Taylor now a Trump favorite for Fed Chair. $USD bid. $GBP weighed down by Carney.

Summary

-

Yield spreads were the focus late yesterday as Bloomberg reported Trump was impressed with John Taylor (known hawk) during interviews for Fed Chair last week. US yields now back above 2.30, US/GE spreads wider now at (see chart). USD seeing broad based buying since the headline, especially against JPY.

-

EUR weighed down further by weak technicals, cross selling. GBP can’t hold bid from in-line UK CPI. Carney speech weighing as well as it doesn’t sound hawkish enough. USDCAD up on rising US yields as well but GBPCAD cross selling is keeping the market capped. AUD holding recent gains well despite position liquidation yesterday. RBA minutes a non-event last night.

-

Quiet day ahead for data and speakers: US Industrial Production 9:15amET. BOC’s Governor Wilkens speaking at Sibos Conference at 2:30pm.

-

CME open interest changes 10/16: AUD -2916, GBP +1128, CAD -1457, EUR +272, JPY +1645

Currency Calendar

| Date | Releases / Holiday | Entity |

|---|---|---|

| October 17, 2017 | Consumer Price Index (YoY) (Sep) | EUR |

| October 17, 2017 | Consumer Prices Index - Core (YoY) (3Q) | EUR |

| October 17, 2017 | BoE Governor Carney Speech | GBP |

Bank holidays and impactful report releases for select countries.

By The Numbers: Daily FX Snapshot

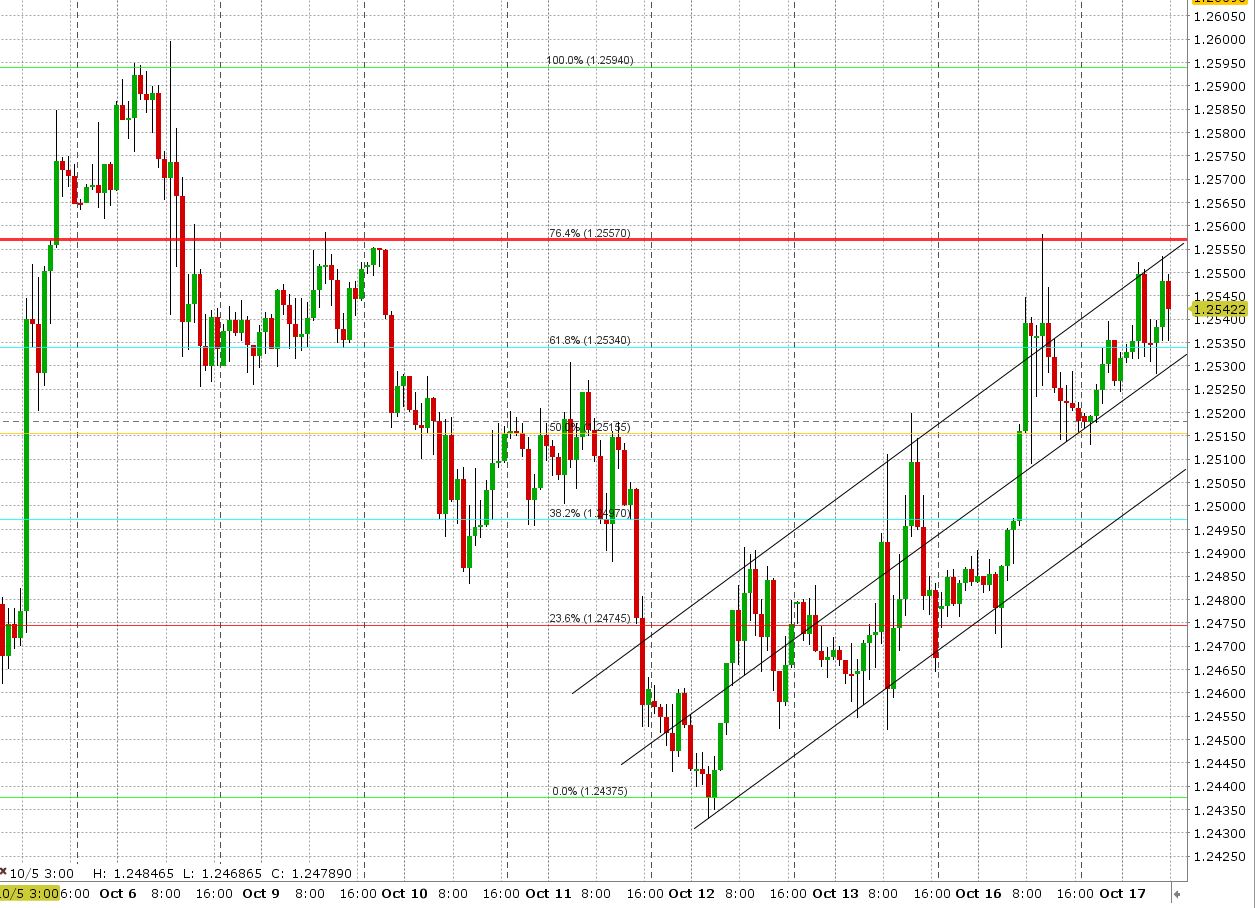

USD/CAD - Canadian Dollar

Dollar/CAD is benefiting from the rise in US yields as well but cross selling has been a drag today, most notably GBPCAD. We’re trading close to hourly resistance in the 1.2550s. A break above invites a test of the 1.26 figure. Market has support from the hourly channel and Fibo’s (1.2510-30). A move back below the 1.2490s would be technically negative. Nothing notable out of the business outlook survey yesterday.

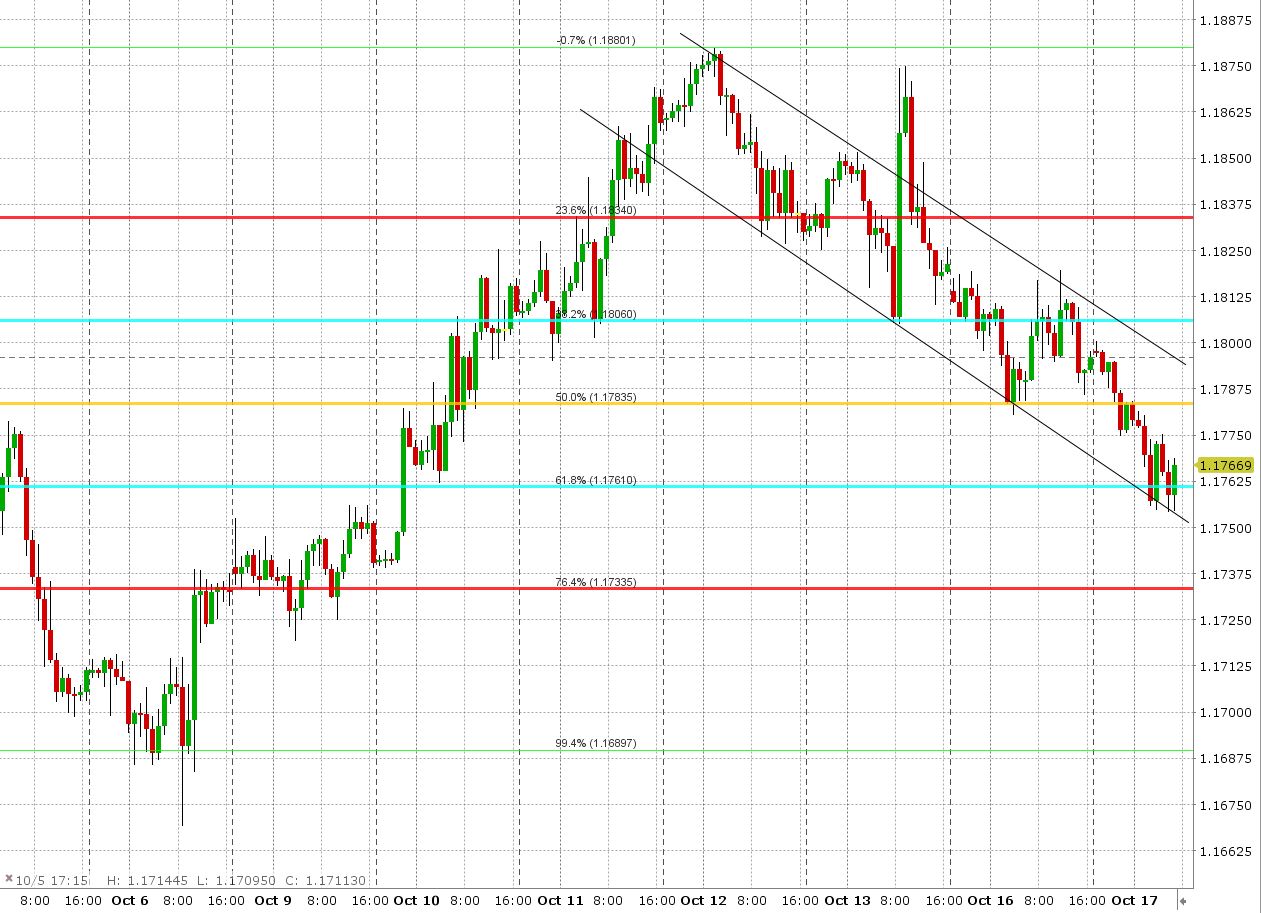

EUR/USD - European Central Bank Euro

Euro is definitely playing catch-up with yield spreads overnight. Technical selling pressure is weighing as well as the H&S topping pattern (that we mentioned on Friday) continues to take shape and make the rounds on newswires. Also hearing some demand for 6mth put options to capture the Italian elections which will be in spring 2018. German ZEW survey came in slightly weaker than expected. EURJPY tried to bottom late yesterday, led by USDJPY, but has since retreated. EURGBP was down again early but has now bounced strongly off yesterday’s NY low. EURUSD currently holding the 61.8% Fibo of the 1.1690-1.1880 move. Next support level 1.1715-30. Market would look better technically if it can regain the 1.1790s.

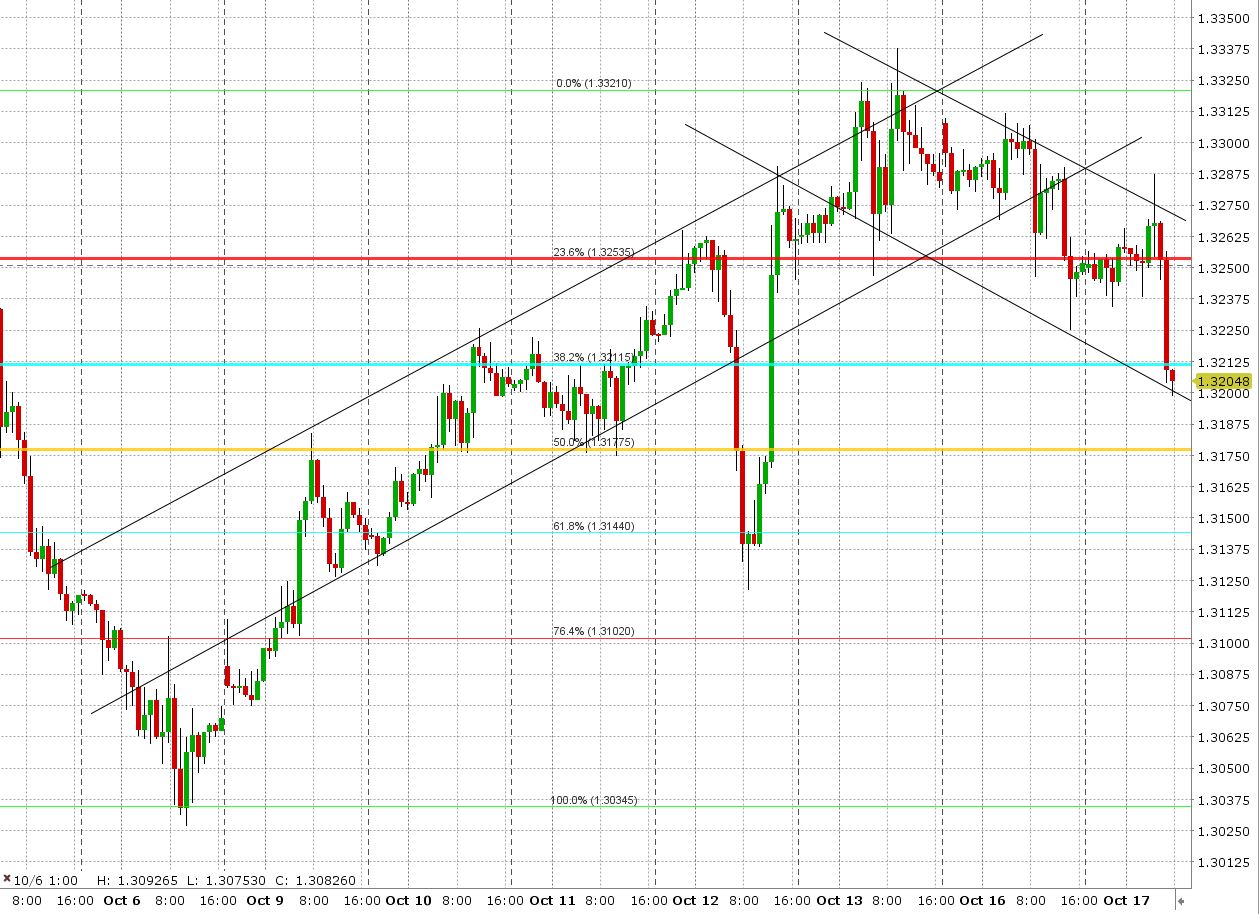

GBP/USD - British Pound

Sterling continues to chop around and be very sensitive to Brexit headlines. Case in point yesterday where we dropped 50pts on an overly dramatic article with the word “catastrophic breakdown” in it. The market recovered fully from it only to see selling again late in the afternoon with the broad, US-yield led, rally in USD. An in-line print for UK CPI (now 3%) provided a bid in early London trade this morning but we’re now breaking the NY low as the BOE’s Carney speaks (sounding a bit less convincing about rate hikes). GBPUSD is now dealing with a negative break of the upward hourly channel from last week. Support 1.3200-15, then the 50% Fibo of last week’s rally (1.3170s). Resistance 1.3250-60s. The EURGBP bounce over the last hour hasn’t helped. The GBPJPY hourly reversal post UK CPI is also weighing (fails above 149 and then losses 148.50).

Market Analysis Charts

USD/CAD Chart

EUR/USD Chart

GBP/USD Chart

Charts: TWS Workstation

US-GE Yield Spreads

Chart: Reuters

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.