USD retreats with US yields. GBP volatile on fat finger. Cdn CPI on deck.

Summary

-

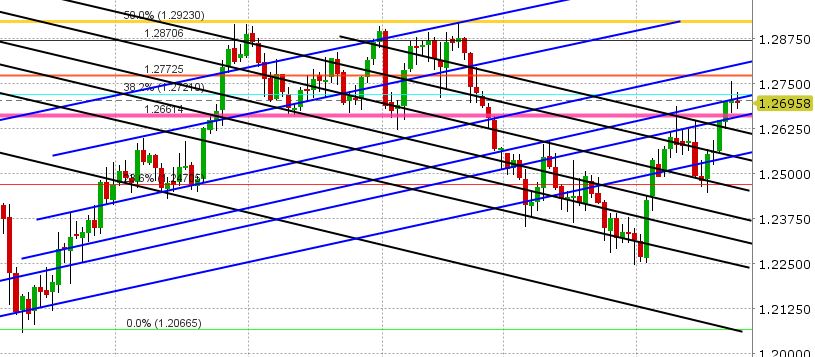

USDCAD: Dollar/CAD is entering NY trading this morning with an offered tone as yesterday’s rally, after the weaker than expected Canadian Retail Sales figures, quickly fell apart. USDCAD closed back below 1.2710, the level it broke above earlier in the day, and that was a negative technical pattern. The market is now about 20pts lower searching for support ahead of the Canadian CPI numbers for January, which will be released at 8:30amET this morning. Traders are expecting +1.5% YoY and +0.5% MoM. A stronger than expected inflation print will likely see the market continue lower and test support at 1.2650-1.2660. Weaker than expected CPI will likely see the market try to regain 1.2710-1.2725. There are no US data releases today, but we’ll have a number of Fed members making speeches later this morning: Dudley & Rosengren 10:15am, Fed releases Monetary Policy Report to Congress 11am, Williams 3pm. The CAD crosses are mixed this morning and therefore not providing much clues for USDCAD. EURCAD is in the process of reversing yesterday’s bullish outside day pattern (USDCAD negative), while GBPCAD maintains its upward trajectory despite this morning’s “fat finger” trade in GBP (see GBPUSD notes below).

-

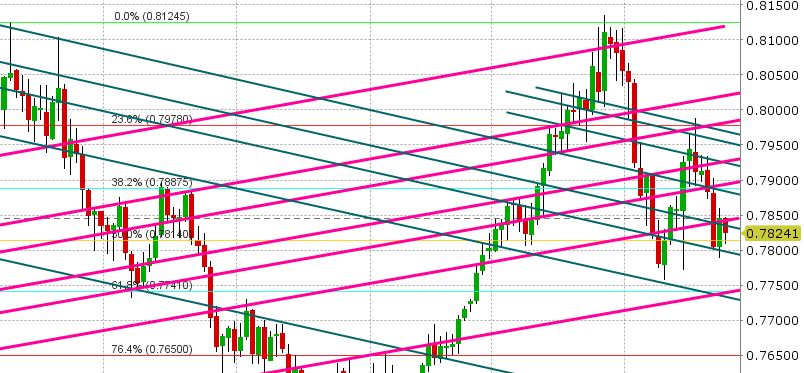

AUDUSD: Aussie traders continue to be content with following EURUSD, copper prices and the broader USD theme, given the lack of Australian data points this week. AUDUSD is entering NY trading with a bid tone, after successfully testing a Fibonacci support level at 0.7815 earlier in European trade. EURUSD is off earlier lows, as is copper. The spike higher in US yields, post FOMC minutes on Wednesday, is also now fading, and that’s helping to underpin AUD as well. We think the key level to watch today for AUDUSD will be 0.7840-0.7850. A firm close above this resistance level would invite some short covering, in our opinion, and a move back up to the 0.7880s, possibly 0.7900. Support at 0.7815 doesn’t look under threat at this hour.

-

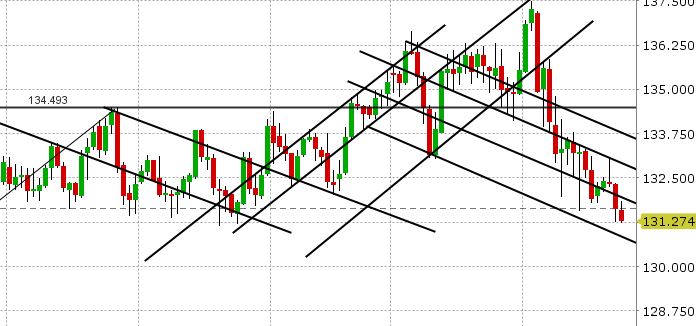

EURUSD: It looks like it might be a quiet one today for the Euro as yesterday’s strong bounce arrested the downward momentum for EURUSD this week. The bounce higher yesterday, in our opinion, was the result of US yields retreating off their highs post FOMC minutes. USDJPY collapsed back down below 107 after failing twice to break resistance above 107.70-107.80. USDCNH failed at overhead resistance above 6.35 as well. All this combined helped to stop the EUR selling yesterday, but now the market’s sort of stuck in a range. We’re calling it 1.2280 to 1.2330-50 for today. Some broad USD selling has come in here over the last hour, so we might see the top end of this range tested first. EURJPY selling continues to be drag on EURUSD. Should the cross break below 131.25 with any force, it will likely drag EURUSD to the lower end of the range.

-

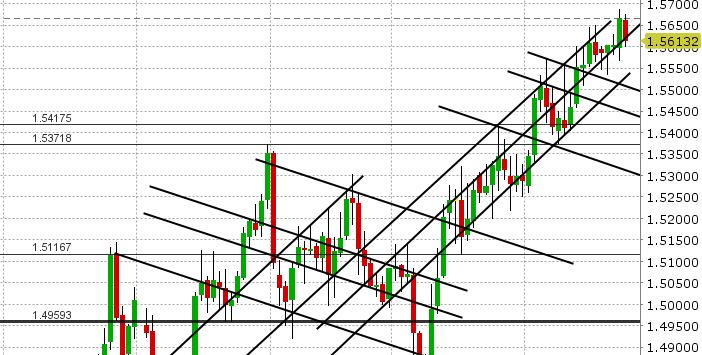

GBPUSD: Everybody’s talking about the bizarre 60pt plunge lower in GBPUSD around 6am this morning. No headlines crossed. The FTSE and UK yields didn’t budge. We’re hearing talk now that this was flow/order driven around the 11am fix in London (someone had big size to move at this scheduled time) and we’re also hearing talk that this could have been a “fat finger” trading error (someone traded a large amount of GBP by mistake). It appears to be such as the GBPUSD, which plunged quickly to support at 1.3910, has recovered completely and then some. The market now sits above the early European highs, and above trend-line support at 1.3990. Should this positive momentum remain, we could see a quick move up into the low 1.40s. Resistance today is pretty chunky: 1.4010-1.4025, then 1.4040. EURGBP is helping the GBP prospects at this hour, as it rejects the 0.8830s after the “fat finger” move and plunges all the way back down below 0.8800. It doesn’t have much support now until the 0.8770s (which is another GBP positive).

-

USDJPY: Dollar/yen traders are still licking their wounds after a rough session yesterday. As we mentioned above, USDJPY failed on two attempts above the 107.70-107.80 level on Wednesday, the most important failure being the 2nd attempt higher after the FOMC minutes. The uptick in US yields that followed the FOMC minutes helped the USD against everything else except JPY. This gave us a somewhat negative NY close on Wednesday, which gave the market an excuse to knock USDJPY lower yesterday, which traders did especially when US yields moved back lower. US yields are lower again this morning, and so there’s no love for USDJPY at this hour. Resistance at 107 is firmly capping, and the downward momentum in EURJPY is not helping either. Next support lies at 106.40-106.50. There’s a downward sloping trend-line today coming in at the 106.70s. If the market can hold this level intra-day, it might help arrest the negative momentum.

Market Analysis Charts

USD/CAD Chart

EUR/CAD Chart

GBP/CAD Chart

AUD/USD Chart

EUR/USD Chart

EUR/JPY Chart

GBP/USD Chart

EUR/GBP Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.