USDCAD offered ahead of Cdn Retail Sales & CPI at 8:30amET. USDJPY extends higher after weaker than expected Japanese CPI. EURUSD still clinging to support.

Summary

-

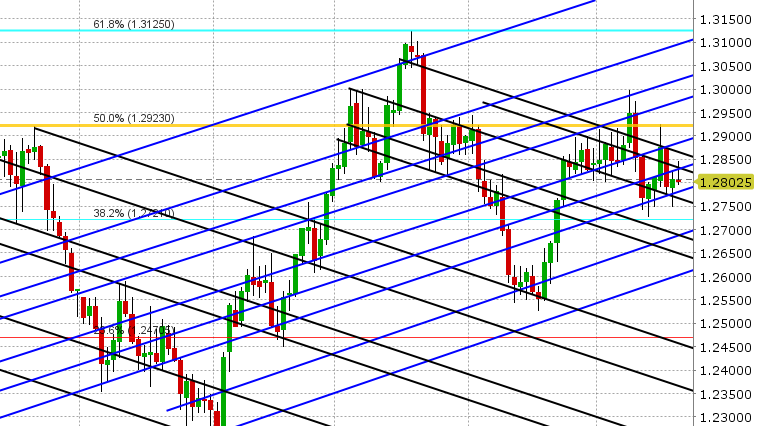

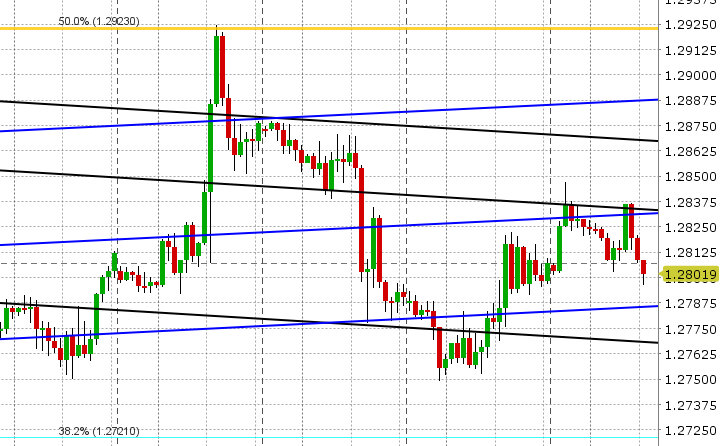

USDCAD: Dollar/CAD is entering NY trading this morning with a neutral to offered tone. Yesterday’s NY close was positive in that the market closed above trend-line support in the 1.2780s. Some negative NAFTA headlines from US trade representative Lighthizer allowed USDCAD to extend further to trend-line resistance in the 1.2830s (“The NAFTA countries are nowhere close to a deal”), but the market is struggling to surpass this level despite broad based USD buying overnight. Some of this is likely position squaring ahead of the Canadian Retail Sales and CPI data out shortly (8:30amET). Markets are expecting +0.4% MoM in April for Retail Sales and +2.3% YoY for CPI, +0.3% MoM and +1.9% on core. Upbeat numbers will likely see traders push USDCAD back to the 1.2770-80 area, while weaker than expected numbers would like see resistance break and a rally up to the next trend-line resistance zone (1.2865-90). Crude oil prices are showing signs of indecision (yesterday’s close was a doji candle on the daily chart). There is a large USDCAD option expiry at the 1.2700 strike this morning (+1.3bln) – won’t be factor unless we get blowout Canadian numbers.

-

EURUSD: Euro/dollar is still clinging to the same trend-line support level that held up prices yesterday. Yesterday’s action was rather lackluster and today’s activity will likely be as well because there’s almost 2bln EUR in options expiring at the 1.1800 strike this morning. As we mentioned yesterday, EURUSD longs need to make a stand here or we risk much lower prices as there’s little in the way of technical support below the market here. We got some good news on the political front overnight, with Italy finally forming a government (Five Star Movement & Lega agreeing to work together) and the Italian 250bln EUR bond write-off request to the ECB has been dropped.

-

GBPUSD: There’s not much going on at all in sterling, with UK traders probably more focused on the lead up to Royal Wedding to be honest. GBPUSD is tracking EURUSD lower this morning, and Fibonacci support in the 1.3480s continues to hold. A fifth day of weakness in EURGBP is helping GBP here. The prospects for a rally look better for sterling if the market can take out the overnight high (1.3528).

-

USDJPY: Dollar/yen extended higher overnight after weaker than expected CPI figures from Japan for April. The market is ebbing and flowing against the trend-line extension level this morning, which checks in at the 110.80. We think this is the key level to watch today. Failure here should invite some profit taking back to the mid 110s, while a strong close above would sustain USDJPY’s uptrend going into next week. US yields are a tad weaker this morning.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.