USD falls apart during holidays. Breakdown continues today, led by EUR. Markets still thin, technically driven, awaiting key data on Wed & Fri

Summary

-

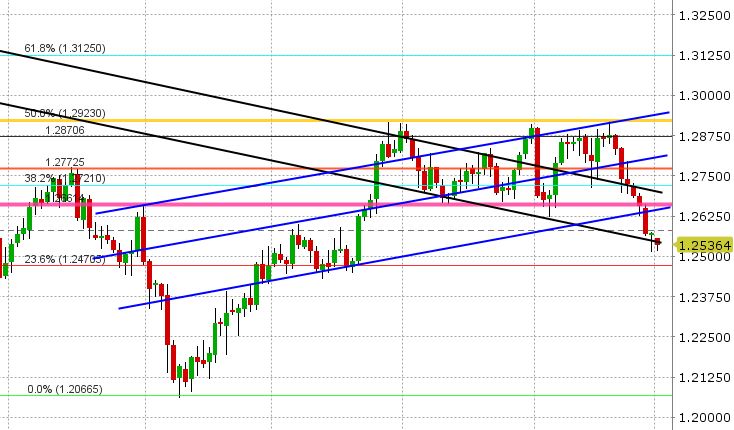

USDCAD: Dollar/CAD had a rough holiday season to say the least. The bump higher in prices we saw after the worse than expected Canadian GDP print on Dec 22nd was short lived, and the market has been in a downward spiral since then, driven by poor technicals, thin trading conditions, and a technical breakdown in the broader USD. Dollar/CAD now sits at the very bottom of trend-line extension support in the lows 1.25s, with EURCAD and GBPCAD supporting for the time being. Reuters is reporting a large 1.1bln USD option expiry at 1.2525 today, which will likely keep the market offered into 10amET. Much technical damage has been done to chart however, which will very likely see rallies being sold into 1.2630-1.2660 (now key resistance). Next support is 1.2450-70. The break higher in crude oil prices over the holidays (first on the Libyan headlines, now Iran) has not been a positive backdrop for USDCAD, nor has the latest read on market positioning from the CME (out last Friday). It shows the market significantly less short USD (long CAD) into Dec 26th, which is a positive development for new USDCAD shorts (entrenched USD shorts have gotten out leaving room for new shorts to build positions once again). The only positive thing we can point to right now is the US/CA 2yr yield spread, which is still trading around 20-21 bps (didn’t go down much as USDCAD declined). The major data points this week are US ISM and the FOMC Minutes from Dec 13th meeting on Wednesday. Thursday sees US ADP jobs numbers, and then we have a very heavy Friday that sees US and Cdn employment reports along with US trade figures and US services ISM. The Bank of Canada meets next on January 17th with markets now pricing in a 40% chance of a 25bp rate hike. NAFTA talks resume Jan 23. The FOMC meets again on Jan 30-31. We’re now calling USDCAD range-bound to lower, given the sharp turn lower in the broader USD and we expect rallies to be sold. The key today will be how the market responds to the 1.2520-30s support level it now sits on, post option expiry.

-

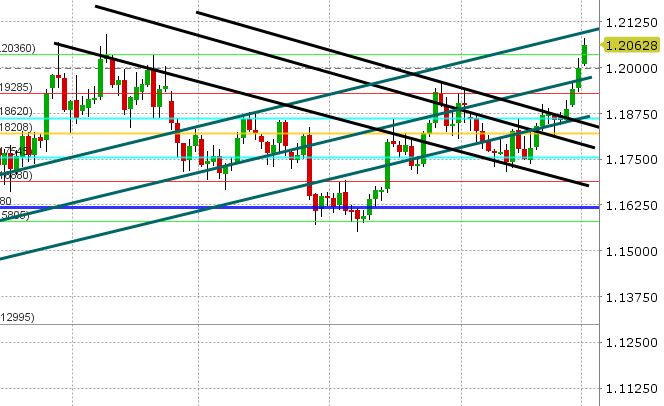

AUDUSD: The Aussie had a rip roaring holiday season, driven by much the same factors that were driving it prior to the holidays (improving technicals, widening AU/US yields spreads and surging base metal prices). Add to this the thin holiday trading conditions and technical breakdowns in USD across the board, and it took very little to move AUDUSD through the 77s in short order. AUDUSD is now up over 100 points from when we last wrote about it, surging through the 61.8% Fibo retrace of the May-Sep rally. It’s running into a little bit of trend-line resistance right now as copper is off its highs. It’s a quiet calendar for Australia this week, so traders will be watching the broader USD and commodity prices. The latest read on CME futures positioning (out last Friday) showed the market flipping to a net short position for the first time in 18 months, which is a very interesting as it shows large speculative traders have (on net) been on the wrong side (entrenched AUD longs used the recent rally above 0.77 to get out, and that now leaves AUD shorts holding a bag which continues to move against them). We think AUDUSD cools off a bit here but we see support on dips back to the high 0.77s. The next RBA meeting is not until Feb 6th.

-

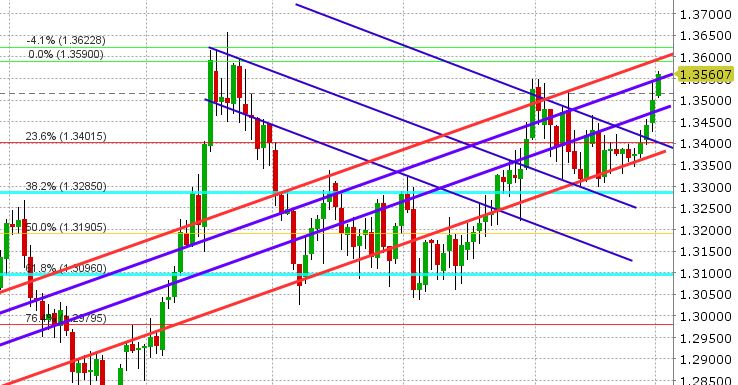

EURUSD: The Euro has been the talk of FX markets this holiday season. Despite three rate hikes from the Fed in 2017, a Fed that is tapering QE, a persistently wide rate differential between US and German ten year bonds, and what some still call an overcrowded net EUR long position, EURUSD broke higher last week amidst thin trading conditions and improved chart technicals. It has shattered all the resistance levels we mentioned during our last post and now looks poised to test trend-line extension resistance at 1.2100, which would be a new 3 year high for EURUSD if tested. Higher than expected German CPI data, out Friday, has traders talking about the ECB being forced to adopt tighter policy sooner rather than later. The weak DAX is helping too, as it’s pushing bund yields higher and forcing the US/GE 10 yr yield spread back below 200 bp (which is EURUSD supportive). The EUR crosses continue to support EURUSD as well, with EURJPY now trading comfortably above 135 and EURGBP looking poised to attack 0.9000 again. There’s plenty of data to digest this week, with German employment on Wed along with all the US data we mentioned above. We think EURUSD will continue its upward bias for now as there’s very little technical resistance. We see support on dips at 1.2030 and 1.1970.

-

GBPUSD: Sterling broke out up to the upside during the holidays as well, resolving the bullish triangular consolidation we mentioned during our last post. The market now sits at trend-line extension resistance at 1.3550 (this also coincides with the November highs). Next resistance is 1.3590-1.3610. Support today comes in at 1.3530. Like EURUSD, AUDUSD and USDCAD, the recent GBPUSD move has been technically driven during thin holiday trading conditions, but there is little to stop the trend as 2018 gets underway. While a higher EURGBP could put the brakes on a GBPUSD rally, we see little right now that suggests this rally will halt near term. It’s a light week for UK data, and so traders will be focused on the US data and how it affects the USD more broadly. The next Bank of England meeting is Feb 8.

-

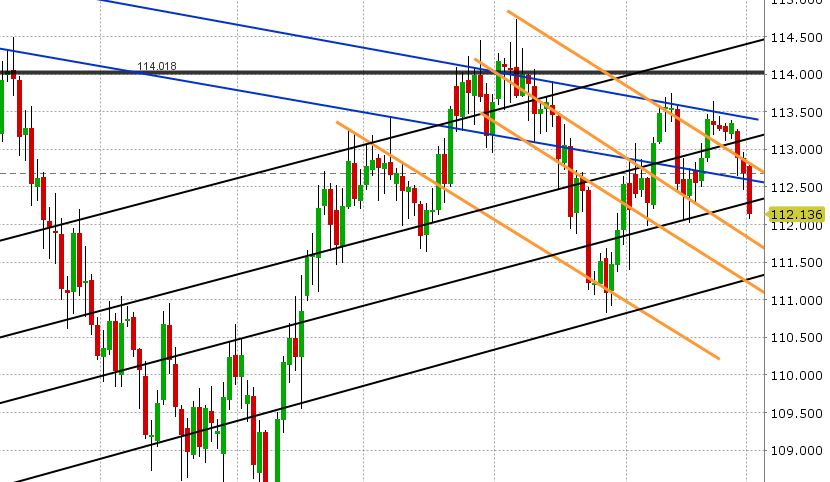

USDJPY: Dollar/yen held recent gains for the early part of last week as US yields backed up again, but it’s having a hard time finding buyers to start 2018 amidst all the USD selling going on elsewhere. The market has now swiftly broken back below support at 112.50 and is struggling to find a base in the low 112s as we write. Some traders are pointing to the net long (net short JPY) market position as being overextended once again, but the net position really hasn’t changed much in recent weeks. Like the other currency pairs, we feel today’s move is more flow and technical driven. Japan was out on holiday today, further exacerbating the thin trading conditions. We see support at 111.80. However, we’re starting to note a possible head & shoulders topping pattern on the daily chart. See chart.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.