USDCAD gaps higher after post G7 rant from Trump administration. Very busy week ahead for markets. Traders eyeing Fed, EBC, BOJ, Brexit vote, US/NK summit, OPEC, + economic data.

Summary

-

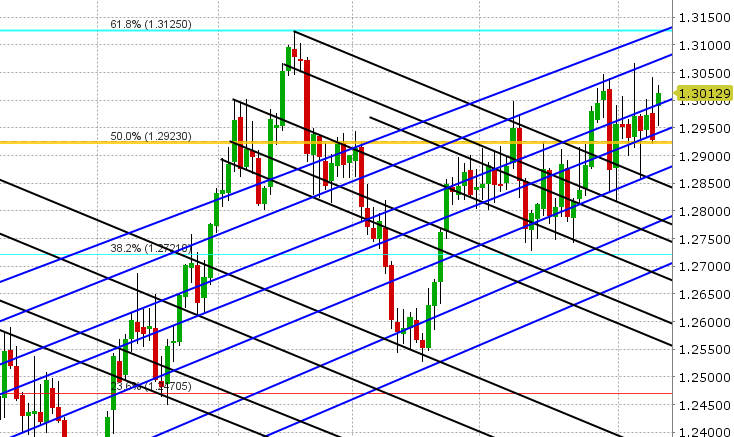

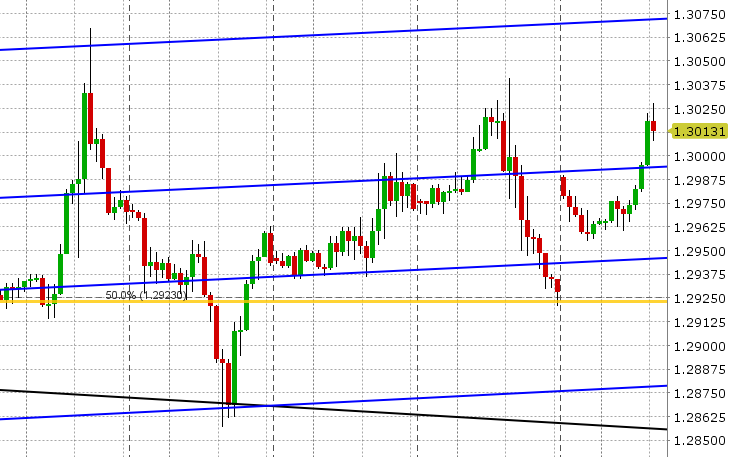

USDCAD: Dollar/CAD is starting the week significantly higher after Trump and his administration reacted hysterically to Trudeau’s post G7 press conference over the weekend. Perhaps it wasn’t the time and place for Trudeau to show some toughness, but Trump reacted swiftly by bashing Trudeau on twitter and he even threatened tariffs on auto imports. With this, USDCAD has reversed most of Friday’s negative trading pattern, and is now trading back above towards the 1.2980-90s (a key level that has acted mostly as resistance over the past week). Lower oil prices this morning are also helping (-0.9%). Support today lies in the 1.2960s (European lows) and then the 1.2920s. It’s also important to note that USDCAD gapped higher to start Sunday night trade, and trading so far in Europe has left 20 pts of it unfilled (chart gaps can sometimes have a magnetizing effect on prices). The calendar this week will be busy, and it all starts tomorrow with the iconic summit between the US and North Korea in Singapore (traders will be watching how this effects the broad risk tone). Tomorrow also features US CPI for May. Wednesday is another big day, with US PPI, the weekly DOE oil inventory data and the FOMC meeting, where the Fed is expected to hike interest rates by another 25bp (traders will be paying close attention to chairman Powell’s tone in his press conference as usual). We then get US Retail Sales, the ECB meeting and potential OPEC headlines on Thursday (when Russian and Saudi Arabian leaders meet at the World Cup) followed by US Industrial Production, Canadian Manufacturing Sales, Canadian Existing Home Sales and the UofM survey on Friday. Both longs and shorts added marginally to the net USD long (CAD short) position at CME during the week ending June 5. We think USDCAD could have a very volatile week, but the trend is higher at this hour.

-

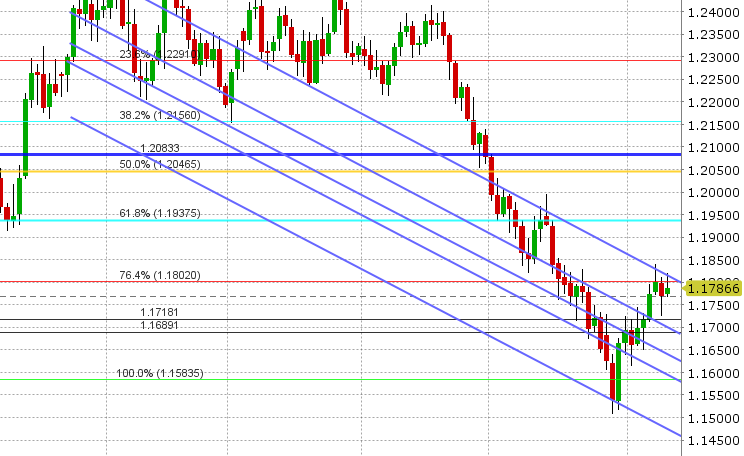

EURUSD: Euro/dollar is bid to start a busy week as new Italian finance minister Tria reaffirmed Italy’s commitment to staying in the EU when he spoke on the weekend. Italian bonds are trading higher today and the BTP/Bund yield spread is trading back down in the 2.20-2.30s. In addition to the US calendar we mentioned above, traders here will be also watching the German ZEW Survey for June tomorrow and April Eurozone Industrial Production on Wednesday. The main event for EUR traders however is on Thursday, when the ECB meets for its latest monetary policy decision. Markets are expecting the central bank to adopt a more hawkish tone towards the end of QE and the eventual rise in interest rates. For the time being though, EURUSD will likely trade a bit range bound. Trend-line resistance in the 1.1820s has reasserted itself in European trade today and we’re now trading back to unchanged as NY trading gets underway. Chart support today lies in the 1.1760s. The net long EUR position at CME declined slightly in the week ending June 5 as shorts added moderately more than longs did.

-

GBPUSD: Sterling is weaker to start the week as both the UK Industrial Production and Trade Balance figures missed expectations this morning. Trend-line resistance in the 1.3420s was the pivotal level to watch, and when the numbers disappointed, GBPUSD traders sold and made a bee line for the next support level, which was the 1.3350-75 level. We’re seeing a slight bounce off this level as NY trading gets underway. EURGBP is trying to break out again, which is remarkable given the technical damage done to its chart on Thursday and Friday last week. This week will be busy for UK data items as well. In addition to the US calendar, GBP traders will also be watching the UK Employment figures and a key Brexit vote in parliament tomorrow (more here: https://www.reuters.com/article/uk-britain-eu-parliament/brexit-legislation-to-return-to-house-of-commons-on-june-12-idUSKCN1J01ZR), UK CPI on Wednesday and UK Retail Sales on Friday. The net long GBP position at CME ticked down slightly in the week ending June 5 as shorts added more than longs. We think GBPUSD could have a big week as well, but traders are taking it one hour at a time right now.

-

AUDUSD: The Aussie is quietly bid this morning, despite the increased trade war rhetoric from Trump at the end of the G7 summit on the weekend. Copper prices are seeing some profit taking from last week’s run, but AUD traders have been ignoring copper lately. The Australian calendar is eventful this week as well, with NAB survey out tonight, Westpac Consumer Confidence and a speech from the RBA’s Lowe for tomorrow, and the Australian Employment Report on Wednesday night. We think Friday’s technical recovery for AUDUSD was important as it gives underwater shorts who didn’t cover something to think about ahead of a busy week (both longs and shorts at CME trimmed positions into June 5, but the market is still net short AUD to the tune of 20k contracts). We think AUDUSD range trades here ahead of the big events this week. The prospects of a rally in AUDUSD improve with a close above 0.7650.

-

USDJPY:Dollar/yen is rallying strongly this morning as global developed market bond yields tick higher and traders price in a successful summit between the US and North Korea tomorrow. Traders might also be trying to get a leg up on the busy US calendar and a dovish Bank of Japan, when it meets this Friday to decide monetary policy. No changes are expected however. Today’s move higher puts USDJPY above support in the 109.70s, but now slightly below resistance at 110. We think USDJPY coasts here ahead of tomorrow’s big event in Singapore.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.