USDCAD steady ahead of Bank of Canada rate announcement. USD broadly weaker as EURUSD and AUDUSD reverse higher. GBP lags on weak UK CPI.

Summary

-

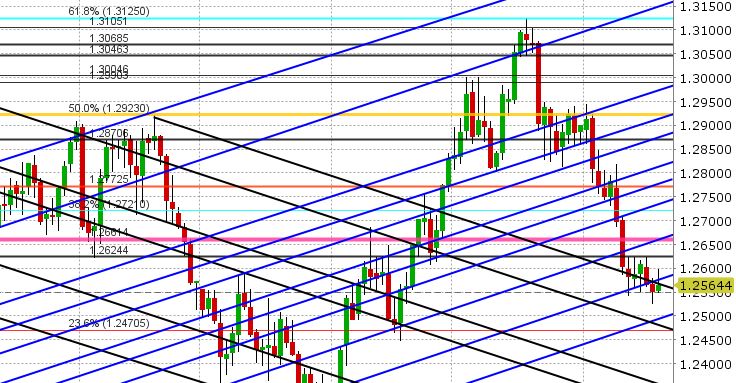

USDCAD: All eyes this morning are on the Bank of Canada and it’s interest rate announcement/Monetary Policy Report, scheduled to be released at 10amET. A press conference will follow at 11:15amET. Option traders have cast their bets, with now over $2bln notional in contracts rolling off between 1.2585 and 1.2600 at the NY cut (very same time as the announcement). This option expiry, along with some modest USD buying against AUD and EUR during early European trade, seems to be providing the bid to USDCAD since the NY close. We’re now trading slightly above the trend-line support level that was broken to the downside yesterday (which is somewhat positive), but there’s not much momentum behind the gains at this hour, which is understandable. May crude oil bounced strongly off support in the mid 65s yesterday and is extending higher another 1.3% so far today, which can also help to explain the lack of momentum higher in USDCAD at this hour. OIS swaps are pricing in less than a 20% chance of a 25bp rate hike today. As always, the focus will be on the tone of the press release and then the tone from Stephen Poloz in the press conference to follow. Any surprise to the hawkish side (rate hike coming sooner) will likely see USDCAD attack the 1.2500 level while any surprise to the dovish side (caution) will likely see USDCAD correct higher to the low to mid 1.26s. Then of course there’s the possibility that the Bank of Canada plays both sides, like it did in January, in which case we likely whip around at current levels. Canadian dollar futures traders liquidated 3746 contracts in positions yesterday. Also note today we get the weekly DOE crude oil inventory data at 10:30amET.

-

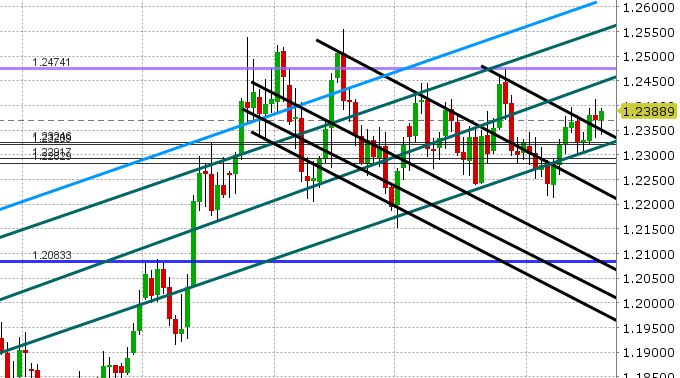

EURUSD: EURGBP buyers came to the rescue yesterday, with a late day surge that helped EURUSD close NY trading back above key trend-line support in the 1.2360s. There was some mild EURUSD selling as European traders walked in today but then EURGBP exploded higher following the release of the UK CPI data, and this helped EURUSD rebound back above the 1.2360s yet again. The chart technicals are in good shape for EURUSD as NY trading gets underway. USDCNH is soft and EURJPY traders look poised to break the cross above the 132.80s (both positive correlations for EURUSD). There’s nothing on the North American economic calendar today out of the US. We think there’s a possibility EURUSD rallies from here as the calendar is light for the remainder of the week. The next major resistance level is 1.2450-60.

-

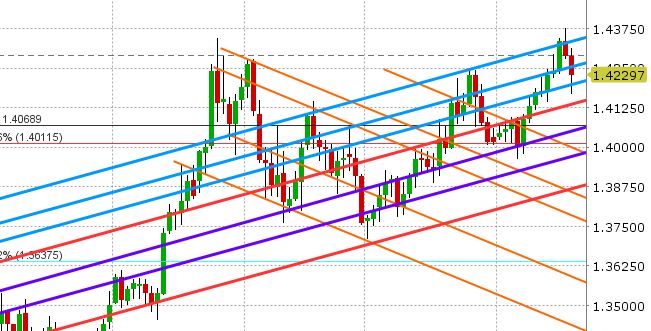

GBPUSD: Sterling was the big mover in overnight FX markets again today; this time as the UK reported CPI figures for March. The numbers came in light (+2.5% vs +2.7% on headline and +2.3% vs +2.5% on core) and traders were in no mood to support GBPUSD, following the weaker than expected wage growth figures reported yesterday. GBPUSD dropped about 100pts in short order, smashing through support in the 1.4240s, but it has bounced off the next major support level in the 1.4180s. Speculation has now increased that the Bank of England’s expected May rate hike will indeed be a “one and done” scenario. Odds for the May rate hike itself are still above 80%. We think GBPUSD consolidates its losses today. EURGBP has hit some trend-line chart resistance now in the 0.8710-0.8720 area, and we think this will help with the consolidation.

-

AUDUSD:The Aussie had a miserably NY session yesterday, trading in a very tight range that could not breach the 0.7780s to the upside, and so it was not surprising to see the market leak lower overnight. Buyers were found just shy of Fibonacci support in the 0.7740s and prices are quickly rebounding higher now as copper surges +2.5% higher today. The big event of the week for Aussie traders is tonight, when Australia reports its employment numbers for March. The expectation is for +20k jobs and the report will be released at 9:30pmET. The NAB Business Confidence survey will also be released at the same time. Should chart resistance in the 0.7770s give way today, it will have traders focused on the next upside targets, which are 0.7790, then 0.7815-25. We think there’s a possibility AUDUSD rallies from here, given the breakout higher in copper and the positive technicals for EURUSD. A better than expected Aussie jobs report tonight would be the icing on the cake.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

GBP/CAD Daily Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.