USD & US yields lower post Fed hike. AUD jobs smash expectations. BOE & ECB keep monetary policy unchanged. US Retail Sales & Mario Draghi presser on deck

Summary

-

CME OPEN INTEREST CHANGES 12/13: AUD -858, GBP +18453, CAD -5906, EUR +3795, JPY +18995

-

ECONOMIC DATA UPDATE: While the headline US CPI came in as expected at +2.2% YoY in November, the core read (ex. Food & energy) came in a tad lighter than expected. Australian consumer inflation expectations came in at +3.7% for December (as expected). The Australian employment report stunned markets, coming at +61.6k job created in November versus +19k expected. Chinese Nov Retail Sales came in slightly weaker than expected (+10.2% YoY vs 10.3%) while Chinese Industrial Production was reported in-line with estimates (+6.1% YoY in Nov). UK Retail Sales for Nov smashed expectations, coming in at +1.5% YoY versus expectations of just +0.2%. Today we get US Retail Sales at 8:30amET, with markets expecting a 0.3% increase MoM in November.

-

CENTRAL BANK UPDATE: The FOMC hiked the Fed funds rate by 25bp yesterday and left its dot plot (three rate hike) projections for 2018 unchanged. This was pretty much what the market expected, and so the broader USD whipped around for a bit after 2pm yesterday without doing much. When Yellen spoke however in the post meeting press conference, her tone didn’t sound as optimistic on growth and inflation as one might expect to hear if the plan is still to raise interest rates three more times next year. With that, US yields backed up and the broader USD made a concerted push lower across all currency pairs. The Bank of England just announced (at 7amET) no change to interest rates, leaving them at 0.50%, and that they are leaving their asset purchase facility target unchanged at 435bln. However, their commentary was dovish. They view Q4 economic indicators being softer than expected and they said “any rate increases will be limited and gradual” and modest tightening is likely in the “next few years” given the outlook. The ECB just announced (at 7:45amET) that it too is keeping rates on hold and that monthly QE purchases will still be $30bln EUR per month starting in January 2018. This outcome is as expected as well. Mario Draghi’s press conference will be at 8:30amET. The Bank of Canada’s Stephen Poloz will be speaking today at the Canadian Club of Toronto at 2:25pmET.

-

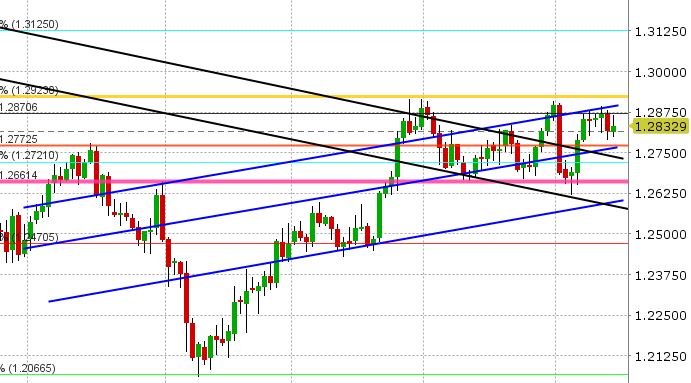

USDCAD: It’s been a very busy 24hrs for economic news and central bank announcements, and all of this had the potential to cause significant movement in the broader USD and hence USDCAD, but the moves in USDCAD have been quite muted. The market came off resistance in the 1.2870s post Fed, retreated to support in the low 1.28s, as is trying to recover now in European trading. The BOE and ECB announcements have been lackluster affairs so far and so EURCAD and GBPCAD, while bid earlier, are now backing off their session highs. The US/CA 2yr yield spread has come in a bit, which is a slight USDCAD negative. USDCAD will likely range trade today, unless 1.2870-80 level breaks to the upside or 1.2790-1.2800 breaks to the downside. Traders will be watching US Retail Sales, Mario Draghi’s press conference and Stephen Poloz later this afternoon.

-

AUDUSD: The Aussie has had a rip roaring 24hrs. It broke above the resistance level we mentioned (0.7570-80s) after the weaker than expected core read on US CPI. Buyers came in again during the post Fed USD sell-off. Then the market received the stunning beat on Australian jobs overnight. Technically speaking, the market has put in a significant bullish turn this week. With AUDUSD now trading comfortably above 0.7650, all those resistance levels we have been mentioning (in the low 0.76s) now turn into support. There’s not much resistance on the charts here until 0.77 (the 50% Fibo retrace of the May-Sep rally). Support today lies in the 0.7640s. The AU/US 2yr yield spread has shot up to 10bp, which supports the recent AUDUSD move higher. The market is stalling now a bit ahead of US Retail Sales and Mario Draghi’s press conference.

-

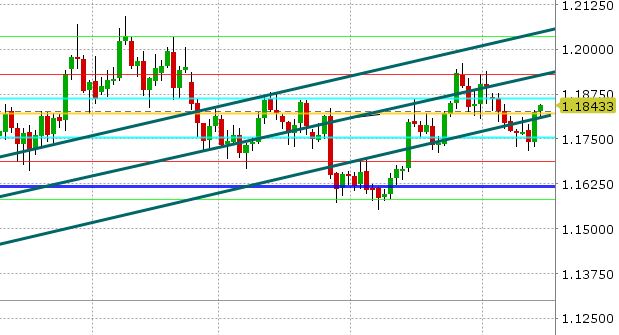

EURUSD: The Euro rocketed higher in the post Fed USD sell-off, and now sits above key resistance in the 1.1810-1.1820s. The US/GE 10yr yield spread has compressed back down to +204bp, which supports the move. EURUSD barely moved on the ECB headline hold to monetary policy. Traders will be focused on Mario Draghi’s tone during his press conference at 8:30amET. With yesterday’s technical bounce higher above key resistance, we now see a higher probability of EURUSD probing into the high 1.18s, possibly even 1.1920-30. Recall the Sunday opening gap from Dec 3rd (1.1880-1.1900) is still left unfilled. EURGBP and EURJPY flows today have been supportive EURUSD.

-

GBPUSD: Sterling also had a nice recovery higher in the broad USD selloff that followed the FOMC announcement yesterday, but the market is being capped so far today by trend-line resistance in the 1.3450-60s. Not even the higher than expecting UK Retail Sales, reported earlier, could get traders to continue buying. The dovish hold from the BOE over the last hour is not helping sentiment, nor is renewed nervousness over potentially negative Brexit headlines from the EU summit over the next 24-48hrs. It’s still very much a range-trade in GBPUSD right now, albeit extended now. If GBPUSD looses support intra-day in the 1.3410-20 area, we expect a move back down into the 1.33s. A firm close above 1.3470 would break the market out of its near term range and see another test of the 1.35s.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.