USD on the backfoot again following weaker the expected US wage growth. Theresa May and GBP survive Friday's key Brexit meeting. EURUSD and AUDUSD breaking out.

Summary

-

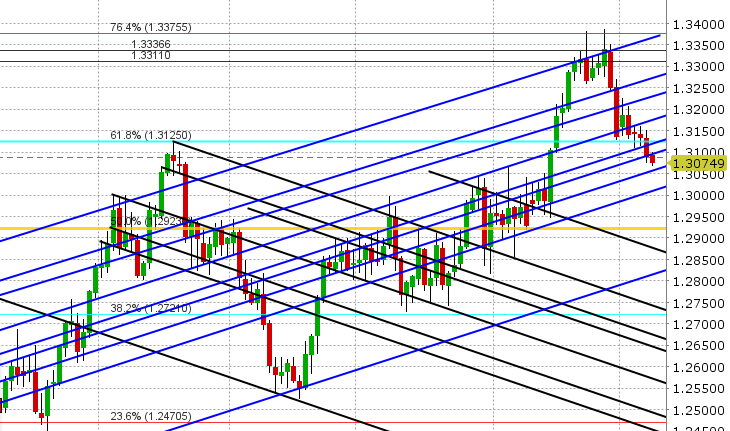

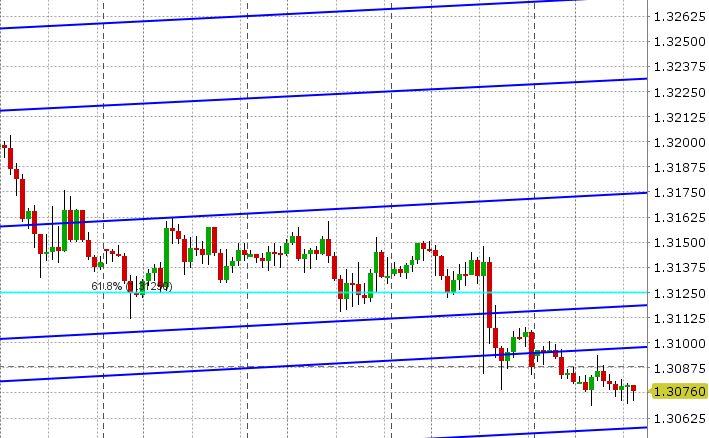

USDCAD: Dollar/CAD is starting the week with a soft tone, after mixed US/Canada employment data and a rally in crude oil prices on Friday saw prices close right below trend-line support in the 1.3090s. USDCNH weakness and a broad “risk-on” tone to markets this morning is helping to keep the USD offered across the board and we’re seeing a extension of the some of the bullish chart patterns we noted in EURUSD and AUDUSD last week. All this is keeping USDCAD heavy as we head into a big week, which will feature the Bank of Canada’s latest decision on interest rates on Wednesday and US CPI in Thursday. Markets are still pricing in 80%+ odds of a 25bp hike this week, following an upbeat Business Outlook Survey (reported June 29) and reasonably good Canadian June employment growth reported on Friday. The next support levels in USDCAD are 1.3050, then 1.3015.

-

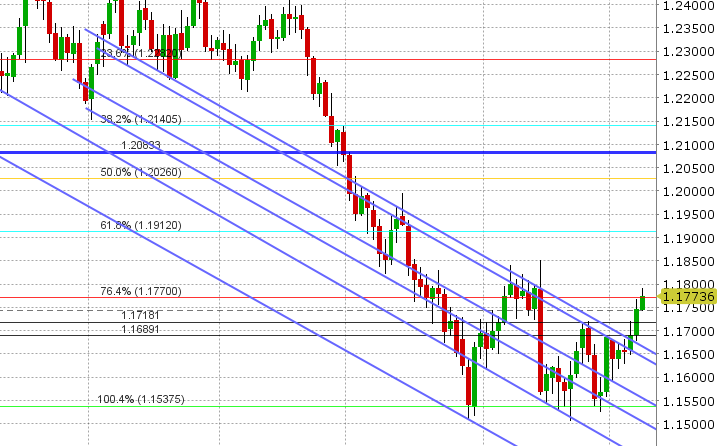

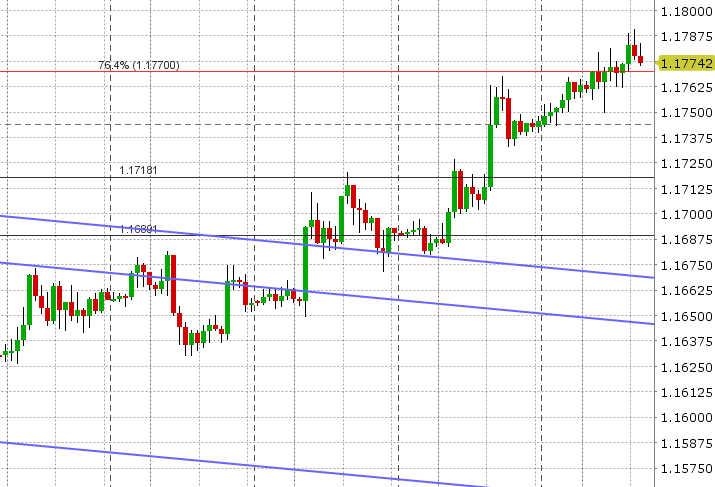

EURUSD: Euro/dollar is extending gains this morning following Friday’s weak US wage data and breakout higher on the charts above 1.1720. Given the lack of meaningful technical resistance above 1.1720 (something we noted last week), it’s not surprising to now see EURUSD closer to the 1.18 handle. The market is currently digesting some mixed comments from the ECB’s Nowotny (who continues to speak), but he’s not saying anything particularly different from the ECB party line. Mario Draghi is up next, with two speeches this morning (one at 9am and another at 11am). Tomorrow sees the German ZEW survey and Thursday features the ECB meetings from the last policy meeting. With Friday’s key technical breakout higher on the charts and the lack of scheduled economic releases this week to keep traders at bay, we think EURUSD could rally even further, but we would not be surprised to see some consolidation around the 1.1770s Fibo level near term. Next key resistance levels are 1.1840-50, then 1.1910.

-

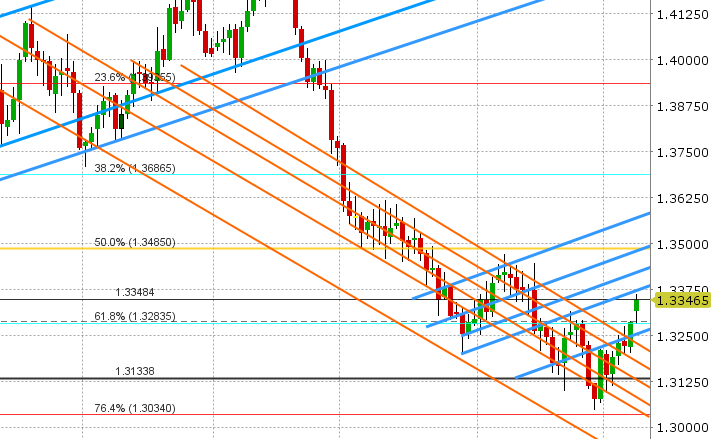

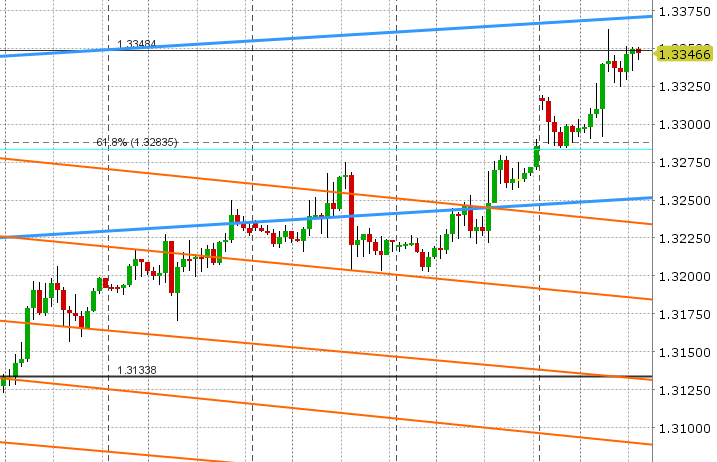

GBPUSD: Sterling continues its rally today as well, following a successful outcome for Theresa May’s key Brexit cabinet meeting at Chequers late Friday. The surprise resignation of chief Brexit negotiator David Davis last night knocked GBPUSD lower after the gap higher on the Sunday open, but conciliatory remarks from the minister this morning and calming comments from pro-Brexit lawmaker Ress-Mogg about no-confidence vote rumors have squashed worries about Theresa May’s future for the time being. The extension of Friday’s EURUSD rally is also helping GBPUSD this morning and with that sterling is now 50pts higher testing the next chart resistance level in 1.3350 area. Tomorrow features some key UK data that will likely play into the BoE rate hike decision this August: Industrial Production, Trade Balance and May GDP. Then we’ll have BoE Governor Mark Carney speaking at an event in Boston on Wednesday. With Friday’s technical breakout higher above the 1.3250s, we see scope for further gains in GBPUSD, but these gains may stall near term at trend-line resistance in the 1.3370s.

-

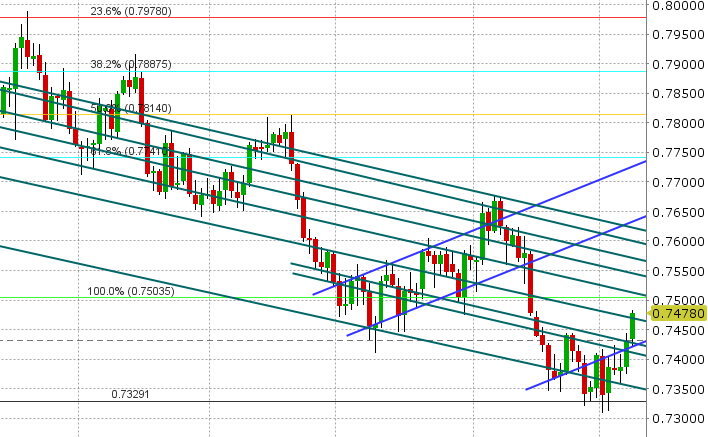

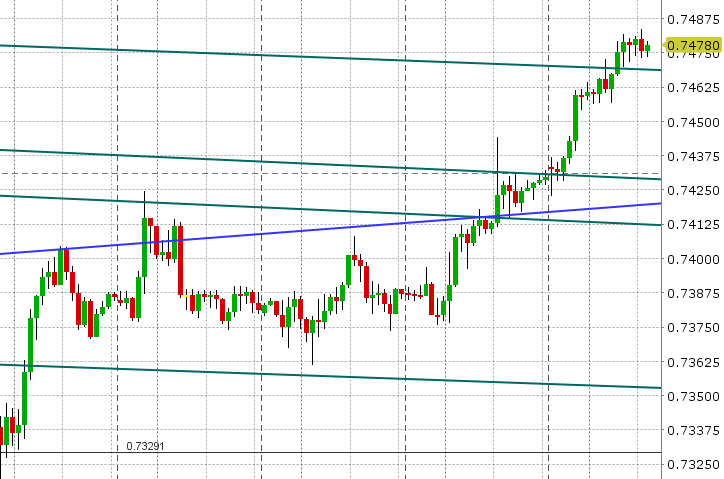

AUDUSD: The Aussie rallied above the key 0.7420 level after the mixed US jobs report on Friday, and this has paved the way for a rip higher today in AUDUSD. USDCNH weakness and a broad “risk-on” tone to markets this morning is certainly helping the underlying tone, as is a bounce in copper prices. This week’s Australian calendar features some 2nd tier data points: NAB Survey tomorrow, Westpac Consumer Confidence on Wednesday and a read on consumer inflation expectations for Thursday. With AUDUSD now trading above trend-line resistance in the 0.7460s, we think there is scope for gains to extend to the 75 handle (perhaps after a brief pullback).

-

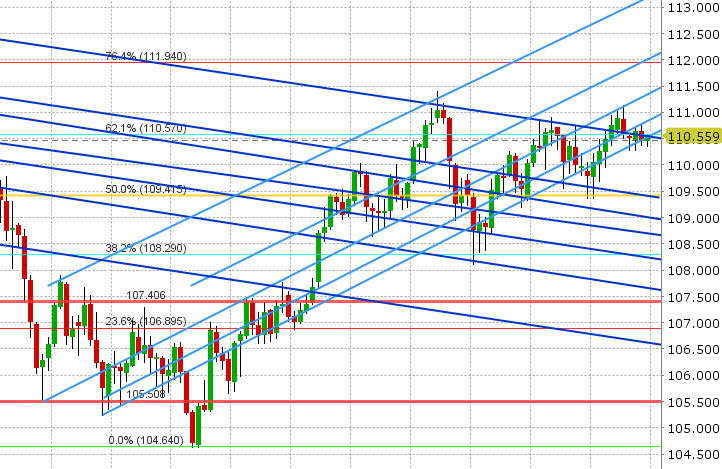

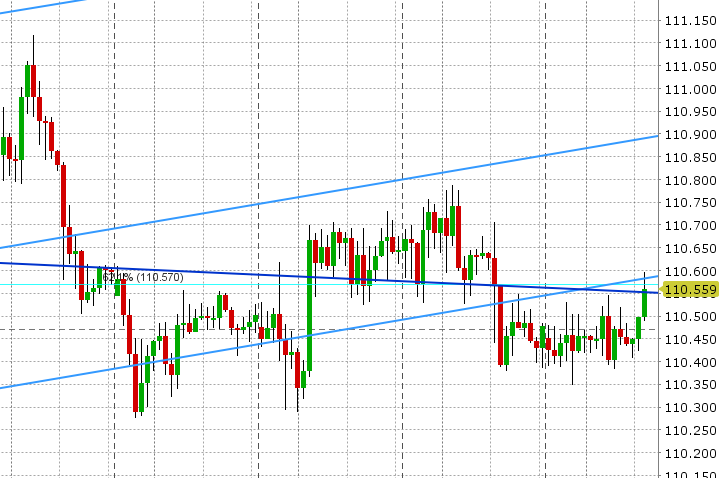

USDJPY:The consolidation in USDJPY continues, and while Friday’s broad USD weakness following the US jobs report took the market below support in the 110.50s, there was very little follow through. The “risk-on” tone to markets this morning and the uptick in US yields today is helping to stem further losses as the USD broadly falls again today. We think USDJPY takes another shot a breaking out to the upside today, but the 110.50s have to give way. Should that level break, we could see the 111s in short order and then a more meaningful follow through higher from the 3-month bullish, triangular, consolidation we mentioned last week.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.