Tentative Brexit financial services deal sees GBPUSD surge

Summary

-

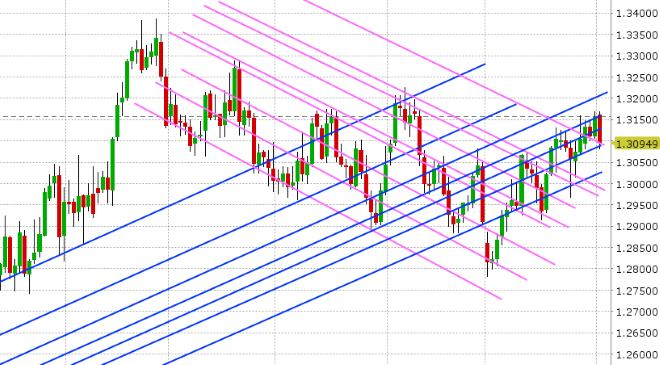

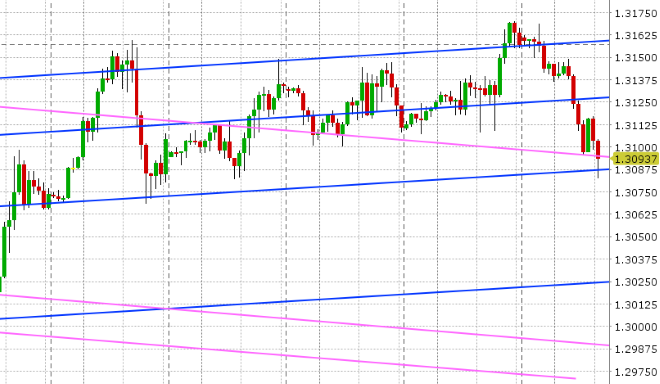

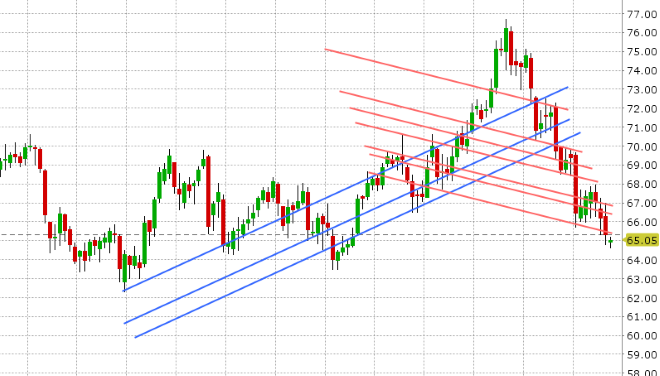

USDCAD: Dollar/CAD is reversing lower this morning as some Brexit optimism sees the British pound surge higher. More below. The rally in GBPUSD is lifting all boats and is pressuring the USD across the board here. USDCAD fell back below the 1.3150s in Asian trade overnight, and this technically gave comfort to the sellers coming back in. The 1.3120s have broken to the downside as well in early European trade, and the 1.3080-90 support level is being tested again now. The BoC’s Poloz didn’t say anything new in his repeat testimony before the Canadian Senate late yesterday. Today sees the release of the US October ISM figures at 10amET, with traders expecting +59 on the headline. December crude oil continues to make news swing lows ahead of the Iran sanctions that go into effect next week as commodity traders continue to witness signs that the market will be able to cope. November is traditionally another weak month of the year for the Canadian dollar (just like October), if we look at 20yr seasonals.

-

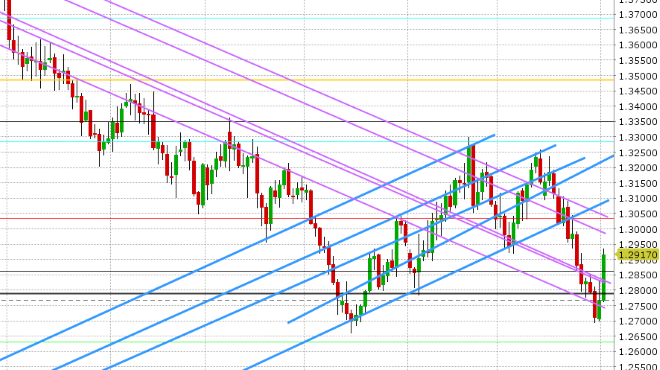

EURUSD: Euro/dollar has exploded higher today; riding on the coattails of the GBPUSD rally. Support in the 1.1310s held into the NY close yesterday, which was a somewhat positive setup leading into today's move. The rally then started in Asia around 8pm and has now seen EURUSD surge back above chart resistance in the 1.1360-80 region. A massive option expiry today at the 1.1400 strike (4blnEUR) will likely keep us bid until 10am at least. The next chart resistance zone is 1.1430-60. USDCNH has receded today in lockstep with EURUSD. We’re hearing chatter that Chinese authorities were on the bid in EURUSD yesterday in an effort to defend the Yuan. A look at 20yr seasonals for November suggests EURUSD stabilizes this month.

-

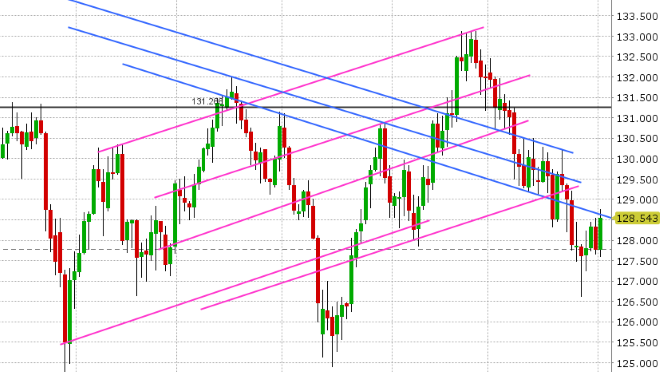

GBPUSD: Sterling it the talk of the town this morning after Theresa May reportedly reached a tentative Brexit deal with the EU with regard to the UK’s financial services sector. More here. This saw GBPUSD smash through three chart resistance levels in overnight trade (1.2780s, 1.2830s, 1.2850-60s). We saw the market pull back down to the 1.2850-60s after some UK officials said that the reports were “unsubstantiated”. Traders continued to buy the dip though ahead of the Bank of England’s interest rate decision. The Bank of England has kept interest rates unchanged at 0.75% in a unanimous 0-0-9 vote. The key takeaway from the press release so far is the fact that the BoE sees the UK output gap as closed and expects the economy to “run hot from late 2019”. With regard to the rates outlook, they say “future increases in the bank rate are likely to be at a gradual pace and to a limited extent”. The BoE was optimistic about Q3 growth, but downgraded their full year GDP growth forecasts for 2018 and 2019. Brexit was also mentioned as a key to the economic outlook. All in all though, a non-event so far we would argue. GBPUSD traders appear to agree, as the market wobbles a bit, but holds its gains ahead of Governor Carney’s press conference at 8:30amET. November is traditionally not a great month of the year for GBPUSD, if we look at 20yr seasonal returns. The EU’s chief negotiator has just called today's Brexit press articles “misleading”.

-

AUDUSD: The Aussie is surging today as it appears the GBPUSD move higher was too much for the entrenched fund short position to handle. Support in the 0.7070-80s held into the NY close yesterday, and like EURUSD, we think this helped the technical setup going into today. Australia also reported a strong Trade Balance for September last night. Today’s rally has seen two chart resistance levels give way (0.7120s, 0.7150s). Traders look poised now to test the next level, which is the 0.7180s. USDCNH has just broken below support in the 6.9450s which is supportive. Gold prices have regained the 1225 level they broke down below yesterday. We think the shorts may continue to scramble here if the 0.7180s give way. November seasonals suggest the Aussie will trade marginally lower this month.

-

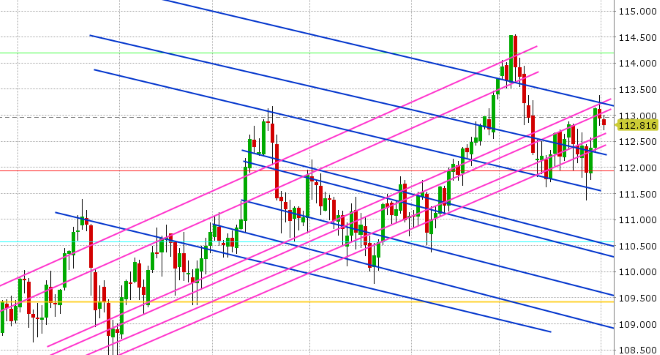

USDJPY: Dollar/yen is struggling today, and it’s been that way ever since traders failed in their attempt to break the market above the 113.20s yesterday. We felt mid-day EURJPY selling played a role in this yesterday, and we think today’s range-bound tone to global equities is not helping for the moment. USDJPY now sits back below chart support in the 113s and we think we may see a pause in the rally here. The seasonals suggests USDJPY will reverse all of October’s losses this month and head higher.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

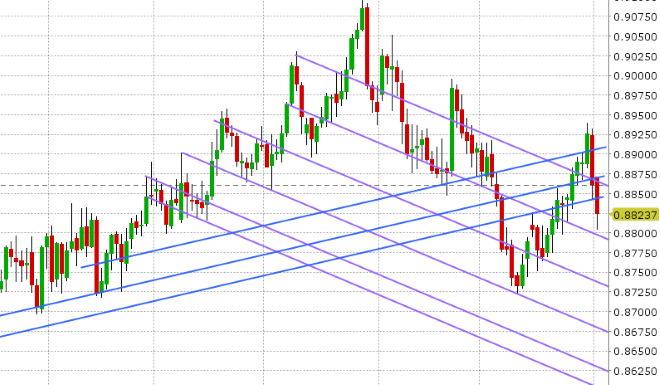

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Gold Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.