USDCAD spikes higher after dovish hold from Bank of Canada, but rallying crude caps. GBP bounces in the face of negative UK retail sales. EUR and AUD directionless

Summary

-

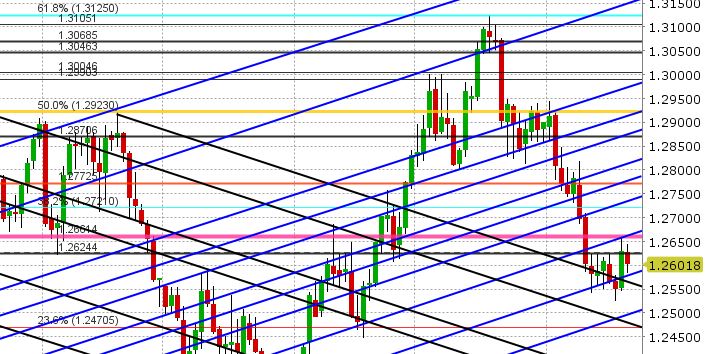

USDCAD: Dollar/CAD longs caught a bit of break yesterday when the Bank of Canada delivered, what we felt, was a dovish hold on interest rates. The market first shot up to familiar resistance in the 1.2620s and then the 1.2660s during Stephen Poloz’s press conference, but then sellers came back in to remind us that the trend is still down. Traders pushed USDCAD back towards the low 1.26s into the NY close and this set up the negative tone we’ve been seeing in overnight trading. A wave of broad USD selling against EUR, AUD and GBP in late Asian, early European trade caused USDCAD to break below the 1.2620s and yet another rally in crude oil this morning (commencing at 7am) is dragging USDCAD lower again now. There’s nothing of significance on the North American calendar today, so traders will continue to watch chart levels, the broader USD tone and crude oil prices for direction. Chart support today checks in at 1.2575, then 1.2555. Resistance is the same as yesterday: 1.2620s, then 1.2660. We think USDCAD consolidates yesterday’s move today without much fanfare. We get Canadian Retail Sales and CPI tomorrow at 8:30amET.

-

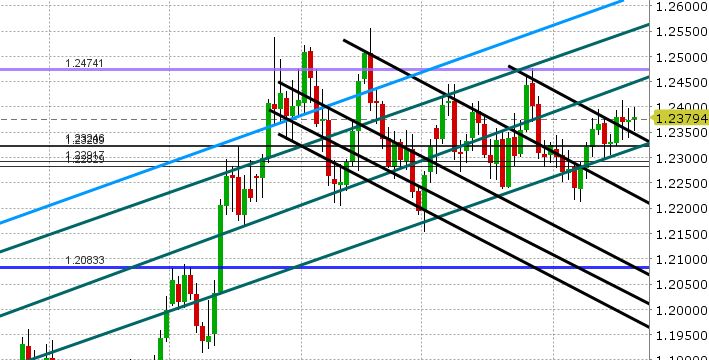

EURUSD: Euro/dollar continues to hold key trend-line support in the 1.2360s (which is positive) but there’s been no drive from traders to push the market higher in any meaningful way in the last 24hrs. USDCNH had a strong move lower in Asia, but rebounded off trend-line support in the 6.26 level, and so that didn’t help. EURJPY and EURGBP looked like they were going to break higher in early European trade, but those rallies have fizzled out. Some of this EURUSD malaise could also likely be option related, as over 3blnEUR in contracts expire today at 10amET between the 1.2360 and 1.2400 strikes. We think EURUSD chops around until we get a catalyst to break support (1.2350-60) or resistance (1.2410-20) in a meaningful way. Let’s see what happens after 10am when the shackles of the option expiry are released.

-

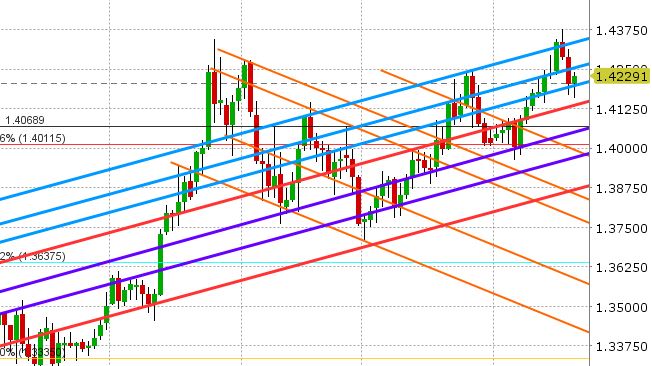

GBPUSD: Today’s release of weaker than expected UK Retail Sales for March marks a trifecta of negative economic headlines for GBPUSD this week. Traders were quick to sell sterling yet again, taking the pair swiftly back below trend-line support in the 1.4180s, but the market bounced back quickly and then some (which is a positive technical development, especially when achieved in the face of negative headlines). GBPUSD has surged back above the 1.42s with traders now eyeing yesterday’s NY highs once again in the 1.4250s. The failed breakout higher in EURGBP today is helping the cause. We think GBPUSD drifts higher today given the momentum at this hour.

-

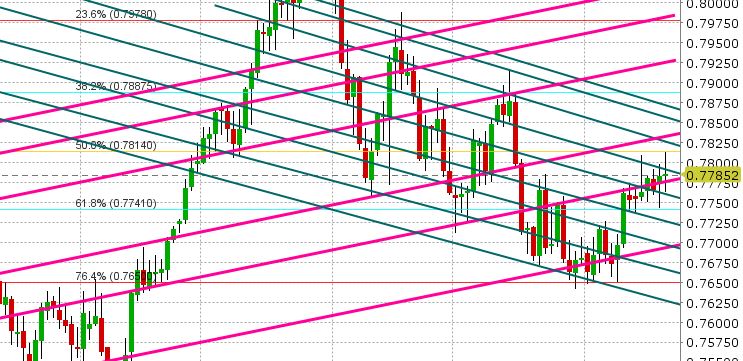

AUDUSD:The Aussie has had a volatile 24hrs, but not much ground has been gained. Yesterday’s intra-day swing from low to high had the earmarks of a reversal higher on the daily chart, but then Australia reported weaker than expected job growth for March overnight. This smacked the market lower and asserted the 0.7790s as resistance (the same level that capped in NY trade yesterday). The market was able to recover going into European trade, but then the EUR saw selling across the board and copper saw a wave of profit taking, and so AUDUSD has been dragged lower yet again. Chart support today checks in at 0.7790, 0.7775, the 0.7760. Resistance is 0.7815-25. We think AUDUSD trades with a directionless tone today given the quiet North American calendar and EURUSD’s range-bound pattern.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

GBP/CAD Daily Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.