-

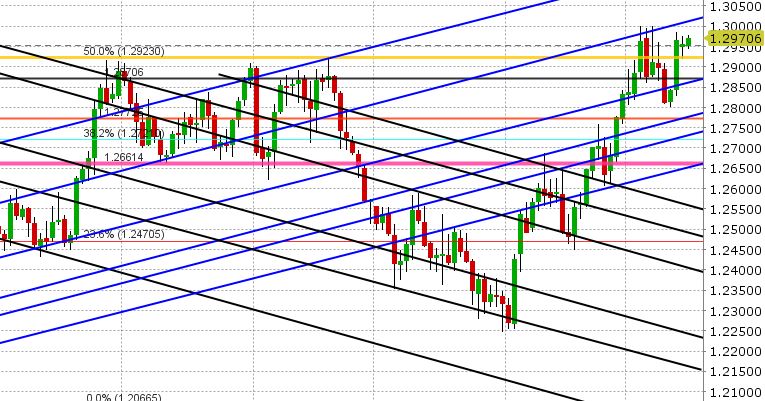

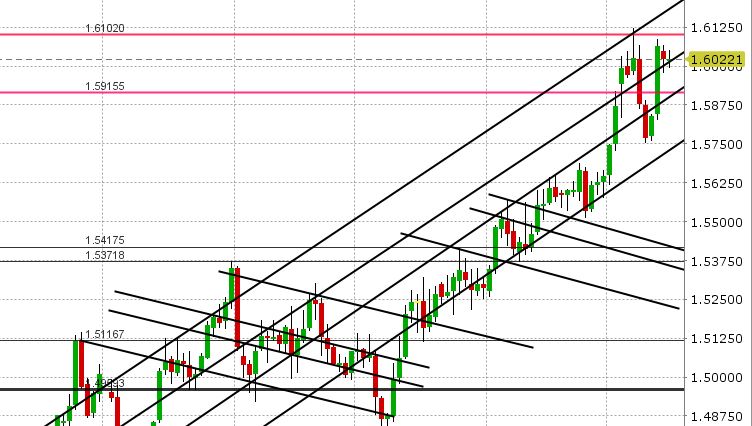

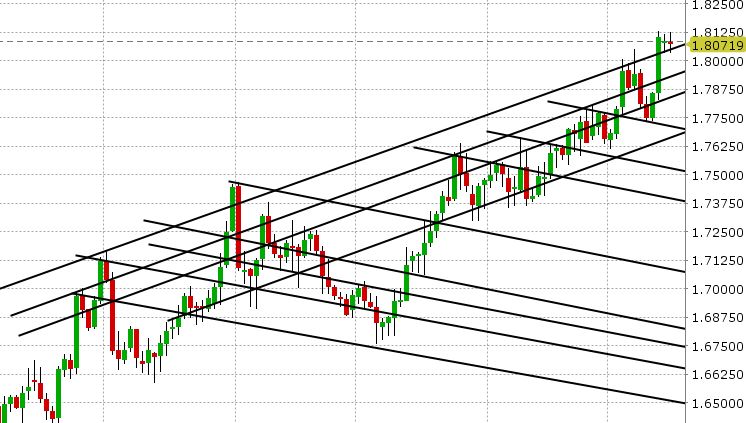

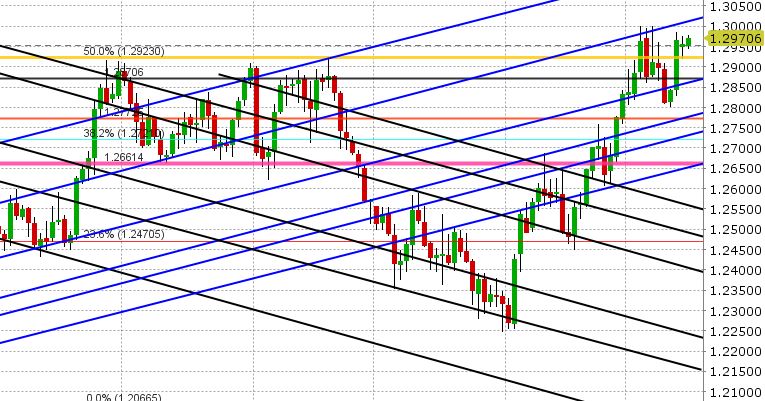

USDCAD: Dollar/CAD is entering NY trading this morning with a firm bid as the broader USD is rebounding against AUD, GBP and EUR. AUDUSD had a negative NY close (tracking copper prices), and that spilled over into further selling overnight. GBPUSD failed for the 3rd time at trend-line resistance at 1.3980-90 in early London trade and is now falling apart. Finally, EURUSD lost chart support in the 1.2370s. All this is keeping USDCAD bid at this hour and on track to test overhead resistance between 1.2990 and 1.3010. EURCAD and GBPCAD spent the better part of yesterday consolidating recent gains, but like USDCAD, the crosses are still in good shape technically. The North American calendar is light today, with US Import Prices and the Philly Fed survey out at 8:30amET, and Canadian Existing Home Sales out at 9amET. We think USDCAD retains its range-bound to upward bias for the time being, with the broader USD theme being the dominant driver of price action. Tomorrow will be another quiet session for data (US Housing Starts and UofM survey), and then all eyes will turn to the FOMC meeting next week (March 21) where the Fed is expected to hike rates 25bp. Canadian dollar futures traders added another 3888 contracts in new positions yesterday (now 15k+ contracts in new length over the last 4 days), which suggests a continued increase in new USDCAD spec longs and an increase in hedge sales from corporates. We’ll know more in the CFTC Commitments of Traders (COT) data released tomorrow afternoon.

Tune in @EBCTradeDesk for more real-time market coverage.

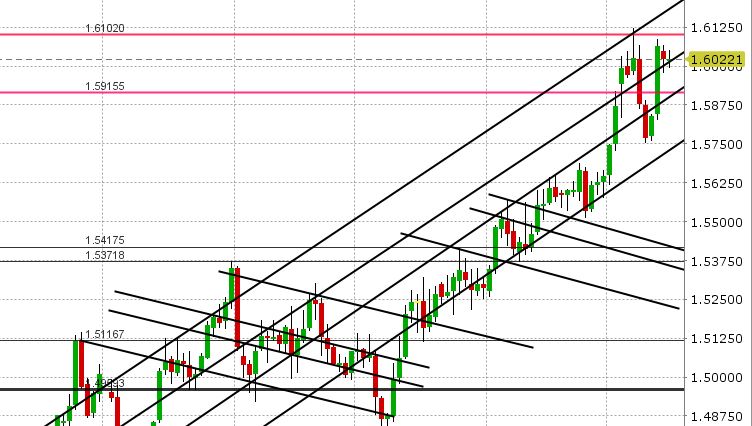

USD/CAD Daily Chart

USD/CAD Hourly Chart

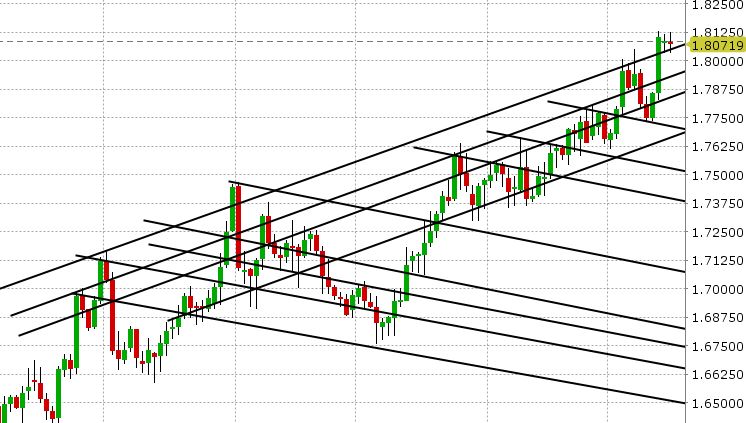

EUR/CAD Daily Chart

GBP/CAD Daily Chart

Charts: TWS Workspace

About the Author

Erik Bregar - Director, FX Trading

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact Us or call EBC's trading desk directly at 1-888-729-9716.

About Exchange Bank of Canada

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement.

This publication has been prepared by Exchange Bank of Canada for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Exchange Bank of Canada, its affiliates or any of their employees incur any responsibility. Neither Exchange Bank of Canada nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Exchange Bank of Canada products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Exchange Bank of Canada.