US drone strike kills top Iranian military commander

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

• President Trump ordered the strike as a defensive action to protect US personnel abroad.

• Iran’s President Rouhani vows “harsh retaliation” to “take revenge for this heinous crime”.

• Global markets reacting with classic “risk-off” moves. Stocks, yields, and USDJPY lower.

• February crude oil +4%, Feb gold punches above $1550, USD broadly higher.

• US December ISM report on deck at 10amET, 49.0 expected.

• Weekly EIA oil inventory report to be released at 11amET, -3.28M barrel draw expected.

ANALYSIS

USDCAD

Global markets are in classic “risk-off” mode this morning after the US took out one of Iran’s most legendary military commanders overnight. In a targeted drone strike ordered by President Trump, the US killed Qasem Soleimaini at the Bagdad International Airport in an effort to deter future Iranian attack plans and to protect US personnel abroad. “General Soleimani was actively developing plans to attack American diplomats and service members in Iraq and throughout the region”, according to the US State Department. “The United States will continue to take all necessary action to protect our people and our interests wherever they are around the world.” More here from Fox News.

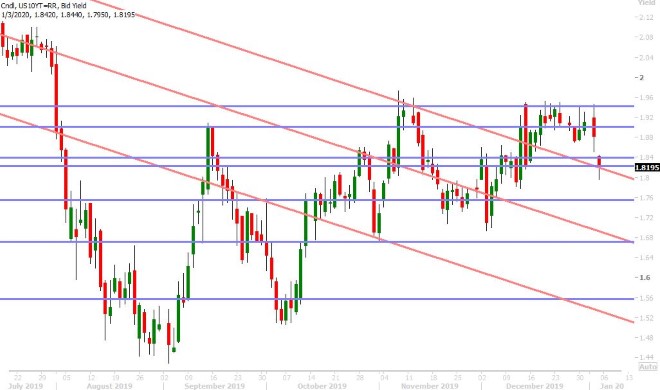

As one might expect, this assassination has drawn fierce rhetoric out of Iranian officials, which in turn has markets a bit spooked this morning. February crude oil prices have spiked 4% higher, February gold prices have punched through the $1550 level, US equity futures are falling 1%, and the US 10yr yield (which waived warning signals yesterday with it’s swift reversal off the 1.95% level) has now fallen all the way back to the 1.80% level. The broader USD and the JPY also saw safe-haven flows.

US Secretary of State Pompeo defended the US’s actions this morning when speaking with Fox News as a response to a “imminent attack”, but emphasized that “we don’t seek war with Iran” and that Washington is committed to “de-escalation” of US-Iranian tensions. With that, we’ve seen markets calm down a bit. USDCAD poked its nose above chart resistance at 1.3000 amid the height of the overnight “risk-off” move, but it has since pulled back. While the upcoming US ISM and EIA reports could get some play this morning, we expect traders will be preoccupied today with the global reactions to this event, especially from Iran.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar traders are deciding to trade off broad USD strength today, as opposed to the safe-haven driven strength we're seeing in gold prices. We arguably saw the same pattern emerge yesterday, which has us wondering if the gold/EUR correlation has now broken down. Chart support in the 1.1170s was lost in overnight trade, giving way to a test of trend-line support in the 1.1120s. Buyers are showing up now it would seem as US Secretary of State Pompeo attempts to calm down the beat of the war drum.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling succumbed to broad USD buying in the overnight session as well, but it got dealt an extra blow after the UK reported a weaker than expected Construction PMI number for the month of December (44.4 vs 45.9). However, similar to EURUSD, the market is trying to bounce now into NY trade. We think GBPUSD could regain chart support in the 1.3110s should the global “risk-off” tone dissipate further, but traders have an US ISM report to deal with first at 10amET. We think the next major support level resides in the 1.2990s.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

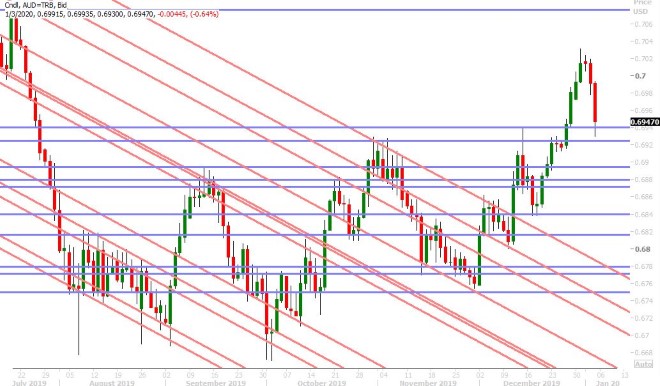

The Aussie is taking it on the chin this morning as global markets go “risk-off” in reaction to the killing of Iran’s Qasem Soleimani. We’re now trading right back down to the 0.6920-0.6940, Boxing Day break-out zone…which is quite discouraging for the AUD bulls. We think the fact that the holiday rally didn’t leave many meaningful chart support levels along the way part in parcel explains the swiftness of this AUDUSD pull-back. We think what we’re seeing today as well is another example of how the Australian dollar is a “high-beta” currency. It tends to behave in a more volatile manner (compared to its G7 peers) when reacting to global “risk-on, risk-off” type events. We think the 0.6920-0.6940 support level must hold, in order to keep the uptrend (since Dec 11th) alive.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

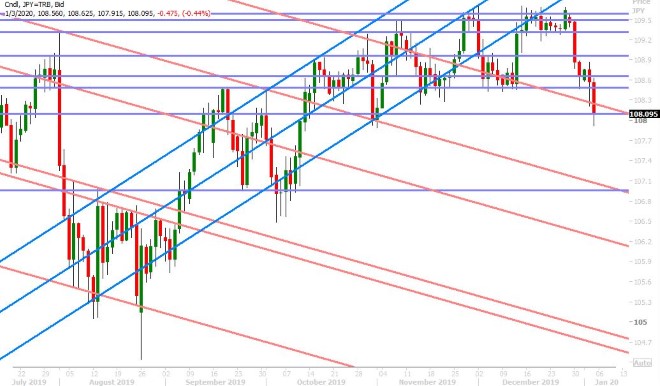

We got our re-test of the low 108s in USDJPY, and it happened rather quickly after two swift downward moves for US yields over the last 24hrs. The first move off the 1.95% was significant in our opinion because it occurred amid a raft of “risk-on”, positive US/China trade headlines to start the new year. It was almost as if bond traders were preparing for something negative, and boy have they been rewarded today.

The US 10yr bond yield dipped below 1.80% at one point overnight on the Soleimani headlines, dragging USDJPY below 108.00, but we think bond traders will need to be fed more “risk-off” headlines before pushing yields into a new downtrend. Until such time, we think US yields could bounce, which in turn helps USDJPY a little bit.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.