USDCNY fixing above 6.70 / USDCNH breakout leads USD broadly higher. AUD falls apart despite stellar Australian job gains. UK Retail Sales miss adds to GBPs woes.

Summary

-

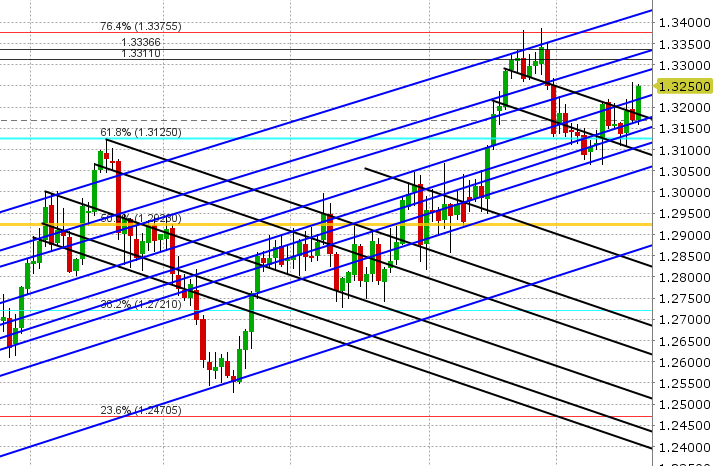

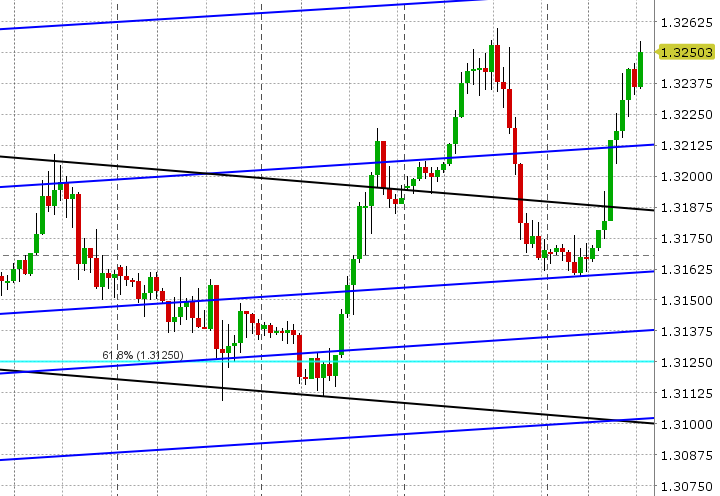

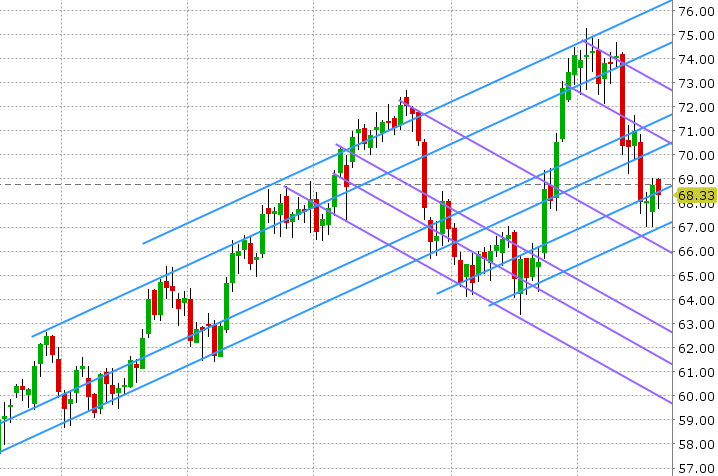

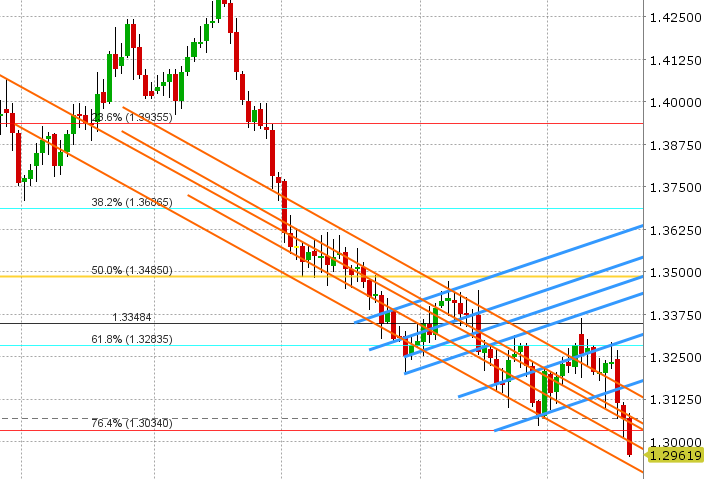

USDCAD: Dollar/CAD is rebounding strongly today on the back of broad based USD buying; led by a breakout higher in USDCNH above 6.76. Yesterday’s dip in USDCAD went a little further than expected as the strength in oil prices (post DOE report) did not abate, but the market found support overnight right at trend-line support in the 1.3160s. This morning’s move back above the 1.3210s puts the upward momentum towards the 1.3270s back in place in our opinion. Today’s North American calendar is light, with just the July Philly Fed survey and a speech from the Fed’s Quarles at 9am. The Philly Fed just beat expectations, coming in 25.7 vs. 21.5 expected. Tomorrow features the Canadian Retail Sales for May and Canadian CPI for June. August crude has given back half of yesterday’s gains amid the rout in commodities today, but the market is looking increasingly more comfortable above the $68 handle.

-

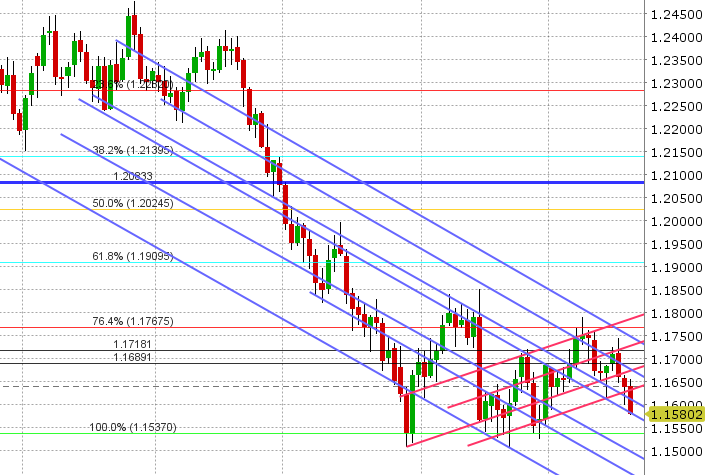

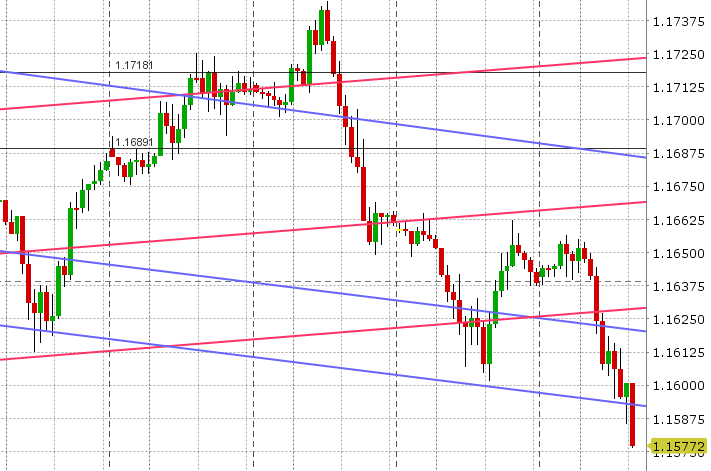

EURUSD: Euro/dollar has resumed lower this morning, after teasing traders with a recovery higher yesterday that didn’t falter until late in the session. The 1.1660s (trend-line support from Tuesday turned resistance yesterday) could not be regained and traders ultimately sold into the EURUSD rally as expected. Last night’s decision by the PBOC to set the USDCNY fixing above the psychological 6.70 mark is the talk of the town today because it effectively signals to the marketplace that Chinese authorities are in fact comfortable with Yuan depreciation right now (in contrast to their tone from two weeks ago). We also continue to hear market chatter that this is how the Chinese are effectively retaliating against US trade aggression, whether they will admit it or not. The explosion higher in USDCNH towards the 6.80 level in European trade has now dragged EURUSD down to trend-line support in the 1.1590s, where odds are we’ll so another bounce, but the bears are still firmly in charge so long as we stay below the 1.1630s.

-

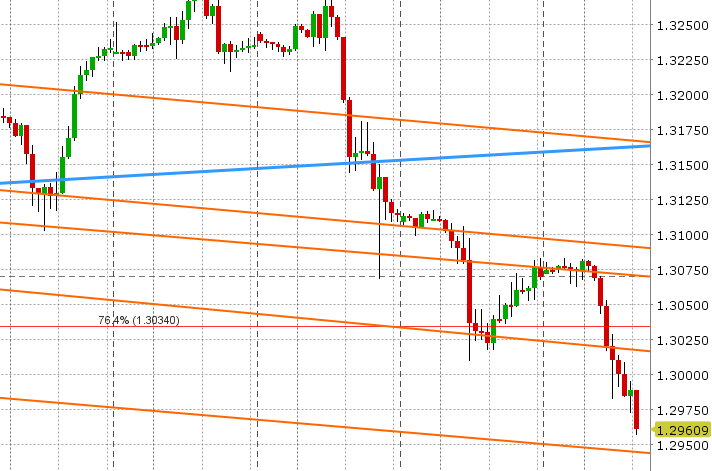

GBPUSD:Sterling is careening to new lows yet again this morning on the back of broad based USD buying, and today’s weaker than expected UK Retail Sales print for June isn’t helping. While the gains in Retail Sales still look good Q2 vs. Q1, the -0.6% change on a MoM basis versus expectation of a +0.3% gain is what the market is fussing about right now, and with that GBPUSD has broken below the psychological 1.3000 mark. August rate hike odds have slipped this week, but surprisingly still sit above 60%. With EURGBP now trading firmly above resistance in the low 0.89s and GBPUSD trading below 1.3020-30, we think the pressure on sterling will remain, but expect potentially another pause (bounce) as 2blnGBP in options roll off today at the 1.3000 strike.

-

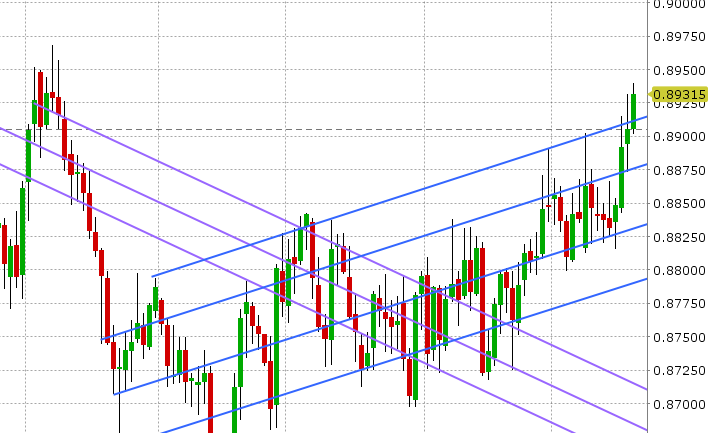

AUDUSD: It’s been a hugely disappointing session for Aussie bulls today. Yesterday’s expected short covering bounce came to fruition amid the bounce in EURUSD and the NY close actually produced a bullish inverted hammer reversal pattern. Then Australia reported a stellar employment report for June last night (+50k jobs vs. +17k expected), taking AUDUSD above trend-line resistance in the 0.7410s. All this unravelled however after the USDCNY fixing and the breakout higher in USDCNH above 6.76, with AUDUSD falling back below the 74 handle. Then copper and gold prices fell apart once again (one could argue CNY depreciation is China punching back in the trade war) and AUDUSD plunged back down to yesterday’s NY lows in the 0.7340s. There’s some further support at 0.7330, but not much below there until the 0.71s, and so shorts continue to have the upper hand right now.

-

USDJPY:Dollar/yen is benefitting from the broad USD buying today, after bouncing off support in the 112.60s overnight, but momentum higher has been lacking as JPY cross selling has been the theme in Europe today. With the S&Ps off 10, the USD broadly higher and the rout in commodities we’re seeing today, one could argue that we’re seeing some “risk-off” flows as well (which tends to benefit the JPY), but we wouldn’t read too much into that yet. We think the new uptrend in USDJPY remains intact so long as the 112.80-90s hold, and we see scope for gains all the way to the 114 handle should yesterday’s high of 113.13 get taken out and US 10yr yields trade back above 2.89. Japan reports CPI tonight at 7:30pmET.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

August Crude Oil Daily

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.