USD quiet to start week. Action packed week ahead with data and central bank meetings/speakers.

Summary

-

CME OPEN INTEREST CHANGES 12/8: AUD +6033, GBP -2264, CAD +451, EUR -11747, JPY +4586

-

CFTC COMMITMENTS OF TRADERS REPORT (NET SPECULATIVE POSITIONS AS OF DEC 5): Open interest grew by almost 5k contracts in AUDUSD as both longs and shorts added after a late November dip and Dec 1st's bullish outside day, leaving the net long AUD position marginally higher. Open interest in GBPUSD shot up 24k contracts in the 200 point rally from 1.3350 to 1.3550 and the 100 pt dip back to 1.3450. The increase was almost evenly divided between new longs and new shorts, leaving the net long position only marginally higher from Nov 28 levels. The net short USD (net long CAD) position barely changed in the week ending Dec 5th, and this was despite an over 200pt plunge off the highs in USDCAD. Open interest in USDCAD marginally higher as well. There was some mild short covering in EURUSD as it waffled around between 1.1825 and 1.1925, leaving the net long position close to six week highs. EURUSD open interest continues to grow steadily week over week and is now close to 500k contracts. The net USD long (net short JPY) position grew slightly again in the week ending Dec 5th as USD shorts took profits on the bounce back up to the 112s.

-

KEY EVENTS ON THE CALENDAR THIS WEEK: TUESDAY: Australian NAB survey, UK CPI, German ZEW WEDNESDAY: Speech from RBA's Governor Lowe in Sydney, Australia Consumer Confidence, Japan Machine Orders, Speech from BOJ's Kuroda, UK Employment figures, US CPI and the much anticipated FOMC rate decision THURSDAY: Australian inflation, Australian Employment figures, Japan Manufacturing PMI, China Retail Sales, China Industrial Production, UK Retail Sales, EU summit, BOE rate decision, ECB rate decision, US Retail Sales, Speech from BOC's Poloz, and Japan Tanken survey FRIDAY: Canadian Existing Home Sales and US Industrial Production.

-

USDCAD: Dollar/CAD starts the week on a quiet footing, consolidating gains from last week. Friday’s range was surprisingly muted post release of the US payrolls data (the higher the expected headline number was offset by weaker than expected wage growth), leaving USDCAD in technically good shape to start this week. It’s going to be a very quiet week for Canadian data but the BOC’s Poloz is expected to speak on Thursday and there will be plenty of other event risks for USDCAD to trade off of, ie. US CPI, FOMC meeting, BOE and ECB rate decisions (watch GBPCAD and EURCAD). The US/CA 2yr yield spread starts the week a little softer, at +29bp. EURCAD is holding recent gains, but is running into a little bit of resistance here at the 1.5150-60 area. GBPCAD is trying to regain its composure here after giving up most of last week’s gains on Thursday and Friday. We continue to call USDCAD range-bound to higher here given improving technicals, and a relative monetary policy outlook that continues to favor higher US yields vs. Canadian yields. Support today lies at 1.2810-20. Resistance at 1.2870-80, then 1.2920s. EURCAD and GBPCAD could be a bit of a drag on USDCAD to start the week. Hearing talk today of a 500mln+ option expiry today at 1.2900.

-

AUDUSD: Aussie traders hung in there on Friday post the US payrolls data, and they continue keep AUDUSD steady to start the week. It’s going to be a busy week for Australian data with four important data points, plus the RBA’s Lowe speaking on Wednesday. AUDUSD traders will also be watching the broader USD’s reaction to the FOMC on Wednesda and the Chinese data on Thursday. All eyes are on base metal prices too given recent correlations. Copper continues to consolidate recent losses. Technically speaking, the AUDUSD market is still in a downtrend. While the option barriers at 0.7500 continue to hold and the AU/US 2yr yield spread trades back above +5bp, we are still trading well below key resistance and there is not much support underneath the market should 0.7500 give way. Support today lies at 0.7505-0.7510. Resistance 0.7530s.

-

EURUSD: Euro/dollar is starting the week with a strong bid after closing Friday with a bullish inverted hammer on the charts. Futures traders liquidated over 11k contracts, suggesting short covering was theme post US payrolls. The key events of the week for EURUSD traders will be the US FOMC on Wednesday and the ECB on Thursday. A 25bp rate hike from the Fed is pretty much priced in and the market is not expecting any changes from the ECB and their dovish approach to tapering QE. While Friday’s close has improved technicals here short term, the market is running into some resistance now just under 1.18 (the lower bound of a trend-line extension). There is also another large option expiry at 1.18 today (over 1bln EUR). If we look at the crosses, EURGBP has had a nice turnaround and is looking stronger now after a couple rough weeks (thank Brexit disappointment for that). EURJPY flows have also been supportive in recent sessions. We continue to call EURUSD range-bound ahead of some key events this week, but would note the possibility of a “buy the rumour, sell the fact” scenario for the USD going into the FOMC as the 25bp hike is “baked in”, which would mean higher EURUSD prices. We would also note that the Sunday opening gap from last week (1.1880-1.1900) still remains unfilled.

-

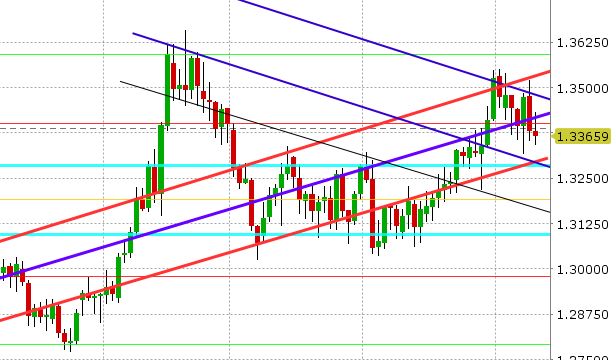

GBPUSD: It’s been a quiet start to the week for sterling for a change, as traders digest last week’s volatility and prepare for a heavy week of data and event risks ahead. We’ll get the UK jobs report and the US FOMC on Wednesday, and then a very heavy Thursday with UK Retail Sales, the BOE rate decision and the EU summit (which will likely give the market some more Brexit headlines). For the time being, the market’s in a bit of a range. We’re calling it 1.3330-1.3400. GBP cross flows ala EURGBP and GBPJPY, which were supportive last week, are now a negative influence near-term given technical reversals in those pairs on Thursday.

-

USDJPY: Dollar/yen starts the week in great technical shape. The fact that the market was able to clear back above the 113 so decisively in Thursday’s trade, and hold gains post US payrolls on Friday, is a very positive development. US stocks, US yields and a general “risk-on” theme to equities globally continues to underpin USDJPY. It will be a big week for USDJPY traders this week as well with a speech from the BOJ’s Kuroda and the US FOMC on Wednesday. Support today lies at 113.00-113.10. Resistance 113.70s. It will be interesting to see how the net USD long (net JPY short) position looks when it’s reported by CFTC again on Friday, but it appears the market is looking much more comfortable again given recent gains in USDJPY.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.