Theresa May expected to announce Brexit Plan B at 10:30amET. US markets closed for MLK Day.

Summary

-

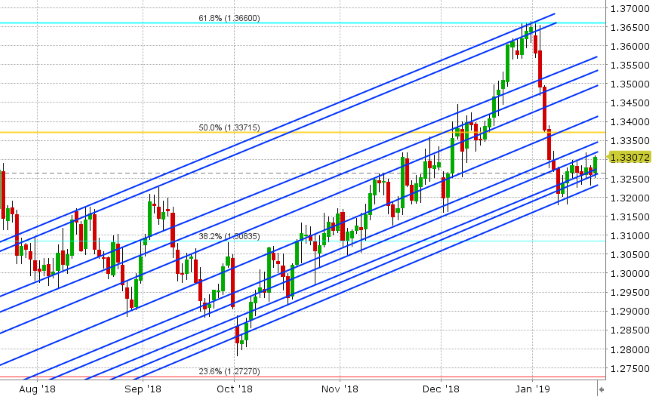

USDCAD: Dollar/CAD is starting the week with a bid bias after the sellers couldn’t pounce on Friday’s upbeat Canadian CPI report. The 1.3250s (key chart support from last week) held into the NY close, which has since provided the technical strength for a rebound into today. We’re still arguably trading in a range though (1.3260-70 to 1.3315), albeit a slightly higher one now as our trend-line levels slope upward. The broader USD is trading moderately higher at this hour (led by EUR and AUD weakness), but the tone is subdued because US markets are closed today for the Martin Luther King Day holiday. March crude oil prices are trading flat in the overnight session. This week’s economic calendar will be on the lighter side once again, with just Canadian Manufacturing Sales and US Existing Home Sales data (2nd tier releases) out tomorrow, and Canadian Retail Sales on Wednesday. We think USDCAD could easily drift higher into trend-line resistance for the time being. Canadian dollar futures traders reduced exposure for the 11th consecutive session in a row on Friday.

-

EURUSD: Euro/dollar made an attempt to work back Friday’s losses to start the week when USDCNH opened with a softer tone, but the rally got cut off in European trade today when Germany reported weaker than expected PPI figures for December (-0.4% MoM vs -0.1%). This also coincided with the market hitting trend-line chart resistance in the 1.1390s. So it’s back down we go to the support levels that stemmed the selling on Friday (1.1350-60). This week’s European calendar features the January German ZEW survey (tomorrow), the Markit PMIs and the ECB monetary policy meeting (Thursday), and the German January IFO survey (Friday). We don’t think Mario Draghi and the ECB will do anything notable on Thursday, but we think traders should be prepared for more cautious sounding headlines, which could get the algorithms in a negative tizzy.

-

GBPUSD: Sterling is trading more or less flat to start the week as traders await Theresa May’s Brexit “Plan B” update at 10:30amET this morning. More here. From a technical perspective, we think Friday’s price action was a bit disheartening for the longs (or those who covered shorts in a hurry on Thursday). The close back below support in the 1.2890s opens the market up for further selling now in our opinion (or a choppy range trade at best), should Theresa May fail to come up with something that appeases markets. The UK reports its January employment report tomorrow morning at 4:30amET.

-

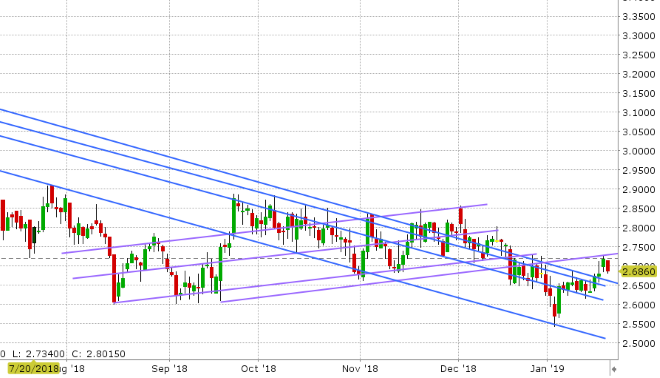

AUDUSD: The Australian dollar demonstrated its super sensitivity to US/China trade headlines again on Friday when it popped higher on a Bloomberg headline. China was said to offer a “path to eliminate [the] US trade imbalance” by boosting imports $1 trillion over 6 years. This saw AUDUSD pop into trend-line resistance at the low 0.72s once again, but when the US expressed skepticism and more urgency (subsequent headlines), the market fell right back down and made a bee line for familiar support levels. The NY close was lackluster, with prices falling right into the 0.7160-70 support zone. An attempt was made to shoot higher when USDCNH traded lower and EURUSD rallied, but this ultimately failed and so sellers have been in control ever since. March copper prices are trading lower to the tune of 1% this morning after hitting chart resistance in the 2.72s late Friday. Australia reports its December employment figures on Wednesday night ET. We think the market may need to slip further here to entice buyers back in. Australian markets will be closed on Friday for the Australia Day holiday.

-

USDJPY: Dollar/yen is off to a very quiet start this week, as the S&P futures drift slightly lower on this holiday Monday. Technically speaking, Friday’s impressive NY close above the 109.60s suggests the possibility for further gains into the 110.20s, but we may have to wait for US cash equity traders to return tomorrow. This week’s Japanese calendar will feature the latest Bank of Japan monetary policy meeting (tomorrow night ET/early Wednesday morning), and the Tokyo CPI figures (late Thursday). Traders aren’t expecting any changes to the BOJ’s dovish policy outlook.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.