USD shorts readjust ahead of Yellen today and OPEC tomorrow. GBP volatile but now higher post Brexit divorce settlement headlines. USDCAD on verge of upside breakout.

Summary

-

CENTRAL BANK SPEAK: Upcoming Fed Chair, Jerome Powell, didn’t rock the boat and took a cautiously optimistic tone during his testimony to the Senate Banking Committee yesterday. Says the Dec rate hike is "coming together", but doesn't see the labor market even close to hot. Powell supports gradual rate rises, but he provided no color on QE and the Fed's balance sheet. The Bank of Canada's Poloz defends recent measures to cool the housing market at the post FSR press conference, while deputy Wilkens defends the recent rate hikes. None of these comments were particularly market moving for the broader USD or for CAD. Janet Yellen appears before Congress at 10amET today.

-

ECONOMIC DATA: US Consumer Confidence rises to a record high of 129.5 (not surprising given historical correlation to stock prices). US Q3 GDP (1st revision) on deck at 8:30amET today. Market expecting +3.2%.

-

CME OPEN INTEREST CHANGES 11/28: AUD +1365, GBP -1026, CAD +2670, EUR -188, JPY -6364

-

CFTC COMMITMENTS OF TRADERS REPORT (NET SPECULATIVE POSITIONS AS OF NOV 21) - The net long position in AUDUSD shrunk for the 4th week in a row, driven largely by a big jump in new short positions as the market made new swing lows below 0.7600. The net GBPUSD position was flat going into last Tuesday's close as some longs added on the crawl back above 1.3200. Short USD (long CAD) position liquidation continued for the 5th week in a row in USDCAD, but this time occurring as the market ground higher again into the 1.28s. The net EURUSD long position grew to a 6 week high (largely on the back of short covering post Merkal's coalition flop), and this was before the dovish FOMC minutes ignited a 200pt rally in the pair. With open interest now 30k contracts higher as of yesterday's close, we expect the market to be significantly more net long at this point. CFTC data is now confirming the purge in USD longs (JPY shorts) that started to occur when the 113.50 level gave way in USDJPY. USD shorts (JPY longs) took profits as well during the fall, albeit less so. The net USD long (JPY short) position came down off multi-year highs as of Nov 21, and that position has probably been reduced even more so now as the USDJPY market is 100 pts lower and about 16k contracts lighter in terms of open interest as of the close of trading yesterday.

-

OTHER NEWS: North Korea launches another ICBM into the Sea of Japan, but this time brags that it can reach the mainland US (markets are largely ignoring this for the time being). US stocks surge higher amidst progress on US tax reform. UK Telegraph reports that the UK and the EU have agreed on a Brexit divorce bill of 45-55bln EUR, closer to the 60bln that the EU wants, but the UK government denies it. All eyes on OPEC going into Thursday.

-

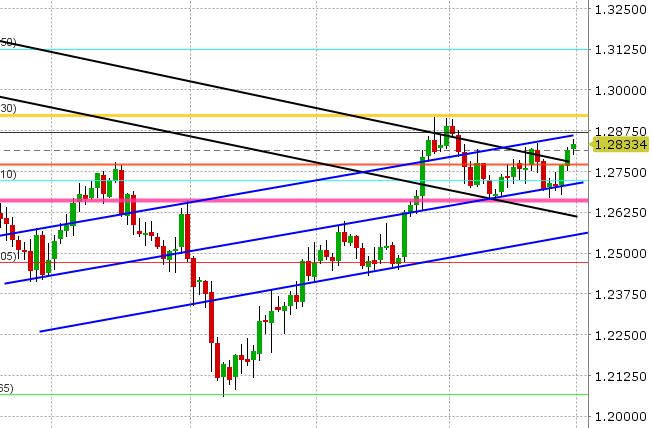

USDCAD: It’s been an interesting first half of the week for the broader USD. It started the week continuing its downward trajectory from last week, but it reversed suddenly higher across the board after 9am on Monday morning. There’s not much we can chalk it up to other than broad based profit taking from recent USD shorts and trader repositioning ahead of key events still to come this week, ie. Yellen, OPEC. USDCAD has benefited from the broadly higher USD theme so far this week. Technically speaking, we scored a bullish outside reversal on Monday’s close with follow through yesterday. We’re now back above key resistance in the 1.2770s (August highs and upper bound of our trend-line extensions from the spring). USDCAD is also on the verge of breaking out to the upside from a triangular consolidation pattern. Relative monetary policy outlooks, and the US/CA 2yr yield spread hitting 33bp continues to lend support. EURCAD and GBPCAD cross flow buying, a dominant positive influence over the last two days, is petering out a bit as we go the press. A massive option expiry tomorrow (1.26bln at 1.2850) is noteworthy too. We’re now calling USDCAD higher due to a sudden positive change in technicals this week. Near term support 1.2810. Resistance 1.2870-80. Traders will be focused on Yellen later this morning, OPEC tomorrow, and Canadian GDP/Employment figures on Friday.

-

AUDUSD: The Aussie also got caught up in the broad USD reversal higher during the NY session on Monday. We’re still trading above the RBA Lowe reversal candle (Nov 21st), but traders have done significant damage to the technical chart structure (Monday outside reversal lower, market now below key weekly support in the 0.7610-20 area), forced us to revise our outlook to range-bound for the time being. Near-term support 0.7560s. Some traders are blaming this week’s weakness on weaker base metal prices.

-

EURUSD: The 76.4% Fibo retracement of the Sep-Nov down move proved to the pivot point for EURUSD traders on Monday. The level acted as support going into 9am Monday but then that level gave way as the USD reversed swiftly higher across the board. The selling continued yesterday and key near-term support was breached (1.1860-1.1875 or the 61.8% Fibo and a trend-line extension from the summer). As mentioned above, we feel the broader USD move over the last couple days has been flow driven more than anything else. Recent CFTC data also hints at possible profit taking from the ever growing net long position. Technically speaking, the EURUSD market now sits near yesterday’s lows and a test of the 50% Fibo area (1.1800-1.1810) looks likely. Cross flows have not been helping at all this week. The EURGBP chart now looks horrible after Monday’s violent reversal lower and EURJPY continues to struggle above 132. The US/GE 10yr yield spread hasn’t moved around much lately and continues to sit around 200bp. While we feel the path of least resistance is still higher in EURUSD, we would feel more comfortable if the market were to regain the 1.1880s. About 1bln in option expiries today between 1.1825-1.1855 will likely keep activity contained, unless Yellen’s speech shakes things up.

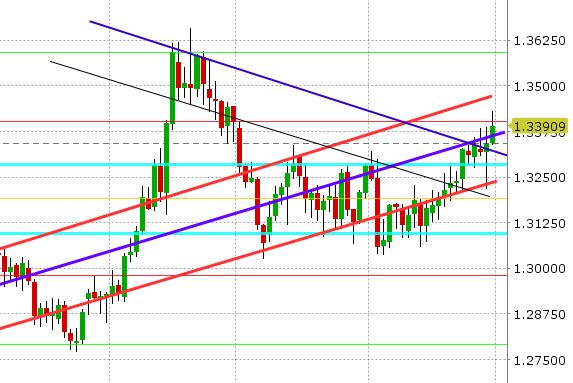

GBPUSD: Sterling saw significant volatility yesterday as the UK Telegraph reported that the UK and the EU reached an agreement on the Brexit divorce bill. GBPUSD surged higher (funny enough, this was right after key channel support was tested in the 1.3230-40s. Then came the UK government denial (a plunge lower) and then a rally back to the highs as GBP shorts were given a chance to escape. Futures traders liquidated 1026 contracts. Technically speaking, yesterday’s move was very bullish. A rough start to the day turned into an extremely strong finish, with GBPUSD clearing resistance in the upper 1.33s. The key today will be follow-through. The market must hold 1.3390-1.3400 (new support). A move lower to 1.3350 wouldn’t be the end of the world. Selling back below 1.3320 would erase recent progress. A few reminders: the UK’s Theresa May meets with the EU’s Juncker on Monday Dec 4.

-

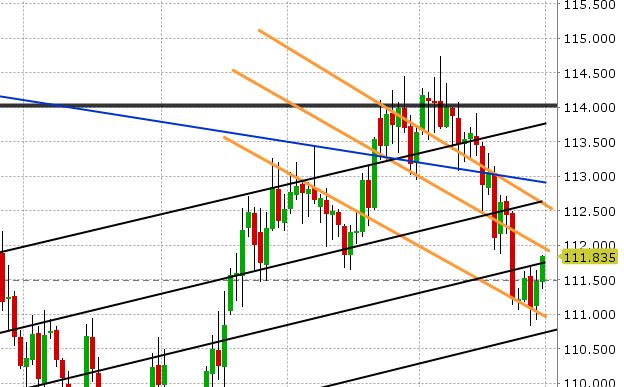

USDJPY: Dollar/yen has staged a solid recovery since dipping below key support at 111.00 early Monday. The broadly higher USD theme has helped, along with a extremely strong performance from the US stock market yesterday. The market has been ignoring the North Korea headlines. US yields were surprisingly weak relative to US stocks yesterday, but they’re ticking higher now which continues to help USDJPY into the 9am hour. The market is now testing near-term resistance in the 111.80s. GBPJPY staged a bullish outside reversal yesterday, which is also supportive. Futures traders liquidated another 6364 contracts yesterday. We would not be surprised to see more of this as USDJPY ticks up. Technically speaking, USDJPY is still in a bit of a downtrend here but we’re attacking near-term resistance (which is positive) and there’s already been a significant purge of long USD (short JPY) positions. We’ll be watching very closely how USDJPY responds to resistance in the 111.80-112.00 area.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.