US payrolls on deck. Traders expecting 165k jobs gained in January.

Summary

-

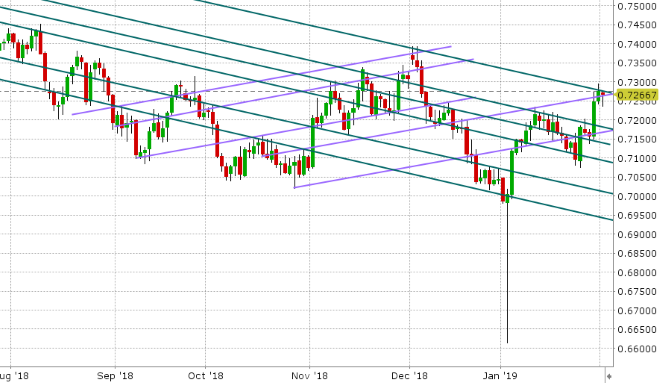

USDCAD: Dollar/CAD struggled to bounce very far off the 1.3120s yesterday despite a late session pullback in crude oil prices and some rather uncertain comments from the Bank of Canada’s Wilkins on the puzzling stretch of weak wage growth in Canada. This is now putting increasing pressure on chart support ahead of the US non-farm payrolls report, to be released at 8:30amET. Traders are expecting +165k jobs gained in January, average hourly earnings growth of 0.3% MoM and +3.2% YoY, and an unemployment rate of 3.9%. Recall the US ADP employment report beat expectations on Wednesday. A beat here today on the payrolls figure could do much to finally give USDCAD a bounce, but we think sellers will emerge again at chart resistance in the 1.3220s. A disappointing number, however, could very well see the market relinquish the 1.3120s and make a bee line for the next major support levels in the 1.3050-80 area.

-

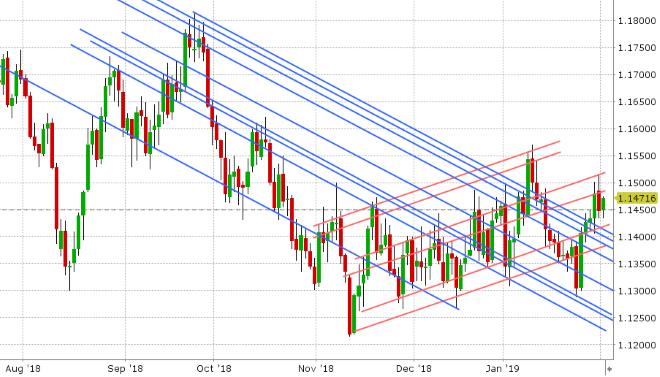

EURUSD: Euro/dollar is nursing back some of yesterday’s losses this morning despite the rather poor spate of pan-European manufacturing PMIs out earlier. The figures for Italy, France, Switzerland, Germany and the UK all came in below expectations, further reinforcing talk of a European slowdown. Some traders are chalking today’s bounce to the marginally better than expected Eurozone core CPI figure for January, which came out shortly thereafter. We would read too far into the 0.1% beat on the YoY figure, and would instead call this EUR buying position squaring (ie. short covering) ahead of the US non-farm payrolls report. We’re also hearing chatter that a large EURGBP buyer come in today. Expect the gains to evaporate should we get a strong number. The next support level is 1.1400-1.1400. Expect the market to pop higher should we get weak numbers. Near term resistance lies in the 1.1480s (yesterday’s support level which fell after the ECB’s Weidmann further reiterated concern on German growth), and the 1.1510s (yesterday’s overnight high). Over 1.2blnEUR in options expire at the 1.1500 strike this morning (10amET), which could make any upside move difficult to sustain initially. USDCNH shot higher overnight (Chinese yuan fell) after the Chinese Caixin Manufacturing PMI missed expectations yet again (48.3 vs 49.5 expected). This should be more EURUSD negative in our opinion, but again we think there is pre-payrolls re-positioning in play this morning so far.

-

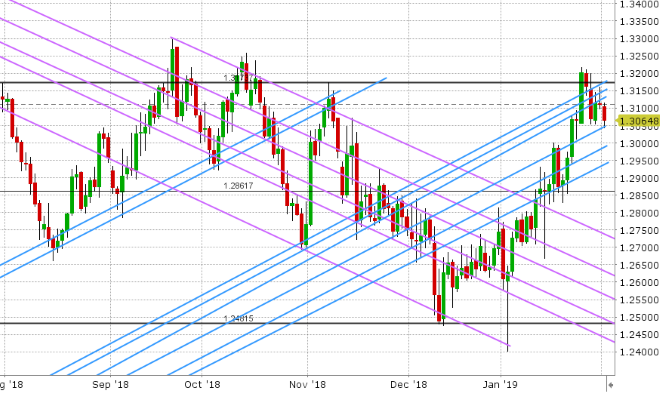

GBPUSD: The weaker than expected UK Manufacturing PMI (52.8 vs 53.5 expected) is really putting a dent into sterling this morning. GBPUSD moved quickly down to the next support level in the 1.3040-50s following the release. One could argue yesterday’s poor NY close back below the 1.3120s was the precursor for overnight weakness. Expect the broad USD buying from an upbeat US payrolls report to see support give way to further selling into the 1.2980s potentially. Conversely, expect the market to find a bid should the US report weaker than expected employment figures.

-

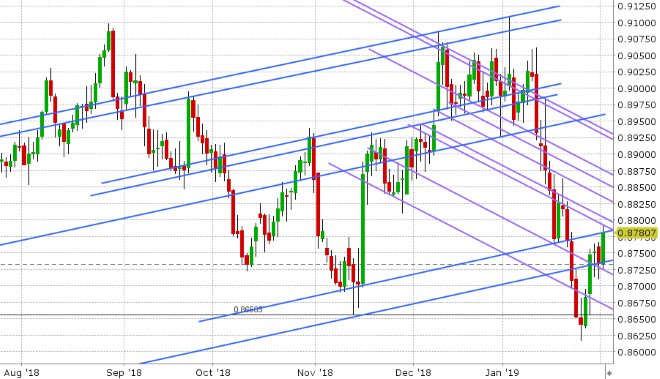

AUDUSD: The Aussie is clawing back losses that it endured following the weaker than expected Chinese Caixin Manufacturing PMI figures that we’re reported overnight. Chart support in the 0.7260s gave way when the report came out and USDCNH surged higher, however EURUSD buying appears to be helping AUDUSD recover ahead of the US payrolls report. We think a rally back above the 0.7280s (likely to occur should we get a weak report) will spur further gains into the 73s. The Reserve Bank of Australia (RBA) meets next on Tuesday Feb 5th.

-

USDJPY: Dollar/yen is marking time here ahead of the US payrolls report. The overnight range has been extremely quiet, but on a positive note, we continue to trade above 108.80s chart support (which was regained in NY trade yesterday). Hard to say at this point if USDJPY will follow the broad USD reaction to the payrolls number or the US stock/bond market response, given the breakdown in the traditional correlations since the Fed meeting this week.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

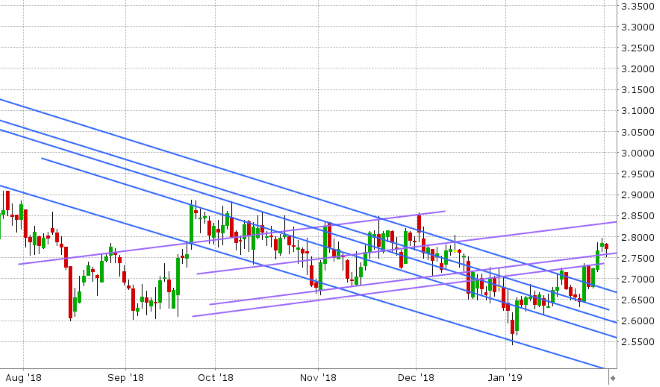

March Copper Daily Chart

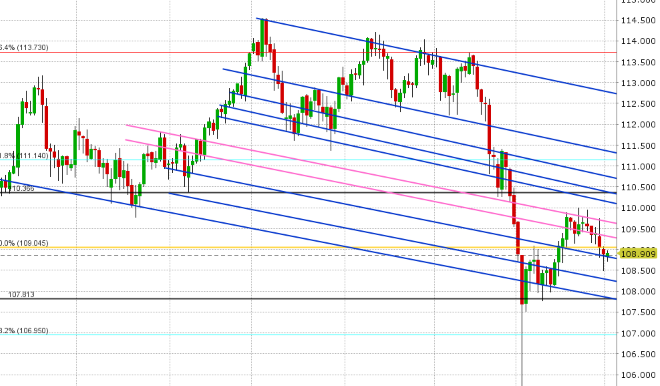

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.