Traders eagerly awaiting comments from latest round of US/China trade talks + Trump speech at 9pmET

Summary

-

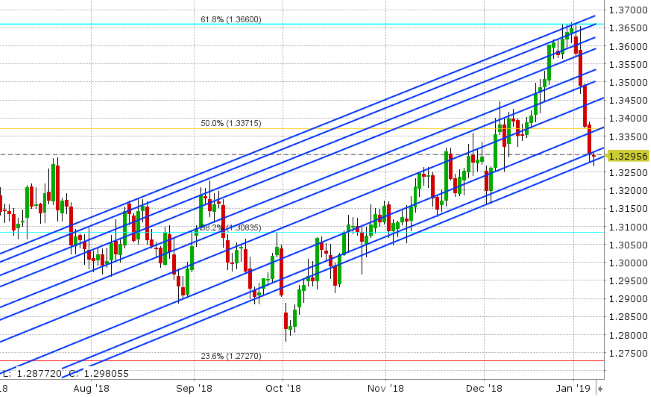

USDCAD: Dollar/CAD continues to languish in the high 1.32s this morning after another trend-line support level gave way in yesterday’s trade. February crude oil is once again trading above the $49 mark after pulling back late yesterday. The broader USD is trading moderately bid, led by some AUD selling that followed some weak Australian Trade figures overnight, but it’s not doing much to help USDCAD at this hour. Canada released its Trade Balance figure for November just now and it came in at vs -2.06bln vs -1.95bln expected. The rest of today’s NY session doesn’t feature any other prominent data releases, and so traders will be left posturing on what President Trump will say when he addresses the nation tonight at 9pmET. Rumors are circling that he’ll invoke a national emergency in order to get some traction on the southern border issue. We think USDCAD finds a bid today ahead of the Bank of Canada rate decision tomorrow and we think the rate hike speculation making the rounds this week has been a bit misplaced. Support 1.3280-1.3300. Resistance 1.3360-70.

-

EURUSD: Euro/dollar is slumping back this morning after a failed attempt to break above trend-line resistance in the 1.1470s. Some AUDUSD selling led the way in Asian trade after Australia reported a weaker than expected trade surplus for November. This saw EURUSD pull back to support in the 1.1430s. Then we got some dismal November Industrial Production figures out of Germany, and that made rally attempts difficult off the lows. A wave of USD buying is now entering the fray as NY trading gets underway, but support in the 1.1430s is still holding. We think the market needs to attack resistance in short order, otherwise we could slip back into a directionless range around the low 1.14 area.

-

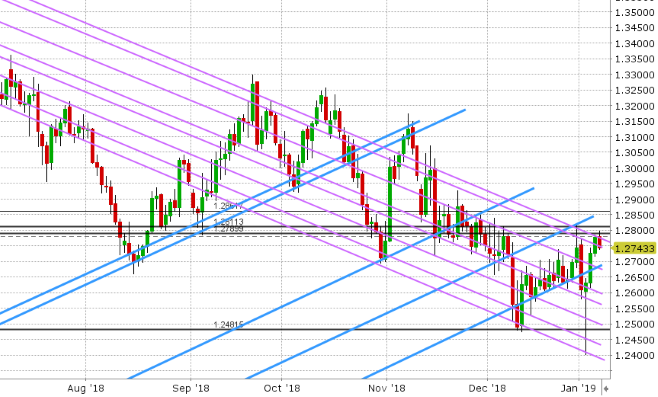

GBPUSD: Sterling continues to struggle with chart resistance in the 1.2750-90 area today as traders digest a slew of new Brexit headlines. Rumors are making the rounds that the UK government will possibly try to extend Article 50 past March 29th amid fears a Brexit agreement won’t be struck in time. We’re hearing, however, that the meaningful vote before Parliament will still occur next week, and that it will mostly likely be on Jan 15th. We still think GBPUSD searches for buyers here after last week’s dramatic turn around. Support 1.2740-50, then 1.2690.

-

AUDUSD: Australia reported a November trade surplus of 1.925bln last night, missing expectations of 2.23bln. This was enough to cement chart resistance in the 0.7140s, which capped the trade in NY trading yesterday. European traders stepped in to buy the dip in AUDUSD this morning however as US equity and copper futures anticipate a positive conclusion to the latest round of US/China trade talks. Australia reports November Building Permits tonight at 7:30pmET. We still would not be surprised to see the market pull back here in search of buyers. A break of chart resistance in the 0.7140s would invite further buying to the 0.7200 level in our opinion.

-

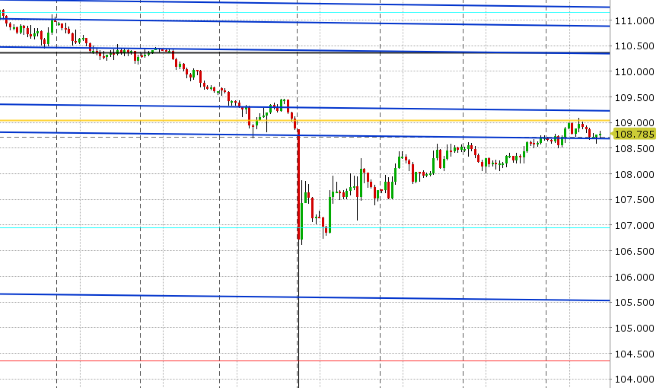

USDJPY: Dollar/yen has inched higher as expected this morning, led by continued strength in the S&P futures, but we’re now running into the 108.70-109.20 resistance zone we talked about yesterday. We think the upper end of this range could be challenged if the S&Ps gun for the 2600 level, but we still think sellers will emerge and knock us back down.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.