q1 CAPEX data both disappointed (-5.2% vs -2.5%, and -2.5% vs +0.6% respectively), however the market is fighting back here going into NY trade. We think any move back above the 0.7310s will get the fund shorts thinking about their positions once again.

-

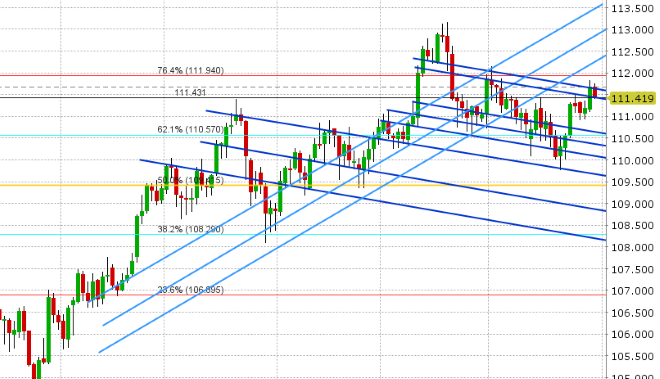

USDJPY: Dollar/yen broke higher a little unexpectedly yesterday, as the correlation with US equities and US yields returned after a few days. Stocks surged to new highs yet again following the upward revision to US Q2 GDP, and a number of tech names led the way too in the Nasdaq. USDJPY broke above resistance in the 111.40s, and then the 111.60s. We settled NY trade however below the 60s, and so it’s not surprising to see a little pullback here in overnight trade today. We’re also seeing a bit of a halt to the broad JPY selling theme of the last week (looking at EM FX selling may be the excuse). We think USDJPY needs to regain the 111.60s in short order to build upon this upward momentum, otherwise we’ll likely give back most of yesterday’s gains at some point.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.