USD broadly offered on EU migration development. USDCAD finds bids after technical selling yesterday. Cdn GDP and Business Outlook Survey on deck today.

Summary

-

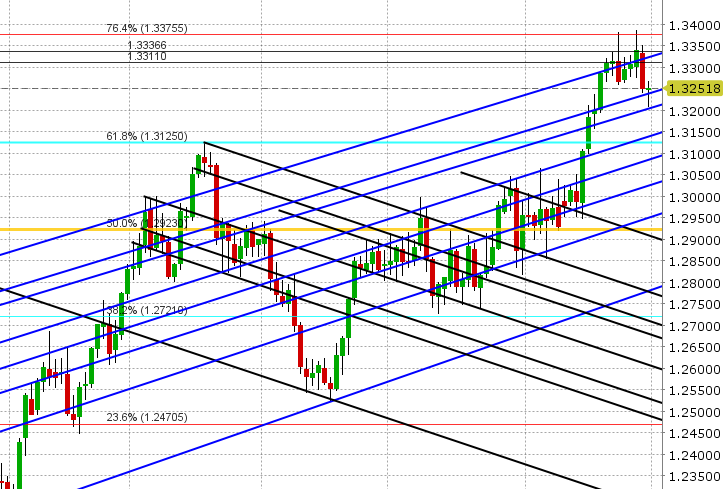

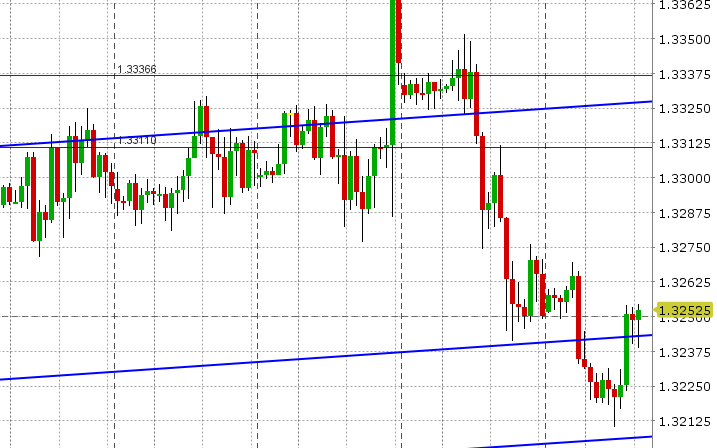

USDCAD: Dollar/CAD succumbed to technical selling yesterday following the market’s swift move back below the key 1.3310 level in early European trade. Losses extended to the next support level we mentioned (1.3240); we then saw a moderate bounce over the NY close and into Asian trade overnight, and then the EU’s Donald Tusk announced that a vaguely worded deal was reached on migration at the EU summit. More here: https://www.theguardian.com/world/2018/jun/29/eu-summit-migration-deal-key-points. EURUSD spiked higher and USDCAD took out the 1.3240s en route to the next support around 1.3200. Buyers have stepped just shy of that level as EURUSD saw some profit taking and the market has managed to regain the 1.3240s going into the NY open today. Today’s calendar features US PCE and Canadian April GDP at 8:30amET, followed by the Chicago PMI at 9:45amET and Bank of Canada Business Outlook survey at 10:30amET: https://www.bankofcanada.ca/publications/bos/ (released four times a year). There’s a decent sized option expiry at 1.3250 today (650mln+). We think USDCAD has the technical setup for a bounce higher today, but weaker than expected results from the Canadian data out today would need to be the driver, otherwise technical strength in EURUSD and crude oil will likely see USDCAD under pressure once again. The 1.3240s is key today. A reminder that Canadian markets will be closed on Monday July 2nd in observance of the Canada Day holiday.

-

EURUSD: Euro/dollar longs got a gift today with the announcement out of the EU summit on migration. Germany’s Angela Merkel must also be breathing a sigh of relief following positive reaction from senior CSU lawmaker Michelbach (a coalition partner). With this, EURUSD popped higher in Asia, taking out trend-line resistance at 1.1600 in the process. We saw some profit taking as Europe came in, but buyers returned after another solid German employment was released around the 4am hour (15k less unemployed vs. -8k expected). USDCNH is showing signs of a short term top by making a new swing in early Asia over 6.65 but now reversing lower for the day. Given recent inverse correlations, we feel this should also help EURUSD here, but we’d need to see follow-through next week by way of lower USDCNY fixes from the PBOC. We think EURUSD has scope now to extend gains into the low 1.17s.

-

GBPUSD: Sterling has seen some short covering today after another rough NY session today. The saviors today have been the EU migration announcement (helped GBPUSD regain 1.31 support) and the slightest of upward revisions to the QoQ percentage gain on Q1 GDP (saw GBPUSD surge past resistance in the 1.3130s...a bit of an overreaction if you ask us). We’re seeing some resistance now in the 1.3150s, but if EURUSD continues higher, we see enough momentum here for sterling to retest the 1.32 level. The EU’s Barnier confirmed “huge and serious gaps” on Brexit, and so it doesn’t look like the UK’s Theresa May accomplished much this week at the EU summit. More here: https://www.theguardian.com/world/live/2018/jun/29/eu-summit-european-leaders-migration-deal-brexit-theresa-may-live-updates. We think GBPUSD can weather this lack of progress on Brexit near term so long as we have other positive drivers.

-

AUDUSD: The Aussie benefited from the EURUSD pop in Asian trade as well. Gains took the market back above trend-line support in the 0.7360, but we hit resistance in 0.7390s and have now settled into a little range. Copper prices traced the overnight move higher in EURUSD, which is supportive. A poll of economists, released today from Reuters, sees Australian rates on hold until late 2019: https://www.reuters.com/article/us-australia-economy-rates/australia-cash-rates-seen-at-record-lows-well-into-2019-reuters-poll-idUSKBN1JP0UV. We expect no change to rates or forward guidance from the RBA when it meets again next week on July 3rd. From a technical perspective, the trend is still down in AUDUSD so long as stay below the 0.7450s in our opinion. We’ll get another update on the futures market’s net short position when the CFTC releases its weekly COT report later today.

-

USDJPY:Dollar/yen is bid this morning as S&P futures and US yields inch higher. A slow and steady rise this week now see USDJPY knocking on the door of trend-line chart resistance that has resisted six times since late May. Should traders be able to push prices above the 110.80s on a closing basis, we think the scope of a breakout higher increases significantly. Market participants seems to be preparing for this, if we look at the swift change in futures positioning to a “longer USD, shorter JPY” stance over the last two weeks. Next week could provide some catalysts, as we’ll have some key US data coming out (US ISM, Services ISM, FOMC Minutes and Employment) combined with potentially lack of liquidity given the July 4th holiday.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

August Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

US 10 YR Yield Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.