USD violently reverses lower yesterday, led by gold breakout. Key technical reversals scored. USDJPY decline continues.

Summary

-

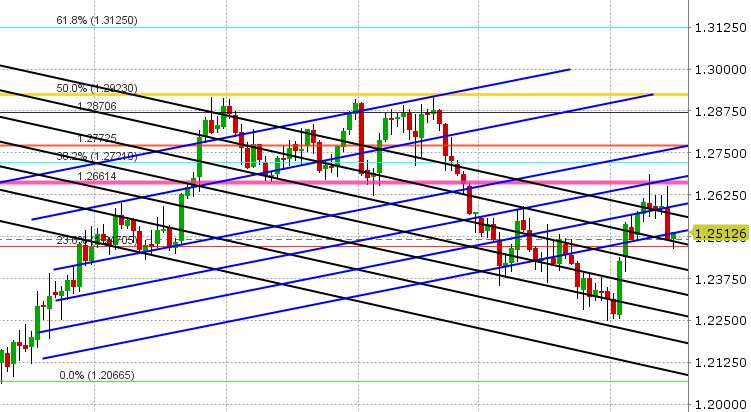

USDCAD: It was a brutal session yesterday for USDCAD, and the USD more broadly, as the post CPI, USD rally faded and then violently reversed for the rest of NY trading. There’s a lot of debate going on this morning as to why, with some market participants pointing to the weak Retail Sales numbers, a subsequent lowering of US GDP estimates from a number of banks, the rebound in the stock market, and that the CPI numbers were not strong enough to scare the Fed into hiking a fourth time this year. But then why did US yields spike higher and remain bid? Why did gold break out to the upside and reporters are running with headlines like this: “Gold surges on inflation worries”. Markets are a little wonky right now to say the least. Correlations are breaking down, interest-rate spreads are not driving FX price action, and reporters are writing different narratives for each market in an attempt to explain things (after the fact). This is why we love technical, position and sentiment analysis. The fundamentals can often get noisy, while human behavior and crowd psychology is a little bit more predictable, relatively speaking. Case in point yesterday for USDCAD. The market spiked higher after the stronger than expected US CPI release, held the gains for about a hour and then violently reversed lower right as gold prices broke higher above 1340. This breakout in gold also came right as a slew of EURUSD options expired, so one could make the argument the EURUSD (and the broader USD) was open to further volatility as spot hedges were no longer needed. With the sudden move back lower in USDCAD, support at 1.2565-70 was taken out easily, and that in turn opened to door to further selling to the next support level we mentioned, which was 1.2510. The drop in USDCAD extended further overnight as the broader USD resumed its decent lower, but it found some support at the 1.2470s (which is the 23.6% Fibo retrace of the May-Sep 2017 decline) and is making an attempt to regain trend-line support at 1.2485-1.2490 at this hour. The broader USD is off its lows. EURCAD and GBPCAD remain buoyant as well. All this is helping USDCAD a little bit here but a firm NY close above 1.2510-1.2520 is what’s needed to arrest the downward momentum now.

-

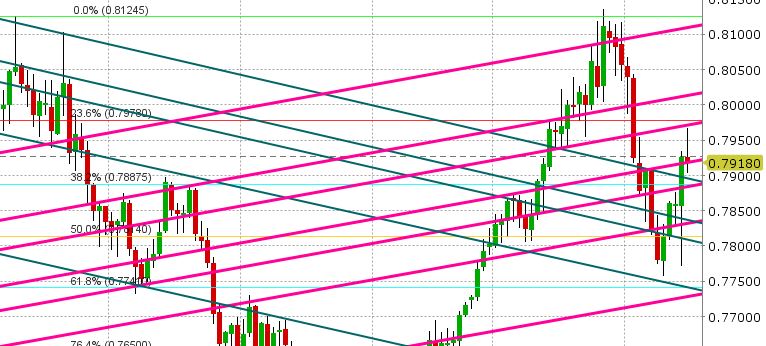

AUDUSD: The Aussie had a spectacular reversal higher during the 10am hour yesterday, as it benefited from the swift move lower in the broader USD. AUDUSD took out three resistance levels on the charts, and closed strongly above 0.7915. This paved the way for further gains in Asia, but the market stalled just shy of trend-line resistance in the 0.7970s. The Australian employment report, surprisingly, turned out not to be a market mover as the headline job gain figure came in pretty much right as expected (+16k). The internals weren’t great (part-time jobs gained and full-time jobs lost), but AUDUSD had enough momentum behind it from the NY session. We’ve since seen AUDUSD back off a bit here as the broader USD recovers, and we’re hearing talk of a 1.5bln AUD expiry at 0.7950 for tomorrow’s NY cut (10am). Support today remains plentiful: First at 0.7915, then 0.7900-0.7905, then 0.7890.

-

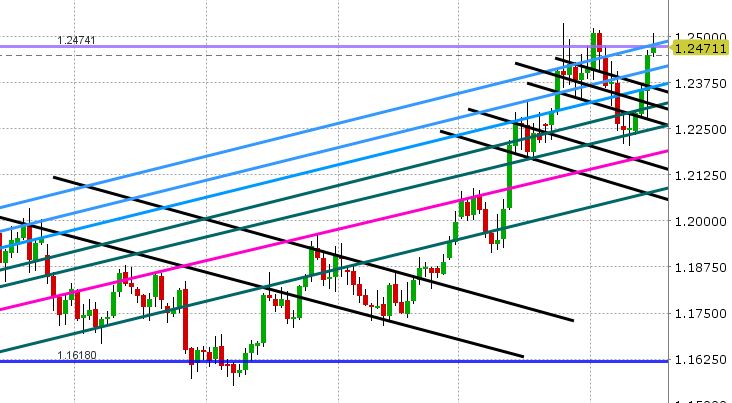

EURUSD: After spiking lower post US CPI yesterday, EURUSD found support in the 1.2280s, slowly regained 1.2305-1.2320 over the next hour, and then violently spiked higher at 10am when gold broke higher and the EUR option expiry passed. The fact that the market surpassed 1.2410-1.2420 by mid-day opened the door to further gains up to 1.2470s, which the market achieved towards the NY close and into Asia. The market then busted higher through the 1.2470s and touched 1.2500 around the 2am hour as USDJPY broke below 106.30, but this has somewhat reversed now as USDJPY attempts to bounce yet again. EURUSD is now testing the 1.2470s as we write. Reuters is reporting large option barriers at 1.2550, 1.2575 and 1.2600, which might cap things a little bit now if the market wants to defend them (barriers option cease when spot reaches the strike price). EURJPY is stable today, but in much better shape now technically speaking, after testing and holding the 132.50s earlier today. USDCNH has slipped lower throughout all this, but with the Chinese Lunar New Year holidays now in full swing until next Wednesday, we don’t expect the Yuan to lead. Should EURUSD fail to hold the 1.2470s today, we could very well see some profit taking here back into the mid 1.24s.

-

GBPUSD: Sterling has been on absolute tear since scoring a bullish outside day on the charts. Same story here. GBPUSD dipped after US CPI, found support at 1.3800-1.3815, hesitated for an hour, and then busted higher along with gold, EUR, AUD, CAD and everything else. The market made quick work of chart resistance at 1.3950 and then managed to close NY trading above 1.3990-1.4000, which was a very strong result technically. This has opened the floodgates for further gains as there’s not much resistance on the charts now until the mid 1.41s. The 1.4060s (Feb 8th highs) capped things for a bit, but GBPUSD is trading above that now too. We think this is the key level to watch today. Expect further gains should the 1.4160s hold. Expect selling back to 1.4010 should it give way. EURGBP is showing again how it’s not comfortable above the 89 handle, and this is helping GBPUSD here a bit. We get UK Retail Sales tomorrow morning at 4:30am (markets are expecting +2.4% YoY in January).

-

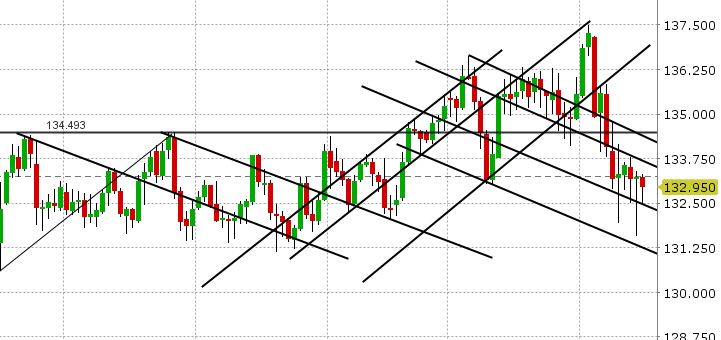

USDJPY: Dollar/yen continues to dominate the airwaves as the decent continues. The market made an attempt to rally back above 107.40-107.50 yesterday post US CPI, but it failed very quickly. It hesitated for a bit in the 9am hour and they gave up again as the broader USD violently sold off starting at 10am. The sharp recovery higher in US stocks had no effect. Nor did US yields approaching 2.90. Some broad based JPY selling came in during the afternoon (EURJPY and GBPJPY buying), and that helped the market regain 107 going into the NY close. Rumors were circulating yesterday as to how the BOJ would respond to recent market action. The Japanese finance minister Aso sort of gave us the answer overnight when he said the Yen’s strength is not abrupt enough to require intervention. Cue more USDJPY selling, which is what we’ve seen overnight. There’s not much of anything technically to hold the market up here, but the selling stopped in the 106.20s, and so that’s the new near-term support level. JPY futures traders added another 2k+ contracts yesterday, which continues to baffle us. Despite the USDJPY decline, there still appears to be no capitulation from the entrenched USD long (JPY short position).

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

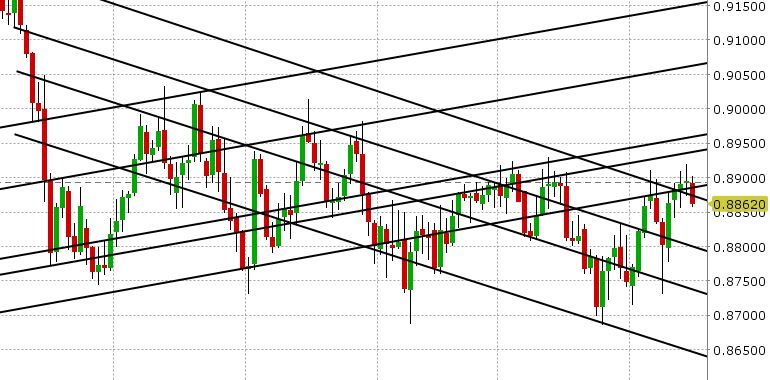

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

EUR/JPY Chart

EUR/GBP Chart

April Gold

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.