Trump complaints about Fed (this time with Reuters) + weak USD technicals spark further USD selling into Asia

Summary

-

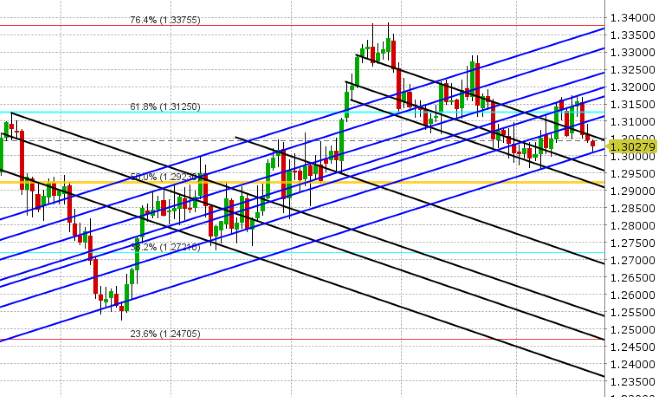

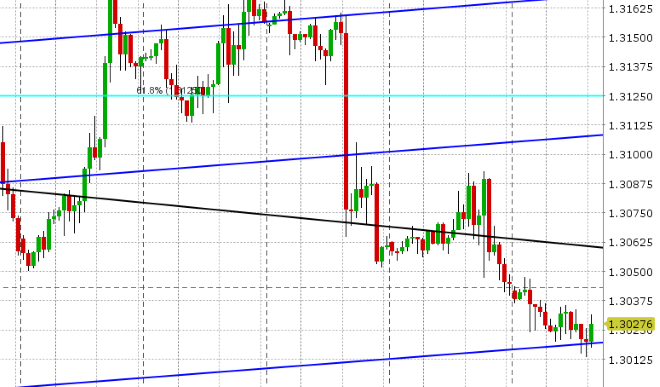

USDCAD: Dollar/CAD is trading down this morning, following a weak NY close and broad USD selling that ensued after Trump complained about the Fed again late yesterday (this time with Reuters) https://www.reuters.com/article/us-usa-trump-fed-exclusive/exclusive-trump-demands-fed-help-on-economy-complains-about-interest-rate-rises-idUSKCN1L5207. It’s been a slow and steady move down today, after chart support in the 1.3060s gave way, and traders are now eyeing the next support level in the 1.3010s. October crude oil (now the new front month) is inching higher, which is not helping. We think how the market deals with 1.3010s is the key thing to watch today. The longer traders can hold the level, the odds of a bounce increase. Any serious probe below, however, will invite further selling into the mid-1.29s. There are no major data items on the North American calendar today.

-

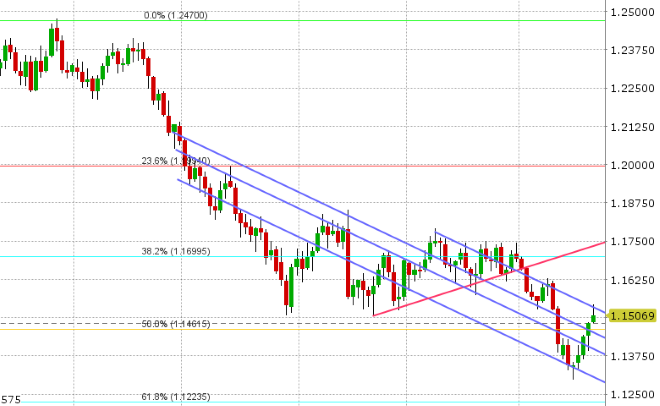

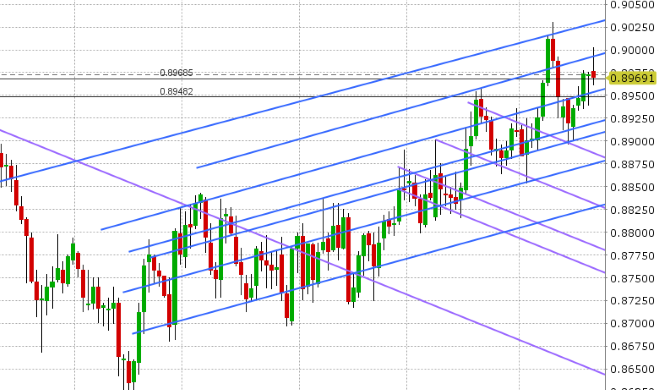

EURUSD: Euro/dollar rallied strongly during NY trading yesterday, closing the session above trend-line resistance in the 1.1460s. This technically bullish pattern along with Trump’s negative comments on the Fed was the fuel for further buying, which we saw overnight in Asian trade predominately. The BTP/Bund spread has narrowed back into the +260s, but European traders appear to be wrestling with the next trend-line resistance level in the 1.1530s. USDCNH also found a bid after three rough days of selling, and so EURUSD has stalled here a bit. The PBOC reiterated overnight that they’re not weaponizing the Yuan: https://www.bloomberg.com/news/videos/2018-08-21/pboc-reiterates-china-won-t-use-yuan-rate-as-trade-war-tool-video. We think EURUSD cools off a bit here after a 4-day run higher.

-

GBPUSD: Sterling had a strong day yesterday as well, closing NY trading above resistance in the 1.2780s after the Trump headlines hit. Like EURUSD, this combination of positive chart technicals and USD bearish news sent GBPUSD higher in Asia. The next chart resistance level in the 1.2810s then gave way, leading to further gains, but we’ve seen some selling off the highs with EURUSD stalling. The 1.2810 level (now support) then survived one test over the 5am hour, and we’ve bounced higher again an what appears to be another sell wave in EURGBP. We think GBPUSD trades with a range bound to higher tone here, with deteriorating EURGBP technicals supporting.

-

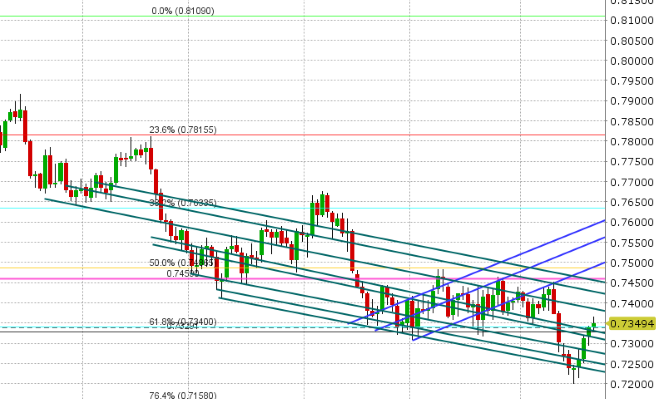

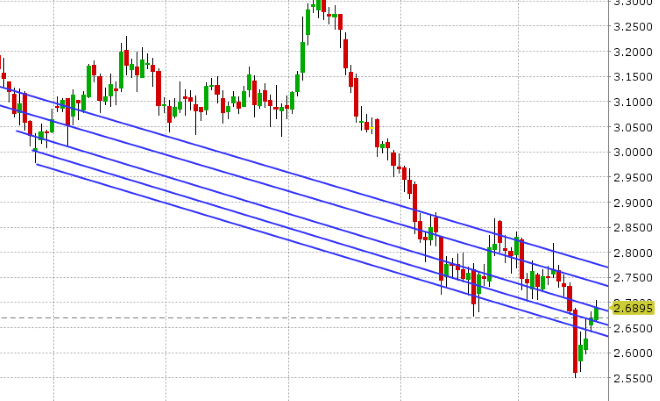

AUDUSD: The Aussie is trading modestly higher this morning, in a slow and steady move like CAD. Yesterday’s late wave of broad USD selling took the market above resistance in the 0.7330s, but the momentum hasn’t been strong. EURUSD’s stall in Europe appears to be the culprit. September copper is trading higher again today, and lends correlative support so long as it continues to trade above 2.6850 in our opinion. Comments from the RBA’s Lowe (https://www.rba.gov.au/speeches/2018/sp-gov-2018-08-21.html) and the RBA Minutes (https://www.ft.com/content/605578ec-a4e2-11e8-8ecf-a7ae1beff35b) were non-events for markets. We think AUDUSD cools off a bit here as well, like EURUSD.

-

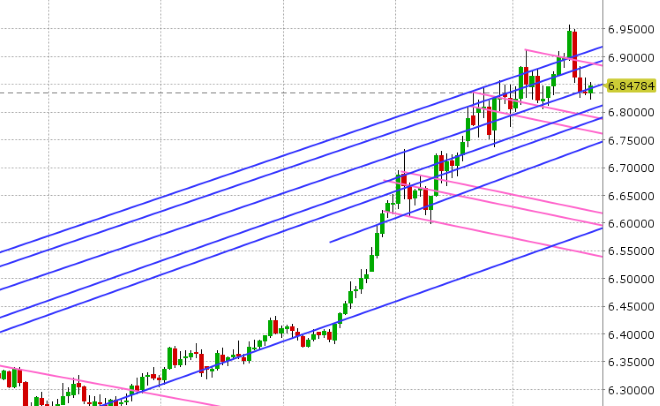

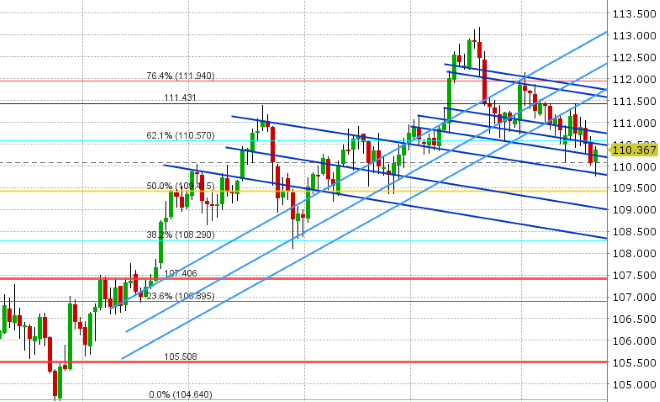

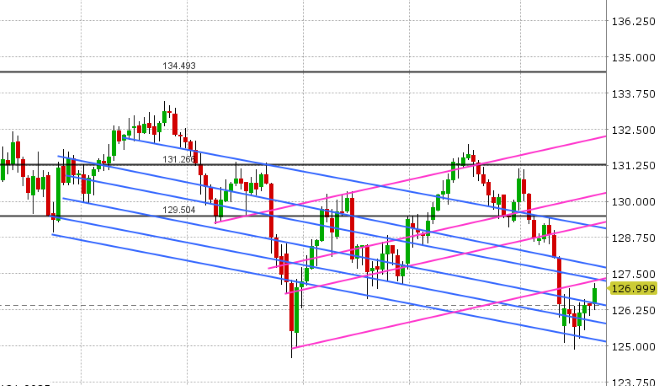

USDJPY: Dollar/yen fell yesterday, on a combination of Trump Fed bashing (first reported by Bloomberg, then later by Reuters) and the attention drawn to overcrowded JPY, bond and gold short positioning. Support gave way at 110.50 in early NY trade, then 110.25 later in the day. This, along with the bearish USD technical patterns noted above for the other majors, contributed to further selling in Asia, all the way down to trend-line support in the 109.80s. The market, however, has bounced strongly off this level, and the buying is picking up steam as we head into NY trade today. We think some of this is option related, as 2blnUSD+ notional rolls off between 110.00 and 110.30 this morning. We’ve also seen USDCNH regain 6.85 and EURUSD come off further here, which is helping. We think USDJPY still finds sellers on rallies sub 110.60.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.