USD broadly bid as lockdown-driven economic anxiety returns

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Crude oil markets bearing the brunt of these fears. May WTI -6%. USDCAD regains 1.41s.

- Three-month EURUSD and USDJPY cross currency swap pricing otherwise steady.

- Bank of Canada’s emergency measures do nothing to help damaged USDCAD technicals.

- EURUSD slumps after 1.1140s buyer failure. Large option expiries likely to contain prices this week.

- Sterling runs into resistance at 1.2460s, ditto for the Aussie at 0.6190s. USDJPY trying to bounce.

- Leveraged funds scramble to cover EURUSD and USDCAD shorts during week ending March 24.

- Economic news this week kicks off tonight with China’s Manufacturing PMI for March, 45.0 expected.

ANALYSIS

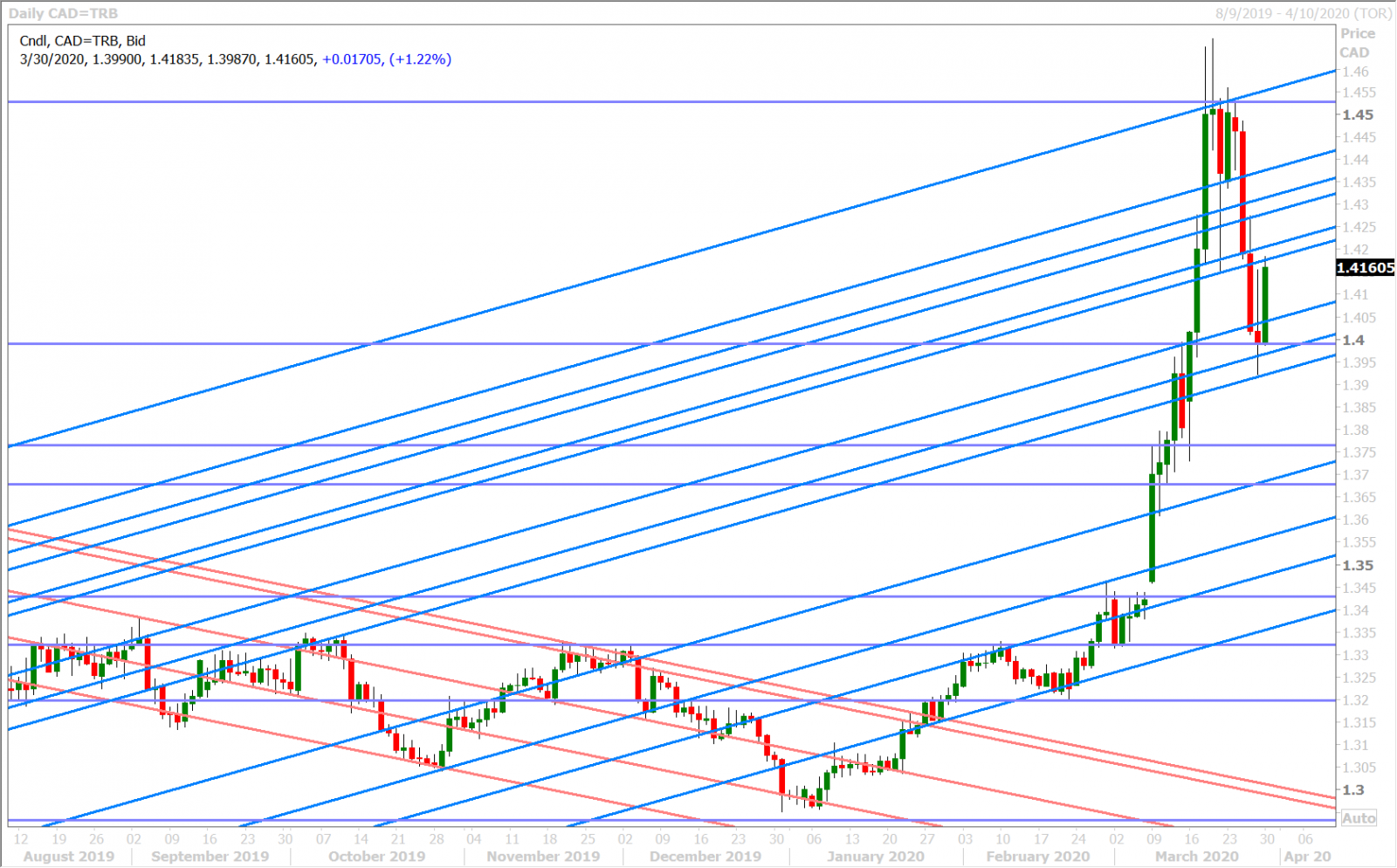

USDCAD

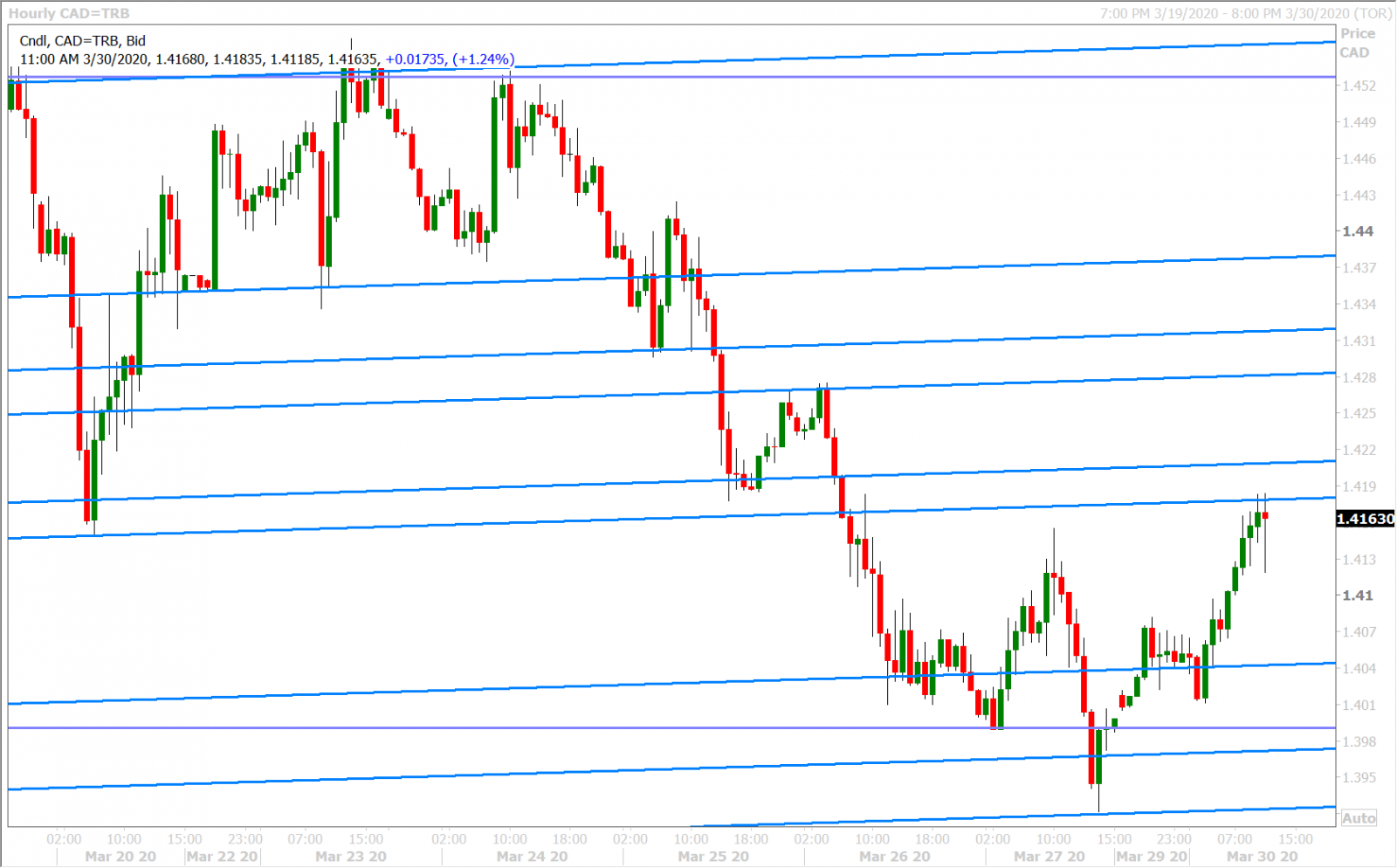

There’s a decent bid to dollar/CAD this morning as traders refocus on the economic ramifications that increased coronavirus lockdowns will have on crude oil demand. The May WTI futures contract is currently trading down over 6% again this morning, and it briefly dipped below the $20 mark in the overnight session. This has allowed USDCAD to reclaim the 1.3990-1.4030 support zone that it lost late on Friday after the month-end USD demand flows had passed. We found it notable on Friday how not even the Bank of Canada’s new emergency measures (50bp cut, $5bln/week in QE and a new Commercial Paper Purchase Program) were able to repair the technical damage done to the charts on Thursday. We think a new 1.3900-1.4200 price range will now be in play to start the month of April provided dollar funding fears don’t suddenly re-emerge.

The latest Commitment of Traders report out from the CFTC on Friday showed the funds scrambling to get out of USDCAD short positions during the week ending March 24. This now extends their new net long USDCAD position to 29,245 contracts, which is a notable week over increase in length, but the new position is nowhere near its recent 2019 extremes because it appears nobody chased this market higher with new long positions.

This week’s economic calendar kicks off with the widely followed Chinese Manufacturing PMI for March, which analysts are expecting will rebound to 45.0 (vs. 35.7 in February) when it comes out tonight around 9pmET. Tomorrow’s Canadian GDP numbers for January will likely be ignored, as will Wednesday’s final readings for Markit’s global March PMIs. Wednesday’s session will also feature the US ISM Manufacturing PMI for March, which is expected to fall 5pts to 45.0. Everyone’s going to be watching the latest US jobless claims figure on Thursday, which is expected to show an additional 3.5M Americans filing for unemployment insurance. Finally, we’ll get the US Non-Farm Payrolls report on Friday, where traders are expecting to see 100k jobs lost in March and an increase in the unemployment rate to 3.8% (vs 3.5% in February).

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

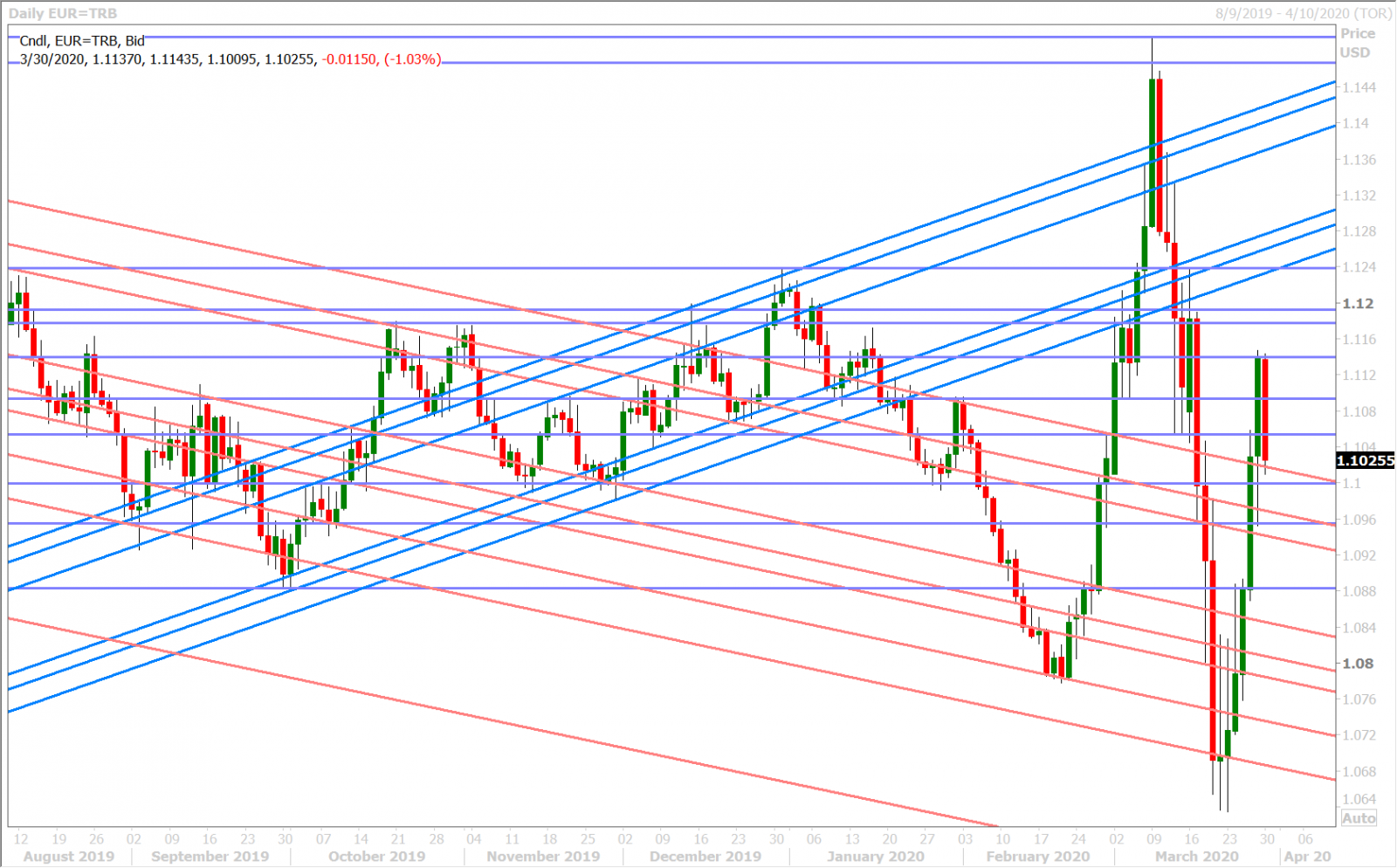

EURUSD

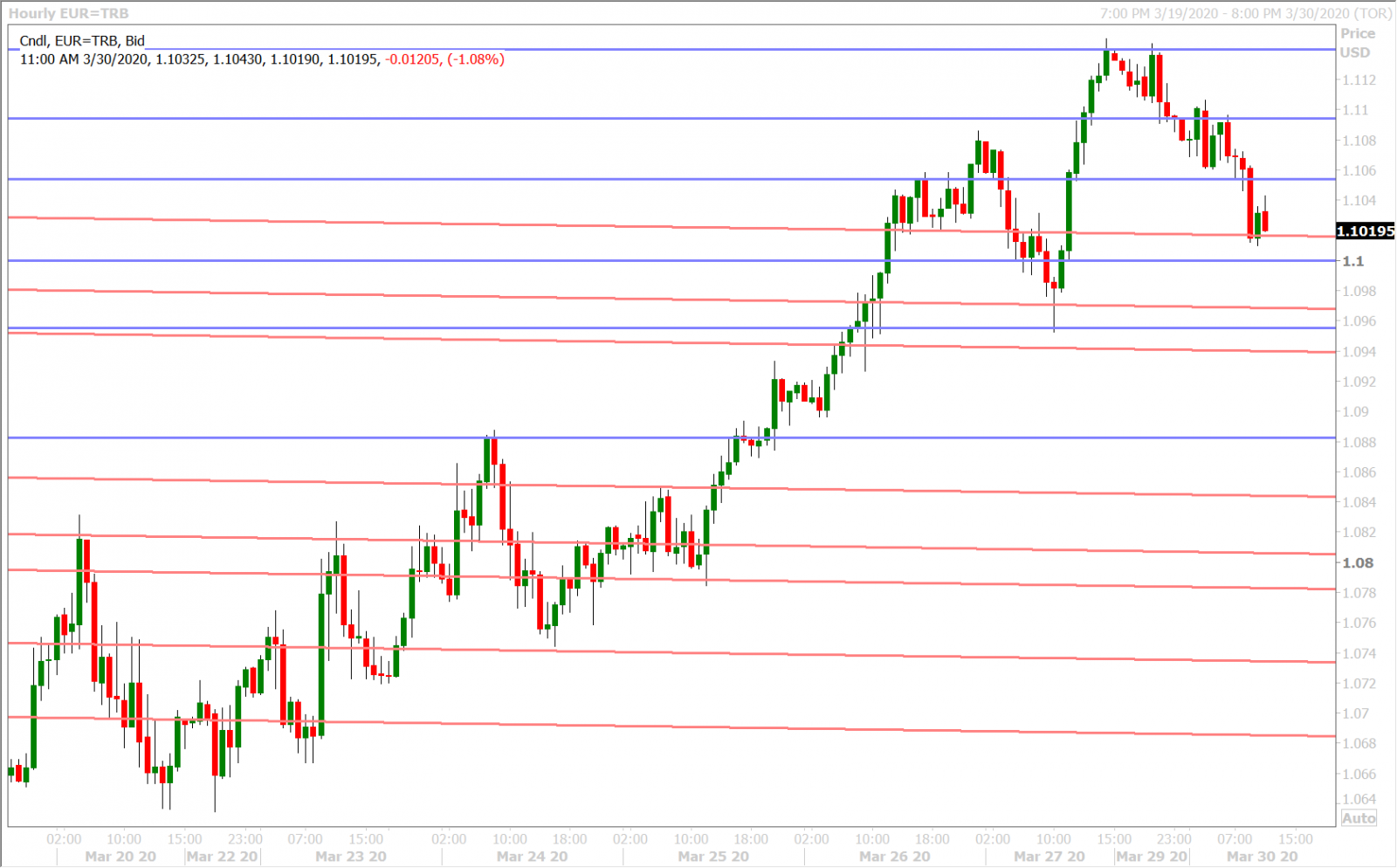

Euro/dollar is slumping 1% lower this morning as the broader risk mood remains tepid to start the week. While we’re not seeing the 3-month EURUSD cross currency basis swap blow out today, it’s as if traders believe this morning’s widening of the BTP/Bund spread, the 10bp slip in the US 10yr yield, and the 6% drop in May crude oil prices will bring back dollar funding stresses at some point this week. We’re hearing chatter that month-end demand for USD (similar to what we saw on Friday) is back again today too, perhaps even some hedging flows ahead of massive EURUSD option expiries at the 1.1000 strike for Tuesday and Wednesday.

Last night’s buyer failure in the 1.1140s signaled a short term top to last week’s incredible recovery for EURUSD in our opinion. We think we could see choppy price action this week, with large looming option expiries between 1.1000 and 1.1150 adding to the potential decrease in volatility.

The latest Commitment of Traders report out from the CFTC on Friday showed the funds rushing to get out of short positions for the third week in a row during the week ending March 24, however these shorts were lucky enough to cash out with profits. This had the effect of increasing their new net long EURUSD position to 61,290 contracts.

EURUSD DAILY

EURUSD HOURLY

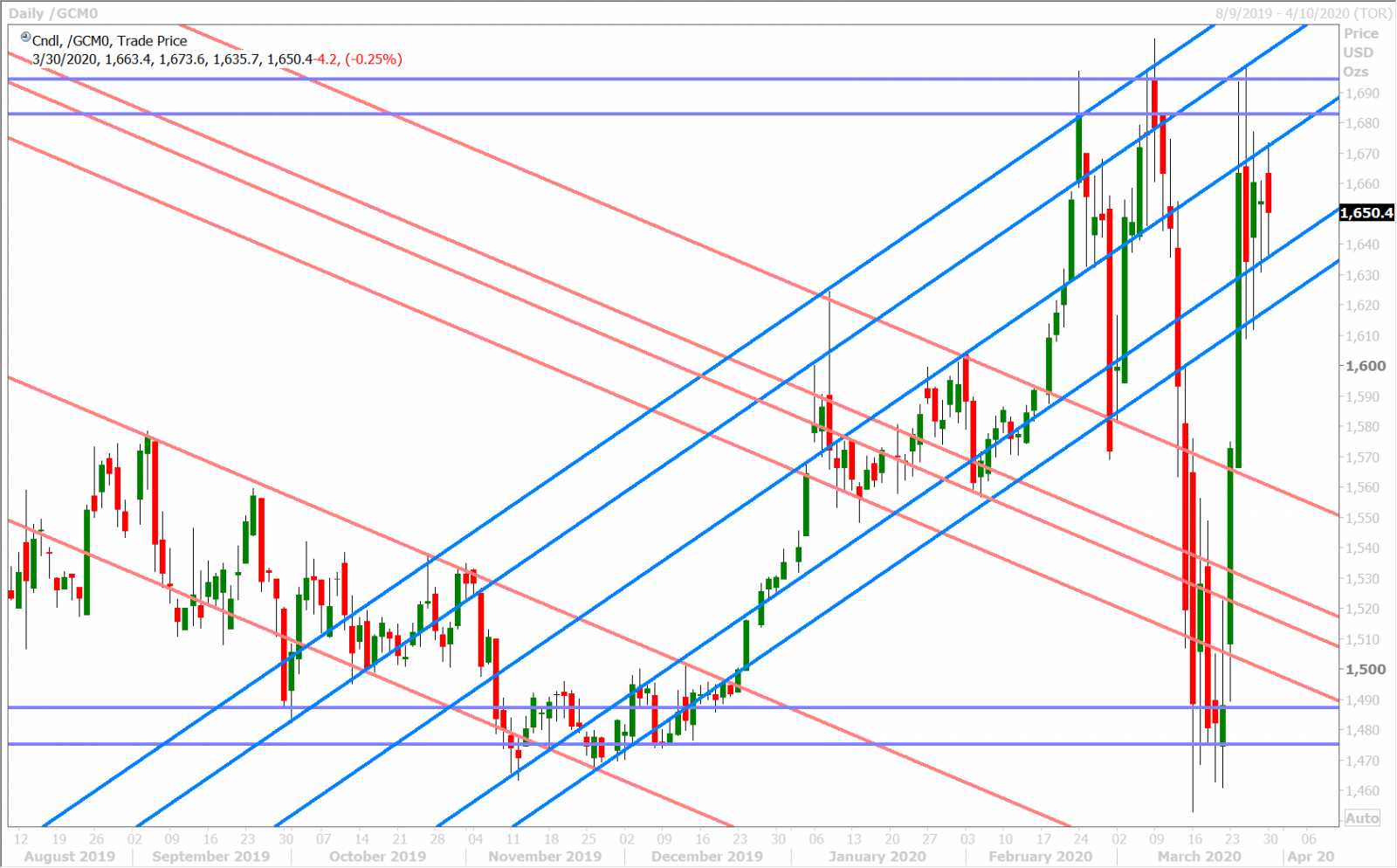

JUNE GOLD DAILY

GBPUSD

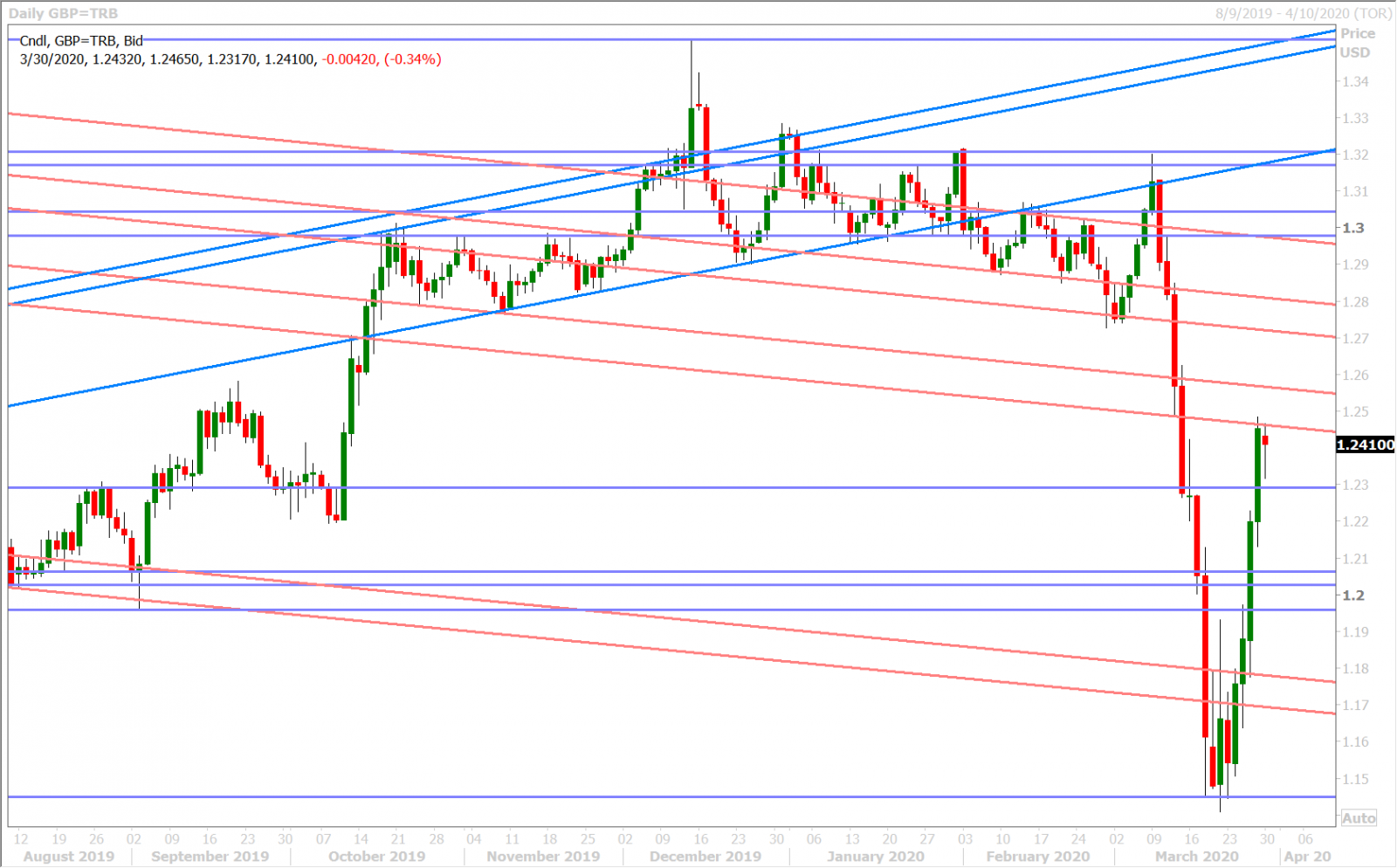

Sterling showed signs of buyer failure in last night’s session as well, with traders unable to re-challenge Friday’s highs in the 1.2480s. Downward sloping trend-line resistance in the 1.2460s hasn’t helped with this setback in our opinion, nor has today’s renewed demand for dollars. The Fitch credit rating agency downgraded the UK to AA- late on Friday, but we’d argue the market was largely expecting this.

The latest Commitment of Traders report out from the CFTC on Friday showed the funds amazingly not capitulating during the week ending March 24 either. Their net long GBPUSD position fell just 7,756 contracts to 10,884, which is making us wonder…who the heck can stomach a 15 figure move against them?

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie has had a very choppy start to the week. It managed to rebound back above the 0.6110s after Friday’s London fixing demand for USD had passed, but it has since struggled with its own downward sloping trend-line resistance (now in the 0.6190s). The market barely budged when the Australian government announced its 130blnAUD job-saving stimulus package.

The Australian dollar continues to display a lower beta (relative volatility) compared to its G7 peers. So while it lagged the gains in the Euro and the Canadian dollar last week, it’s now lagging their declines today as well. We think AUDUSD, like EURUSD, could get relegated to a range trade for this week. Australia reports its February Building Approval data tomorrow night and its February Retail Sales report on Thursday night.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

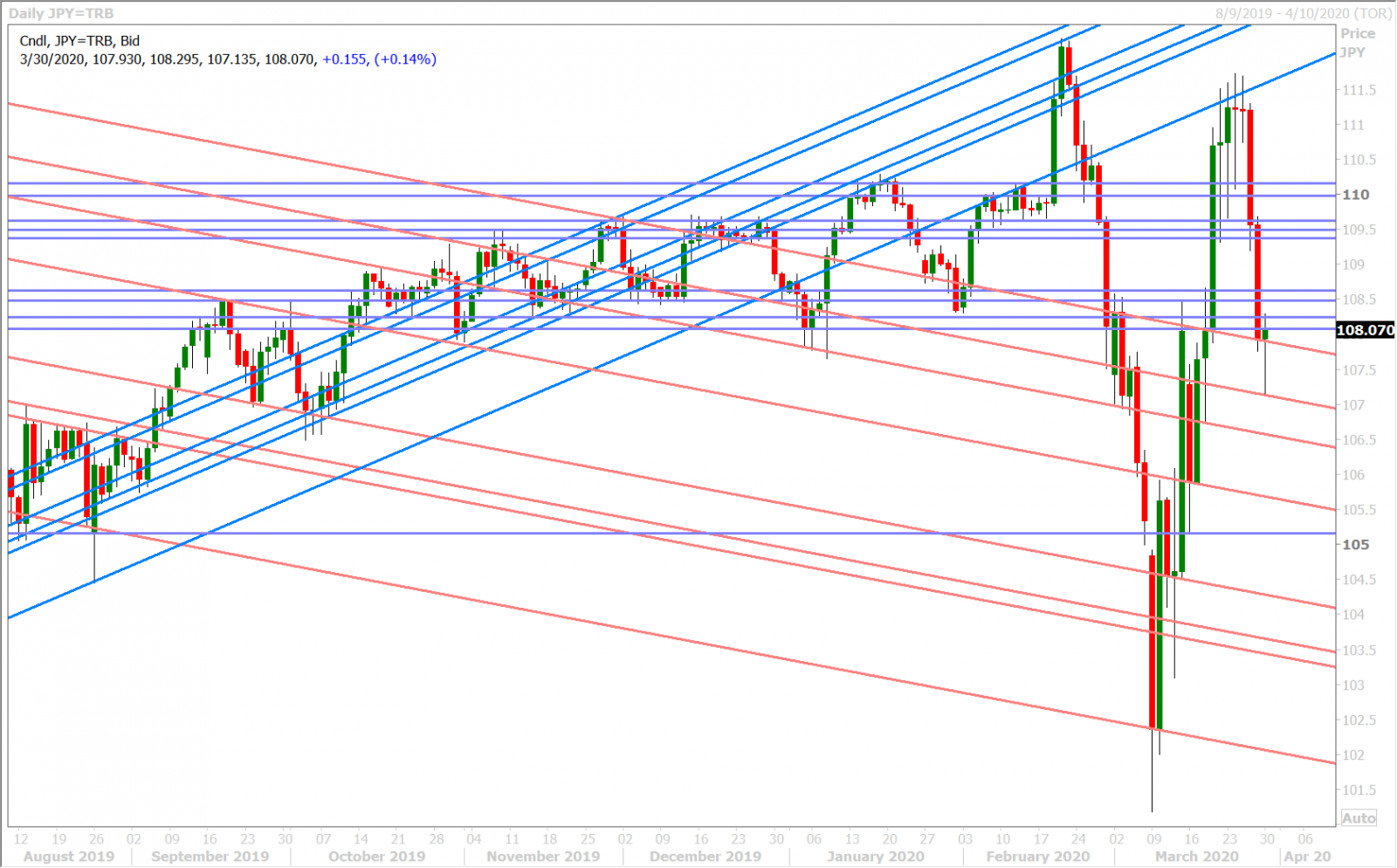

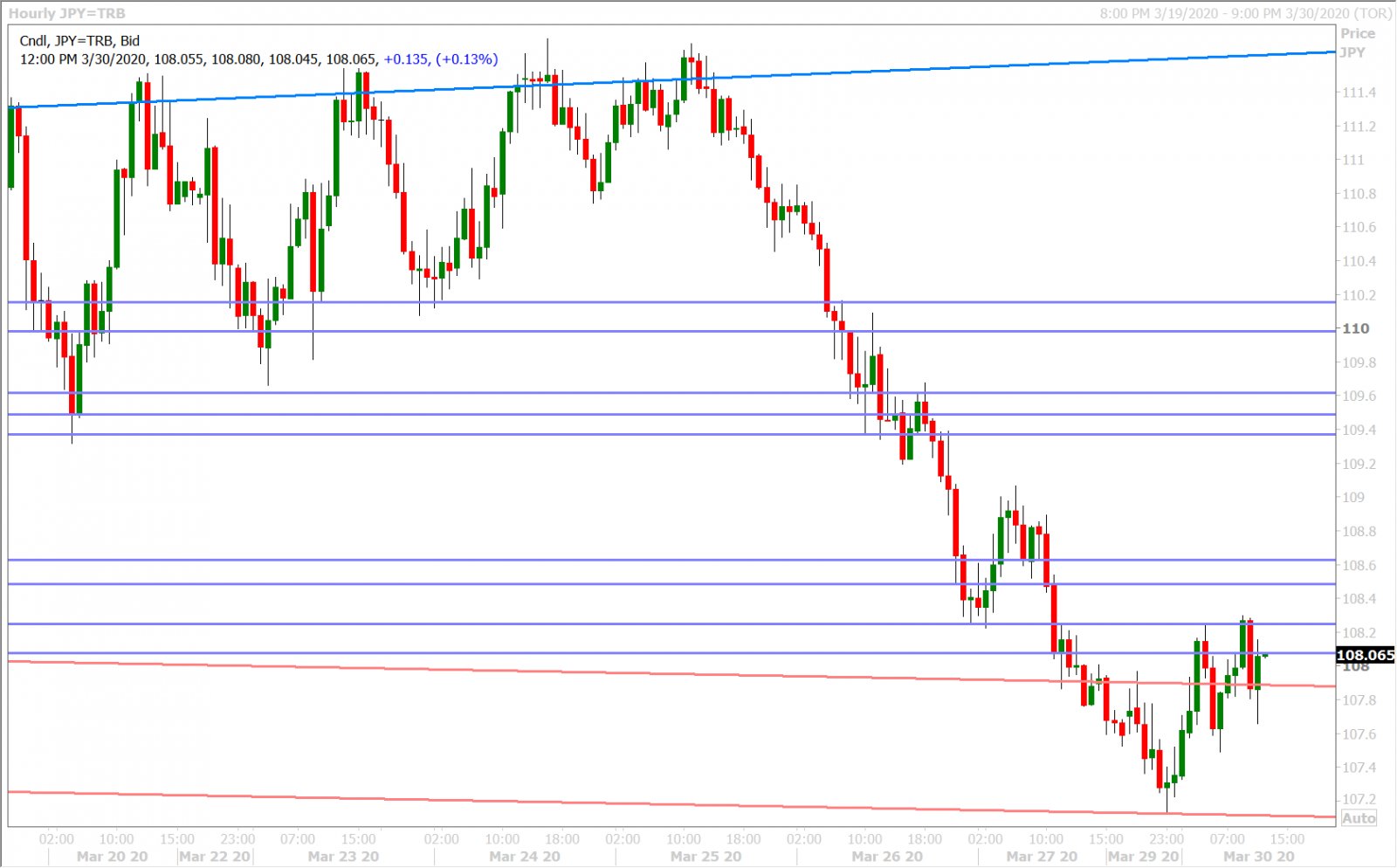

Dollar/yen is trying to recover with the 2% bounce in US stocks at the start of cash trading this morning, but it continues to struggle with the 108.00-108.20s, a level that the market finally fell below after Friday’s month-end USD demand had been processed. The funds reduced their net short USDJPY position during the week ending March 24, which was not surprising given the market’s continued run-up to the 111.40s. We’d posit that some of these shorts have since rushed to get back in after last Wednesday’s bearish NY close combined with a loosening of broad dollar funding anxiety. We have to wonder though at what point the market starts to take a looming Japanese lock-down seriously.

USDJPY DAILY

USDJPY HOURLY

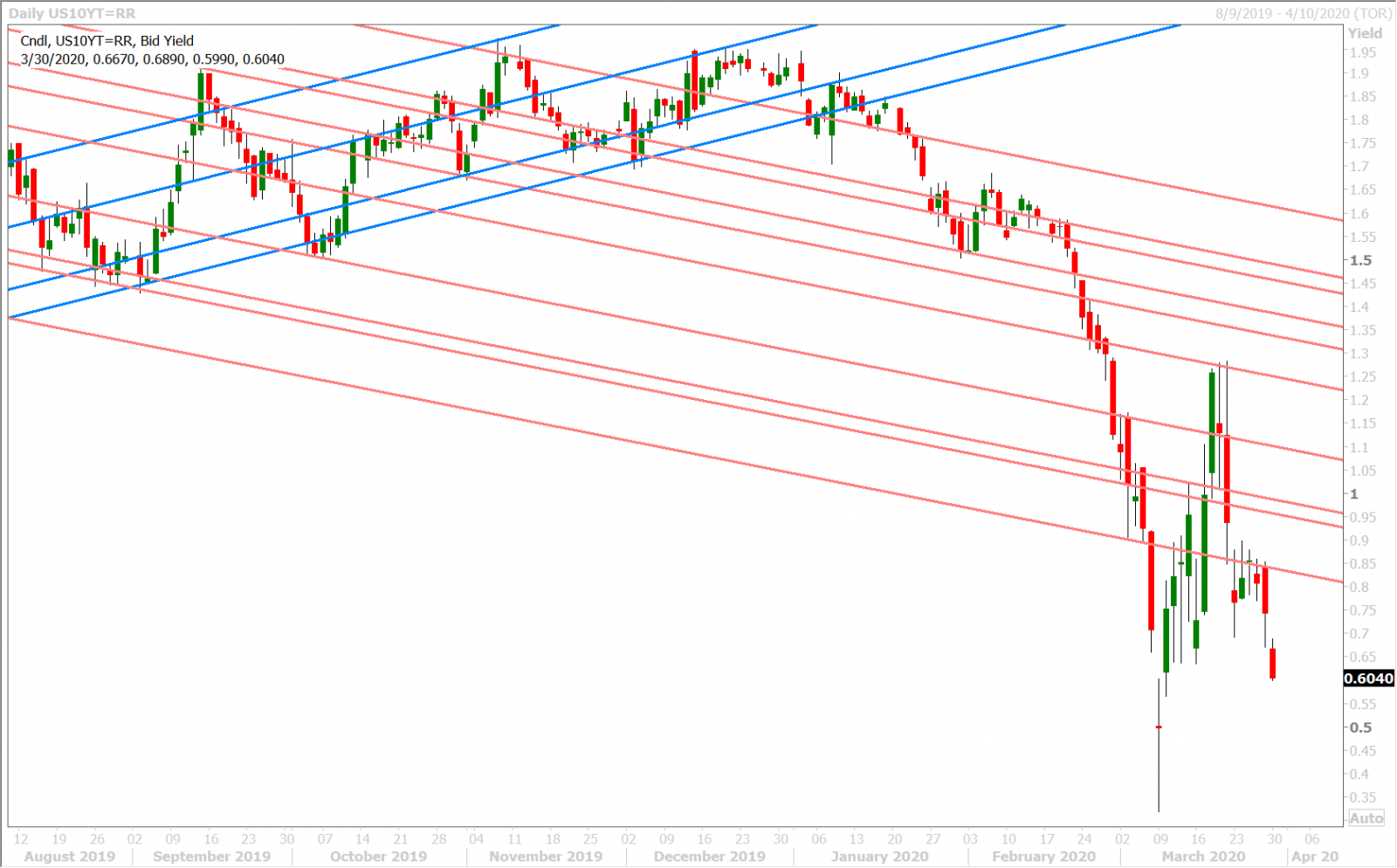

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.