USD trying to recover amidst USDCNH breakdown and US govt shutdown fears. CAD quiet. BOJ, ECB, NAFTA talks in focus for next week.

Summary

-

USDCAD: Dollar/CAD traders couldn’t get much going yesterday, as we suspected. Buyers made an attempt to push higher but they were stalled by EURCAD and GBPCAD sellers and some USD-negative US government shutdown headlines from US Senator Mitch McConnell around mid-day. The NY close was not great technically, with USDCAD trading back below key trend-line support (which today checks in at 1.2435). The market is trying to regain the 1.2430s as we write as the broader USD recovers from overnight lows, and we could have an interesting start to the NY session with decent option expiries at 1.2400 and 1.2450 ($600mln+ each). A move back above the trend-line would invite further buying into the mid to high 1.24s. The CAD crosses are mixed this morning and the US/CA 2yr yield spread remains steady at +23bp. The 6th round of NAFTA talks resume next week on Jan 23, and it was reported overnight that they will be extended an additional day now, ending on Jan 29. We expect traders will be focused on the USDCAD option expiries today and the broader USD’s reaction to the looming US government shutdown (which looks like it will be averted at the last minute, just like last time).

-

AUDUSD: The Aussie continued its rally higher yesterday, regaining much of the ground lost after the Beige Book/Apple headlines from late Wednesday. It punched higher yet again overnight with EURUSD and GBPUSD when USDCNH broke to new lows below 6.3925, but it has since pulled back below Wednesday’s highs (which is slightly negative technically). Copper was up 0.6% earlier today, which was supportive, but it’s running into trend-line resistance once again (see chart) and is seeing some swift selling again as we write. Traders here will be glued on the US government shutdown drama as well and its effect on the broader USD. Resistance today checks in at 0.8025 and support is 0.8005-0.8010.

-

EURUSD: The Euro put in a half-decent performance yesterday, despite Wednesday’s bearish outside candle pattern. The 1.2230s were regained (which we said would be important in order to stem further selling), but then the market just stalled around there for the rest of the session. EURUSD broke trend-line resistance at 1.2250-1.2260 during Asia as USDCNH broke down (which was positive technically), but it stalled at Wednesday’s NY highs in the last few hours and is threatening a break back below this trend-line level as we write (which is negative). It appears markets are expecting a resolution to the US government shutdown drama going into the weekend, as the broader USD continues to recover and US bonds finally find a bid. The key today, from a technical perspective, is how EURUSD responds to the 1.2250-1.2260 level. A break below would invite further selling back towards the low 1.22s, while a close above would keep buyers in control. We’ll be watching USDCNH as well and its attempt to regain trend-line support at 6.4025 (would be EUR negative). The ECB meets next week on Thursday. While market rumors continue to swirl that the ECB is going to curtail QE sooner this year rather than later, we’re not expecting any major changes next week and we see a risk of Mario Draghi pouring some cold water on the excitement when he speaks on Thursday.

-

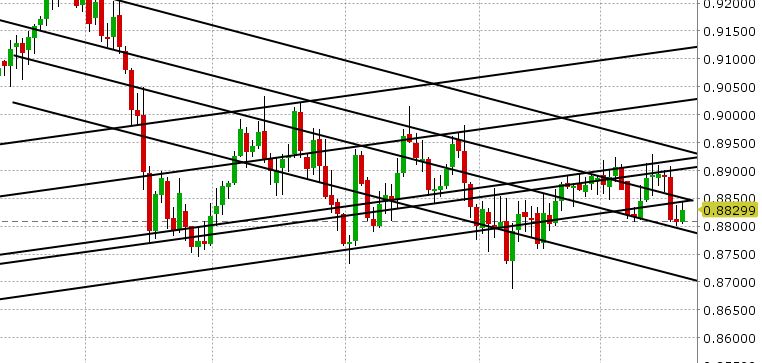

GBPUSD: Sterling traders gave another go at the upside overnight, after a strong close to the NY session yesterday. However, GBPUSD failed miserably when testing Wednesday’s highs in the 1.3930s. This coincided with technical failures for EURUSD and AUDUSD in the last few hours, bids returning for USDCNH after making new lows, and a poor UK Retail Sales report (+1.3% YoY in December vs +2.6% expected) out at 4:30am. Buyers are still in control however, so long as trend-line support holds at 1.3840-1.3850. EURGBP has bounced off support in the low 0.88s again today, but technical resistance continues to look stiff heading into the weekend (see chart), which is GBPUSD supportive.

-

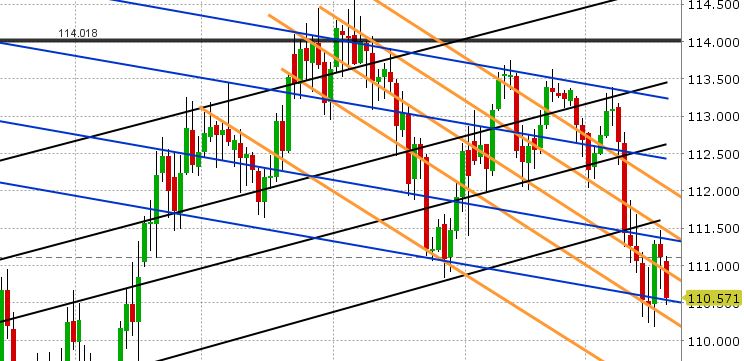

USDJPY: Dollar/yen struggled at chart resistance yesterday, and closed the day below the 111.00 support level as USD negativity built up surrounding the looming US government shutdown. Traders made an attempt higher overnight as the broader USD recovered but USDJPY could not regain 110.95-111.00, and so selling emerged again in European trade. Broad JPY buying also seems to be the theme today, with EURJPY and GBJPY down swiftly in the last few hours. US yields are also mildly softer. Support checks in now at 110.50 once again. Resistance at 110.95-111.00. We feel USDJPY continues to range trade ahead of the BOJ meeting on Jan 23.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

March Copper

EUR/GBP Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.