USDJPY reversing off highs. EURUSD sales continue. USDCAD finds support. Quiet week ahead. $CAD $JPY $EUR

Summary

-

USD starts the week mixed. It’s a quieter week ahead in terms of economic data and central bank speak, which may allow markets to trend and move around a little more. US NFPs disappoint on Friday while Canadian employment data surprises to the upside.

-

USDJPY tries to break higher overnight on comments from Kuroda and Trump, but is now back to unchanged. EUR sales continue. USDCAD has found support but is looking for direction. GBP fighting to get back into a range trade. AUD finds a bid ahead of the RBA rate announcement tomorrow (tonight at 10:30pm ET) – no changes expected.

-

Friday’s Commitments of Traders Report (futures positioning as of 10/31): The GBP net position remained flat into last Tuesday as traders stayed sidelined ahead of the Bank of England rate announcement. CAD longs finally liquidated some loosing positions after the Bank of Canada’s dovish hold on interest rates caused USDCAD to break through 1.2800. The net CAD long (USD short) has been reduced to 58k contracts. The move lower in EUR after the dovish taper from the ECB was driven by further long liquidation. The net EUR long has been reduced to 72k contracts. The JPY net short position remained largely unchanged at 120k contracts as both longs and shorts reduced by a few thousand contracts.

-

CME open interest changes 11/3: AUD -3364, GBP -9663, CAD -6104, EUR -3682, JPY +10006

By The Numbers: Daily FX Snapshot

USD/CAD - Canadian Dollar

The US and Cdn employment figures out Friday were a double negative for USDCAD (Cdn numbers were better than expected and the US numbers were weaker than expected). With that, we saw the market trade decisively back into our downward sloping trend-line extensions from the spring (black channel on chart). We saw position liquidation in futures again too, this time to the tune of 6k contracts. Buyers stepped up to the plate at the 38.2% Fibo of the May to Sep move (1.2720s) however and the market now sits awaiting further catalysts. Friday’s Commitments of Traders report confirmed that CAD longs (USD shorts) trimmed positions a little bit after the Bank of Canada’s dovish hold on interest rates. It will be a rather quiet week ahead for Canadian economic data. We get Ivey PMI today at 10am (not usually a market mover), Stephen Poloz speaking tomorrow in Montreal (around 3pm), and Cdn Housing starts on Wednesday. We’re calling it range-bound for USDCAD today with the 1.2770s capping (the Aug highs), and Friday’s low supporting. EURCAD and GBPCAD flows continue to be a negative headwind. A break of Friday’s low in USDCAD invites the high 1.26s which would be technically negative. A rally back above the 1.2770s would do much to bring back some upward momentum and repair the weekly chart a little bit.

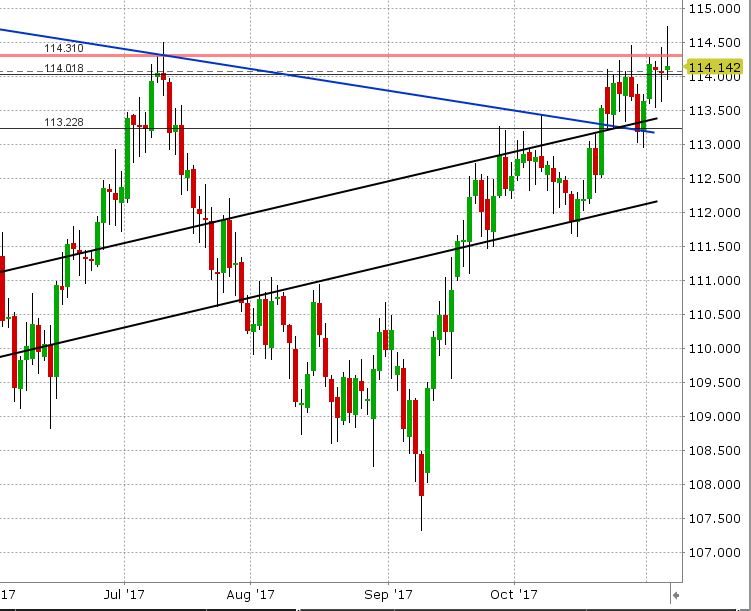

USD/JPY - Japanese Yen

It was a lively session for USD/JPY overnight as the BOJ’s Kuroda talked down the Yen in a speech to business leaders (says more monetary stimulus to come) and Trump bashed Japan on trade (saying trade with Japan has been unfair). The much talked about barrier options at the 114.50 level were knocked out, stops were hit and the market tried to break higher, but we’ve pulled back quite decisively over the European session setting an overall “reversal” type mood going into NY trading. US yields continue to pull back, which is negative for USDJPY. EURJPY is also struggling to stabilize. After bouncing a bit last week, it was sold aggressively overnight in Europe. JPY futures traders added over 10k contracts on Friday, probably further extending the net short JPY position (which is now close to the summer highs, ~120k net short). After seeing the overnight reversal lower in USDJPY however, we would not be surprised to see some profit taking.

EUR/USD - European Union Euro

Euro starts the week on a shaky footing as the neckline of the head and shoulders topping pattern holds (1.1660-70) post NFP on Friday. There is not much technical support below the 1.1570s (the post ECB low). EURJPY and EURGBP flows are dragging today. US/GE yield spreads are still hovering around +2.00 which is not helping...an all around negative situation for the market which (according to the COT report on Friday) is still net long. Longs were trimmed after the dovish taper from the ECB, but the net long is still +72k contracts. Futures traders liquidated another 3k+ contracts on Friday. There’s not much on the economic calendar for Europe this week either, leaving traders to focus on option activity and chart levels. We’re calling it lower for EURUSD today unless the market can regain the 1.2625-40 level.

Market Analysis Charts

USD/CAD Chart

USD/JPY Chart

EUR/USD Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.