USD trading broadly mixed following Trump/Kim summit. UK traders eyeing key Brexit related vote. US CPI on deck.

Summary

-

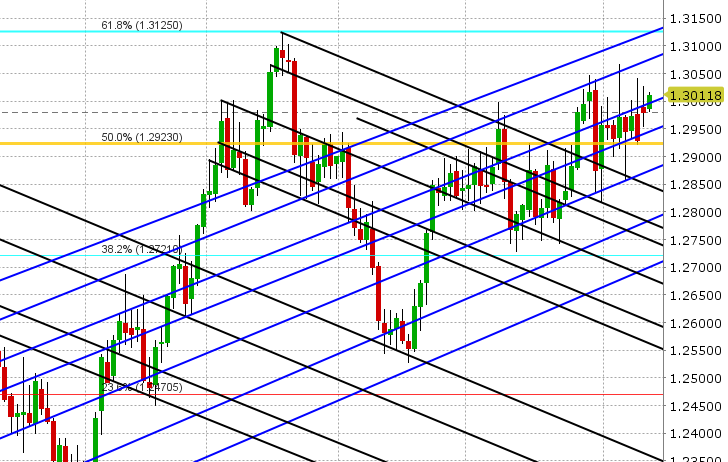

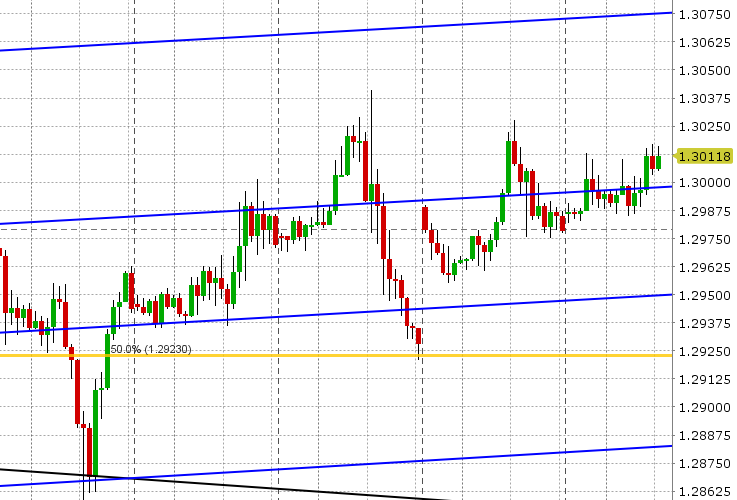

USDCAD: Dollar/CAD is bid again this morning as the broader USD trades off its European lows. The historic Trump/Kim summit in Singapore, while an important first step in the path towards denuclearization in North Korea, came and went today without much substance for markets...and more importantly, there were no negative surprises. With that, USDJPY saw a bit of profit taking and EURUSD/GBPUSD traders then focused on European data. USDCAD is now trading back above the pivotal upward sloping trend-line resistance level we noted yesterday (it now sits at 1.30 even). This will keep buyers in charge near term as we head into the US CPI report at 8:30amET. Markets are expecting +2.7% YoY, +0.2% MoM, and +2.2% YoY on core. July crude oil is backing off its overnight highs as OPEC highlights oil demand uncertainty in its monthly report, and this is helping USDCAD a bit here too.

-

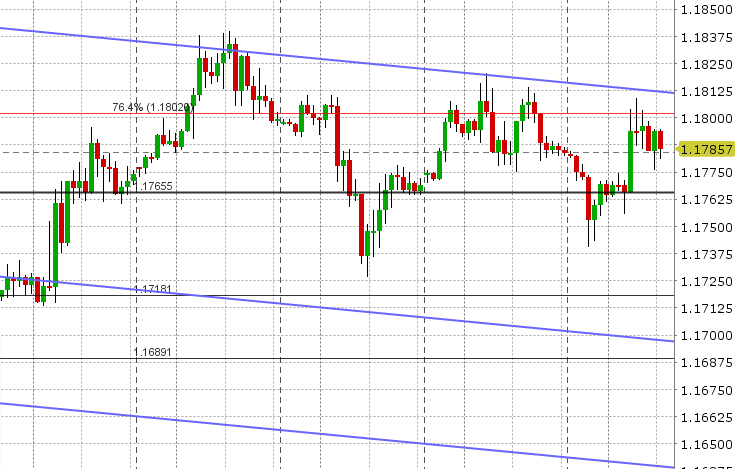

EURUSD: Euro/dollar is trading flat this morning following a range-bound overnight session. After an arguably lackluster NY close, support in the 1.1750-60s was tested in Asian trade, but the market bounced higher. We then saw a spike higher in the 3am hour as Italian assets opened higher, but we’re now seeing some selling after the weaker than expected June read for the German ZEW survey, which came out in the 5am hour. We think EURUSD will continue to trade in a range-bound pattern until chart support in the 1.1750s or resistance in the 1.1810s gives way in a meaningful way. US CPI is up next. Today also features a 1blnEUR+ option expiry at 10am around current levels (1.1780-1.1790 strikes).

-

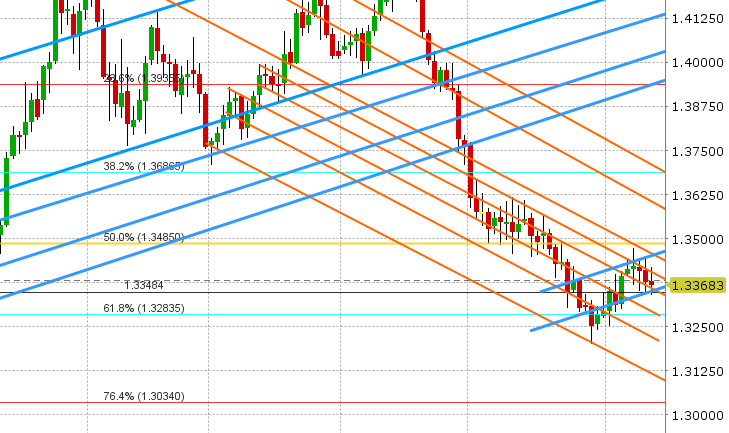

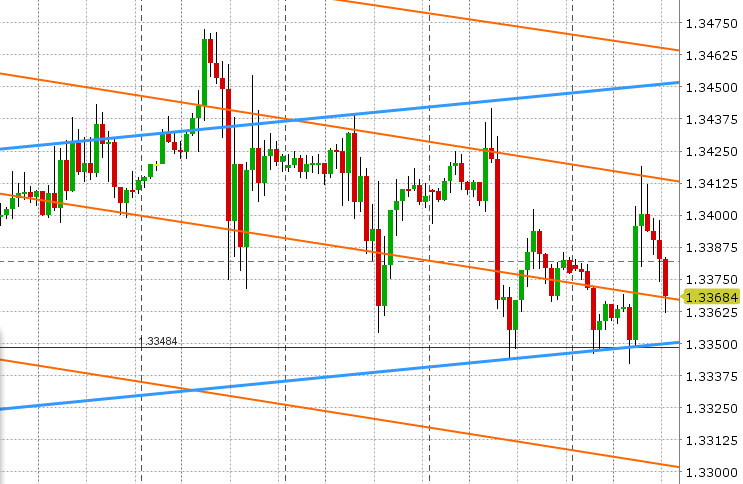

GBPUSD: Sterling found a bid earlier today; bouncing off chart support in the 1.3350s twice and then moving higher with EURUSD in the 3am hour. Gains picked up heading into the UK employment report at 4:30am, but then we saw sellers return as the report came in mixed (strong headline gain in job creation, but weaker than expected wage growth). GBPUSD grazed trend-line resistance in the 1.3415 area going into the report, but we’re now trading back to UNCH. Chart support today remains in the 1.3350-60 zone. EURGBP is trading flat today, but the cross is still holding the bulk of yesterday’s gains, which will likely be a drag on GBPUSD. The key event for GBP traders today is a House of Commons debate on Brexit exit terms and a vote which will follow.

-

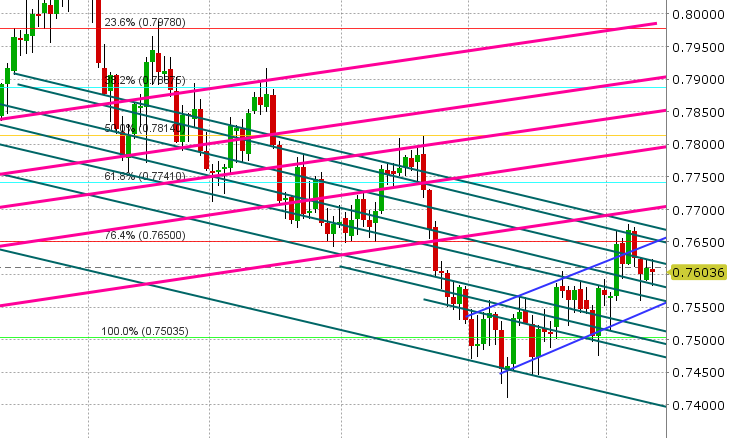

AUDUSD: The Aussie is trading with a quiet range-bound tone so far today. We saw a brief dip into 0.7580s chart support ahead of the Trump/Kim summit last night, and then a quick rebound as European trading got underway, but chart resistance in the 0.7620s is still capping. Australia reported a weaker NAB Business Confidence number for May last night (when compared to April), but it had no effect on markets.

-

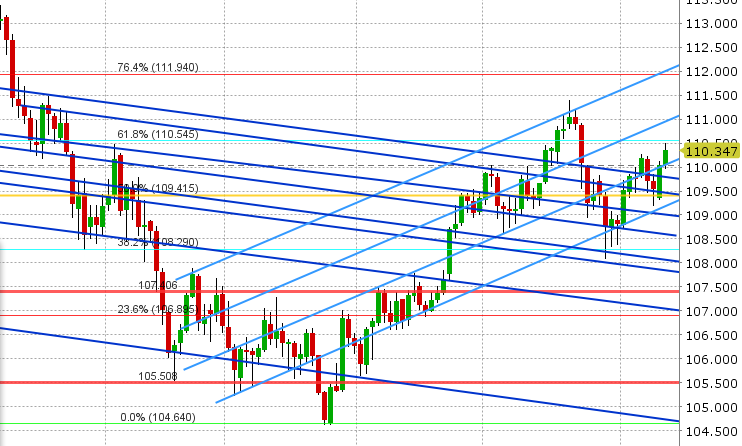

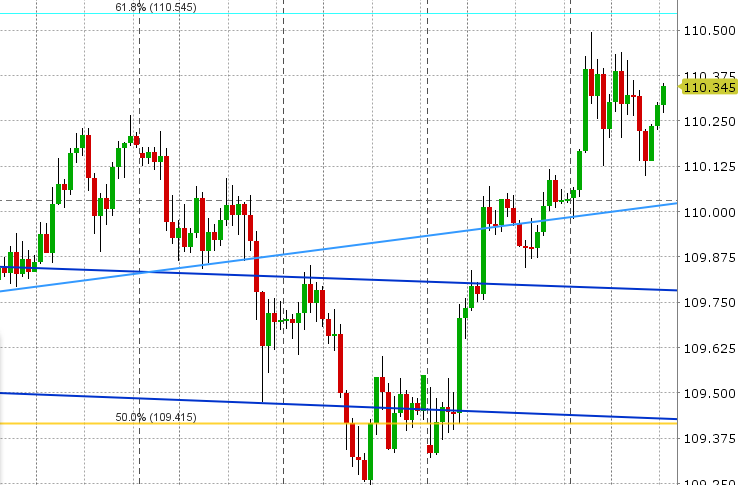

USDJPY:Dollar/yen is bid again this morning, following an almost 100pt run-up of optimism leading into the Trump/Kim summit last night. While nothing is binding yet between the two nations, one could argue markets got what they were looking for (commitment to denuclearization, peace, further dialogue between US and North Korea), and with that USDJPY has seen a bit of profit taking. US yields are ticking higher again though this morning and this is helping the market bounce off the London lows. We think USDJPY bulls will remain in charge here so long the 110 level holds. The next chart resistance level is in the 110.50s.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.