USDCNH gains & GBPUSD weakness leading USD gains overnight, but momentum waning. GBP lags after Trump interview with UK press. Trump/May press conference on deck.

Summary

-

USDCAD: Dollar/CAD is following the broader USD higher this morning after a rather a range-bound session yesterday. The drivers overnight appear to be GBPUSD weakness and its break of support at 1.3200 following a Trump interview with the UK’s Sun; and a resumption of the rally in USDCNH following break back above the 6.69s. USDCAD is currently attacking the upward sloping trend-line level that gave way as support yesterday (now stands at 1.3200). We feel this will be the key level to watch today. Stay above and there’s room to rally to 1.3260, but move back below and we’re back to a range-bound to negative tone near term. Today’s North American calendar is quiet, with just some US 2nd tier data releases (US import/export prices + the University of Michigan sentiment index). The Fed’s Bostic will be speaking at 12:30pmET. August crude oil is steady after bouncing off trend-line support in the 69.50-70 area yesterday. We’ll get an updated read of speculative futures positioning later today from the CFTC. Next week’s calendar features US Retail Sales, a meeting between Trump and Putin, a speech from the Fed’s Powell before the US Senate, US Industrial Production, US Housing Starts, the US Philly Fed survey, and Canadian Retail Sales/CPI.

-

EURUSD:Euro/dollar is trading down again this morning, following a range-bound session yesterday that saw yet another attempt to breach 1.1690 fail. Asian trade overnight was relatively quiet despite GBPUSD weakness and USDJPY strength, but the wheels came off EURUSD once again when trend-line support broke in the 1.1650s and USDCNH broke back above the 6.69s (around the 3am hour). The market has traded down to trend-line support at 1.1610-20. EURJPY sales appear to be a factor today as well, as the cross backs of key resistance in the 131.25 area after a six day rally. With a very quiet North American session ahead, we think EURUSD waffles around again, but we would not be surprised to see another attempt at a rebound in price. Resistance currently is 1.1640-50, then 1.1690-1.1720.

-

GBPUSD: Sterling is dominating the FX airwaves today, as GBPUSD breaks lower following comments Trump made against Theresa May during an interview with the UK’s Sun. More here: http://time.com/5338007/the-sun-interview-donald-trump/. Headlines starting crossing in Asia last night and with that GBPUSD lost the 1.3200 support level (a level that the market tried to rally above post US CPI yesterday to no avail). The selling picked up steam as European traders entered the fray and very quickly we’re trading back down to the next support level in the 1.3120-30s. Some slightly hawkish headlines have just crossed from the BoE’s Cunliffe (blames soft Q1 on poor weather), and with that we’ve seen a small bounce higher. Like EURUSD, we would not be surprised to see a bounce higher today as well. Trump/May will hold a joint press conference shortly at 8:45amET. https://youtu.be/41Mi4StjfC0. Next week’s UK calendar features some key items that will likely factor into whether or not we see an August rate hike from the Bank of England: UK employment numbers on Tuesday, CPI on Wednesday and Retail Sales on Thursday. Also expect more lively debate in UK Parliament next week over Theresa May’s Brexit white paper.

-

AUDUSD: The Aussie is down once again this morning after yesterday’s post US CPI bounce faltered near the resistance levels we mentioned. The move back lower today resumed around the 3am hour, coinciding with the EURUSD move lower. Copper and gold prices also down-ticked around that time as well. With the continued lack of Australia specific headlines, we think AUDUSD continues to trade on the broader USD theme, but with extra sensitivity to headlines regarding US/China trade (given its dependence on China). China reported a record surplus in its June Trade Balance figures, reported overnight. No response yet from Trump. The Australian calendar is a little more eventful next week, with the RBA Minutes on Tuesday (Monday night ET) and the Australian employment report on Thursday (Wednesday night ET).

-

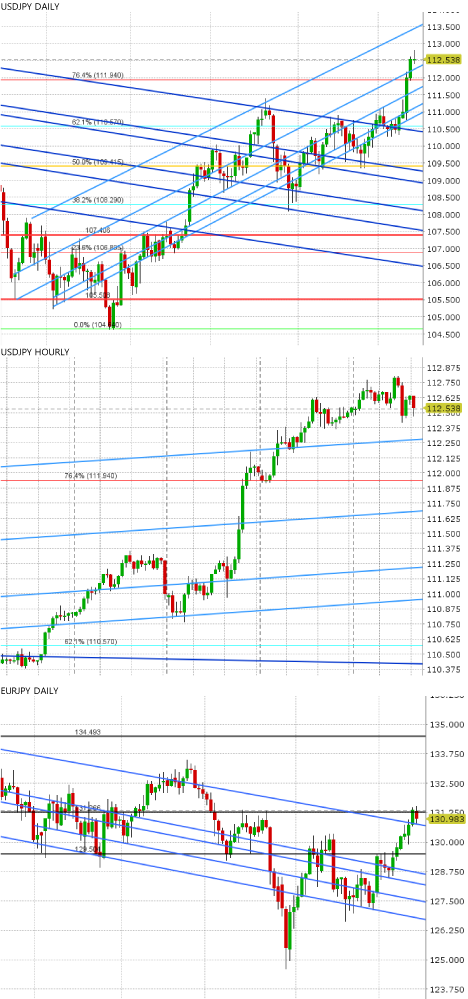

USDJPY: Dollar/yen is taking a bit of a breather this morning after a bullish breakout on the charts this week. Gains in Asia and early European trade have been met with sellers on both occasions, and we’re now trading flat on the day. US equity futures are also trading off their overnight highs. All the JPY crosses are seeing sales as well after runs higher this week. Given what appears to be an inverted hammer candlestick pattern take shape for today, we think USDJPY might inch lower still to test support in the 112.10-20 area and range trade a bit going into next week. Monday is a holiday in Japan (Marine Day). Next Friday (Thursday night ET) features Japanese CPI.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Charts

EUR/USD Daily Charts

GBP/USD Daily Charts

AUD/USD Daily Charts

USD/JPY Daily Charts

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.