US & Canada reach new NAFTA deal

Summary

-

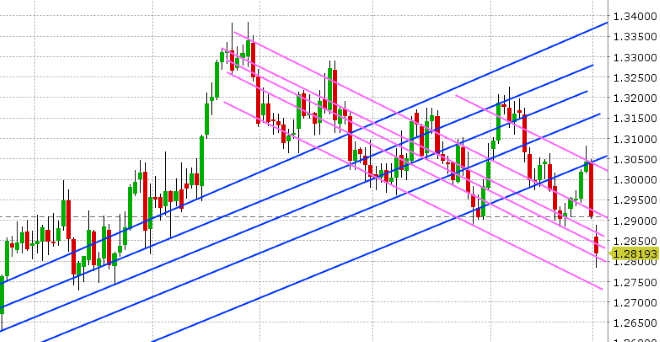

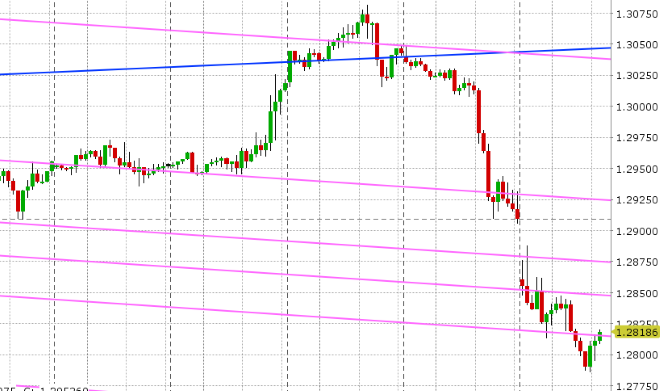

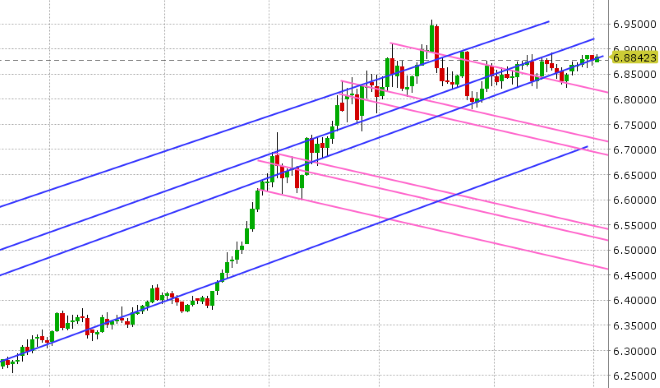

USDCAD: Dollar/CAD is trading significantly lower this morning as the US and Canada have reached a new NAFTA deal in principle, called the United States-Mexico-Canada Agreement. More here. This morning’s drop extends last week’s dramatic turn lower in USDCAD, which started on Thursday with a wave of EURCAD selling that pulled the market back below 1.3050, and intensified on Friday after the beat on July Canadian GDP and yet another rally in oil prices. After gapping lower at the Sunday open, the market now sits over 100pts lower, looking for a support level that will hold. The broader USD is trading mixed. November crude oil is trading comfortably range-bound above the $73 mark. The 2yr US/Canada yield spread has fallen back to +57bp. The latest update on fund positioning from the CFTC shows a USDCAD market that liquidated longs and built short positions into Sep 25. While this report shows the market still held net long of last Tuesday, we think those long positions that remain are likely in the process of getting shaken out. Expect the headlines today to be dominated by further details about the new USMCA, debate and formal announcements from the US and Canada. We’ll also have the US ISM figures for September at 10amET, some Fed speak from Bostic and Rosengren, and a speech from the BoC’s Lane at 1pmET. We think USDCAD tries to bounce here today, and we’d be on the lookout for the market possibly trying to fill Sunday’s opening gap (1.2885-1.2905) at some point this week. Tomorrow’s calendar features a speech from the Fed’s Powell. Wednesday sees the US ADP employment report for September, along with some more Fed speak. On Thursday, we get US Factory Orders. Finally, Friday brings the employment and trade balance reports for both the US and Canada. The Canadian dollar is now entering a seasonally weak time of year (October/November).

-

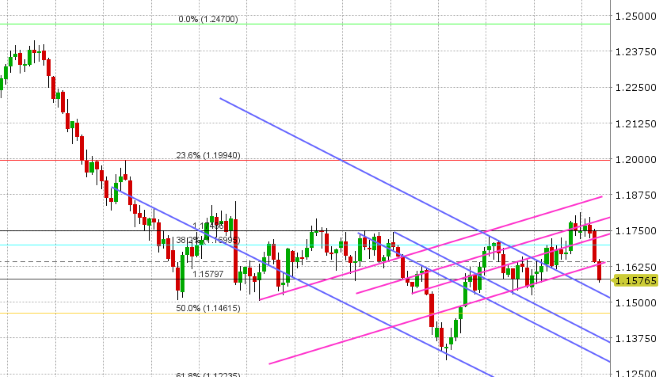

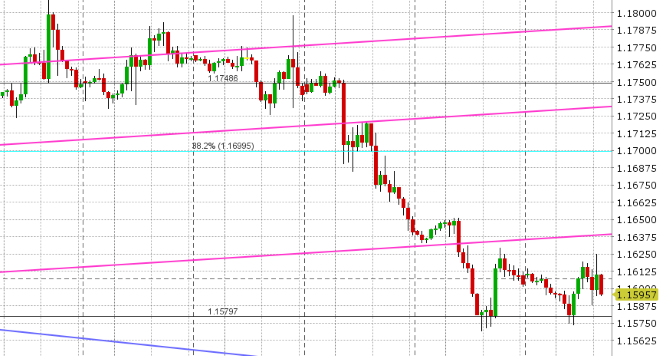

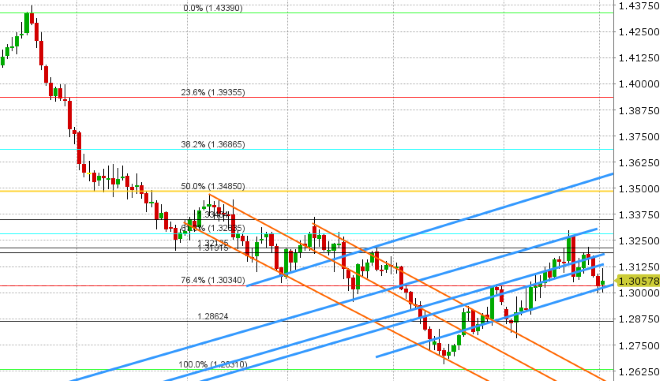

EURUSD: It’s been a tepid start to the week for Euro/dollar, as traders continue to digest the Italian budget news from last week. Italian bonds opened weaker, recovered some, but are trading lower again into the NY open, and it’s been much the same pattern for EURUSD. The Sep manufacturing PMIs out of Germany, Italy, Spain out earlier were lackluster in our opinion. Today is also a SOMA redemption day; a day when the Fed’s balance sheet shrinks and USD liquidity is withdrawn (USD positive). USDCNH is trading very quietly as China enters its Golden Week holidays. The funds added marginally to both long and short positions during the week ending Sep 25, leaving net market positioning slightly long. This week’s European economic calendar is fairly light. Tomorrow is a German banking holiday. We’ll get the Sep Services PMIs on Wednesday, some Spanish bond auctions on Thursday, and German Factory Order data on Friday. Italian budget headlines are likely to dominate the headlines leading up to October 15th, when Italy is set to formally submit its 2019 budget to Brussels. S&P and Moody’s will look at Italy’s sovereign credit rating again at month’s end. Twenty year seasonals suggest weakness for EURUSD during the month of October.

-

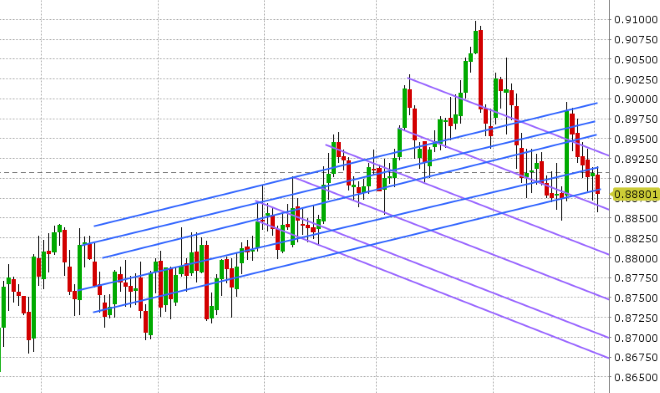

GBPUSD: Sterling has also had a slow start to the week; bouncing early off trend-line support in the 1.3010s, but falling back once again with EURUSD into the NY open. With the lack of UK economic data items on the calendar this week, traders will likely focus on headlines out of a four-day-long conference, where Theresa May seeks to reunite her fractured Conservative Party. The funds trimmed short positions during the week ending Sep 25 (the week covered Theresa May’s setback at Salzburg), but net market positioning still remains quite short. We’re just getting reports that the UK is said to plan compromise on the Irish border to get a Brexit deal, and this is seeing GBPUSD pop 100pts. It’s now technically positive that support in the 1.3010s has held three times over the last two trading sessions, but we don’t see shorts getting spooked until we move back above the 1.3190s. Twenty year seasonals point to weakness this month, after gains in September.

-

AUDUSD: There’s not much going on down under today as Australia is on holiday, China begins its week long holiday and traders keep their powder dry ahead of the RBA rate decision tonight (12:30amET). The Aussie sits steady at trend-line support in the 0.7210s. Next support 0.7185. Resistance 0.7230s, then 0.7290. The funds liquidated longs during the week ending Sep 25, extending the net short position to a whopping 72k contracts. December copper is showing a firm rejection of the 2.81 handle today. Twenty year seasonals suggest AUDUSD bounces this month.

-

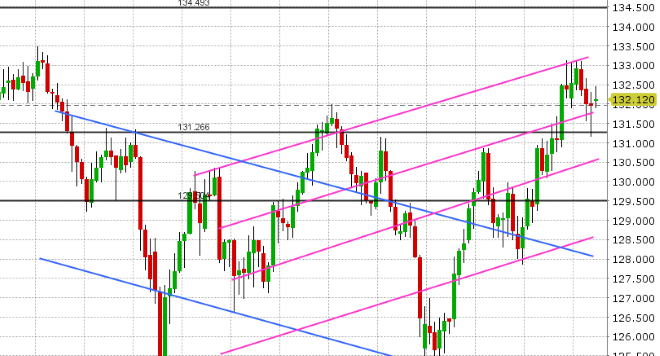

USDJPY: Dollar/yen extends its rally this morning as a broad “risk-on” bid, stemming from the new NAFTA deal with Canada, helps US equity market sentiment. The S&Ps are up 14, US yields are opening higher, and USDJPY has touched the 114 handle. The funds added to long positions during the week ending Sep 25, extending their the net fund long to new swing highs (following price). We wouldn’t be surprised to see some profit taking here, but we think all eyes will now focus on the November 2017 highs in the mid 114s. Twenty year seasonals point to JPY strength during the month of October.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.