USDCAD up post BOC, down after White House exemption headlines. Now steady as markets await ECB press conference. US and Cdn job reports tomorrow

Summary

-

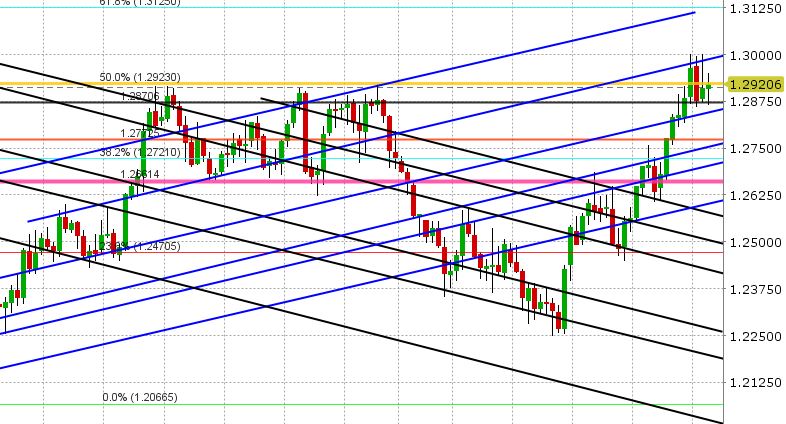

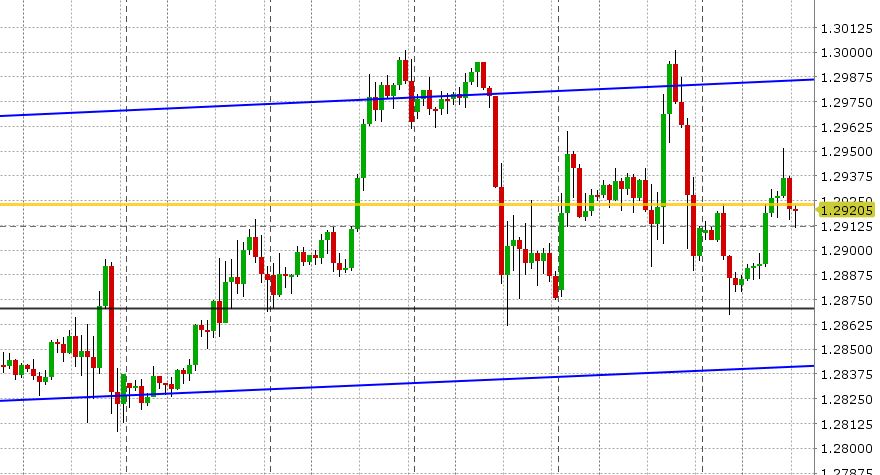

USDCAD: It’s been a volatile 24hrs for USDCAD traders. The Bank of Canada stood pat on interest rates yesterday and didn’t really offer anything of substance in their press release that was different from the January meeting. If anything, the central bank sounded a touch more positive as they barely acknowledged recent trade tensions and they didn’t even mention NAFTA, the weak January employment report or the slight month over month declines in annualized inflation for December and January. Combine this with the lack of a press conference this time around to really test the bank’s position and markets whipped around for a bit, but barely moved. However, USDCAD did manage to hold the 1.2920s after the announcement, and that gave buyers confidence when some broad USD buying came in over the next hour. With that, USDCAD jumped up to test chart resistance in the 1.2980s. However, the market could only hold the area for 30mins, we then receded lower to start afternoon trading, and then we got the headlines about the White House willing to consider tariff exemptions for Mexico and Canada. These headlines took the floor out beneath USDCAD and the market quickly fell back down through the 1.2920s for the NY close. This closing pattern was negative, and it allowed traders to push USDCAD lower in overnight trading. Buyers have stepped in however at 1.2870 (horizontal chart support) and broad USD strength against the EUR, GBP and AUD during early European trade has allowed USDCAD to recover all the way back to the 1.2920-30 area. Traders are watching EURUSD pop higher at this hour as the latest ECB monetary policy statement drops the central banks’s pledge to increase the size of QE if needed. This EURUSD move is pressuring USDCAD a bit right now. Next up we Canadian Housing Starts for February at 8:15amET (markets expecting +220k). Mario Draghi’s press conference follows at 8:30amET. Stephen Poloz will be speaking at 11amET in Halifax (but it’s not expected to be monetary policy related). Deputy Bank of Canada Governor Tim Lane, however, speaks later just before 4pmET. We’ll be watching this closely to see if he talks about yesterday’s BOC rate decision. All this being said, we think USDCAD range trades today baring any surprise headlines on trade as the largest event risks for the week are for tomorrow, where we’ll get both the Canadian and US employment reports for February along with a large USDCAD option expiry at 1.3000 (now touted to be $1.4bln+ in size). Tomorrow is also the option expiry for all March FX futures contracts.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

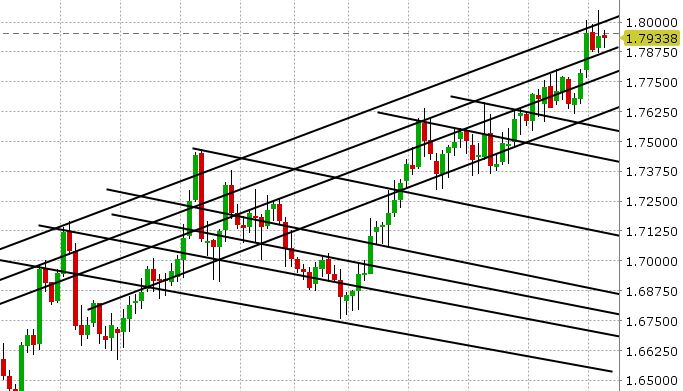

EUR/CAD Daily Chart

GBP/CAD Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.