USD broadly offered for the third morning in a row. All eyes on Canadian jobs report at 8:30amET. EURUSD bid but contained by Fib level and option expiry.

Summary

-

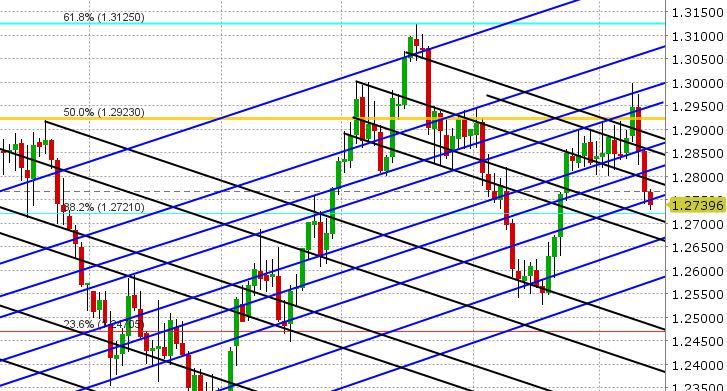

USDCAD: It’s jobs Friday in Canada this morning with all eyes focused on the Canadian Employment Report. Markets are expecting +20.5k new jobs for the month of April and Hourly Earnings of +3.3% YoY. Dollar/CAD is leaking lower ahead of the report, following another rough session yesterday and another weak NY close. The market closed right at another trend-line support level (1.2760) and made no attempt to bounce higher in Asian trading overnight. When Europe came in and starting selling USD broadly again against EUR, GBP and AUD, this was the catalyst for yet dribble lower in USDCAD. We now sit in a bit of a “no-mans” land between 1.2760 and 1.2715-25 (the next support level). A good job reports will likely see the downside move extended while a weaker than expected report will likely cause some short covering. The next upside targets are 1.2800-25, then the 1.2860s (should the 1.2760s give way). The CAD crosses (EURCAD and GBPCAD) are showing signs of technical exhaustion on the downside this morning. Deputy BoC Governor Wilkins is speaking at 9am today at Women’s Forum Canada, but her speech is not expected to touch on the outlook for monetary policy.

-

EURUSD: The Euro is bid again going into NY trading this morning, but the market appears to still be struggling with Fibonacci resistance in the 1.1940s (blue line on chart). There’s talk of another large option expiry today at the 1.19 figure (2.7bln+) and so that could be weighing as well. EURJPY is trading flat today after marking a short-term lower a couple days ago. USDCNH does not look in good shape at this juncture (failing to bounce at support in the 6.33s yesterday, and then losing the level early this morning), so this should help EUR a little. There’s very little on the US calendar this morning (just the UofM survey at 10amET), but it’s not a closely watched release any more. We do have Mario Draghi speaking in Florence however after 9amET. Traders will be watching for any comments that tips the ECB’s position after a rather lackluster monetary policy update a couple weeks ago.

-

GBPUSD: Sterling is on the leader board this morning when it comes to the gainers against the USD, but we feel it’s more the result of technical failure to the downside post BoE yesterday and the fact this market is tired of selling (all the bad news of the last few weeks appears to be priced in). GBPUSD regained the 1.3480s as Mark Carney spoke, closed above near-term resistance at 1.3515 into the NY close, successfully completed a downside test of that level in overnight trade, and has now surpassed trend-line resistance in the 1.3550s. All this is positive technically, which opens the door for the market to drift higher in our opinion towards the 1.36 figure. EURUSD overcoming the 1.1940s would certainly help.

-

AUDUSD: The Aussie continues higher today, following a very strong day yesterday that concluded with a bullish NY close above chart resistance in the 0.7530s. Broad USD weakness overnight is helping AUD today as well, along with a bid tone to copper prices. We think AUDUSD might struggle here a bit now with more trend-line resistance in the 0.7550-75 area.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

GBP/CAD Daily Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.