Technical selling continues to hit EURUSD. USDCAD bid on broad USD strength. Busy US calendar today.

Summary

-

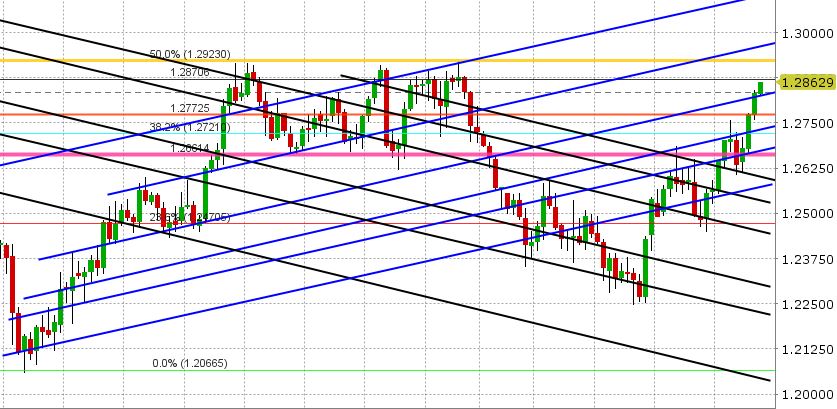

USDCAD: Dollar/CAD scored another positive NY close yesterday, largely on the back of a broadly higher USD. EURUSD could not find a bid at all yesterday. The AUD got sold, and continues to get sold today. Sterling got pummelled. USDCAD benefited handsomely from all this, and when traders pushed the market past resistance of 1.2760-1.2780 in early NY trade yesterday, it was a quick and easy move to the next resistance level, which was 1.2820. The market then inched above the 1.2820 resistance level yesterday afternoon, which cemented yet another bullish close for USDCAD. The momentum continued overnight with USDCAD now poised to test 1.2870 (horizontal resistance from Dec 2017). There’s a lot on the North American calendar today to take note of. First we get US Core PCE (the Fed’s preferred inflation gauge) at 8:30amET with markets expecting +1.5% YoY. February US ISM is next at 10amET and markets are expecting 58.7 on the headline. Then we’ll get Powell “Round 2” at 10am, this time in front of the US Senate Banking Committee (will Powell try to dial back the market’s excitement about a 4th rate hike?). Finally, Trump is expected to announce tariffs of 25% on steel imports at some point today. While we would argue this developing story hasn’t been driving the broader USD or CAD of late, it may prompt some negative headlines from Canadian officials (which could in turn propel USDCAD higher). If we look at the CAD crosses so far today, both EURCAD and GBPCAD are starting to exhibit signs of technical exhaustion on the charts. EURCAD continues to struggle with its retest of 1.5650 and GBPCAD rolled over decisively yesterday amid the GBP plunge. To come full circle, we think USDCAD remains at the whims of the broader USD trend. Positive momentum on the charts should remain as long as the 1.2820s hold and the EURUSD keeps moving lower. We will be paying close attention to how the market handles resistance at 1.2870. A firm push above the level with no pullback would invite a surge to the 1.2930s, whereas a failed test of the 1.2870 level would invite profit taking in our opinion.

-

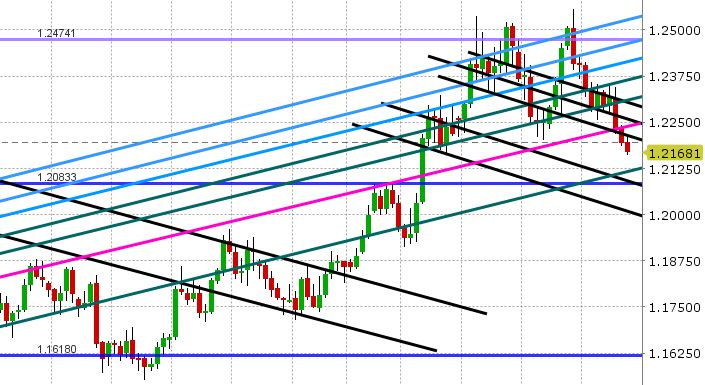

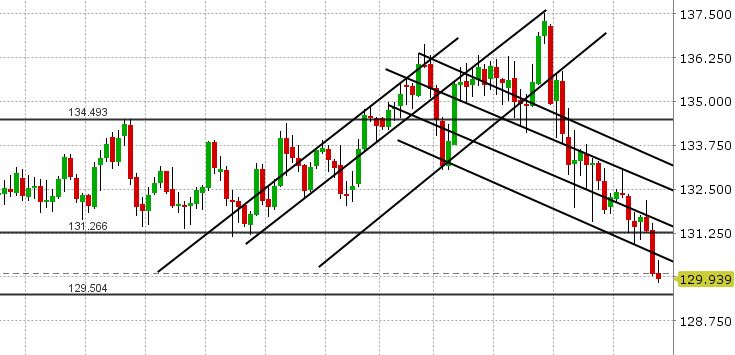

EURUSD: Technical selling pressure continues to hurt EURUSD as we enter NY trading today. While yesterday’s option expiry seemed to keep EURUSD pinned to the 1.2200 level, no real bid materialized after 10amET. Chart resistance in the 1.2230s was never challenged; the USD kept rising against AUD, CAD, GBP and everything else, and so EUR traders felt comfortable pushing EURUSD lower still. The market is looking rather precarious at this hour, with the February lows now firmly broken and no real support on the charts until the 1.2140s (one could argue that even that support level is not strong and that the better support level is 1.2080). EURJPY remains firmly in trouble technically, with the next support level being 129.50. USDCNH has been moving straight up today, without stopping, and it is now seriously challenging the 6.36 resistance level. All this is pressuring EURUSD at this hour. Add to this some more option expiries below the market (1.2bln at 1.2150 today and 4bln+ at 1.2125-50 tomorrow) and we have a market with stones attached to its ankles right now. EURUSD traders will be watching the same North American headlines today (mentioned above).

Tune in shortly @EBCTradeDesk for this morning’s update on AUDUSD, GBPUSD and USDJPY

Market Analysis Charts

USD/CAD Chart

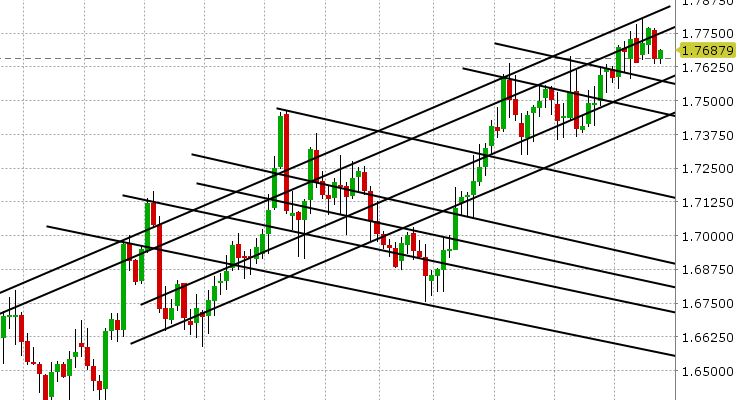

EUR/CAD Chart

GBP/CAD Chart

EUR/USD Chart

EUR/JPY Chart

USD/CNH Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.