USD longs starting to look vulnerable ahead of Jackson Hole

Summary

-

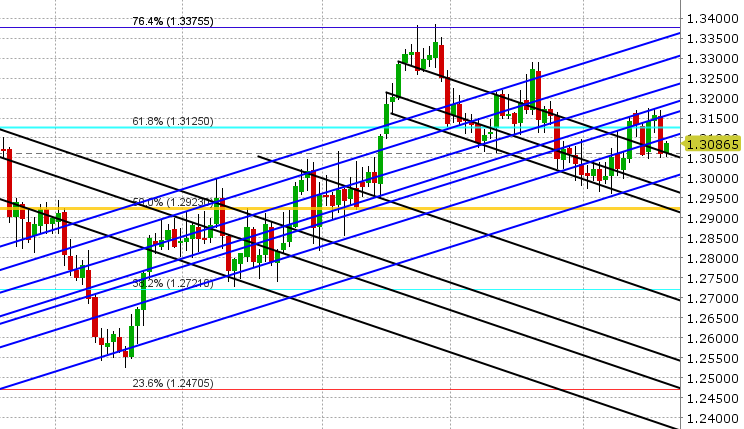

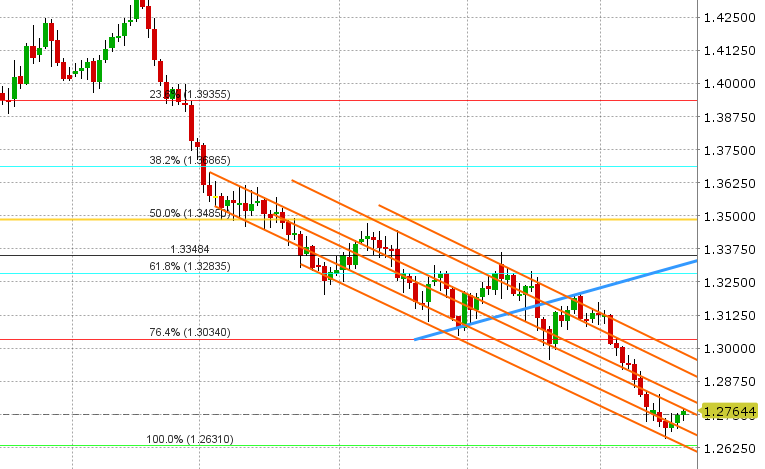

USDCAD: Dollar/CAD is starting the week with a steady tone after Friday’s hot Canadian CPI reading spurred speculation of another 25bp rate hike from the Bank of Canada this fall. OIS swaps for September moved to 30% odds for a hike while October up-ticked to 80%. The US/Canada 2yr bond yield spread contracted to +50bp. USDCAD lost all its upward momentum from mid-week last week and fell swiftly into downward sloping chart support at 1.3070. We traded below this level into the NY on Friday (which was bearish), but we have regained it in European trading so far today, which is contributing to the steady tone at this hour. The broader USD is trading with a quiet, mixed tone so far today, with all eyes on Turkey and emerging markets as expected. Today’s calendar is light, with the only notables feature being a speech from BoC Deputy Governor Wilkens at 9:15amET and a speech from the Fed’s Bostic at 11amET. Later this week we’ll get Canadian June Retail Sales, FOMC Minutes and the annual Jackson Hole Symposium (Wed), Markit PMIs (Thursday), and US July Durable Goods (Friday). The net long USDCAD (CAD short) fund position grew slightly during the week ending Aug 14th as shorts liquidated and longs added. We think USDCAD could drift higher today into chart resistance at 1.3105, but we would not be surprised to see sellers re-emerge at that point.

-

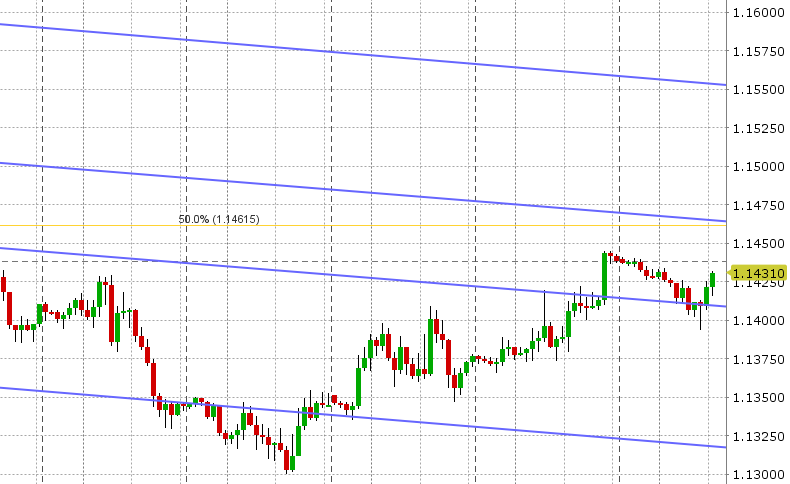

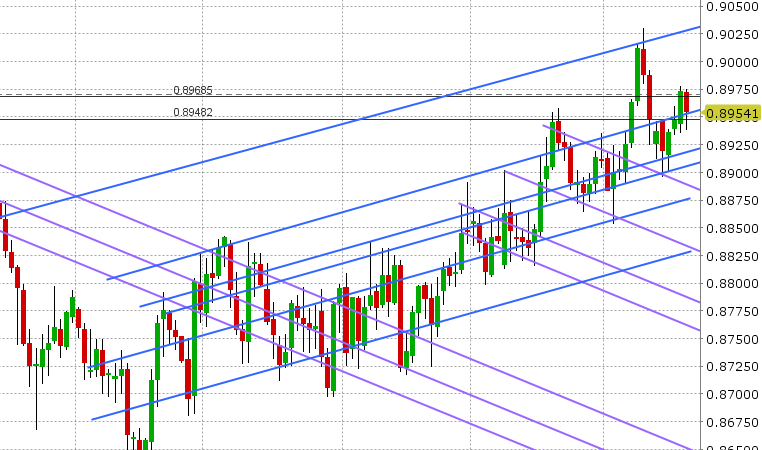

EURUSD: Euro/dollar has seen a little bit of selling to start the week, after Friday’s late breakout higher above trend-line resistance in the 1.1410s, but traders have been quick to buy-the-dip back to this level. USDTRY, USDCNH and the BTP/Bund spread are all trading rangebound and the news flow over the weekend and into this week has been light, so there hasn’t been a whole lot for traders to chew on. One thing that is making the rounds however is Friday’s COT report from the CFTC, which shows the fund position going net short EURUSD for the first time since May 2017 (just as the market bottomed out in the low 1.13s). We think this may be fuel for the EUR to turn higher here as it draws attention to an overcrowded short trade. Today’s calendar is light, with the above mentioned speech from the Fed’s Bostic and a speech from Bundesbank President Weidmann (12pm). Later this week the focus will turn to the FOMC Minutes and Fed Chairman Powell’s comments from the annual Jackson Hole Symposium. We’ll also get the German and Eurozone Markit PMIs (Thursday) and German Q2 GDP (Friday).

-

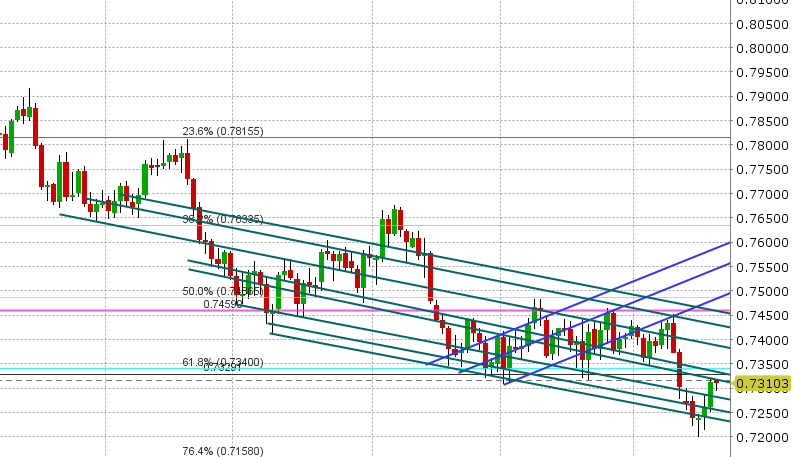

GBPUSD: Sterling is mildly bid this morning on not much news. EURGBP seems to be the only driver, with the cross giving back the 0.8970 level it achieved in late NY trading on Friday. Major Brexit headlines have been lacking, but negotiations between the UK and EU resume this week. Open interest shot up big time in GBP futures during the week ending Aug 14th, as both longs and shorts added on the move to the low 1.27s, leaving the net short fund position marginally higher than it was the week before. Similar to EURUSD, we think this development draws further attention to an overcrowded short trade, and may prompt some short covering this week. The next near term resistance test is the 1.2780s.

-

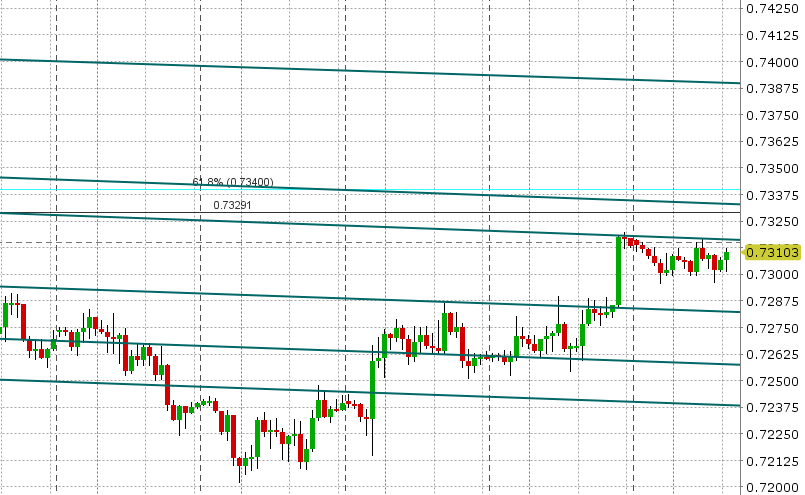

AUDUSD:The Aussie is trading very quietly to start the week, hovering just below trend-line resistance in the 0.7310s. Friday afternoon’s break above resistance in the 0.7280s (on the positive US/China trade headlines) was technically positive. More here: https://www.wsj.com/articles/u-s-china-plot-road-map-to-resolve-trade-dispute-by-november-1534528756?mod=hp_lead_pos1. Copper prices participated in that break higher as well, and lead again today (+1.6%). The RBA’s Lowe is speaking again tonight (6pmET), but traders are not expecting anything notable as usual. We’ll also get the RBA Minutes from their last meeting at 9:30pmET.

-

USDJPY: Dollar/yen is hovering around the 110.50 level to start the week, as Friday’s late bout of optimism on US/China trade relations spurred a rally in US equities to close out the week. These “risk-on” flows arrested the downward momentum we’ve seen in USDJPY since Aug 15th, but the bounce has been mild and sellers are starting to remerge again now as NY trading gets underway. The funds marginally trimmed longs and added to shorts during the week ending Aug 14th, but the net fund long position is still quite elevated and looking vulnerable here in our opinion. The short fund positioning in US 10-yr notes (record) and gold futures (shortest since 2001) is also looking overcrowded, which doesn’t help the USDJPY bull thesis in our opinion should these positions begin to unwind.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

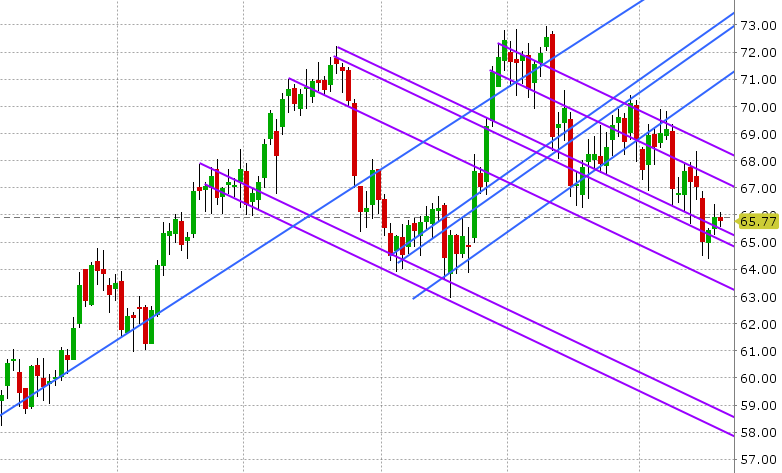

September Crude Oil Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

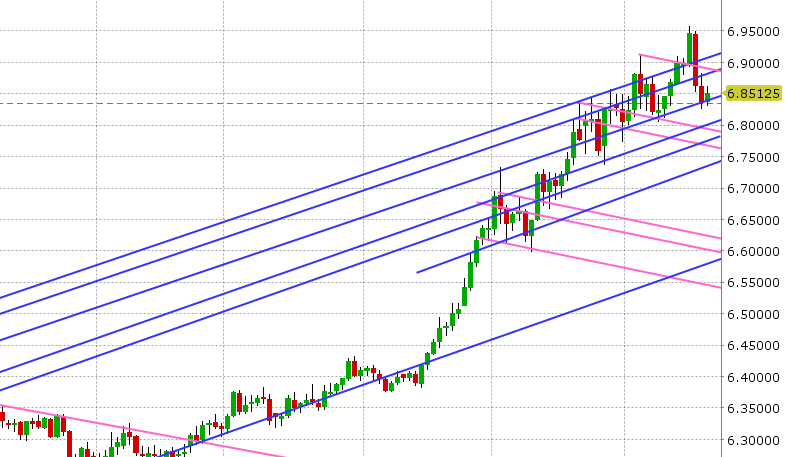

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

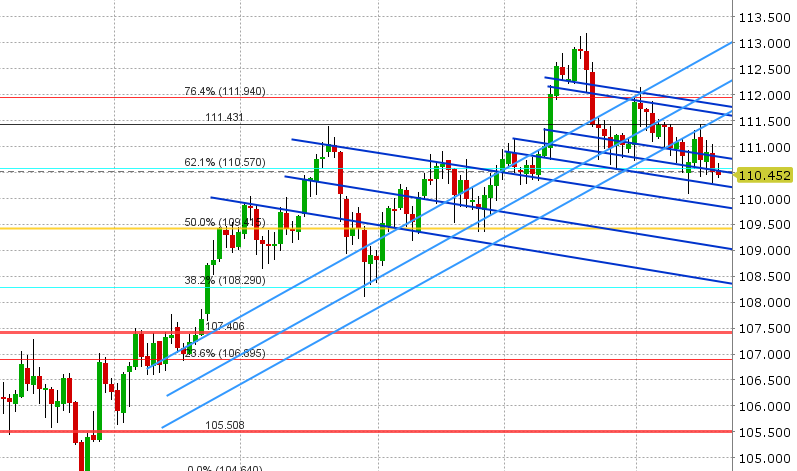

USD/JPY Daily Chart

USD/JPY Hourly Chart

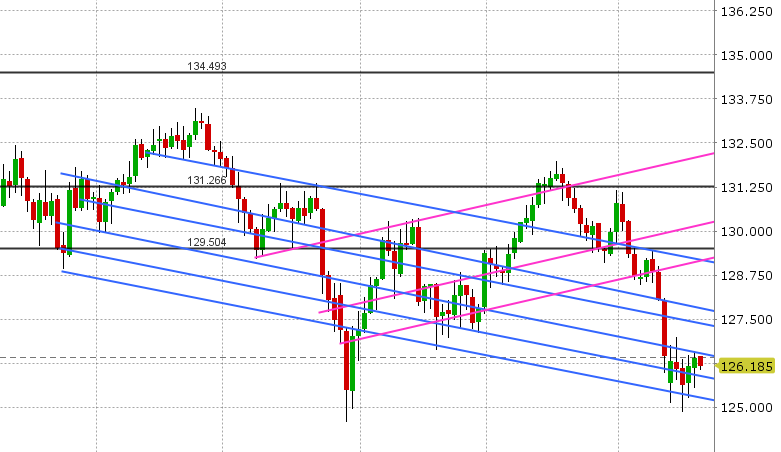

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.