Theresa May survives no-confidence motion. Brexit "Plan B" expected for Monday.

Summary

-

USDCAD: Dollar/CAD is trading up this morning as some broad USD buying in early European trade appears to have tripped buy stop orders above yesterday’s NY high. We’ve since seen a pull back off trend-line resistance at the 1.3310 level, but a developing crude oil selloff (-2% at this hour) is seeing USDCAD make a run at resistance once again. OPEC reported a 751k bpd drop in oil production for December, when it released its latest monthly report today. While this Saudi-led drop in crude oil production was largely expected by markets and while OPEC left 2019 “global” oil demand unchanged at 1.29mln bpd, what seems to have traders in a funk this morning is the fact that they lowered their 2019 demand forecast for oil from “OPEC countries specifically” down to 30.83mln bpd, down 910k bpd from 2018. So we’d watch oil prices here, as that market figures out if the $51 level can act as support. Other than that, there’s not much to talk about this morning from a US or Canadian macro perspective. The light news week continues; the range trade continues, and hopefully the Canadian CPI report for December can shake things up tomorrow. Canadian dollar open interest fell for the 9th day in a row at CME yesterday.

-

EURUSD: Euro/dollar is trading marginally higher this morning after an attempt to break chart support in the 1.1370s failed overnight. The selling seemed to occur after some comments crossed the wires from the ECB’s Lautenschlaeger around the 2am hour. More here. Nothing to see here in our opinion, and so like USDCAD’s early European move today, it feels like the dip below support in EURUSD was flow driven. With the market now trading comfortably back above the 1.1370 level, we think the downward momentum may stall here. Near term chart resistance is 1.1415, then 1.1440. The Eurozone CPI figures for December were reported earlier today, and the +1.0% YoY read matched market expectations.

-

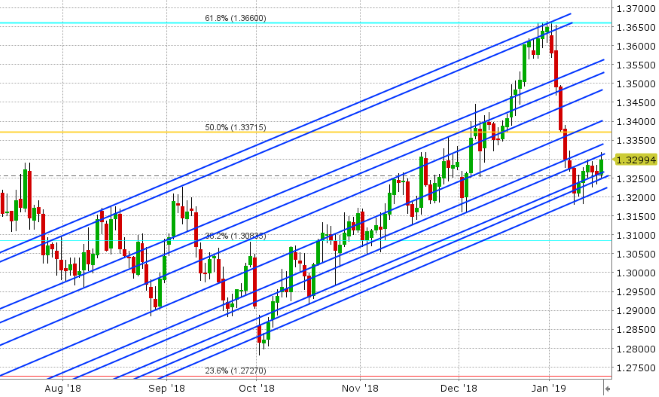

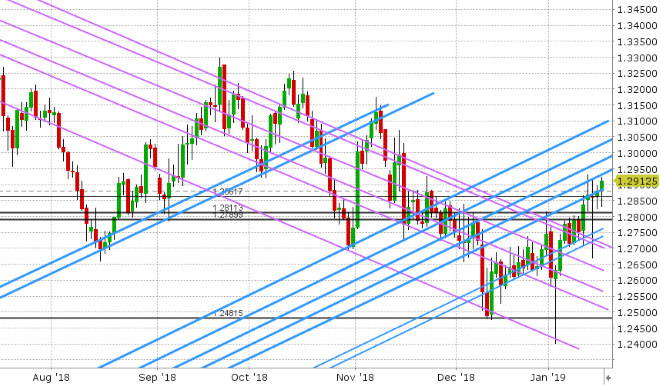

GBPUSD: Sterling is creeping higher this morning after the Tory’s and Theresa May survive yesterday’s vote of no-confidence in the government. The UK PM now has until Monday to come up with a “Plan B” and markets are looking increasingly comfortable with the idea that there will not be a hard crash out of the Eurozone (ie. no-deal Brexit). Either the UK kicks the can down the road by delaying Article 50 (most likely scenario in our opinion), or Theresa May finds some way to renegotiate with the EU at the 11th hour. GBPUSD is trading above chart support in the 1.2860-70 level this morning, but it’s struggling to surpass the 1.2920s resistance level we mentioned yesterday. So we don’t think longs should be getting excited just yet. Pound futures traders liquidated 4,954 contracts in yesterday’s trade.

-

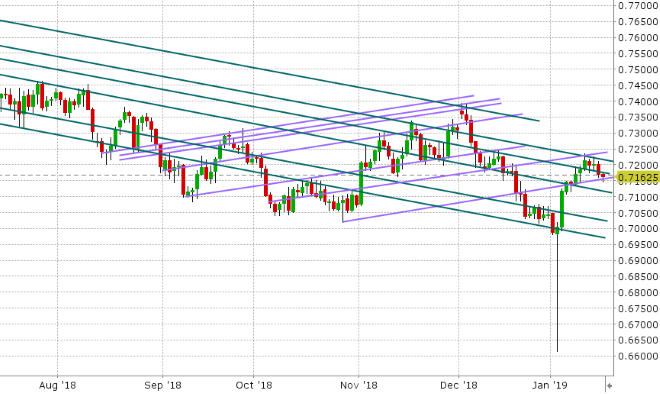

AUDUSD: The Aussie is floundering around this morning after yesterday’s NY close didn’t inspire confidence for buyers. The bounce off the upper range of the 0.7150-0.7180 support zone was short lived during trading yesterday and the close fell right back down within this zone. So it’s this zone now that traps AUDUSD. Buyers bought the bottom of it and sellers have crept back in at the top of it. Yesterday’s copper price rally lacked follow through, and so we think today’s 0.5% pull back there is not helping. Australian dollar futures traders continued to liquidate positions yesterday; this time to the tune of 1313 contracts.

-

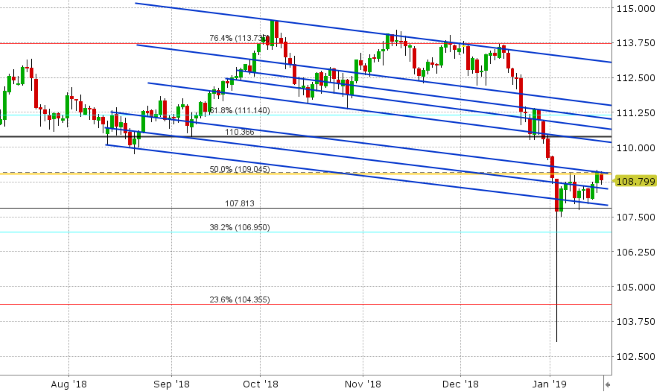

USDJPY: Dollar/yen indeed inched higher to the low 109 level in yesterday’s trade, but this seemed to be all that the battered fund long community could muster. We’ve since pulled back, with a 20pt decline in the S&P futures (off yesterday’s highs) as a corollary factor. The upbeat Philly Fed number out of the US seems to attracting some bids here, but we’d argue the market needs a little more than this in order to break out to the upside.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

February Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

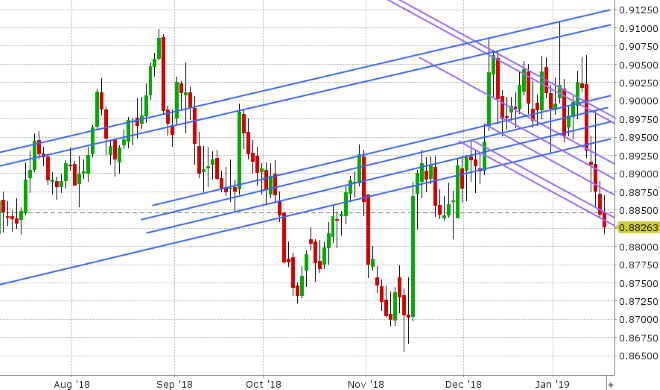

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.