USD finding bids again to start holiday week

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Traders shrug off negative COVID headlines from the weekend as usual.

- Weaker USDCNY fix + topside EURUSD expiry adds to USD weakness overnight.

- Risk tone takes negative turn at NY open though, now sees USD broadly higher.

- RBA’s Debelle + Chinese PMI on deck tonight. Powell speaks tomorrow.

- US ISM/ADP reports + FOMC Minutes for Wed while Canada closed for holiday.

- US Non-Farm Payrolls features for Thursday. US markets closed on July 3.

ANALYSIS

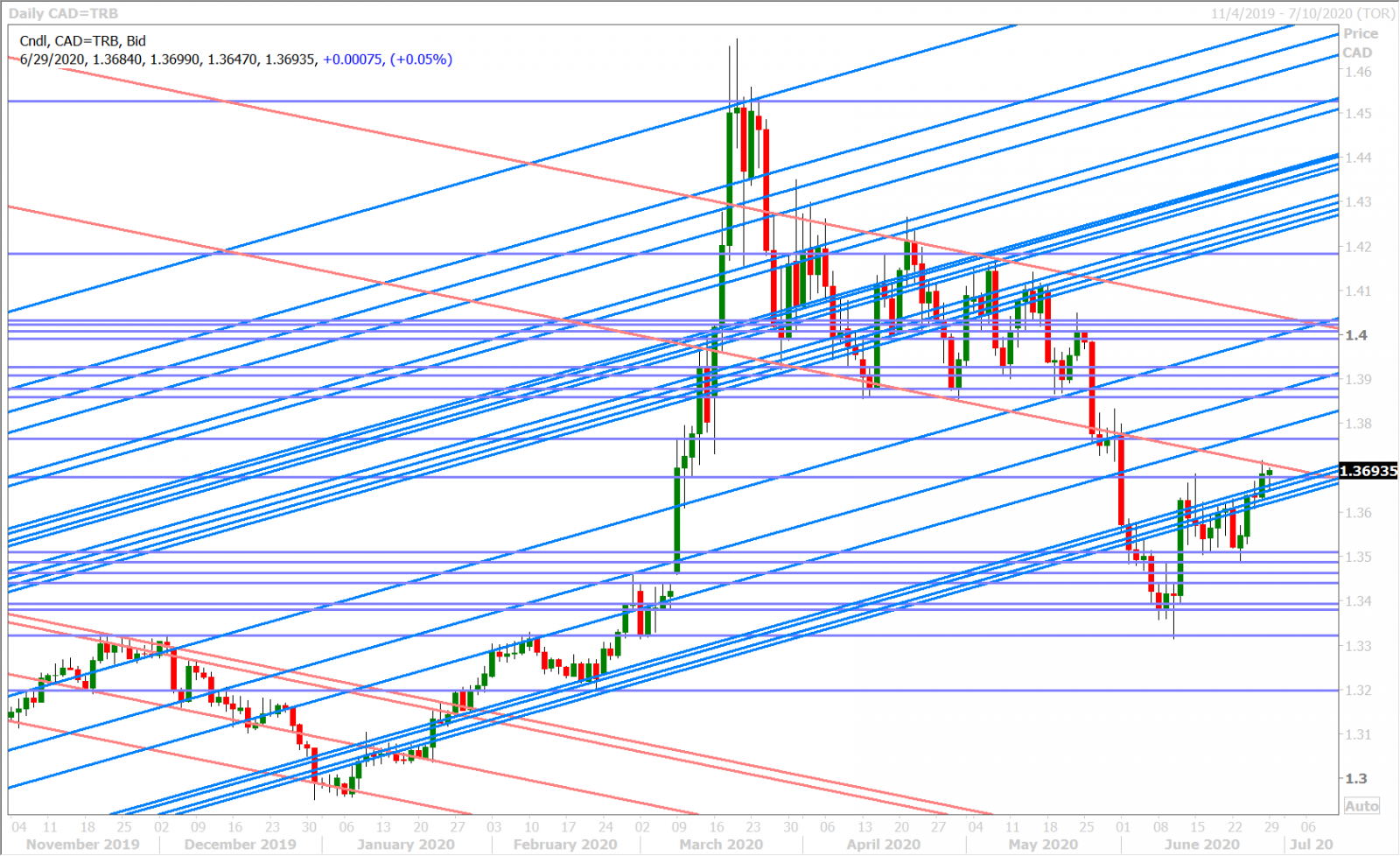

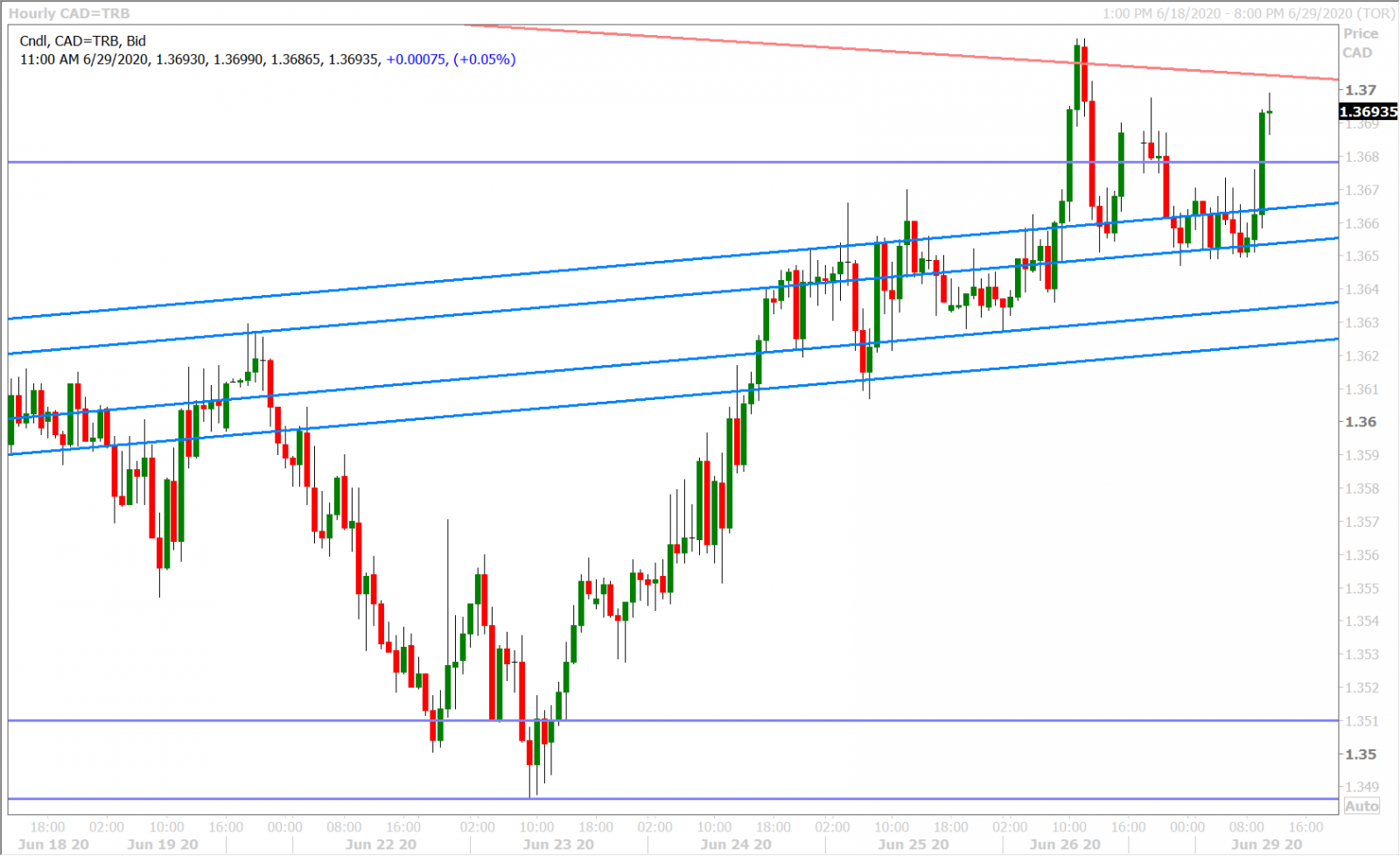

USDCAD

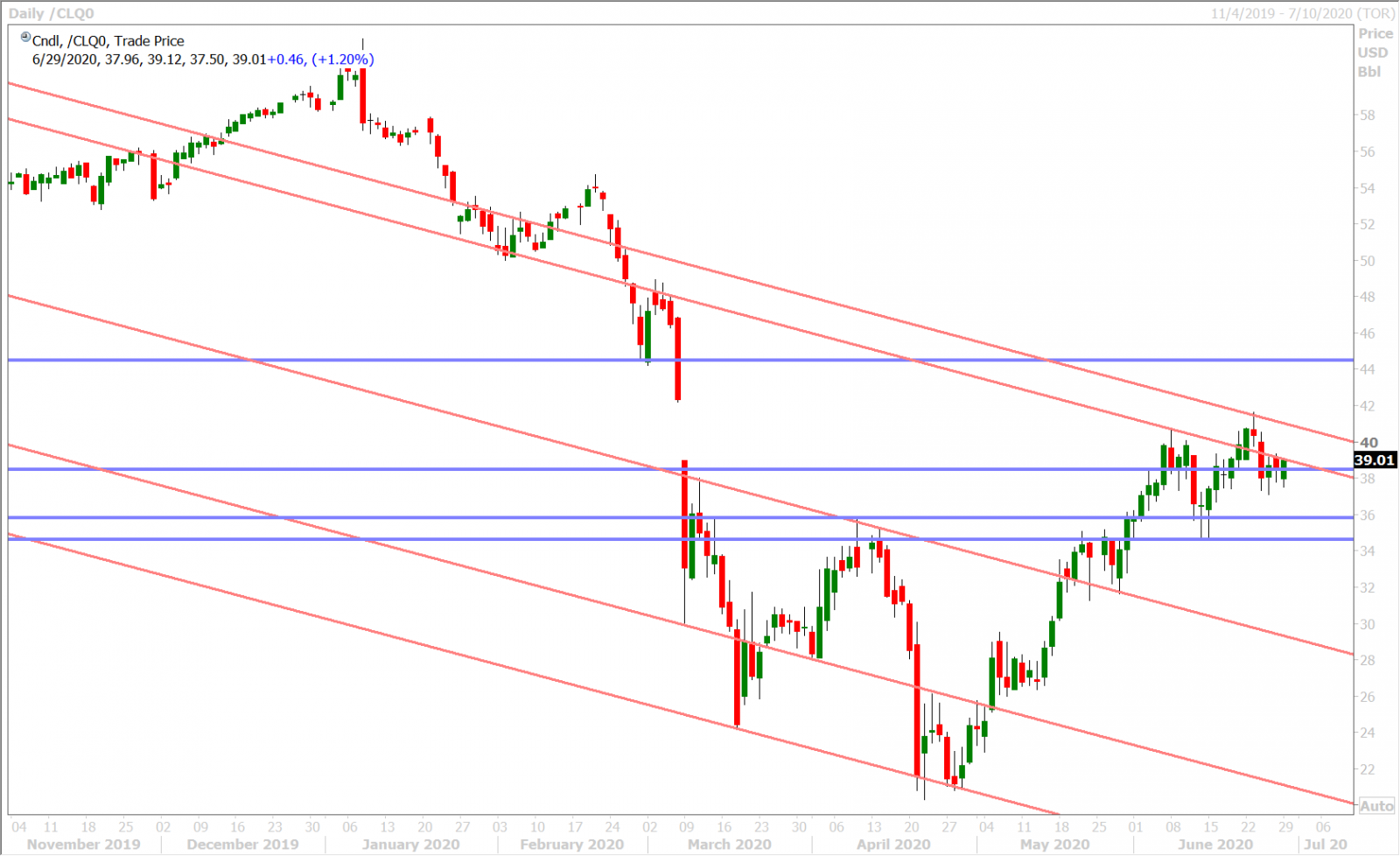

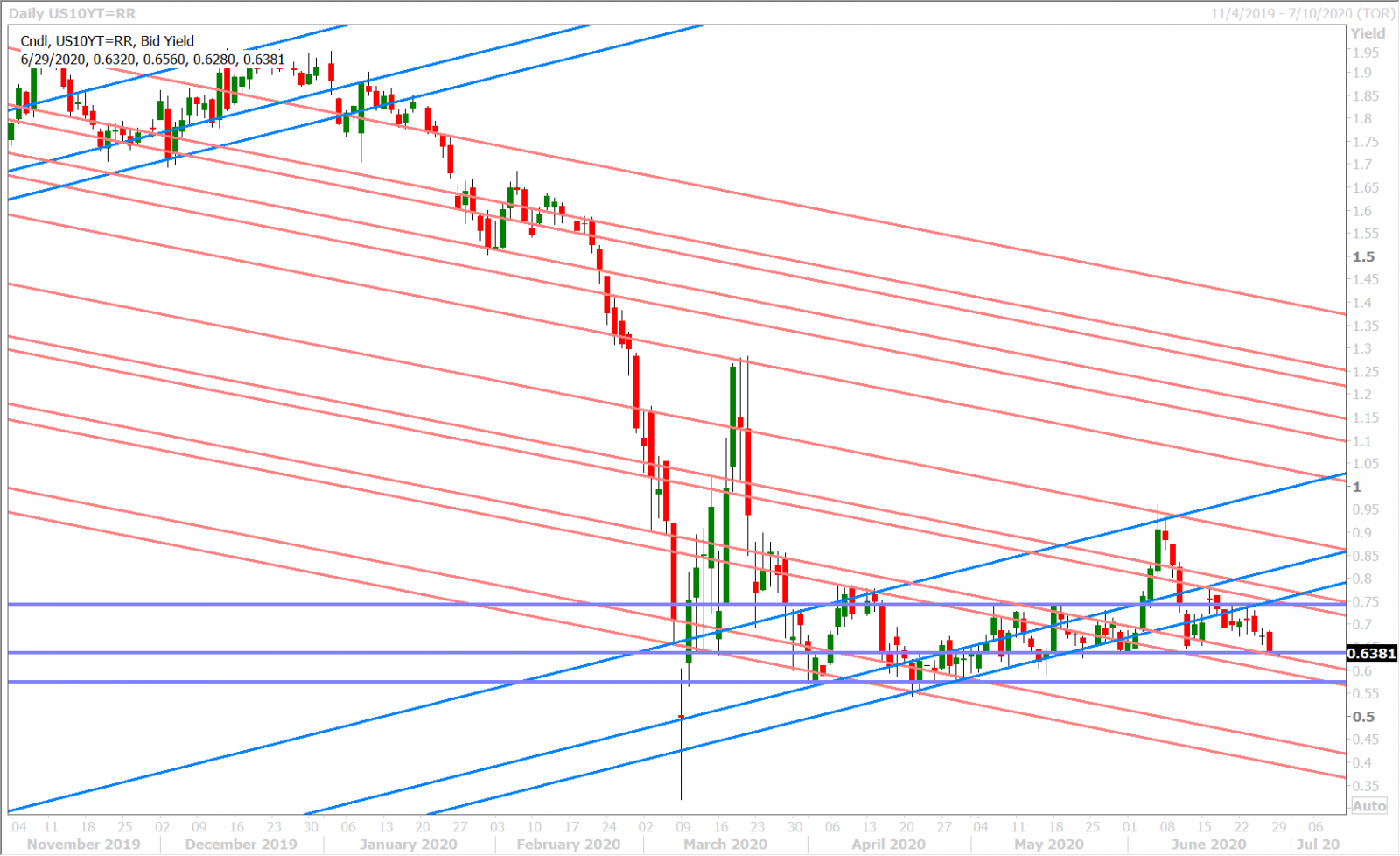

The US coronavirus statistics worsened over the weekend; prompting California to follow in the footsteps of Texas and Florida to re-close bars, but traders ultimately faded this negativity yet again in Asian trade last night. The S&P futures, August WTI oil prices, and US 10yr yields are now all trading higher vis a vis their Sunday opening levels and the broader USD is trading lower to reflect this mild “risk-on” mood, albeit with some help from option expiry related EURUSD buying in our opinion. Dollar/CAD tested its daily downtrend at the 1.3710s resistance level during Friday’s rally, but the market eventually fell back lower as negative rate bets showed up 2021 Fed Funds curve once again and dragged the broader USD lower.

We think FX traders will be focused on the bond market’s new NIRP bets to start the week as this was a USD negative for a short time during the month of May. Month end/quarter-end/half-year end rebalancing flows, at today and tomorrow’s London fixes (11amET), should add an unpredictable wrinkle to FX price action however. This week’s economic/central bank-speak calendar will be cramped into four business days because of Friday’s US market closure for the Independence Day holiday. A speech from the Fed’s Powell (tomorrow), the US ISM Manufacturing/ADP reports, the FOMC Minutes (Wednesday), and the Non-Farm Payrolls report (Thursday) are the key features. China’s official Manufacturing PMI for June is out tonight around 9pmET (exp 50.4). Canada’s Q2 GDP number is expected to be bad (-13%) when it’s announced tomorrow. Canadian markets will be closed on Wednesday for the Canada Day holiday.

The latest Commitment of Traders report showed the leveraged funds trimming their net long USDCAD position to a 13-week low during the week ending June 23 as shorts were added and longs were liquidated. This felt like traders giving up a little bit as the week in question was marred by a directionless range, but we think the USDCAD longs now have the slight upper hand by virtue of last Wednesday’s push above 1.3600 and Thursday's defense of that level. A strong NY close above the 1.3710s would arrest the market’s downtrend which commenced on May 26.

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

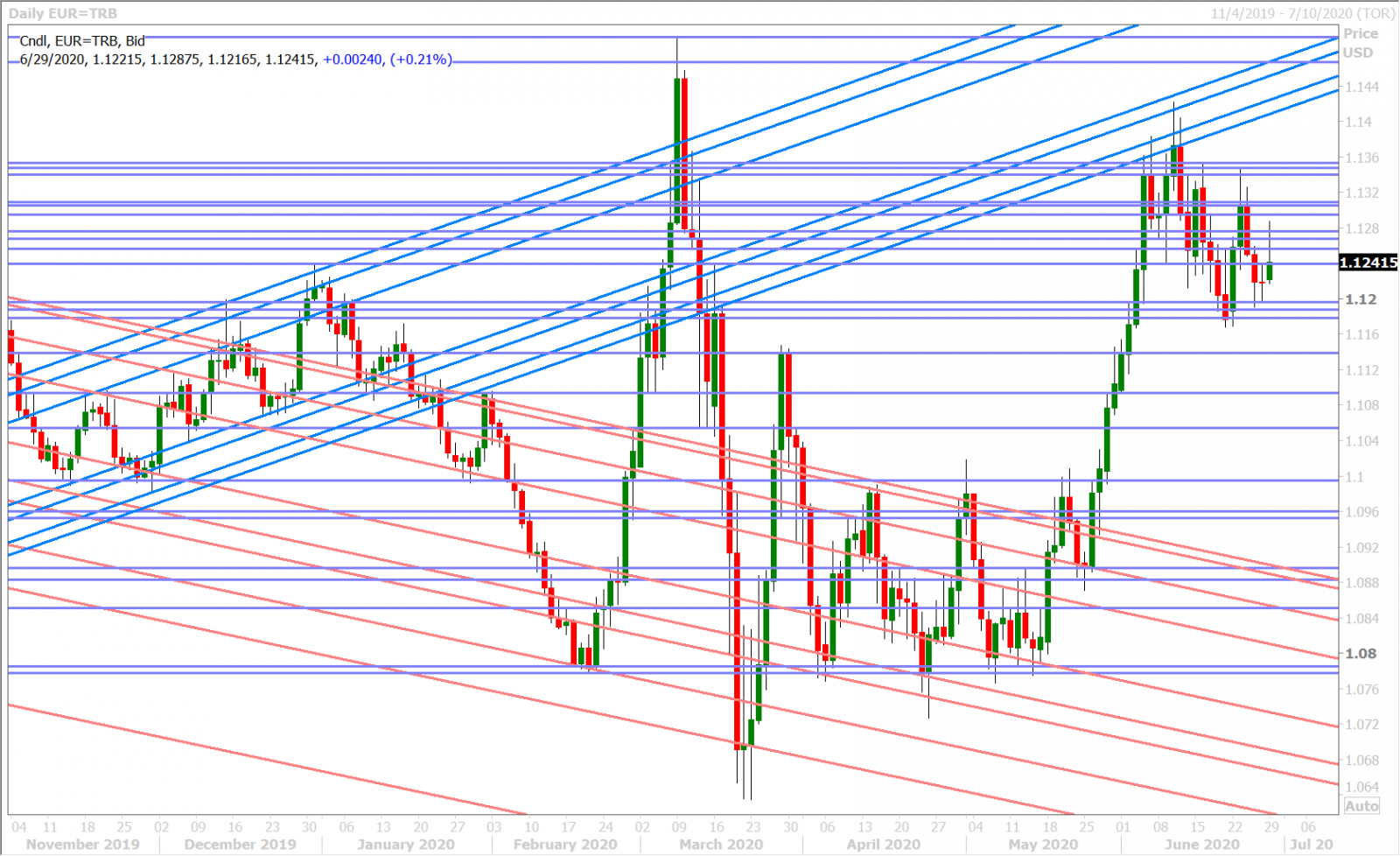

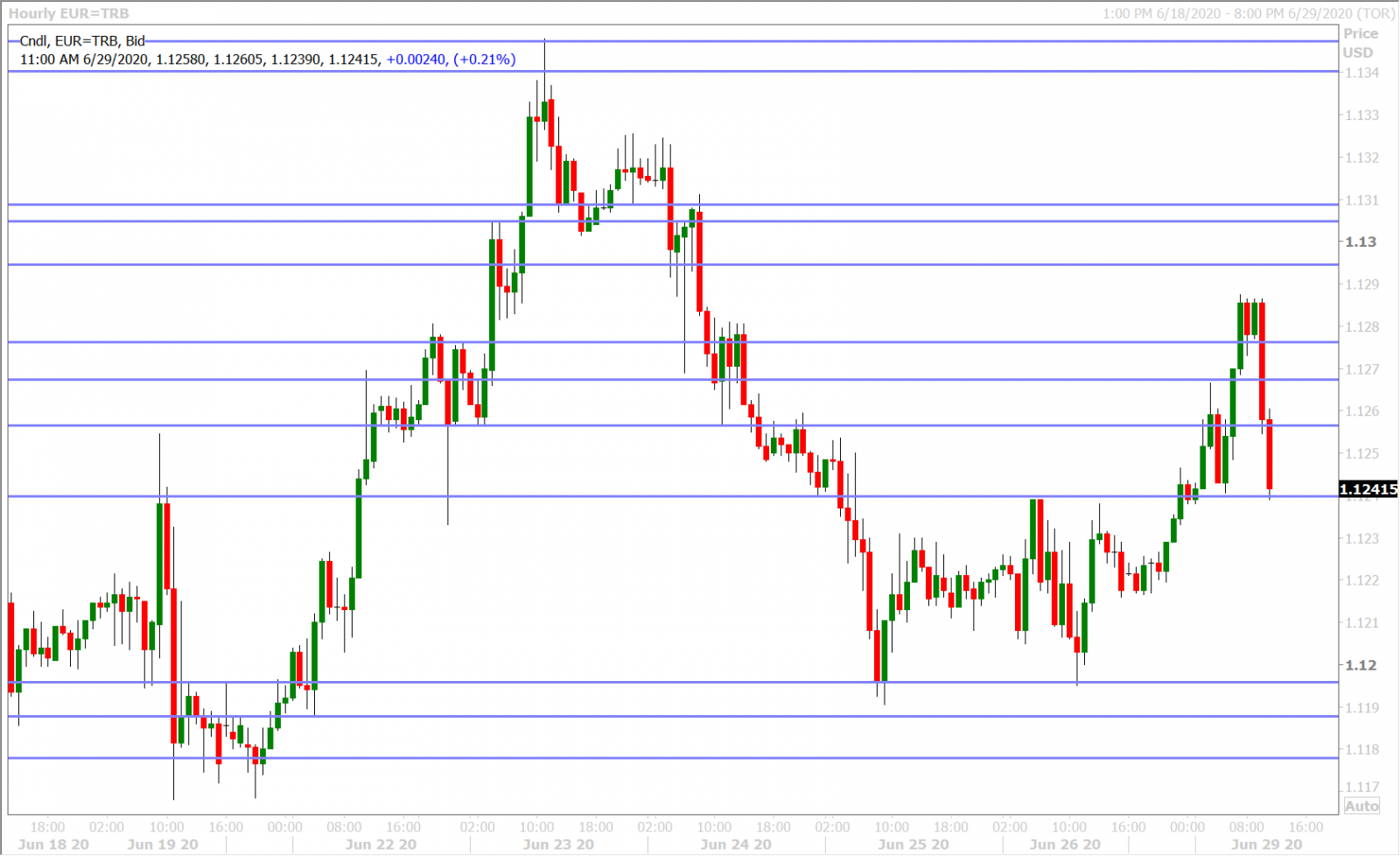

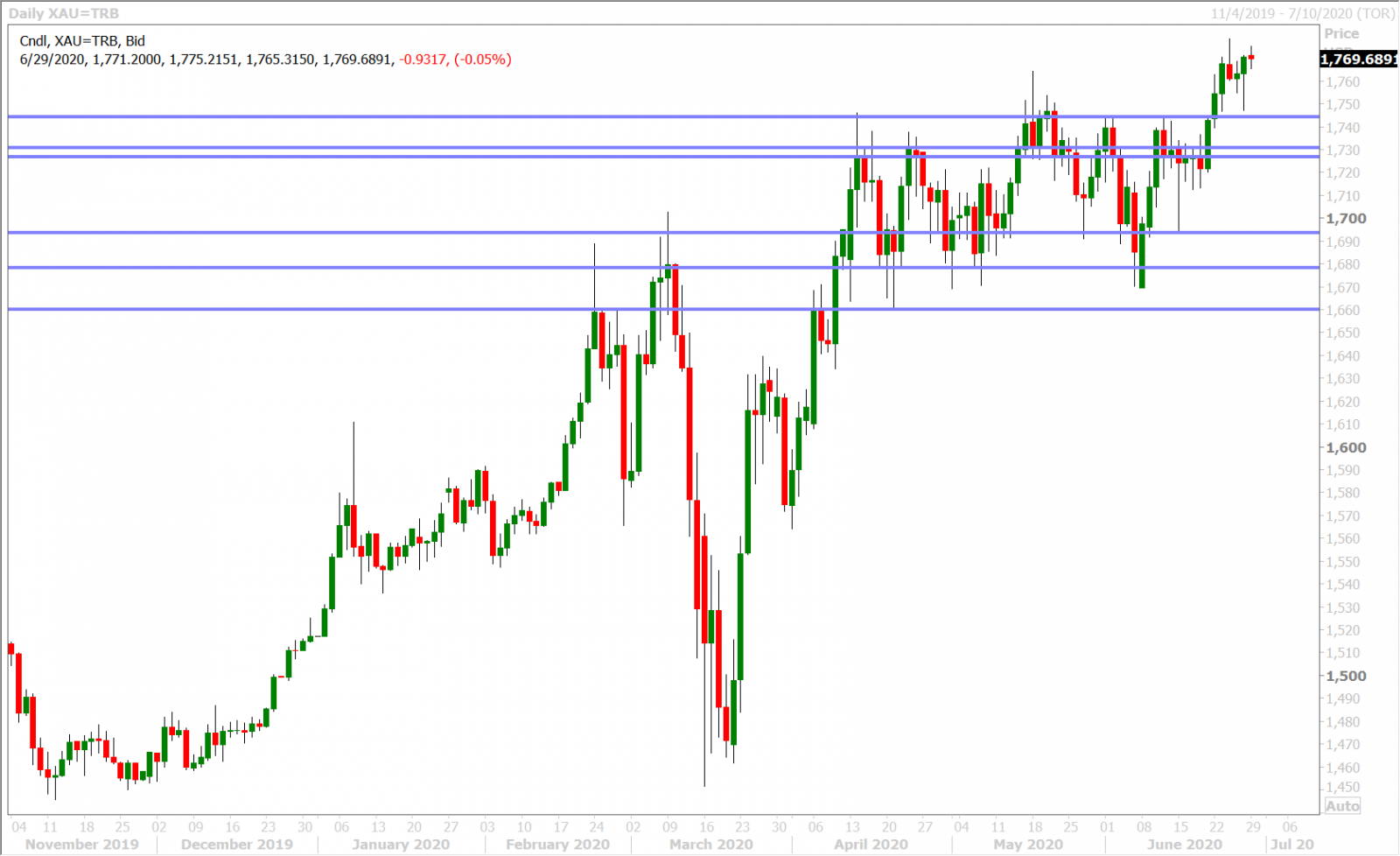

EURUSD

Euro/dollar led the G7 FX space higher this morning, but the move honestly felt option driven as opposed to “risk-on” related given the large 1blnEUR expiry at the 1.1270 strike at 10amET. Friday’s mid-day fall in US rates helped the market bounce off familiar chart support in the 1.1190s and today’s move through the 1.1240s now puts resistance at the 1.1290-1.1310 zone back in focus.

This week’s European calendar features German data (May Retail Sales and June Employment) and the final pan-European PMIs for June (Manufacturing on Wednesday and Services on Friday). Germany’s Angela Merkel and France’s Emmanuel Macron are expected to hold a joint press conference this morning following talks today on the EU recovery fund.

The latest Commitment of Traders report showed the leveraged funds adding ever so slightly to their net long EURUSD position during the week ending June 23; which made sense given the market’s volatile, non-directional, tone during that week, but we think that the overall size of their net long is looking increasingly over-extended in the context of recent price action. A lot needs to go right here, from an EU-recovery fund/risk sentiment perspective in order to see recent longs “get paid”.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

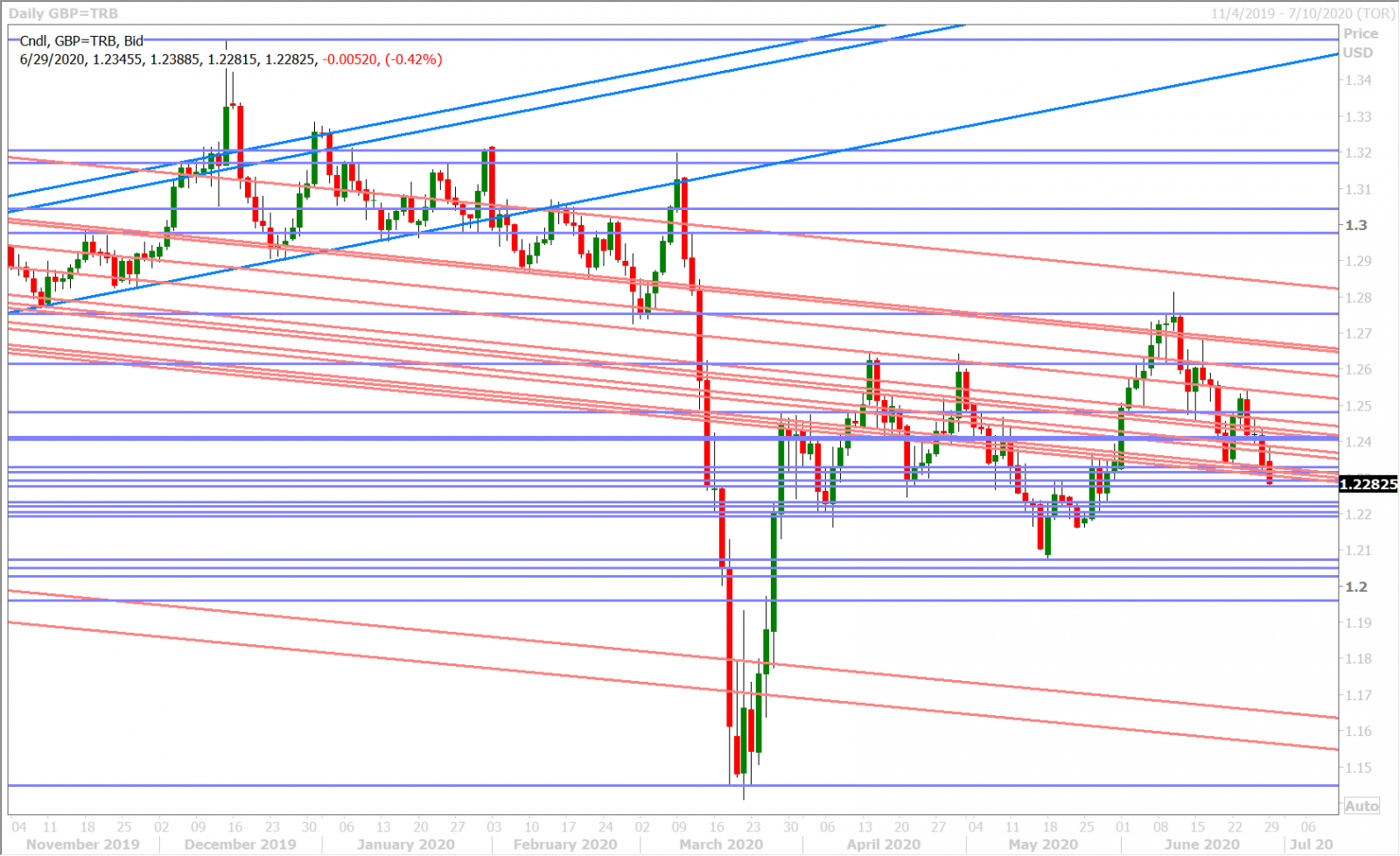

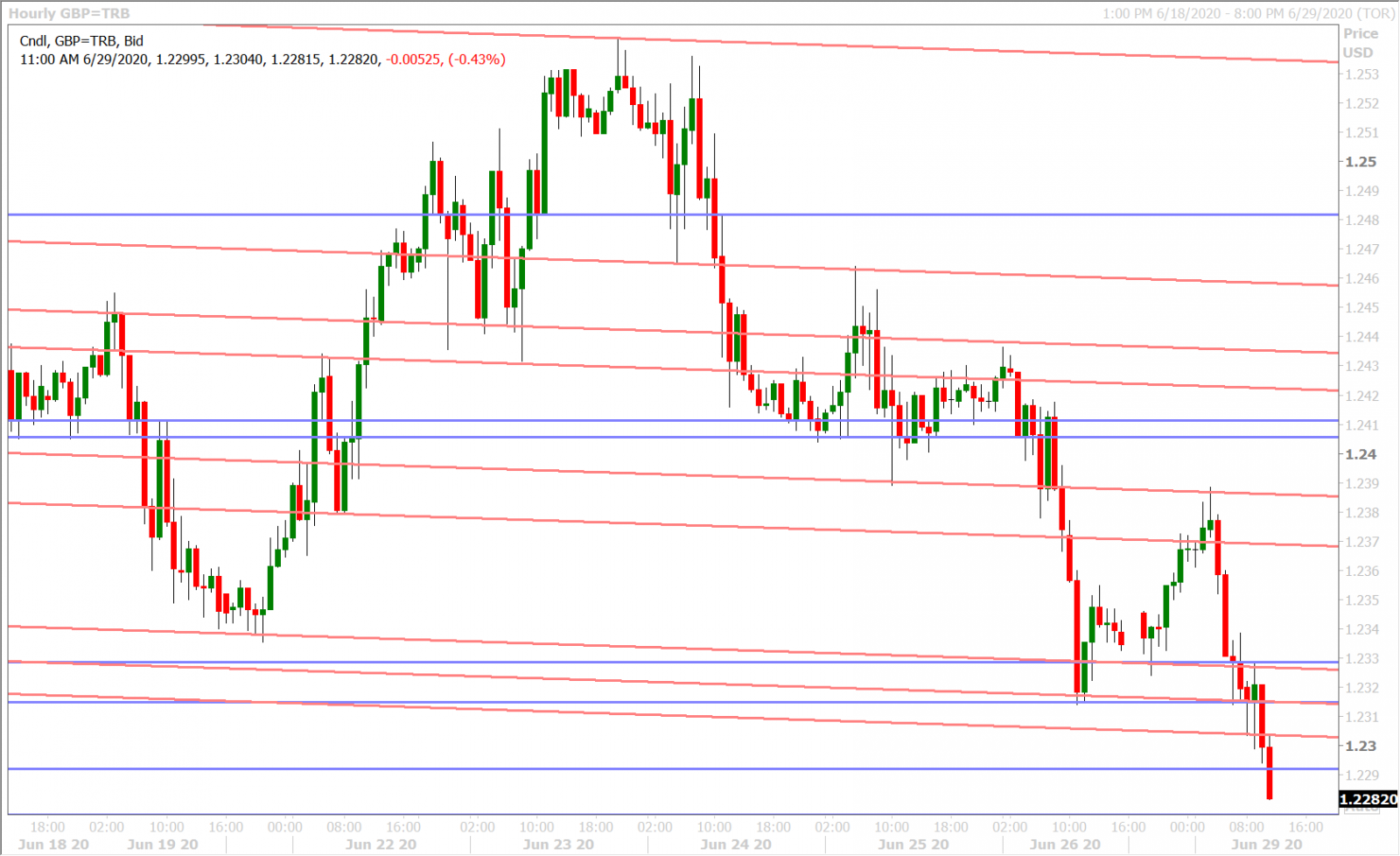

GBPUSD

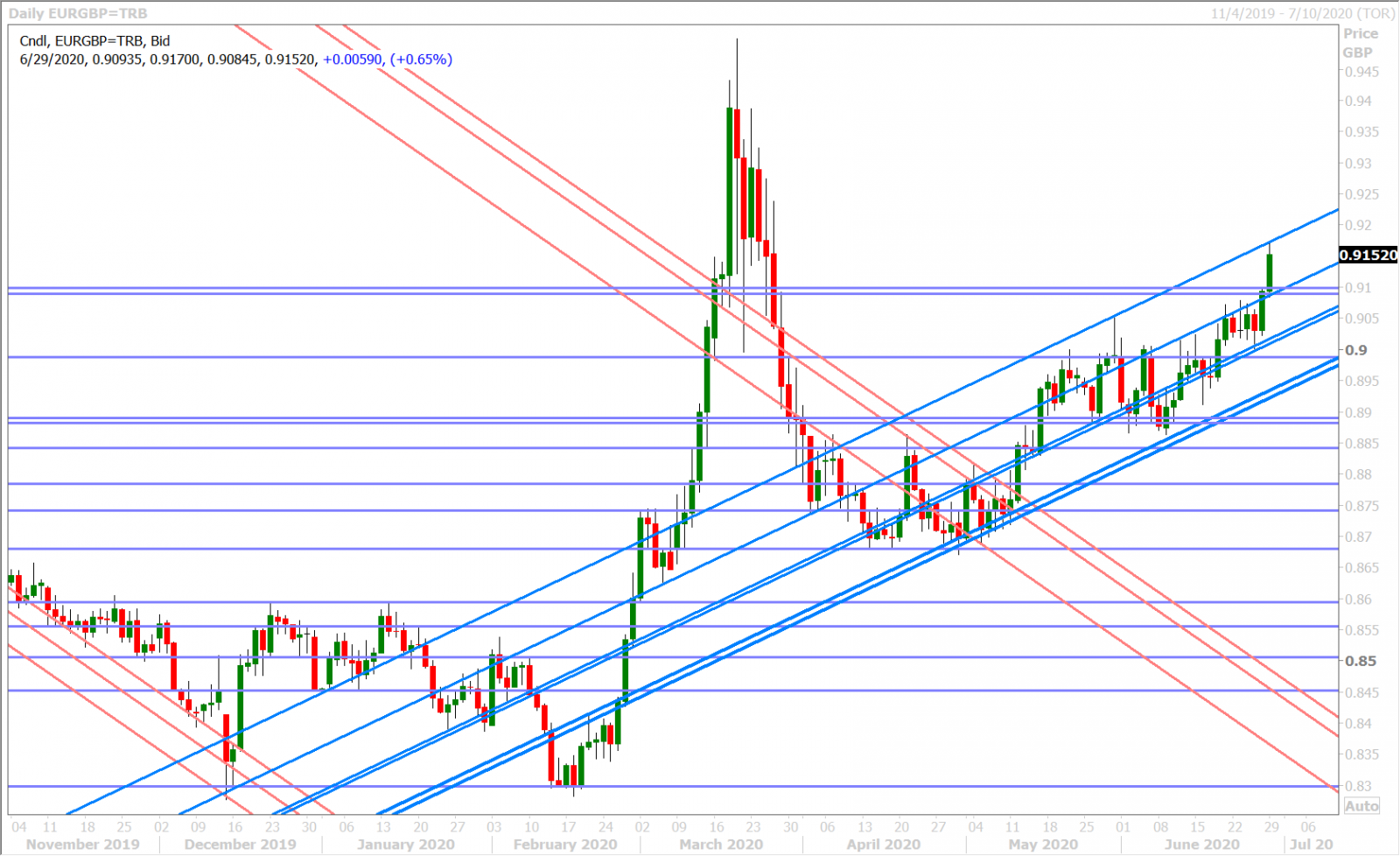

Sterling traders are not in a good mood today as EU/UK trade talks resume. PM Boris Johnson said that Britain will be ready to quit its transitional agreements with the EU “on Australia terms” if no deal on their future relationship is reached and, while this was technically weekend news that didn’t affect the market all that much at the Sunday open, traders appeared to pile on the negative Brexit bets this morning by rallying EURGBP strongly above the 0.9100 level.

This surge capped off GBPUSD at Friday’s support (turned resistance) in the 1.2370-80s during early European trade today and we’re now quickly staring at a market that wants to trade with a 1.22 handle. The BOE’s Bailey and Vlieghe didn’t say anything notable, from a monetary policy perspective, in their speeches this morning. The latest Commitment of Traders report showed the leveraged funds mildly adding to their net short GBPUSD position during the week ending June 23; which aligns with the “sell on strength” mentality we were expecting last Monday.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

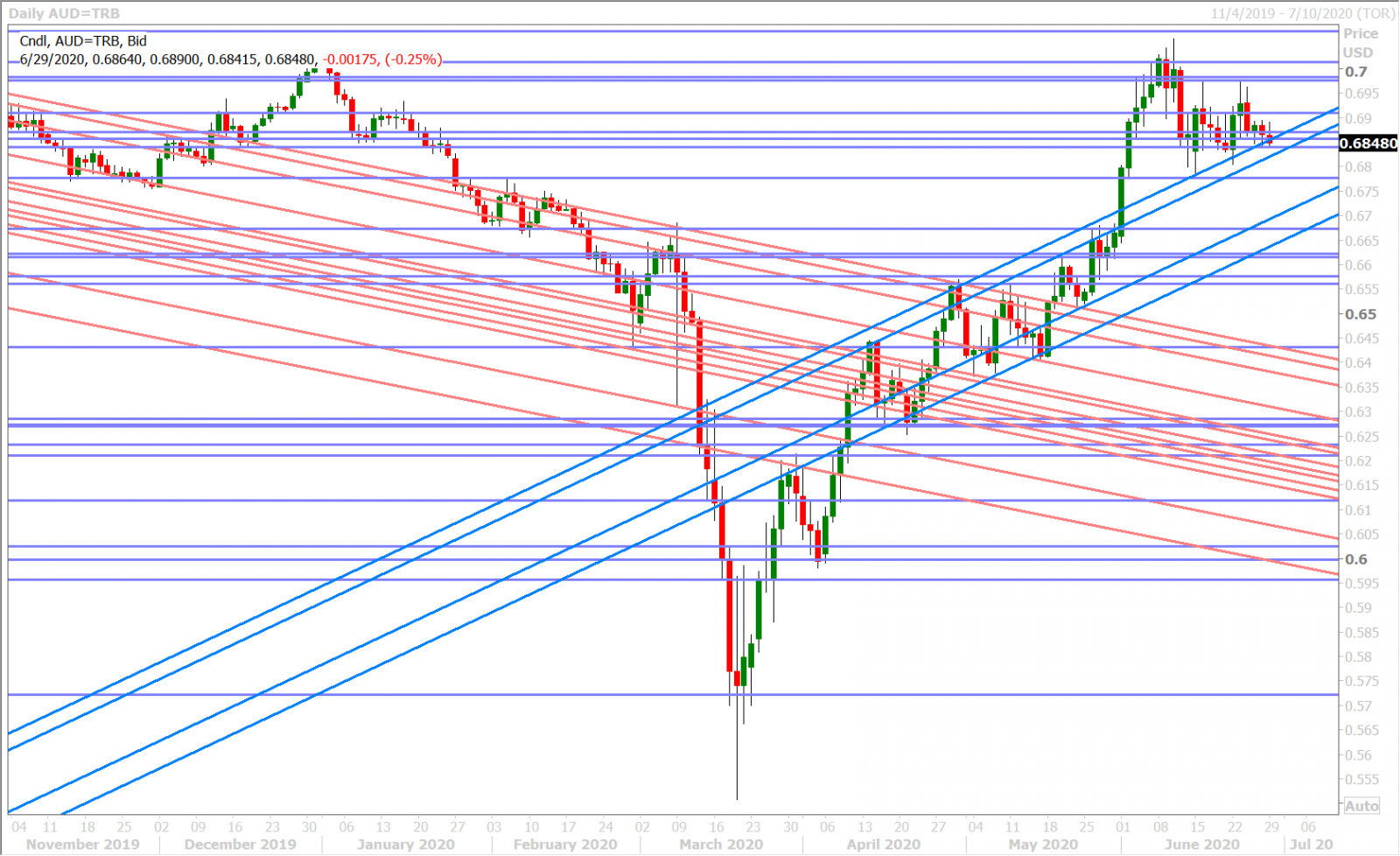

Last night’s lower than expected daily USDCNY fix (7.0808 vs 7.0830-80) seemed to help the Chinese yuan and broader risk sentiment recover from the Sunday opening lows, but the mood is now souring once again as the US stock market opens lower. The Australian dollar is trading back towards the top end of Friday’s support zone in the 0.6810-40 area, which should be a concern for recent longs as any further selling pressure here could put AUDUSD’s daily uptrend to the test.

Keep in mind that the RBA’s Guy Debelle speaks tonight at 10:30pmET and that two large option expiries feature around at the 0.6895-0.6900 strikes for tomorrow/Thursday, which may ultimately keep new short sellers at bay for the moment.

The latest Commitment of Traders report showed the leveraged funds reducing their net short AUDUSD to another 2-year low during the week ending June 23; which we think now confirms speculative money completely abandoning their bearish arguments. Problem is…the market has not rewarded this dramatic bullish shift in positioning, which has us wondering if the leveraged funds ill-timed this move and solidified a longer-term top AUDUSD in the process.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

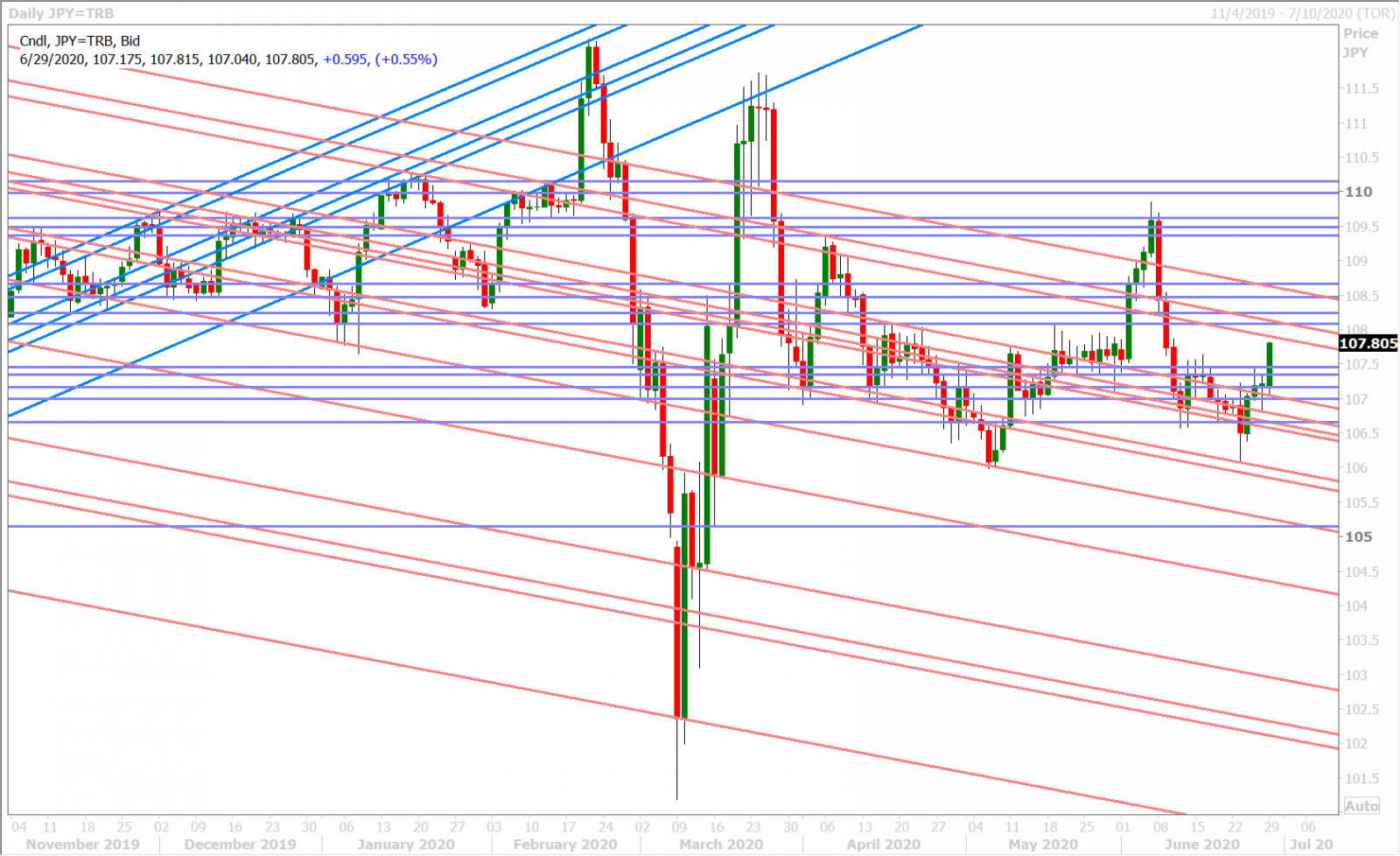

The 107.40s resistance level has given way in dollar/yen this morning and this is occurring despite a tepid bounce for US yields overnight. It appears traders are continuing to focus on rising Japanese COVID-19 cases and the impact this will have on domestic consumption (weaker than expected Japanese Retail Sales released last night). Japan will report its May employment and Industrial Production numbers tonight at 7:50pmET. The widely followed Q2 Tankan business survey will be reported tomorrow night.

The leveraged funds added to the net short USDJPY position for a 2nd week in a row during the week ending June 23, which was exactly the wrong move if we look at price action since last Tuesday. Whoever put on that massive $2bln USDJPY short (according to Reuters last Tuesday) could be scrambling to get out now too.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.