USD trading mixed ahead of US mid-term elections

Summary

-

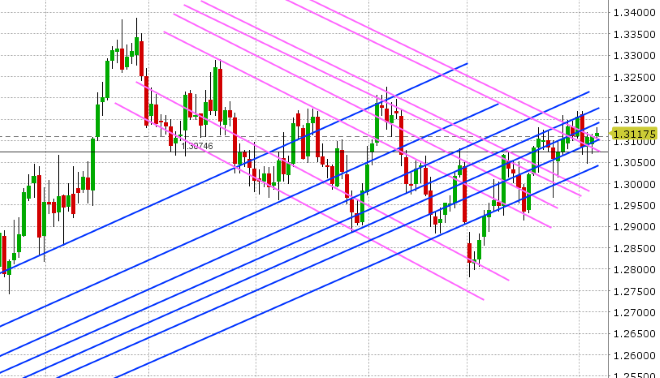

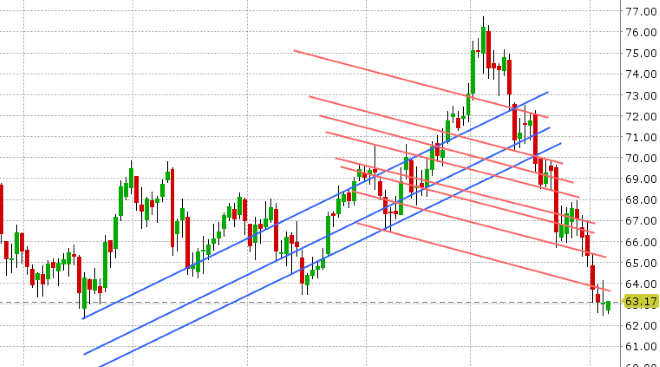

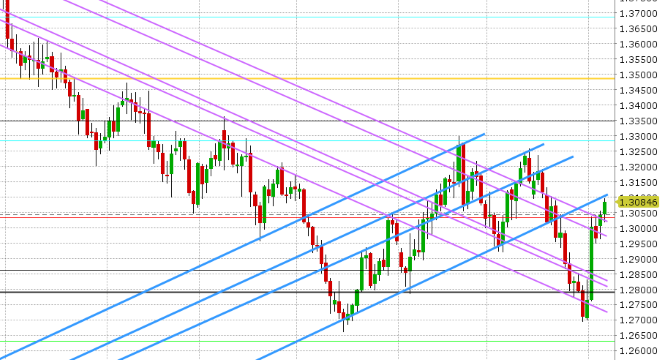

USDCAD: The range trade continues for USDCAD today, but price action has an upward bias to it after December crude rejected the $64 mark to the upside yesterday. The broader USD is trading mixed ahead of the US mid-term election results tonight. Canadian Building Permits for September were just reported in-line with expectations of +0.4% MoM, but the August figures were revised down to -1.1% from +0.4%. We think USDCAD’s momentum might shift to the downside here as EURUSD looks poised to break higher, but we think they’ll be support on dips to 1.3075-1.3100 as the chart for EURCAD looks quite constructive.

-

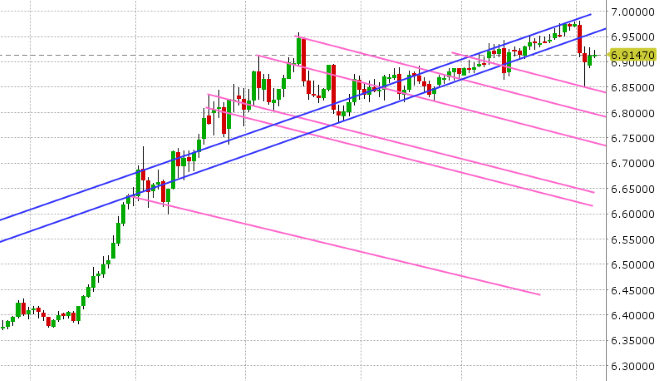

EURUSD: Euro/dollar has had a choppy overnight session, but the market is now looking poised to break above downward sloping trend-line resistance in the 1.1410s. German Factory Orders beat consensus for September, coming in at +0.3% MoM vs -0.6% expected. The BTP/Bund spread, however, has ticked up again as the Italians are playing a game of chicken ahead of the EU’s looming deadline for a revised budget (Nov 13), after which sanctions could possibly be applied. More here. USDCNH traded very quietly in overnight trade and it not providing any clues at this hour. Over 1.6blnEUR in options expire at the 1.1500 strike tomorrow, which could make for an interesting overnight session should the USD react negatively to the US mid-term election results. We think the fund short position should be way of the upside here.

-

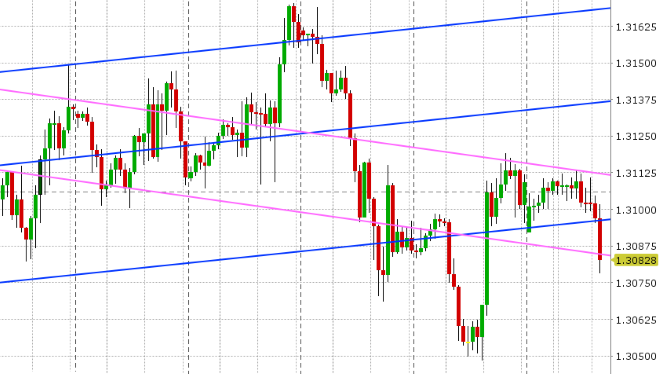

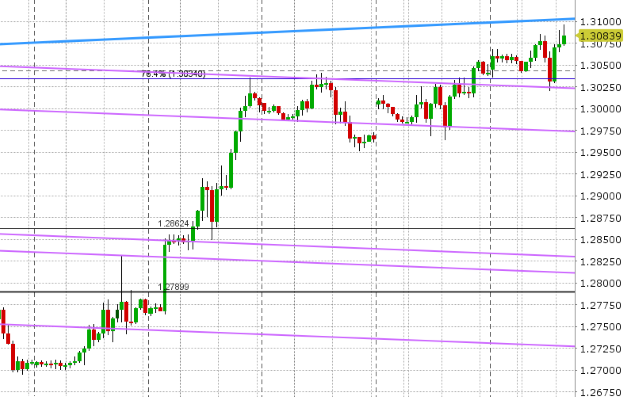

GBPUSD: Sterling continues to hold its gains from last week, as market participants appear to be giving Theresa May the benefit of the doubt for her self-imposed deadline to get back to the EU this week. The UK’s Brexit secretary Raab was seen leaving the cabinet meeting today giving a “thumbs up” to reporters. More here. The market has successfully tested the 1.3020s to the downside after breaking above the resistance level in afternoon trade yesterday. We think GBPUSD might gun for the 1.31 level today should EURUSD rally, but any bounce in EURGBP (after an awful 4 days of losses), might temper the gains.

-

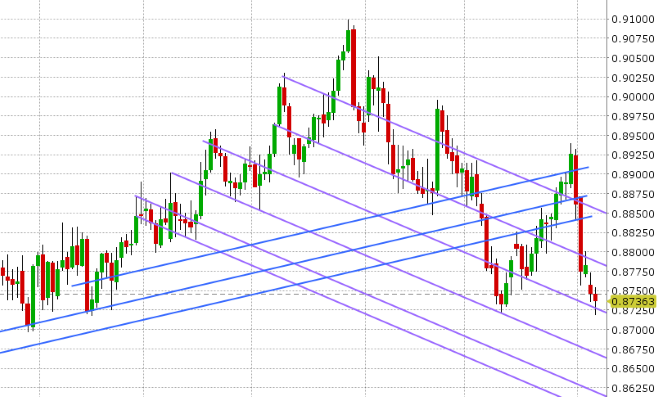

AUDUSD: The Reserve Bank of Australia left interest rates unchanged at 1.5% overnight (as expected), and while the central bank sounded a touch happier when it came to GDP growth and the labor market, the guidance didn’t deviate much from the dovish tone it had last time around. The Aussie didn’t react much at all around the announcement, but instead followed EURUSD higher into European trading. AUDUSD now sits back above the 0.7220s, which should be supportive for price action. Copper prices are trying to bounce this morning after yesterday’s pullback. New Zealand reports its Q3 employment report just before the NY close today (4:45pmET). Given the AUD’s sensitivity to NZD at times, we’d be on the lookout for potential volatility at end of day.

-

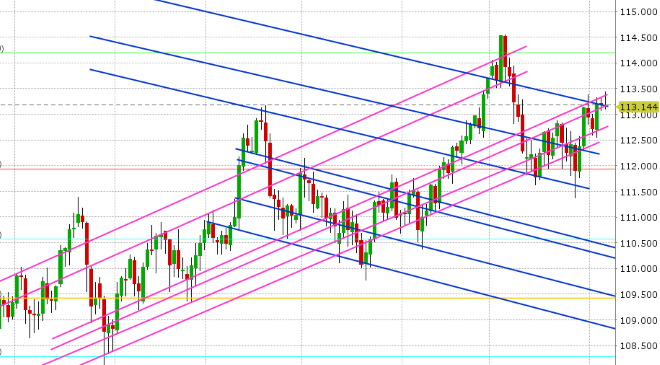

USDJPY: Dollar/yen is slipping this morning, and this comes after traders tried to push the market above the 113.30s yet again overnight but failed. This, along with some EURJPY selling, then saw the market fall lower and we now have a situation where 113.10-15 support is being threatened to the downside. The S&Ps are trading soft this morning ahead of election day in the US. We think the market risks pulling back further here should broad USD selling pick up steam. Next support is 112.70-80.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Gold Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

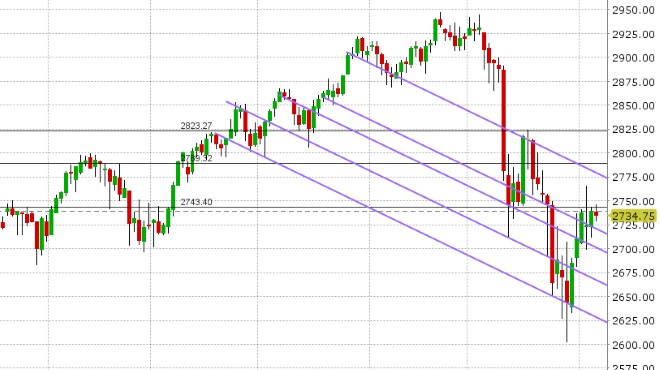

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.