US dollar battered over the holidays

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

• US-China driven “risk-on” was a narrative, but steady demand for bonds/precious metals also noteworthy.

• Are traders bracing some dovish Fed development or negative US economic news?

• US December ISM report on deck for 10amET tomorrow morning, 49.0 expected.

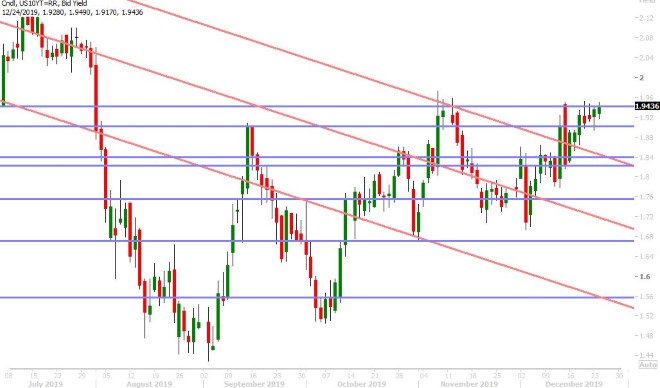

• US 10yr yield now trading back below 1.90% after rejecting 1.95% yet again. Feb gold now breaking above $1530.

• EURUSD and AUDUSD trying to recover from overnight selling. Weak UK Manufacturing PMI adding weight to GBPUSD.

• USDCAD continues to hold 1.2950-60s lows, but US yield move not supportive.

ANALYSIS

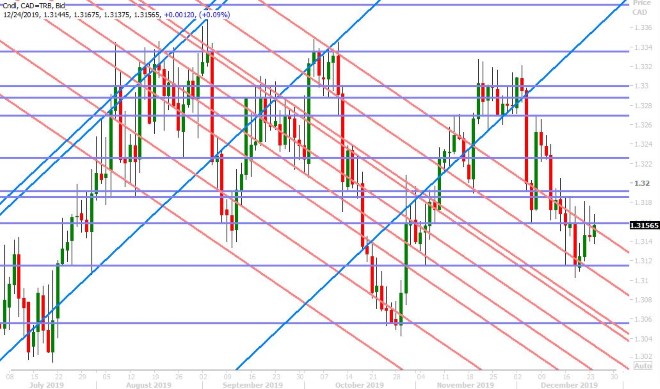

USDCAD

The last five trading sessions (between the Christmas and New Years holidays) have been absolutely brutal for the broader USD. While one could definitely argue that the incessantly positive narrative surrounding the US/China phase one deal (now to be signed on January 15th by President Trump) provided a “risk-on” backdrop that continued to help commodity currencies over the holidays, we think FX traders were also paying close attention to the steady bid in bond and gold markets. We touched on this topic on Christmas Eve, by noting February gold’s upside breakout above $1490 and the US 10yr yield’s inability to break out above the 1.95%. This steady demand for US paper and precious metals continues into today’s trade, and suggests to us that perhaps bond and FX traders are preparing for some sort of dovish surprise from the Fed, or some negative US economic news, to start 2020.

Dollar/CAD plunged 200pts over the last week and we’d argue that the market’s inability to close above the 1.3150-60s on three occasions before Christmas was the negative precursor to this downside move, as it technically kept the market’s new downtrend, from Dec 16th, alive and in good shape. The selling reached its fever pitch on New Years Eve, but then some buyers finally showed up at chart support in the 1.2950-70s. This level is acting as support once again this morning as the broader USD bounces, but we’re not so sure how long this can last because we’re seeing strong demand emerge now once again for US bonds and gold. The US reports its December ISM report at 10amET tomorrow morning, with traders expecting 49.0 for the headline.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar surged 150pts higher over the holidays; extending at one point all the way up to the August 2019 highs in the 1.1230s. We’ve since seen some selling to start the New Year as the USD bounces more broadly, but we think chart support in the 1.1170s should hold for now as US 10yr yields now slip below 1.90%. Today’s final December Manufacturing PMIs for Germany and the Eurozone were reported slightly better than the expected (43.7 vs 43.4 and 46.3 vs 45.9 respectively). The leveraged funds at CME extended their net short EURUSD position to a new 9-week high during the week ending December 24th.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling benefited handsomely from the broad USD selling observed over the holidays, but traders are now hitting the sell key as they get reminded once again about some unnerving economic reality in the UK. The final December Manufacturing PMI was reported at 47.5, which is now the fastest slide in factory output since 2012. More here from HIS Markit.

With GBPUSD now slipping below chart support at the 1.3210s, think the market’s momentum has now shifted back in the favor of the sellers near-term and we would not be surprised to see a move back down to the 1.3120s at some point over the next week. The CFTC’s latest commitment of traders (COT) report showed the funds flipping from a net short to a net long GBPUSD position during the week ending December 24th. This is not bullish news in our opinion, as it confirms a long trade that got a little ahead of itself heading into the UK general election last month and it shows how these traders have since doubled down on their bets.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

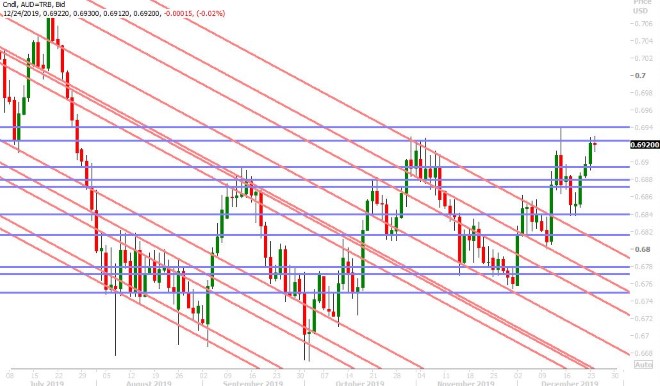

AUDUSD

The Australian broke out over the holidays, and it all started with a Boxing Day rally above 0.6920 and then 0.6940. As we mentioned on Christmas Eve, there’s not resistance on the charts to hold back a market rally now to the 0.7070s in our opinion, but it seems traders are having to deal with a little bit of profit taking today. China announced another 50bp cut to their banking system’s Required Reserve Ratio (RRR) overnight, but it doesn’t seem to be having much effect on the markets. Off-shore dollar/yuan is hovering above trend-line chart support in the 6.9560s after non-stop, positive, US/China trade headlines finally pushed the market back below the psychological 7.00 figure over the holidays. The funds added significantly to their net short AUDUSD position during the week ending December 24th; and because AUDUSD has broken out since then (moved against this position), we think this is a development that will help the market find buyers on dips.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen traders look a little dazed and confused to start the new year. On the one hand, we have the loud drumbeat of a phase 1 trade deal with China (which is driving stocks higher) but on the other hand, we have a bond market that is either a) not buying the US/China narrative or b) concerned about something else. The US 10yr yield has reversed lower off the 1.95% handle yet again this morning. February gold prices continue to rally higher today. Both these developments are rather bearish USDJPY, and thus has us thinking once again the December 19th bearish reversal signal.

It appears the leveraged funds are bracing for a continuation of USDJPY selling as well, if we look at the latest COT report from the CFTC. The net long USDJPY position was trimmed for a 3rd week in a row during the week ending December 24th. We’d also note the option market’s preference for USDJPY puts over calls, if we look at short term risk reversal pricing. We think traders need to be on guard for a potential re-test of chart support in the low 108s. Japanese markets were closed today for a banking holiday and they’ll be closed again tomorrow.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.