USD sees broad selling ahead of Jerome Powell speech at Jackson Hole

Summary

-

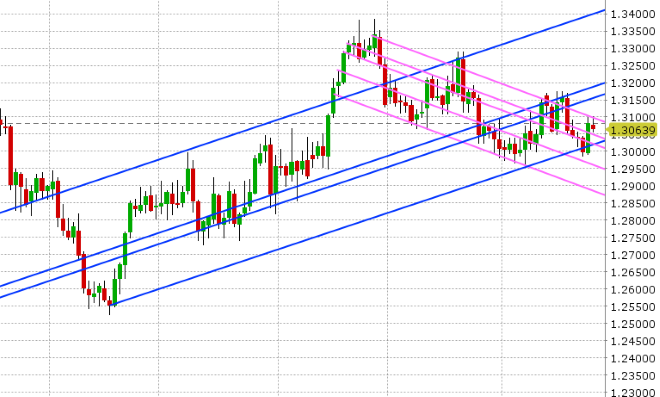

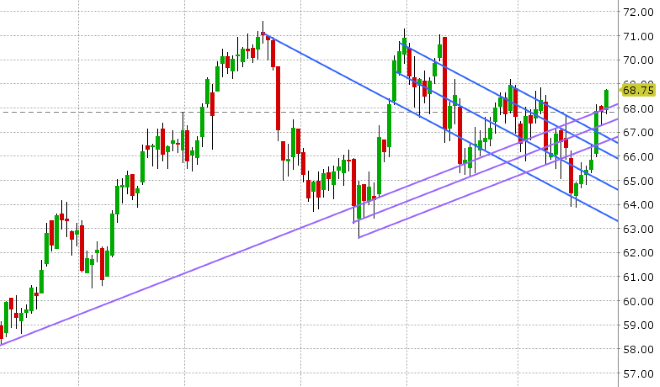

USDCAD: Dollar/CAD is pulling back this morning after yesterday’s broad, AUD-driven, USD rally caused the market to break above resistance in the 1.3050s. Today’s early moves were AUD driven, with USDCAD rejecting the next resistance level at 1.3100 when Scott Morrison was appointed as the new Australian PM, and we’re falling back a little bit further now following USDCNH and its negative reaction to headlines regarding China re-introducing the counter-cyclical factor into the CNY daily fix. More here: https://www.nytimes.com/2018/08/23/world/australia/scott-morrison-prime-minister.html and https://www.business-standard.com/article/reuters/china-resumes-use-of-counter-cyclical-factor-in-yuan-midpoint-fixing-mechanism-sources-118082400688_1.html. US Durable Goods for July were just reported, and it was a mixed bag: -1.7% on headline vs -expectations of -0.5%, but June revised higher by 0.1% and capital goods orders (ex. air) beat expectations. Next up is Jerome Powell’s speech at 10am to open up the Jackson Hole Symposium. Full schedule here: https://www.kansascityfed.org/publications/research/escp/symposiums/escp-2018. Note that the Bank of Canada’s Stephen Poloz is a feature for tomorrow’s panel. October crude oil is trading above the 68.20 resistance level it couldn’t surpass yesterday, but after a tremendous $3.50 run higher here since last Friday, we’d be wary of a pull back here to support USDCAD on dips into 1.3040-50. The Fed’s Bullard has just crossed the wires with some dovish comments: BULLARD: FED SHOULD HOLD OFF ON MORE RATE RISES, BULLARD: FED SHOULD NOT IGNORE YIELD CURVE'S MESSAGE.

-

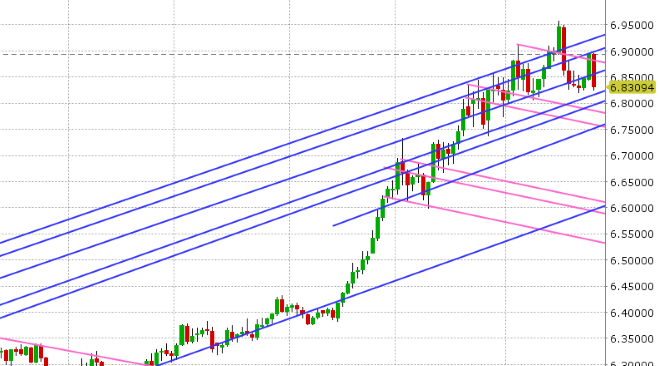

EURUSD: Euro/dollar is fighting back today, regaining the downward sloping trend-line support level it lost yesterday amid broad AUD selling. Today the level checks in around the 1.1560s, and the market is trading back above it on a combination of the Australian and Chinese news mentioned above, and now the Bullard headlines. The headlines about Trump offering to help Italy buy its bonds (when it refinances its debt next year) saw Italian 2yr yields come in briefly, but this was quickly laughed off by markets. We think buyers are now back in control heading into Jackson Hole. The ECB will not be present.

-

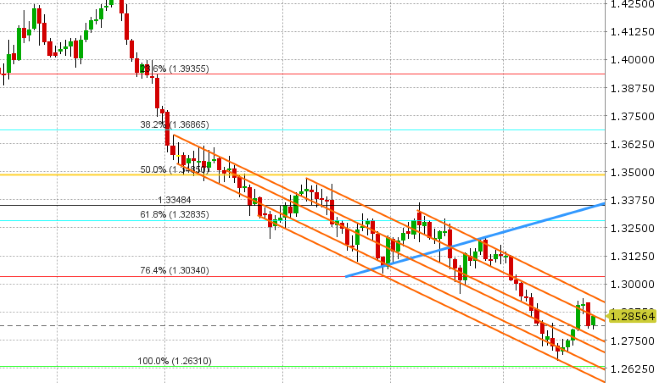

GBPUSD: Sterling is bouncing higher this morning after yesterday’s ultimate failure to hold gains above the 1.2870-80s led to steep losses when the level broke. Today’s drivers are the factors we mentioned above (causing broad USD selling) and what appears to some heavy EURGBP sell orders going through the market at different points this morning. We think the downward sloping trend-line level in the 1.2860s is the line in the sand today going into Powell. Expect sellers to return should we continue to trade below it, and buyers to take over should we trade back above it. The BoE’s Haldane will be speaking at Jackson Hole just before 1pmET.

-

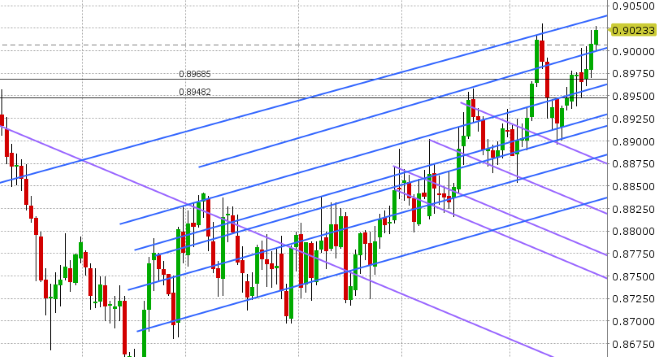

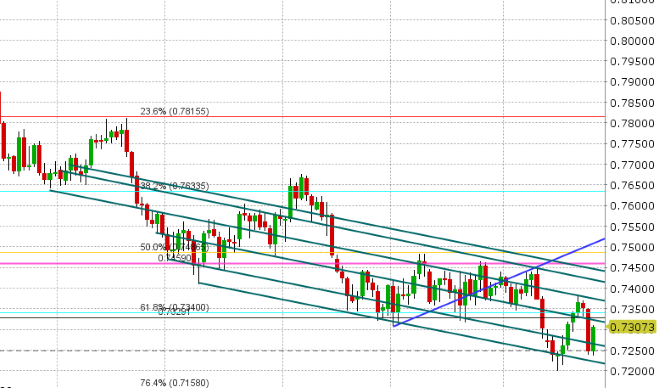

AUDUSD: The Aussie is recovering half its losses from yesterday today, as a sigh of relief sweeps over Australia following the appointment of the country’s treasurer as the new interim prime minister. More here: https://www.npr.org/2018/08/24/641452032/australia-gets-a-new-prime-minister. With this, AUDUSD regained chart support in the 0.7260s during late Asian trade. We’ve seen some follow-through buying during Europe this morning, led by the fall in USDCNH. We think AUDUSD hugs the low 73 handle going into Powell’s speech, as 1.4blnAUD in options go off at 0.7305 today. Expect chart resistance in the 0.7330s to be testing should Powell dial back the excitement about rate hikes.

-

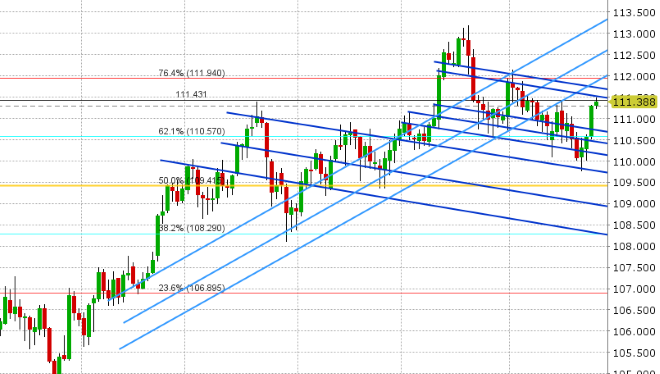

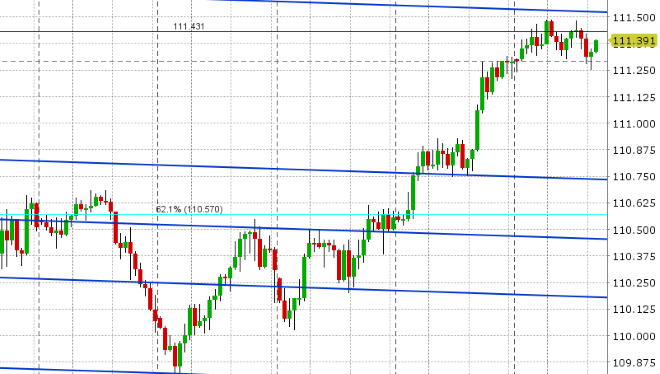

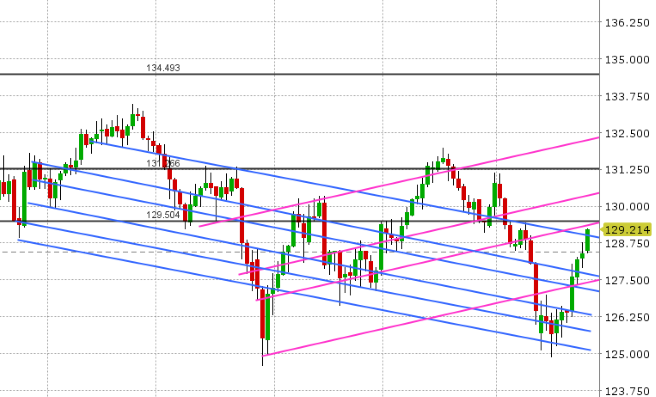

USDJPY: Dollar/yen rocketing higher yesterday and into Asian trade overnight, achieving the target we mentioned (111.50) in relatively short order after resistance in the 110.60s gave way. This came despite a pullback in US stocks and treasury yields mid-day yesterday, and was very much a broad USD inspired move. We’re seeing some selling here 111.50 stems the buying and NY traders prepare for Jerome Powell at Jackson Hole. The BOJ will not be present. Japan reported CPI overnight at +0.9% YoY in July, vs. expectations of +1.0%. Expect chart resistance at 111.50 to come under threat should Powell sound hawkish, and a pull-back should he sound dovish.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.